How To Interpret The Net Asset Value (NAV) Of The Amundi Dow Jones Industrial Average UCITS ETF

Table of Contents

What is Net Asset Value (NAV)?

Net Asset Value (NAV) is a crucial metric representing the intrinsic value of an ETF's holdings. For the Amundi Dow Jones Industrial Average UCITS ETF, the NAV reflects the total value of the ETF's underlying assets – its holdings in the 30 companies comprising the Dow Jones Industrial Average. This is calculated by taking the total market value of all the ETF's assets and dividing it by the number of outstanding shares.

It's important to distinguish the NAV from the ETF's market price. While ideally they should be very close, the market price can fluctuate throughout the trading day based on supply and demand. This means the market price can be slightly higher or lower than the NAV.

- NAV represents the total value of the ETF's holdings (stocks in the Dow Jones Industrial Average) divided by the number of outstanding shares. This gives you a per-share valuation.

- It reflects the intrinsic value of the ETF. This is a measure of the ETF's true worth, based on the assets it owns.

- Market price can deviate slightly from the NAV due to supply and demand. This difference is usually small and temporary, but it’s important to understand the distinction.

How is the Amundi Dow Jones Industrial Average UCITS ETF NAV Calculated?

The Amundi Dow Jones Industrial Average UCITS ETF NAV is calculated daily, typically after the market closes. The process involves several steps:

- Daily calculation based on the closing prices of the constituent stocks. The value of each stock in the Dow Jones Industrial Average is multiplied by the number of shares the ETF holds in that stock.

- Consideration of dividends and other income received by the ETF. Any dividends received by the ETF from its holdings are added to the total asset value.

- Adjustments for expenses and management fees. The ETF's operational costs, including management fees, are deducted from the total asset value.

- Published daily, usually after the market closes. The calculated NAV is then made publicly available, usually on the ETF provider's website and through financial data providers. This allows investors to track the ETF's performance.

Factors Influencing the Amundi Dow Jones Industrial Average UCITS ETF NAV

Several factors influence the daily NAV of the Amundi Dow Jones Industrial Average UCITS ETF. Understanding these helps investors predict potential fluctuations and make better investment decisions.

- Performance of the Dow Jones Industrial Average: The primary driver. The NAV is directly tied to the performance of the underlying index. A rise in the Dow usually leads to an increase in the NAV, and vice-versa.

- Economic indicators and market sentiment: Macroeconomic factors such as interest rate changes, inflation reports, and overall market sentiment significantly impact the Dow and consequently the ETF's NAV. Positive economic news often boosts the NAV, while negative news can cause it to decline.

- Currency fluctuations: If the ETF holds assets denominated in different currencies, fluctuations in exchange rates can affect the NAV. A strengthening US dollar (assuming the ETF is denominated in USD) could lower the NAV if the underlying assets are in other currencies.

- Dividend payments: Dividends paid by the constituent companies of the Dow Jones Industrial Average directly influence the ETF's NAV. Dividend payments increase the total asset value, leading to a temporary increase in NAV.

Using NAV to Make Informed Investment Decisions

The NAV of the Amundi Dow Jones Industrial Average UCITS ETF is a valuable tool for informed investment decisions. Investors can use the NAV in several ways:

- Comparing NAV with other similar ETFs to assess relative value. By comparing the NAV of the Amundi ETF with other Dow Jones Industrial Average ETFs, investors can determine which offers better value.

- Monitoring NAV trends to identify growth or decline. Tracking the NAV over time allows investors to understand the long-term performance of their investment and make adjustments as needed. A consistently upward trend indicates strong performance.

- Using NAV to evaluate the effectiveness of the ETF's investment strategy. Consistent deviations between the NAV and the market price may indicate issues with the ETF's strategy or liquidity.

Conclusion

Understanding the Net Asset Value (NAV) of the Amundi Dow Jones Industrial Average UCITS ETF is crucial for successful investing. By grasping how the NAV is calculated and the factors influencing it, investors can make more informed decisions about buying, selling, or holding this ETF. Regularly monitoring the Amundi Dow Jones Industrial Average UCITS ETF NAV, alongside other market indicators, allows for a comprehensive view of investment performance and helps to optimize your investment strategy. Start tracking the Amundi Dow Jones Industrial Average UCITS ETF NAV and related metrics today to make the most of your investment opportunities!

Featured Posts

-

Amundi Msci World Catholic Principles Ucits Etf Acc Daily Nav Updates And Analysis

May 24, 2025

Amundi Msci World Catholic Principles Ucits Etf Acc Daily Nav Updates And Analysis

May 24, 2025 -

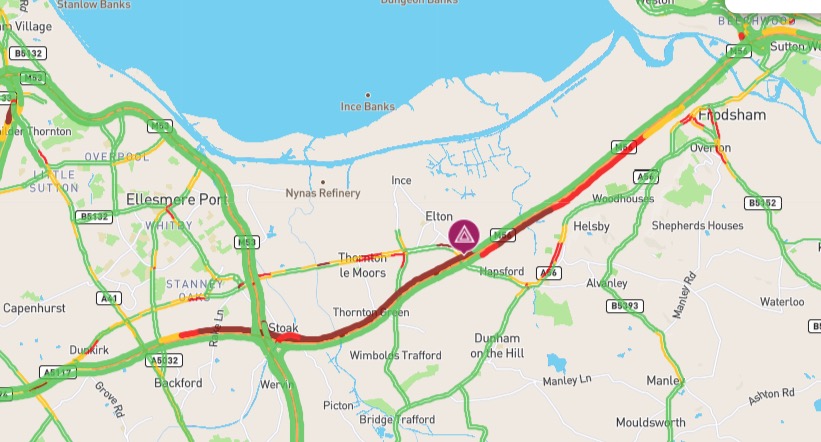

Cheshire Deeside M56 Delays Following Road Accident

May 24, 2025

Cheshire Deeside M56 Delays Following Road Accident

May 24, 2025 -

M56 Motorway Closure Latest Traffic Updates And Diversions

May 24, 2025

M56 Motorway Closure Latest Traffic Updates And Diversions

May 24, 2025 -

Escape To The Country Your Guide To A Peaceful Retreat

May 24, 2025

Escape To The Country Your Guide To A Peaceful Retreat

May 24, 2025 -

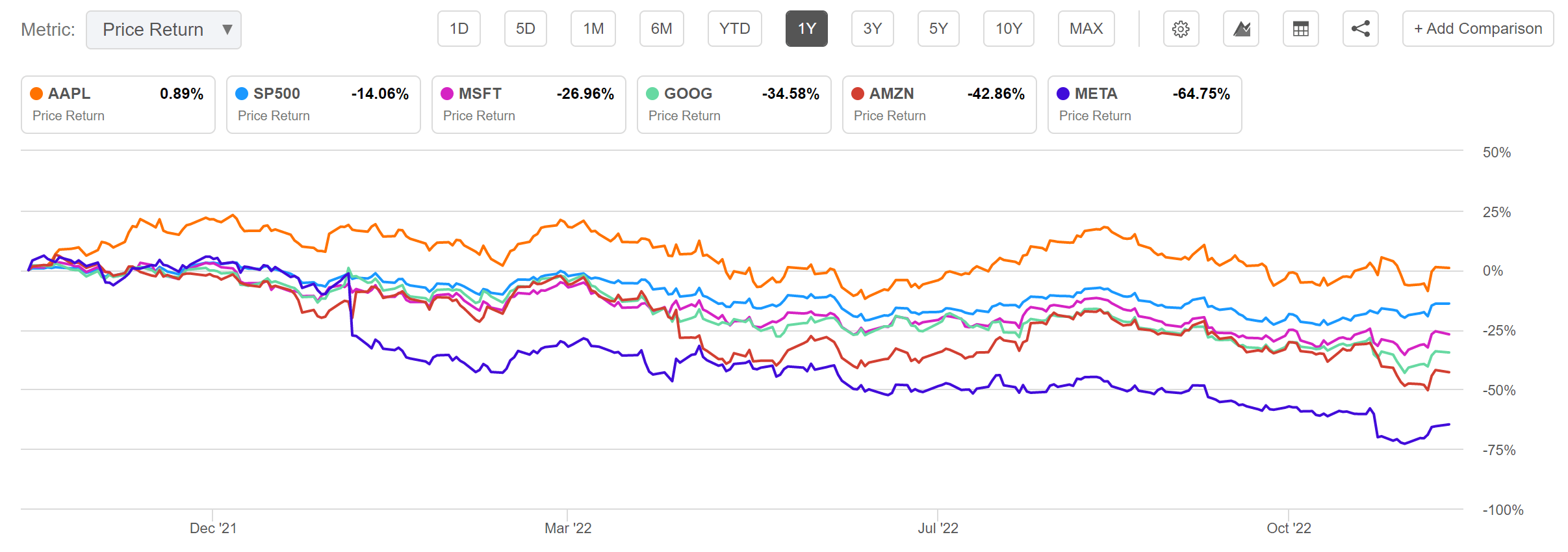

Apple Price Target Lowered But Is It Still A Good Investment

May 24, 2025

Apple Price Target Lowered But Is It Still A Good Investment

May 24, 2025

Latest Posts

-

Mia Farrow Demands Trump Be Prosecuted For Venezuelan Deportation

May 24, 2025

Mia Farrow Demands Trump Be Prosecuted For Venezuelan Deportation

May 24, 2025 -

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportation

May 24, 2025

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportation

May 24, 2025 -

Farrow Seeks Legal Action Against Trump Regarding Venezuelan Deportations

May 24, 2025

Farrow Seeks Legal Action Against Trump Regarding Venezuelan Deportations

May 24, 2025 -

Mia Farrow Demands Trumps Imprisonment For Deporting Venezuelan Gang Members

May 24, 2025

Mia Farrow Demands Trumps Imprisonment For Deporting Venezuelan Gang Members

May 24, 2025 -

Exploring Frank Sinatras Four Marriages And Their Significance

May 24, 2025

Exploring Frank Sinatras Four Marriages And Their Significance

May 24, 2025