How Norway's Top Investor, Nicolai Tangen, Navigated Trump's Tariffs

Table of Contents

Understanding the Impact of Trump's Tariffs on Global Investment

Trump's "America First" trade policy led to the imposition of significant tariffs on various imported goods. These tariffs, initially targeting steel and aluminum, later expanded to include numerous other sectors, notably technology and consumer goods. The unpredictable nature of these policies created significant market volatility. For global investors like NBIM, this meant:

- Increased import costs: Tariffs directly increased the price of imported goods, impacting production costs and consumer prices.

- Supply chain disruptions: The imposition of tariffs led to companies scrambling to adjust their supply chains, often resulting in delays and increased costs.

- Retaliatory tariffs: Other countries responded to Trump's tariffs with their own, creating a complex web of trade restrictions and further market uncertainty.

- Negative impact on global trade: The overall effect was a slowdown in global trade growth, impacting numerous economies, including Norway. This uncertainty made effective global investment strategies crucial.

Nicolai Tangen's Strategic Responses to Trade Uncertainty

Faced with this unprecedented level of trade uncertainty, Nicolai Tangen and NBIM implemented a multi-pronged approach to mitigate risk and protect the fund's value. Their strategy centered on diversification and proactive risk management:

- Geographical diversification: NBIM likely reduced its exposure to regions heavily impacted by the trade war, re-allocating investments to more stable markets.

- Sector diversification: The fund probably shifted away from sectors directly affected by tariffs (e.g., specific manufacturing sectors) and towards sectors less susceptible to trade disruptions.

- Enhanced risk assessment and management: NBIM strengthened its due diligence processes, incorporating geopolitical risk analysis into its investment decisions. This involved rigorously assessing the potential impact of tariffs on individual companies and industries.

- Specific investments/divestments: While NBIM's investment strategy is not publicly available in granular detail, it's plausible that they selectively divested from companies heavily exposed to tariffs and invested in businesses demonstrating resilience to such trade conflicts.

The Role of ESG Investing in Navigating Trade Wars

NBIM's commitment to Environmental, Social, and Governance (ESG) factors played a crucial, albeit subtle, role in navigating the tariff challenges. While not directly mitigating tariffs, ESG considerations likely contributed to a more resilient portfolio:

- Emphasis on sustainable and responsible investments: Investing in companies with strong ESG profiles often means investing in businesses with diverse supply chains and robust governance, making them more adaptable to trade disruptions.

- Focus on companies with strong governance structures: Well-governed companies are better equipped to navigate regulatory changes and unforeseen geopolitical events.

- Reduced investment in companies with high environmental impact: This aligns with mitigating risks associated with resource scarcity and climate change, factors that can be exacerbated by trade conflicts. This long-term perspective provided an element of stability.

Lessons Learned and Long-Term Implications

NBIM's approach to navigating Trump's tariffs highlights several key lessons for investors:

- Importance of diversification and risk management: Diversification across geographies and sectors is crucial for mitigating the impact of unforeseen geopolitical events. Robust risk management frameworks are essential.

- The role of long-term strategic planning: A long-term perspective, as demonstrated by NBIM's commitment to ESG investing, can provide stability and resilience in the face of short-term market volatility.

- The increasing relevance of ESG factors in investment decisions: ESG considerations are no longer just a "nice-to-have" but a crucial aspect of building a resilient and sustainable portfolio, particularly in an increasingly volatile global environment.

Conclusion: Navigating Future Trade Uncertainties with the Nicolai Tangen Approach

Nicolai Tangen's leadership at NBIM during the Trump tariff era demonstrates the effectiveness of proactive diversification, rigorous risk management, and a long-term perspective incorporating ESG factors. By understanding and adapting to geopolitical risks, NBIM successfully navigated a turbulent period. Learn how to implement Nicolai Tangen’s strategies for navigating future trade conflicts and build a robust investment portfolio. Explore expert resources on global investment strategies today!

Featured Posts

-

First Round Nhl Playoffs Key Factors And Predictions

May 05, 2025

First Round Nhl Playoffs Key Factors And Predictions

May 05, 2025 -

The Impact Of Potent Cocaine And Narco Submarines On The Global Drug Trade

May 05, 2025

The Impact Of Potent Cocaine And Narco Submarines On The Global Drug Trade

May 05, 2025 -

How Norways Top Investor Nicolai Tangen Navigated Trumps Tariffs

May 05, 2025

How Norways Top Investor Nicolai Tangen Navigated Trumps Tariffs

May 05, 2025 -

Turning Poop Into Prose An Ai Powered Podcast Revolution

May 05, 2025

Turning Poop Into Prose An Ai Powered Podcast Revolution

May 05, 2025 -

Seven Fatalities Reported In Yellowstone National Park Vicinity Crash

May 05, 2025

Seven Fatalities Reported In Yellowstone National Park Vicinity Crash

May 05, 2025

Latest Posts

-

Ufc 314 Results Who Won And Lost At Volkanovski Vs Lopes

May 05, 2025

Ufc 314 Results Who Won And Lost At Volkanovski Vs Lopes

May 05, 2025 -

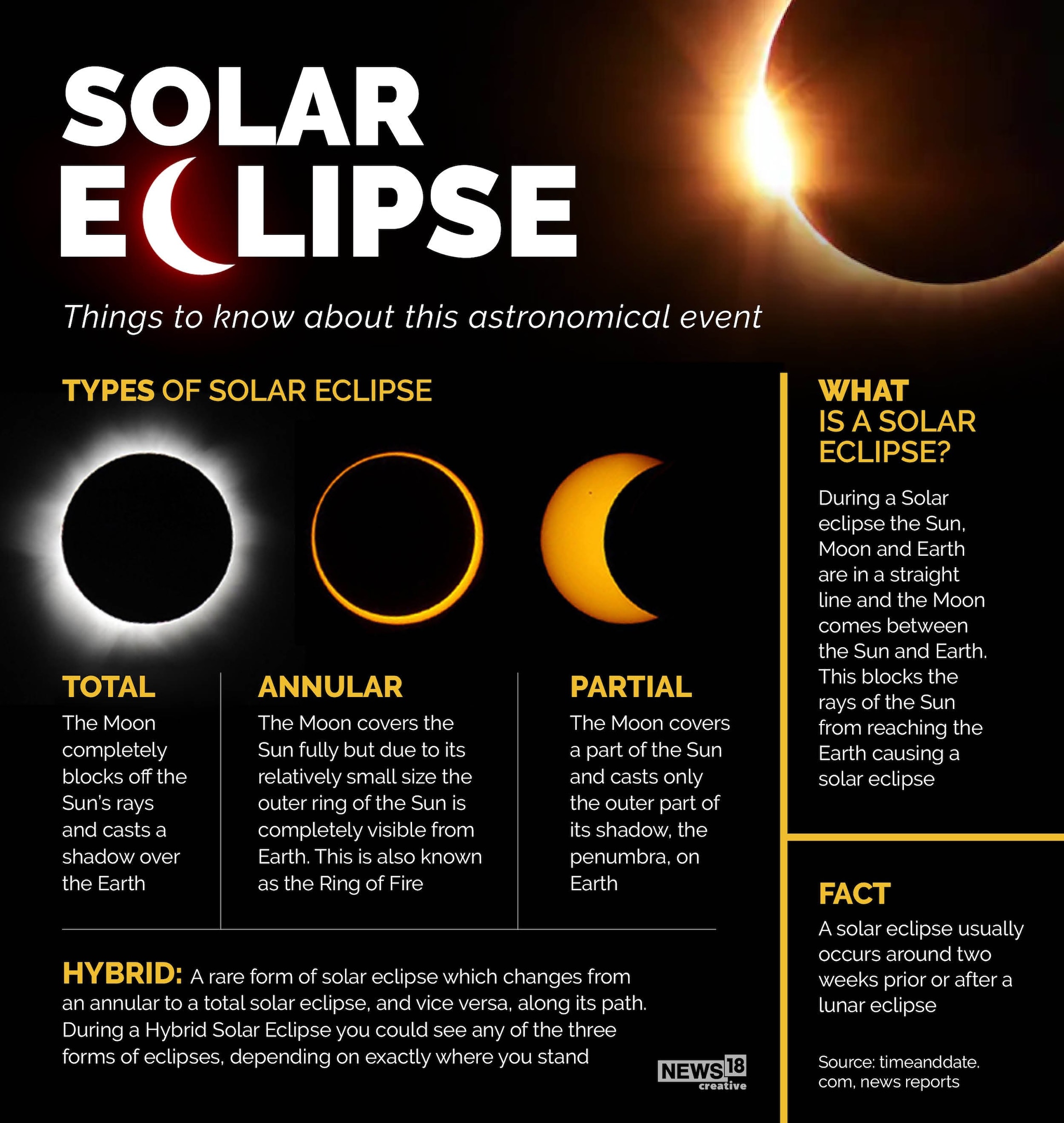

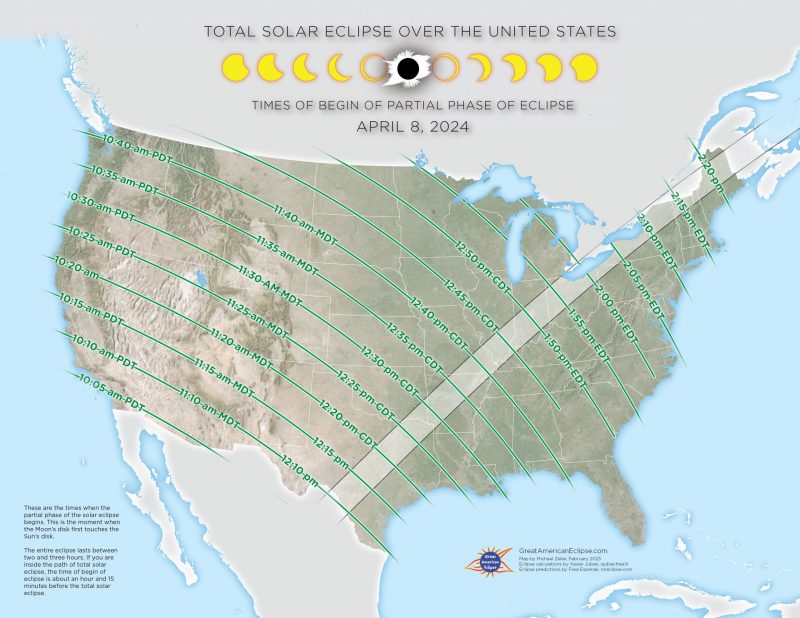

Partial Solar Eclipse Over Nyc This Saturday Time And Viewing Information

May 05, 2025

Partial Solar Eclipse Over Nyc This Saturday Time And Viewing Information

May 05, 2025 -

Ufc 314 Complete Fight Card Results Volkanovski Vs Lopes Breakdown

May 05, 2025

Ufc 314 Complete Fight Card Results Volkanovski Vs Lopes Breakdown

May 05, 2025 -

Saturdays Partial Solar Eclipse In New York City What Time And How To Watch

May 05, 2025

Saturdays Partial Solar Eclipse In New York City What Time And How To Watch

May 05, 2025 -

Nyc Partial Solar Eclipse On Saturday Timing And Safe Viewing

May 05, 2025

Nyc Partial Solar Eclipse On Saturday Timing And Safe Viewing

May 05, 2025