How Lack Of Funds Impacts Your Goals And What You Can Do

Table of Contents

Financial Constraints and Goal Setting

The relationship between financial resources and goal achievement is undeniable. The feasibility of various goals – short-term, long-term, personal, and professional – is directly impacted by your financial situation. A lack of funds can create significant barriers, making even seemingly simple objectives feel unattainable.

Impact on Short-Term Goals

Limited funds can significantly impact your ability to meet immediate needs and desires.

- Examples: Difficulty affording groceries or utilities, postponing necessary car repairs, foregoing opportunities for skill development due to the cost of courses.

- Bullet points:

- Increased stress and anxiety related to financial insecurity.

- Compromised health due to inability to afford healthcare or healthy food options.

- Strain on relationships due to financial disagreements or limitations on shared activities.

Impact on Long-Term Goals

The long-term consequences of a lack of funds can be even more severe, potentially impacting your entire life trajectory.

- Examples: Inability to save for retirement, delayed homeownership, postponement of higher education or career training opportunities that require significant upfront investment.

- Bullet points:

- Reduced financial security in retirement and old age.

- Missed opportunities for wealth building and investment growth.

- Decreased overall life satisfaction due to unmet aspirations and unfulfilled potential.

- Bullet points:

Impact on Personal Goals

A lack of funds doesn't just affect professional aspirations; it also significantly impacts personal goals and overall well-being.

- Examples: Inability to travel, pursue hobbies, or participate in social events that require financial investment.

- Bullet points:

- Feelings of deprivation, isolation, and resentment.

- Limited opportunities for personal growth and self-expression.

- Increased feelings of stress and unhappiness.

Strategies to Overcome Lack of Funds

While a lack of funds can be daunting, it doesn't have to define your future. Proactive financial management can empower you to achieve your goals despite financial limitations.

Creating a Realistic Budget

A well-structured budget is the cornerstone of effective financial management.

- Explanation: Track your income and expenses meticulously. Identify areas where you can cut back and allocate funds towards your goals.

- Bullet points:

- Utilize budgeting apps (Mint, YNAB, Personal Capital) to automate tracking and analysis.

- Create a monthly budget spreadsheet to monitor your progress and make adjustments as needed.

- Review your expenses regularly to identify potential areas for savings and cost reduction.

Exploring Additional Income Streams

Increasing your income is a powerful way to alleviate financial strain and accelerate your progress towards your goals.

- Explanation: Explore various avenues for generating additional income.

- Bullet points:

- Identify transferable skills and explore freelance opportunities on platforms like Upwork or Fiverr.

- Consider a part-time job that complements your schedule and skills.

- Sell unused items online through platforms such as eBay or Craigslist.

Seeking Financial Assistance

Don't hesitate to seek help when needed. Numerous resources are available to assist individuals facing financial hardship.

- Explanation: Research and explore grants, loans, scholarships, and financial counseling services.

- Bullet points:

- Research relevant non-profit organizations and government programs that offer financial assistance.

- Understand the terms and conditions of any loans or financial aid before accepting them.

- Seek professional financial advice from a certified financial planner to create a personalized plan.

Prioritizing Goals

Focusing your efforts on the most important goals is crucial when dealing with limited resources.

- Explanation: Rank your goals based on their importance and long-term impact. Break down larger goals into smaller, more manageable steps.

- Bullet points:

- Utilize the SMART goals framework (Specific, Measurable, Achievable, Relevant, Time-bound) to set clear targets.

- Celebrate small wins along the way to maintain motivation and momentum.

Conclusion

A lack of funds significantly impacts the ability to achieve personal and professional goals. However, by implementing proactive financial management strategies – including creating a realistic budget, exploring additional income streams, seeking financial assistance, and prioritizing goals – you can overcome these obstacles. Don't let a lack of funds derail your dreams; take control of your finances and start working towards a brighter future! Start tackling your lack of funds today! Take the first step towards financial freedom and achieve your goals! Use resources like [link to budgeting tool] and [link to financial planning website] to get started. Overcome your lack of funds with a strategic plan! Don't let a lack of funds define your future; take action now!

Featured Posts

-

Trans Australia Run Record On The Brink

May 21, 2025

Trans Australia Run Record On The Brink

May 21, 2025 -

Trans Australia Run The Race To Break The Record

May 21, 2025

Trans Australia Run The Race To Break The Record

May 21, 2025 -

Antiques Roadshow Leads To Jail Time For Couple With Stolen Items

May 21, 2025

Antiques Roadshow Leads To Jail Time For Couple With Stolen Items

May 21, 2025 -

Jeremie Frimpong Transfer Agreement Reached But No Contact With Liverpool Yet

May 21, 2025

Jeremie Frimpong Transfer Agreement Reached But No Contact With Liverpool Yet

May 21, 2025 -

Half Dome Wins Abn Group Victoria Pitch A New Era In Industry

May 21, 2025

Half Dome Wins Abn Group Victoria Pitch A New Era In Industry

May 21, 2025

Latest Posts

-

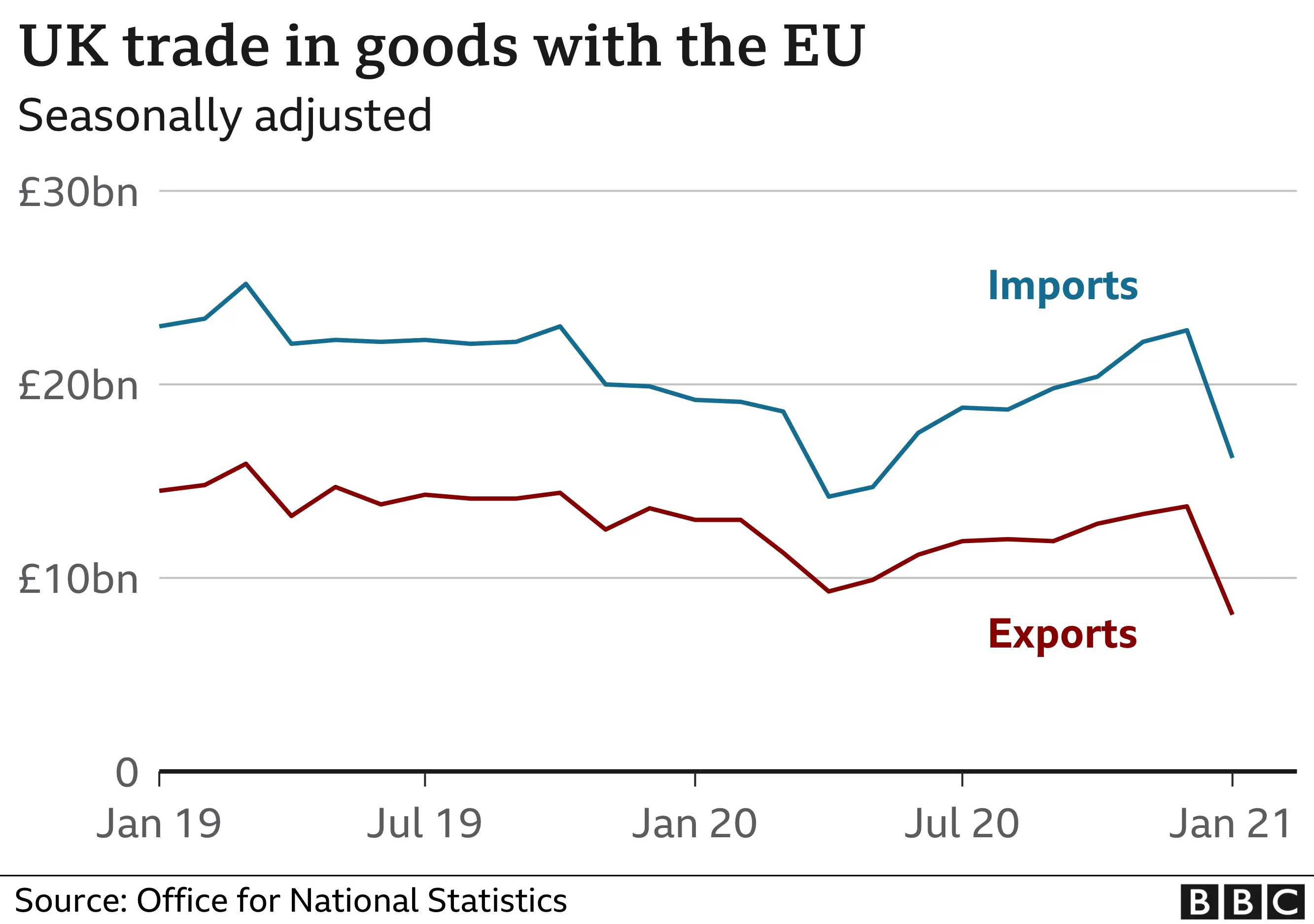

Brexit Impact Uk Luxury Goods Exports To The Eu Suffer

May 21, 2025

Brexit Impact Uk Luxury Goods Exports To The Eu Suffer

May 21, 2025 -

Uk Luxury Lobby Blames Brexit For Slower Eu Export Growth

May 21, 2025

Uk Luxury Lobby Blames Brexit For Slower Eu Export Growth

May 21, 2025 -

Reviving American Manufacturing The Reality Of Job Creation

May 21, 2025

Reviving American Manufacturing The Reality Of Job Creation

May 21, 2025 -

Navigating The Path To European Citizenship For Americans

May 21, 2025

Navigating The Path To European Citizenship For Americans

May 21, 2025 -

The China Factor Analyzing Market Headwinds For Luxury Auto Brands Like Bmw And Porsche

May 21, 2025

The China Factor Analyzing Market Headwinds For Luxury Auto Brands Like Bmw And Porsche

May 21, 2025