How Extreme Weather Events Could Impact Your Creditworthiness For A Mortgage

Table of Contents

Damage to Property and Missed Mortgage Payments

Extreme weather can cause significant property damage, potentially leading to missed mortgage payments. This directly impacts your credit score, making it harder to secure future financing, including a mortgage.

Direct Impact on Credit Score

Even minor damage requiring repairs can strain finances. Significant damage, such as that caused by hurricanes, floods, or wildfires, can lead to substantial repair costs. If you lack sufficient insurance coverage or emergency funds, this can easily result in missed mortgage payments.

- Even one missed payment can negatively affect your credit report for several years, impacting your credit score.

- Lenders view consistent on-time payments as a crucial indicator of financial responsibility. A history of late payments significantly reduces your chances of mortgage approval.

- If you are facing financial difficulty due to weather damage, consider exploring mortgage hardship programs offered by your lender. These programs may offer temporary payment modifications to help you get back on track.

The Role of Insurance

Adequate homeowners insurance is crucial in mitigating the financial impact of extreme weather. It's not enough to simply have insurance; you need to understand exactly what your policy covers.

- Review your policy annually to ensure it's up-to-date and provides comprehensive coverage for extreme weather events specific to your area. Coverage needs may vary significantly depending on location.

- Consider supplemental insurance, such as flood insurance (often not included in standard homeowners insurance), to protect yourself from a wider range of potential weather-related damages. This proactive approach can safeguard your financial stability.

Impact on Employment and Income

Beyond property damage, extreme weather can disrupt businesses and employment, further jeopardizing your mortgage application.

Job Loss Due to Extreme Weather

Extreme weather events can cause widespread business closures and job losses. If you lose your job due to a weather-related event, your ability to make timely mortgage payments diminishes considerably.

- Building a robust emergency fund to cover at least three to six months of living expenses is a critical step in preparing for potential income disruptions.

- If you lose your job due to weather-related circumstances, explore unemployment insurance benefits immediately. This can provide temporary financial assistance while you search for new employment.

Difficulty Obtaining New Employment

In the aftermath of a major weather event, job opportunities in the affected area might become scarce, creating a prolonged period of financial instability. This makes it even more challenging to maintain good credit and secure a mortgage.

The Process of Rebuilding Credit After Extreme Weather

Rebuilding your credit after experiencing extreme weather and its financial consequences requires proactive steps and patience.

Dispute Inaccurate Reporting

If late payments resulted from circumstances beyond your control (like severe weather damage), contact your lender and the credit bureaus immediately. Explain the situation and provide supporting documentation.

- Gather all relevant documentation to support your claim, including insurance claim documents, repair bills, and proof of weather damage from reputable sources (e.g., news reports, government agencies).

- Regularly monitor your credit reports from all three major credit bureaus (Equifax, Experian, and TransUnion) for any errors. Dispute any inaccuracies promptly.

Strategies for Credit Repair

Rebuilding your credit takes time and consistent effort. Focus on establishing good financial habits.

- Prioritize paying down existing debts. This will lower your credit utilization ratio, a key factor in your credit score.

- Avoid applying for new credit during this period. Each new application creates a hard inquiry, temporarily lowering your score.

- Maintain a positive payment history across all accounts. Consistent on-time payments are crucial for rebuilding your credit.

- Consider credit counseling from a reputable agency if needed. They can provide guidance on budgeting, debt management, and credit repair strategies.

Conclusion

Extreme weather events pose a significant threat to your financial stability and your creditworthiness for a mortgage. Understanding the potential impacts, preparing with adequate insurance, and knowing how to rebuild your credit after a disaster are essential steps to protect your future. By taking proactive measures and being informed about the potential financial consequences, you can mitigate the risk and strengthen your position when applying for a mortgage, even after facing extreme weather events. Don't let unforeseen circumstances derail your homeownership dreams; take steps today to protect your financial health and prepare for the potential impact of extreme weather events on your mortgage application.

Featured Posts

-

Todays Nyt Mini Crossword Answers For March 18

May 20, 2025

Todays Nyt Mini Crossword Answers For March 18

May 20, 2025 -

Improving Apples Llm Siri Key Challenges And Solutions

May 20, 2025

Improving Apples Llm Siri Key Challenges And Solutions

May 20, 2025 -

Leclercs Clear Message Analyzing The Ferrari Strategy And Its Impact On Hamilton

May 20, 2025

Leclercs Clear Message Analyzing The Ferrari Strategy And Its Impact On Hamilton

May 20, 2025 -

Paulina Gretzkys Topless Selfie And Other Revealing Photos

May 20, 2025

Paulina Gretzkys Topless Selfie And Other Revealing Photos

May 20, 2025 -

Solve The Nyt Crossword April 25 2025 Answers

May 20, 2025

Solve The Nyt Crossword April 25 2025 Answers

May 20, 2025

Latest Posts

-

School Delays And Closures Due To Winter Weather Advisories

May 20, 2025

School Delays And Closures Due To Winter Weather Advisories

May 20, 2025 -

Collins Aerospace Layoff Impact On Cedar Rapids Workers

May 20, 2025

Collins Aerospace Layoff Impact On Cedar Rapids Workers

May 20, 2025 -

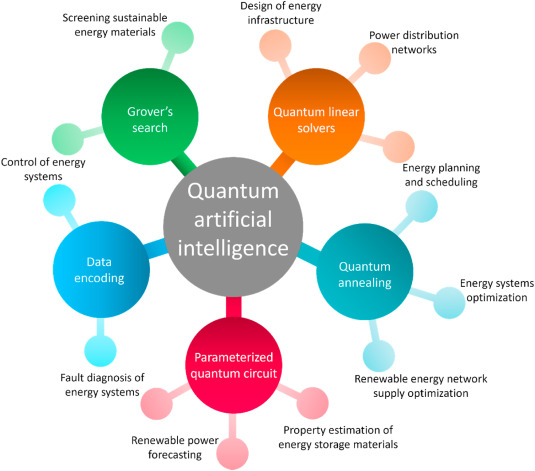

Buy This Ai Quantum Computing Stock The Dips Hidden Advantage

May 20, 2025

Buy This Ai Quantum Computing Stock The Dips Hidden Advantage

May 20, 2025 -

Confirmation Of Layoffs At Collins Aerospace Cedar Rapids Plant

May 20, 2025

Confirmation Of Layoffs At Collins Aerospace Cedar Rapids Plant

May 20, 2025 -

Investing In Ai Quantum Computing Stocks One Reason To Buy The Dip

May 20, 2025

Investing In Ai Quantum Computing Stocks One Reason To Buy The Dip

May 20, 2025