Hong Kong Intervenes To Defend Currency Peg With US Dollar Purchases

Table of Contents

Understanding the Hong Kong Dollar Peg

The Hong Kong dollar's peg to the US dollar is a cornerstone of Hong Kong's economic policy. It operates within a linked exchange rate system, maintaining a narrow band against the USD (typically between 7.75 and 7.85 HKD per USD). This tightly controlled exchange rate provides significant benefits: it fosters price stability, attracting foreign investment and boosting Hong Kong's role as a major trading and financial center. The stability encourages international trade by minimizing exchange rate risks for businesses.

However, maintaining this peg isn't without its challenges. The system, effectively a currency board system, requires the HKMA to hold sufficient US dollar reserves to meet any demand for HKD. This creates vulnerabilities, particularly during periods of significant capital outflow or global economic uncertainty.

- Fixed exchange rate band: The HKD is pegged within a narrow band against the USD, offering predictability.

- Role of the HKMA: The HKMA actively manages the peg, intervening to maintain the exchange rate within the specified band.

- Impact on interest rates: Hong Kong's interest rates tend to track those of the US, influencing borrowing costs and investment decisions.

- Advantages and disadvantages of a currency board system: While offering stability, a currency board system limits monetary policy flexibility and can create vulnerabilities during crises.

Reasons Behind the HKMA's Intervention

The recent intervention by the HKMA was triggered by a confluence of factors placing pressure on the HKD peg. External factors, such as global economic uncertainty and the relative strength of the US dollar, played a significant role. Internally, local market conditions and potentially speculative attacks contributed to the weakening of the HKD. A weakening HKD threatens to destabilize the entire economy, potentially impacting trade, investment, and inflation.

- Geopolitical risks and their impact: Global events can create uncertainty and impact capital flows, putting pressure on the HKD.

- Capital flows and their influence on the exchange rate: Significant capital outflows can weaken the HKD, necessitating HKMA intervention.

- Speculative attacks and their consequences: Speculators might bet against the HKD, further weakening the currency and forcing the HKMA to act.

- Role of interest rate differentials: Differences in interest rates between Hong Kong and the US can influence capital flows and put pressure on the exchange rate.

The HKMA's Response: US Dollar Purchases

To counter the downward pressure on the HKD, the HKMA took decisive action, purchasing US dollars in the foreign exchange market. This involved selling HKD and buying USD, thus increasing demand for the HKD and supporting its value against the USD. The scale of the USD purchases reflects the HKMA's commitment to maintaining the peg. The exact amount purchased isn't always publicly disclosed immediately, but the HKMA's actions clearly signal its intent to maintain stability.

- Quantity of US dollars purchased: While precise figures are not always released immediately, the scale of the intervention demonstrates the seriousness of the situation.

- Impact on Hong Kong's foreign exchange reserves: The intervention would naturally reduce Hong Kong's foreign exchange reserves.

- Short-term and long-term effects of the intervention: The short-term effect aims to stabilize the exchange rate, while long-term effects depend on underlying economic conditions.

- Comparison with past interventions: This intervention can be compared to previous instances where the HKMA defended the peg, offering insights into the effectiveness of its strategies.

Implications and Future Outlook for the Hong Kong Dollar

The HKMA's intervention has short-term and long-term implications for the HKD and the Hong Kong economy. In the short term, the intervention stabilized the exchange rate, providing much-needed certainty for businesses and investors. However, the long-term sustainability of the peg depends on various factors, including global economic conditions, interest rate differentials, and potential future speculative attacks. Maintaining the peg may necessitate further interventions if external pressures persist.

- Impact on inflation and interest rates: The intervention's impact on inflation and interest rates will depend on the overall economic situation.

- Effects on businesses and consumers: Exchange rate stability benefits businesses by reducing uncertainty, while consumers benefit from price stability.

- Potential challenges to maintaining the peg: Sustaining the peg requires sufficient foreign exchange reserves and the ability to counter speculative attacks.

- Alternative scenarios for the future of the HKD: While the peg remains the official policy, considering alternative scenarios helps to prepare for potential future adjustments.

Conclusion: Maintaining the Hong Kong Dollar Peg

The HKMA's recent intervention to defend the Hong Kong dollar peg against the US dollar underscores the crucial role this peg plays in Hong Kong's economic stability and prosperity. The reasons behind the intervention – a mix of global uncertainty and potential speculation – highlight the ongoing challenges in maintaining a fixed exchange rate system. While the immediate impact was a stabilization of the HKD, the long-term sustainability of the peg remains dependent on various economic factors. It is vital for businesses, investors, and individuals to stay informed about developments concerning the Hong Kong dollar peg. Stay updated on announcements from the HKMA and follow reputable financial news sources to understand the evolving dynamics of the HKD and its relationship with the USD, ensuring you remain well-informed about the future of the Hong Kong dollar peg.

Featured Posts

-

Manage Spotify Payments On I Phone A Guide To The New Options

May 05, 2025

Manage Spotify Payments On I Phone A Guide To The New Options

May 05, 2025 -

Sesame Street And Laugh In Star Ruth Buzzi Dead At 88

May 05, 2025

Sesame Street And Laugh In Star Ruth Buzzi Dead At 88

May 05, 2025 -

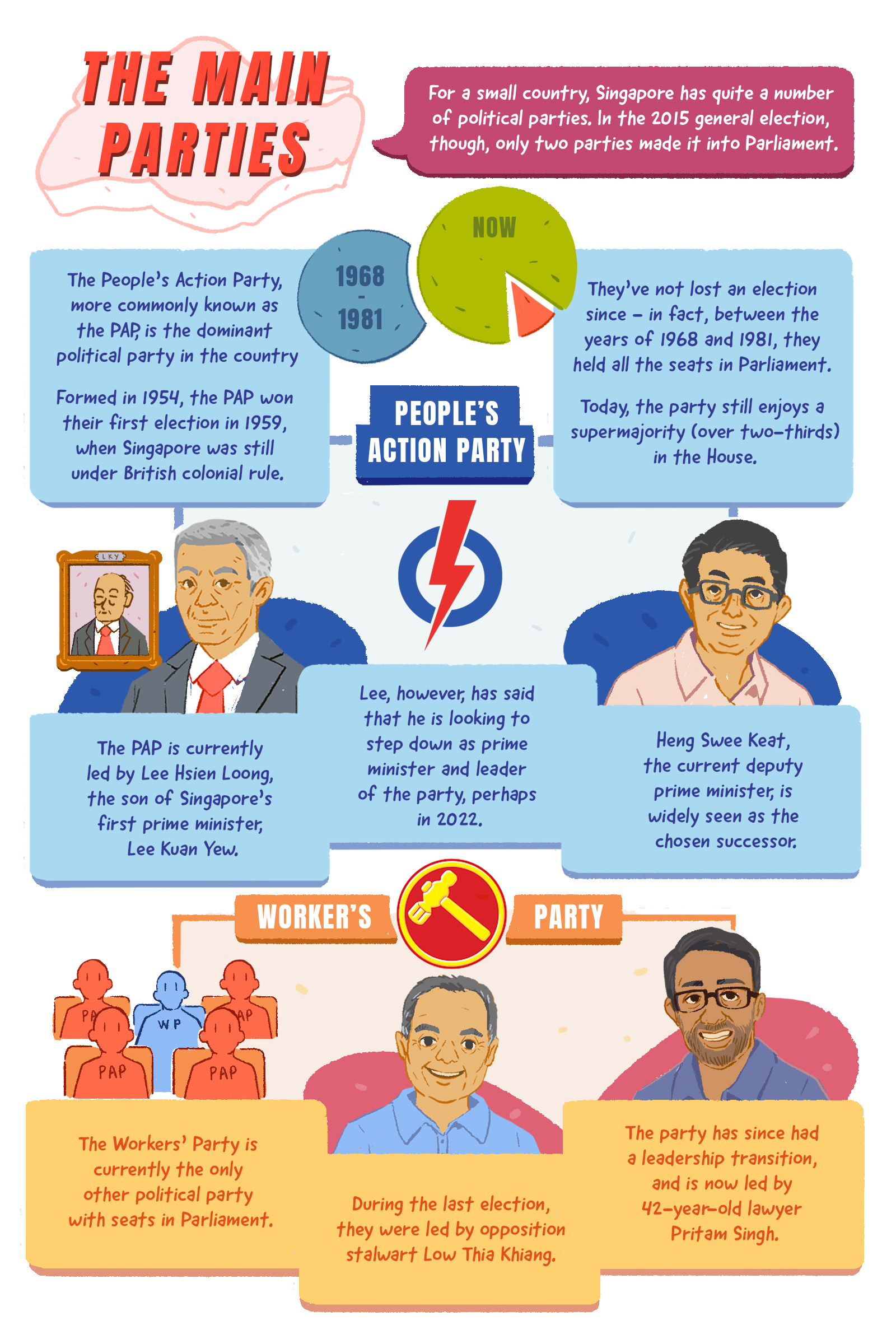

How Singapores Elections Could Shift Political Power Dynamics

May 05, 2025

How Singapores Elections Could Shift Political Power Dynamics

May 05, 2025 -

Aritzia On Tariffs No Price Increases Announced

May 05, 2025

Aritzia On Tariffs No Price Increases Announced

May 05, 2025 -

Guilty Plea Lab Owner Falsified Covid 19 Test Results During Pandemic

May 05, 2025

Guilty Plea Lab Owner Falsified Covid 19 Test Results During Pandemic

May 05, 2025

Latest Posts

-

Calgary Flames Wolf Playoff Predictions And Calder Trophy Discussion With Nhl Com

May 05, 2025

Calgary Flames Wolf Playoff Predictions And Calder Trophy Discussion With Nhl Com

May 05, 2025 -

2025 Playoffs Capitals And Vanda Pharmaceuticals Announce Collaborative Initiatives

May 05, 2025

2025 Playoffs Capitals And Vanda Pharmaceuticals Announce Collaborative Initiatives

May 05, 2025 -

Nhl Com Q And A Wolf On Calgary Flames Season Playoff Outlook And Calder Race

May 05, 2025

Nhl Com Q And A Wolf On Calgary Flames Season Playoff Outlook And Calder Race

May 05, 2025 -

Washington Capitals 2025 Playoffs Plan Key Initiatives Announced

May 05, 2025

Washington Capitals 2025 Playoffs Plan Key Initiatives Announced

May 05, 2025 -

Capitals Announce 2025 Playoffs Initiatives A Vanda Pharmaceuticals Partnership

May 05, 2025

Capitals Announce 2025 Playoffs Initiatives A Vanda Pharmaceuticals Partnership

May 05, 2025