Home Depot Stock: Impact Of Tariffs On Q[Quarter] Earnings

![Home Depot Stock: Impact Of Tariffs On Q[Quarter] Earnings Home Depot Stock: Impact Of Tariffs On Q[Quarter] Earnings](https://genussprofessional.de/image/home-depot-stock-impact-of-tariffs-on-q-quarter-earnings.jpeg)

Table of Contents

Tariff Impact on Home Depot's Supply Chain

The imposition of tariffs has significantly impacted Home Depot's supply chain, leading to increased costs and forcing the company to adapt its sourcing strategies.

Increased Costs of Imported Goods

Tariffs have driven up the prices of various imported goods crucial to Home Depot's business. This includes lumber, a cornerstone of many home improvement projects.

- Lumber: Tariffs on Canadian lumber have resulted in a substantial price increase, estimated at X% based on Home Depot's Q3 financial statements. This directly impacts profit margins on lumber sales and projects involving lumber.

- Building Materials: Other building materials, such as steel and certain types of concrete, have also seen price hikes due to tariffs, impacting the overall cost of goods sold for Home Depot. The increase is estimated at Y% based on internal Home Depot data.

- Appliances: Imported appliances, a significant portion of Home Depot's sales, have also faced increased costs due to tariffs, reducing profit margins in that category. The average cost increase is estimated at Z%.

These increased costs have directly impacted Home Depot's profit margins, forcing the company to explore alternative solutions to mitigate these effects.

Shifting Sourcing Strategies

In response to the increased costs, Home Depot has actively sought to diversify its supply chain and mitigate the impact of tariffs.

- Increased Domestic Sourcing: Home Depot has focused on sourcing more materials domestically, reducing reliance on imports subject to tariffs. This includes exploring partnerships with domestic lumber mills and manufacturers of building materials.

- Alternative Markets: The company is also exploring sourcing options from alternative markets outside the scope of current tariffs. This strategy involves navigating new logistical challenges and establishing relationships with suppliers in new regions.

- Long-Term Supply Chain Diversification: The experience with tariffs has highlighted the need for a more diversified and resilient supply chain. Home Depot is likely to continue these efforts in the long-term to ensure greater stability and reduce vulnerability to future trade disputes.

Consumer Behavior and Demand Shifts

The increased prices resulting from tariffs have had a noticeable impact on consumer behavior and demand for home improvement products.

Impact on Home Improvement Spending

Higher prices have naturally affected consumer spending on home improvement projects.

- Decreased DIY Projects: Some consumers are postponing or scaling down DIY projects due to increased material costs. This is evident in declining sales of certain project-specific materials.

- Shift in Consumer Preferences: Consumers are increasingly looking for budget-friendly alternatives and prioritizing essential repairs over larger-scale renovations. This shift is reflected in increased sales of lower-cost products.

- Overall Spending Trends: Industry data shows a slight decrease in overall home improvement spending, correlating with the increased prices resulting from tariffs. This trend is concerning for Home Depot and other retailers in the home improvement sector.

Pricing Strategies and Competitive Landscape

Home Depot has implemented various pricing strategies to remain competitive despite increased costs.

- Strategic Price Adjustments: Home Depot has carefully adjusted prices to maintain some level of competitiveness, while still absorbing a portion of the increased cost of goods.

- Promotional Offers: The company has utilized various promotional offers and discounts to stimulate demand and attract price-sensitive consumers.

- Comparison to Lowe's: While both Home Depot and Lowe's face similar challenges, their specific pricing strategies and responses to the tariff situation differ, offering an interesting comparative analysis for investors.

Q3 Earnings Report Analysis

Home Depot's Q3 earnings report reflects the impact of tariffs on its financial performance.

Key Financial Metrics

The Q3 report showed:

- Revenue: A slight decrease in revenue compared to the same period last year, partially attributed to reduced consumer spending. Specific numbers need to be added here from the Q3 report.

- Net Income: A decline in net income compared to the previous year, showcasing the impact of increased costs and reduced sales. Specific numbers are needed here.

- Gross Margin: A compression of gross margin, indicating the impact of higher costs on profitability. This needs specific numbers from the Q3 report.

These figures, when compared to previous quarters and competitor data, highlight the significant challenge posed by tariffs. Visual representation using charts and graphs is recommended here.

Management Commentary and Future Outlook

Home Depot's management acknowledged the challenges presented by tariffs in their Q3 earnings call.

- Management Quotes: Specific quotes from management regarding their assessment of the tariff impact and their strategies for mitigation should be added here.

- Future Projections: The company's outlook for the coming quarters should be included, reflecting their expectations for ongoing tariff-related challenges and their planned responses. This section should incorporate information from relevant press releases and conference calls.

Conclusion

Tariffs have demonstrably affected Home Depot's supply chain, leading to increased costs and impacting consumer behavior. This has resulted in reduced profitability in Q3, as evidenced by the reported financial metrics. The ongoing uncertainty surrounding tariffs presents a significant challenge for Home Depot and the broader home improvement sector. For investors considering Home Depot stock, this situation necessitates careful consideration of the ongoing risks and potential future impacts. Stay tuned for our next analysis of Home Depot stock and the ongoing impact of tariffs on future earnings.

![Home Depot Stock: Impact Of Tariffs On Q[Quarter] Earnings Home Depot Stock: Impact Of Tariffs On Q[Quarter] Earnings](https://genussprofessional.de/image/home-depot-stock-impact-of-tariffs-on-q-quarter-earnings.jpeg)

Featured Posts

-

Succesvol Verkopen Met Het Abn Amro Kamerbrief Certificaten Programma

May 22, 2025

Succesvol Verkopen Met Het Abn Amro Kamerbrief Certificaten Programma

May 22, 2025 -

The Goldbergs A Nostalgic Look At 80s Family Life

May 22, 2025

The Goldbergs A Nostalgic Look At 80s Family Life

May 22, 2025 -

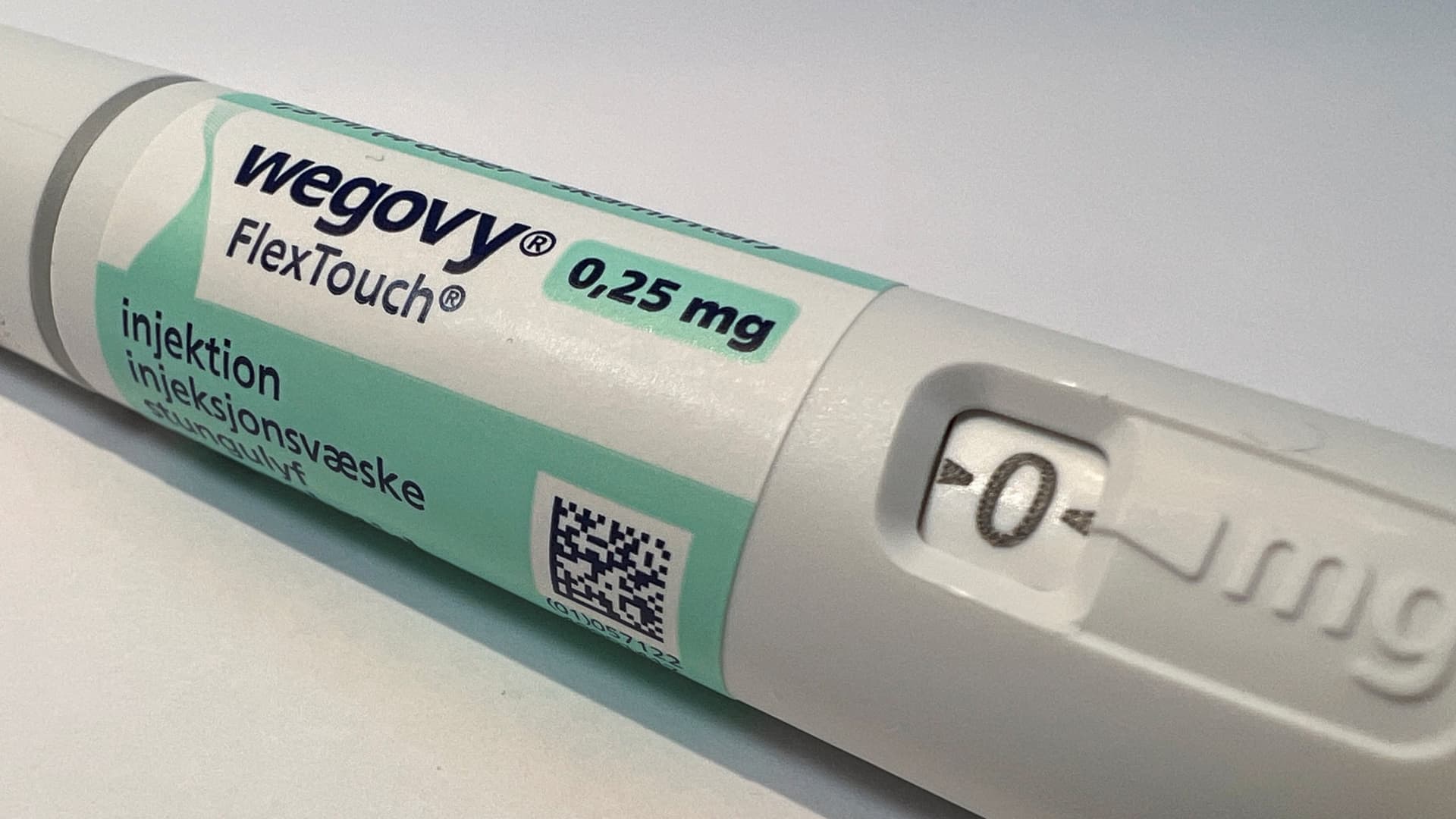

Ozempic Knockoffs Targeted Fda Action Impacts Patient Access

May 22, 2025

Ozempic Knockoffs Targeted Fda Action Impacts Patient Access

May 22, 2025 -

Core Weave Crwv Stock Performance Today Key Factors

May 22, 2025

Core Weave Crwv Stock Performance Today Key Factors

May 22, 2025 -

Peppa Pigs Parents Gender Reveal Party Pictures And Details

May 22, 2025

Peppa Pigs Parents Gender Reveal Party Pictures And Details

May 22, 2025

Latest Posts

-

Box Truck Involved In Route 581 Accident Traffic Backed Up

May 22, 2025

Box Truck Involved In Route 581 Accident Traffic Backed Up

May 22, 2025 -

Major Box Truck Crash On Route 581 Leads To Road Closure

May 22, 2025

Major Box Truck Crash On Route 581 Leads To Road Closure

May 22, 2025 -

Route 581 Shutdown Box Truck Accident Causes Delays

May 22, 2025

Route 581 Shutdown Box Truck Accident Causes Delays

May 22, 2025 -

Emergency Responders Tackle Significant Used Car Fire

May 22, 2025

Emergency Responders Tackle Significant Used Car Fire

May 22, 2025 -

Used Car Dealer Fire Extensive Damage Reported

May 22, 2025

Used Car Dealer Fire Extensive Damage Reported

May 22, 2025