CoreWeave (CRWV) Stock Performance Today: Key Factors

Table of Contents

Market Sentiment and Overall Market Conditions

The overall market climate significantly influences CoreWeave's stock performance. CRWV, as a growth stock in the tech sector, is highly sensitive to broader market trends. Its price often correlates with the performance of major tech indices like the NASDAQ.

- Impact of Interest Rate Hikes/Changes: Rising interest rates typically lead to decreased investor appetite for growth stocks like CRWV, as higher borrowing costs reduce the perceived value of future earnings. Conversely, rate cuts can boost investor confidence and drive up prices.

- Correlation with NASDAQ or Other Tech Indices: CRWV's stock price often moves in tandem with the NASDAQ Composite and other technology-focused indices. A positive trend in the broader tech market usually benefits CRWV, while a negative trend can weigh heavily on its performance.

- Overall Investor Risk Appetite: Periods of high investor risk aversion often see investors moving towards safer investments, leading to sell-offs in higher-risk growth stocks like CoreWeave. Conversely, increased risk appetite can fuel investments in growth sectors.

- Recent Market Events: Recent macroeconomic events, such as inflation reports, geopolitical instability, or unexpected economic news, can significantly impact investor sentiment and consequently influence CRWV's stock price. For example, news about potential regulations in the AI sector could negatively impact CRWV's valuation.

Company-Specific News and Announcements

Company-specific news plays a vital role in shaping CRWV stock price. Positive announcements tend to boost investor confidence, while negative news can trigger sell-offs.

- New Partnerships or Contracts: Securing significant partnerships with major cloud providers or enterprise clients can positively influence CRWV's stock price, demonstrating the company's market traction and growth potential.

- Financial Earnings Reports: Quarterly or annual earnings reports are closely watched by investors. Exceeding expectations typically leads to positive price movements, while disappointing results can cause a decline.

- Product Launches or Updates: Announcements of new products, significant software updates, or technological advancements can boost investor confidence and drive up the stock price if they represent a meaningful step forward for the company.

- Analyst Ratings and Upgrades/Downgrades: Changes in analyst ratings and price targets can influence investor sentiment and trading activity. Upgrades usually lead to increased buying pressure, while downgrades can trigger selling.

Competitor Analysis and Industry Trends

Analyzing CoreWeave's competitive landscape and the broader industry trends is crucial for understanding its stock performance.

- Comparison with Other Cloud Computing Companies: CRWV competes with established cloud computing giants and other emerging players in the AI infrastructure market. Its relative performance compared to competitors provides insights into its market positioning and growth prospects.

- Emerging Trends in the AI Infrastructure Market: The rapid growth of artificial intelligence is driving demand for specialized cloud infrastructure. Understanding the evolving industry trends and how CRWV is positioned to capitalize on them is essential for assessing its long-term potential.

- Analysis of Competitive Advantages and Disadvantages: Identifying CRWV's competitive advantages, such as its specialized infrastructure or strategic partnerships, and disadvantages, such as its relatively smaller market share, helps in evaluating its prospects relative to the competition.

Technical Analysis of CRWV Stock Chart

Technical analysis can offer insights into potential price movements, but it's crucial to remember that it's not a foolproof method.

- Key Support and Resistance Levels: Identifying key support and resistance levels on the CRWV stock chart can help predict potential price reversals or breakouts.

- Trading Volume: High trading volume during price movements often suggests stronger conviction behind the trend. Low volume can indicate indecision or weakness.

- Significant Chart Patterns: Analyzing chart patterns such as trends, breakouts, or head-and-shoulders formations can provide clues about future price direction. However, interpreting these patterns requires experience and expertise.

- Disclaimer: It is crucial to understand that technical analysis is not a guaranteed predictor of future price movements. Investing in the stock market involves risk, and past performance is not indicative of future results. Consult with a qualified financial advisor before making any investment decisions.

Conclusion

CoreWeave (CRWV) stock performance is influenced by a complex interplay of market-wide sentiment, company-specific news, competitive dynamics, and technical factors. Understanding these elements is crucial for investors seeking to navigate the volatility of the CRWV stock. While positive news, strong financial results, and favorable market conditions can drive up the price, negative news or broader economic downturns can lead to declines. Remember that this analysis is for informational purposes only and does not constitute financial advice. Staying updated on CoreWeave stock performance requires continuous monitoring of these key factors. Track CRWV stock price fluctuations and monitor key factors affecting CRWV to make informed investment decisions. To stay informed, regularly check reputable financial news sources for the latest updates on CRWV and the broader market. Understanding these key factors is crucial for navigating the volatility of CoreWeave (CRWV) stock.

Featured Posts

-

Betalingen In Nederland Van Bankrekening Tot Tikkie

May 22, 2025

Betalingen In Nederland Van Bankrekening Tot Tikkie

May 22, 2025 -

Ex Tory Councillors Wifes Racial Hatred Tweet Appeal The Wait Continues

May 22, 2025

Ex Tory Councillors Wifes Racial Hatred Tweet Appeal The Wait Continues

May 22, 2025 -

Alles Wat U Moet Weten Over Tikkie En Nederlandse Bankrekeningen

May 22, 2025

Alles Wat U Moet Weten Over Tikkie En Nederlandse Bankrekeningen

May 22, 2025 -

Weekly Virginia Gas Price Update Gas Buddy Reports Decrease

May 22, 2025

Weekly Virginia Gas Price Update Gas Buddy Reports Decrease

May 22, 2025 -

Trans Australia Run Is A New Record Imminent

May 22, 2025

Trans Australia Run Is A New Record Imminent

May 22, 2025

Latest Posts

-

Your Netflix Guide 7 Shows To Watch May 18 24

May 22, 2025

Your Netflix Guide 7 Shows To Watch May 18 24

May 22, 2025 -

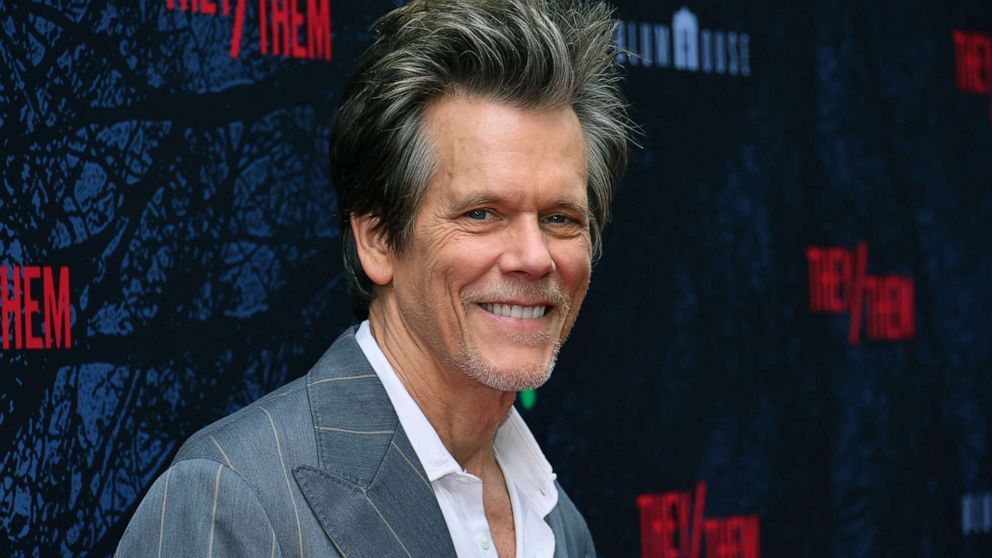

Is This The Next Big Netflix Hit Kevin Bacon And Julianne Moore In A Dark Comedy

May 22, 2025

Is This The Next Big Netflix Hit Kevin Bacon And Julianne Moore In A Dark Comedy

May 22, 2025 -

7 Must See Netflix Shows Your Watchlist For May 18 24

May 22, 2025

7 Must See Netflix Shows Your Watchlist For May 18 24

May 22, 2025 -

Netflix Drops Trailer For Dark Comedy With Kevin Bacon And Julianne Moore Will It Be A Hit

May 22, 2025

Netflix Drops Trailer For Dark Comedy With Kevin Bacon And Julianne Moore Will It Be A Hit

May 22, 2025 -

Kevin Bacon And Julianne Moore Star In Netflixs Upcoming Dark Comedy

May 22, 2025

Kevin Bacon And Julianne Moore Star In Netflixs Upcoming Dark Comedy

May 22, 2025