High Stock Market Valuations: A BofA Perspective For Investors

Table of Contents

BofA's Current Market Outlook and Valuation Metrics

BofA's current market outlook often reflects a nuanced perspective, acknowledging both the potential for growth and the risks associated with high valuations. While not explicitly stating a purely "bullish," "bearish," or "neutral" stance, their analysis incorporates cautionary notes. BofA utilizes a range of valuation metrics to assess market health, including the Price-to-Earnings ratio (P/E), the cyclically adjusted price-to-earnings ratio (Shiller P/E), and the Price-to-Sales ratio (P/S).

-

Current P/E ratio compared to historical averages: BofA's analyses frequently compare the current P/E ratio to its historical average, identifying deviations that may signal overvaluation or undervaluation. A consistently high P/E ratio compared to historical norms can suggest a market priced for significant future growth, implying elevated risk.

-

Analysis of other key valuation ratios: Beyond P/E, BofA considers other ratios like P/S, which can be less sensitive to earnings volatility, offering a different perspective on valuation. They also analyze dividend yield and other metrics to paint a holistic picture.

-

Mention any specific BofA reports or publications referencing these metrics: Investors can find detailed information in BofA Global Research publications, including their regularly updated market commentaries and strategy reports. These reports often delve into specific sectors and offer detailed analysis of valuation metrics.

Factors Contributing to High Stock Market Valuations

Several interconnected factors contribute to the current environment of high stock market valuations.

-

Low interest rates and quantitative easing: Historically low interest rates reduce the attractiveness of bonds, driving capital into the equity market, thus increasing demand and prices. Quantitative easing (QE) programs further inject liquidity into the financial system, boosting asset prices, including stocks.

-

Strong corporate earnings (in certain sectors): While not universal across all sectors, robust corporate earnings in specific areas like technology contribute to higher valuations. Strong earnings justify higher price-to-earnings multiples.

-

Inflationary pressures: Inflation, while potentially damaging to long-term growth, can create short-term upward pressure on stock prices as companies raise prices. However, unchecked inflation can erode earnings over time and lead to market corrections.

-

Investor sentiment and speculation: Positive investor sentiment and speculation, driven by factors like technological advancements and anticipation of future growth, can fuel market rallies and inflate valuations beyond what fundamental analysis alone might suggest.

Risks Associated with High Stock Market Valuations

Investing in a market characterized by high stock market valuations presents several risks:

-

Increased risk of corrections or crashes: High valuations often precede market corrections or crashes. History is replete with examples where extended periods of high valuations ended in significant market downturns.

-

Lower potential returns: Investing at high valuations typically means lower potential returns compared to investing at lower valuations. The upside is limited, while the downside risk remains substantial.

-

Potential for market bubbles: Certain sectors or asset classes might be experiencing speculative bubbles, prone to sudden and sharp corrections when investor sentiment shifts.

-

Impact of rising interest rates: Rising interest rates, a potential response to inflation, can increase borrowing costs for companies and reduce investor appetite for equities, leading to lower stock prices.

BofA's Investment Strategies for Navigating High Valuations

BofA's recommended investment strategies generally emphasize a cautious approach in a market with high stock market valuations. This typically includes:

-

Diversification: Diversifying across asset classes (stocks, bonds, real estate) and sectors can help mitigate risk and potentially improve returns.

-

Value investing: Focusing on undervalued companies with strong fundamentals can offer better risk-adjusted returns compared to chasing high-growth stocks in already expensive sectors.

-

Hedging strategies: Employing hedging strategies to protect against market downturns can help mitigate losses during market corrections.

-

Sector-specific analysis: BofA analysts likely highlight specific sectors they deem to be relatively undervalued compared to others, allowing for a targeted approach to investing.

High Stock Market Valuations: Investor Takeaways and Next Steps

BofA's analysis suggests a market environment characterized by high stock market valuations, presenting both opportunities and significant risks. While certain sectors might show strong earnings, the overall risk profile warrants a cautious approach. Investors should prioritize diversification, consider value investing strategies, and potentially employ hedging techniques. Understanding high stock market valuations is crucial for successful investing. Consult BofA's research and reports to make informed decisions and develop a well-informed investment strategy tailored to your risk tolerance and financial goals.

Featured Posts

-

Vegas Golden Knights Potential Hertl Absence Looms Large After Lightning Game

May 10, 2025

Vegas Golden Knights Potential Hertl Absence Looms Large After Lightning Game

May 10, 2025 -

Jeanine Pirros Past Did A Drunk Episode Jeopardize Her Dc Attorney Appointment

May 10, 2025

Jeanine Pirros Past Did A Drunk Episode Jeopardize Her Dc Attorney Appointment

May 10, 2025 -

The Scars Of Hate A Familys Struggle After A Racist Murder

May 10, 2025

The Scars Of Hate A Familys Struggle After A Racist Murder

May 10, 2025 -

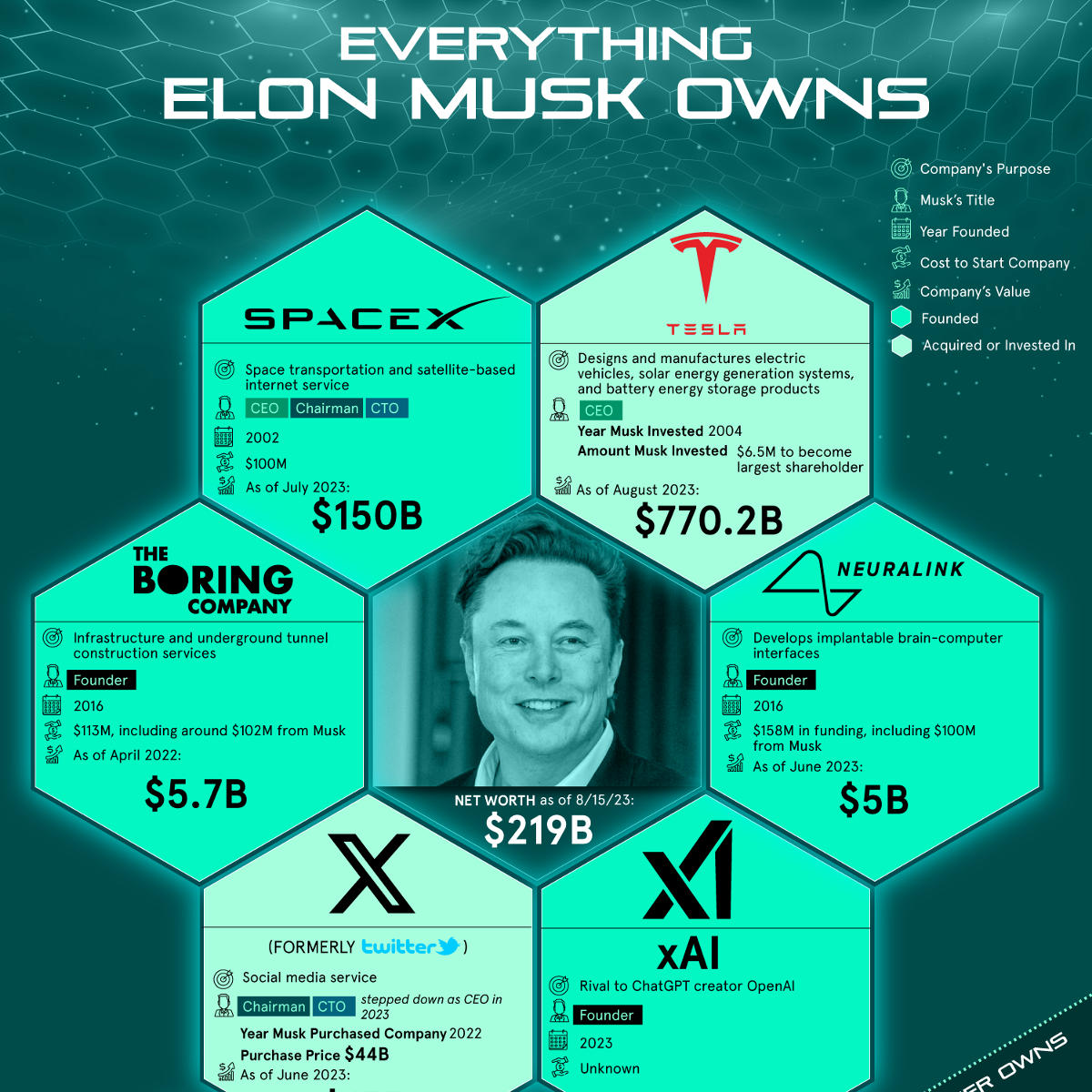

Fluctuations In Elon Musks Net Worth Correlation With Us Economic Policy

May 10, 2025

Fluctuations In Elon Musks Net Worth Correlation With Us Economic Policy

May 10, 2025 -

His Rise From Wolves Rejection The Heartbeat Of Europes Best Team

May 10, 2025

His Rise From Wolves Rejection The Heartbeat Of Europes Best Team

May 10, 2025