High Stock Market Valuations: A BofA Analysis For Investors

Table of Contents

BofA's Key Findings on Current Market Valuations

BofA's recent report paints a picture of a market characterized by elevated valuations, requiring careful consideration from investors. Several key factors contribute to this assessment, impacting various sectors and investment strategies.

Elevated Price-to-Earnings Ratios (P/E):

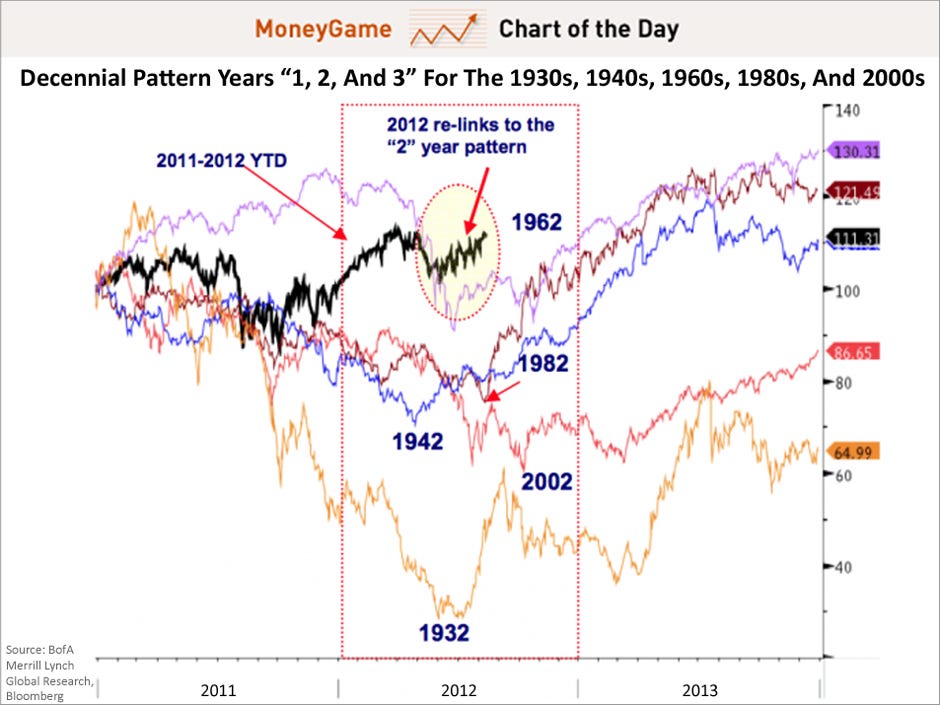

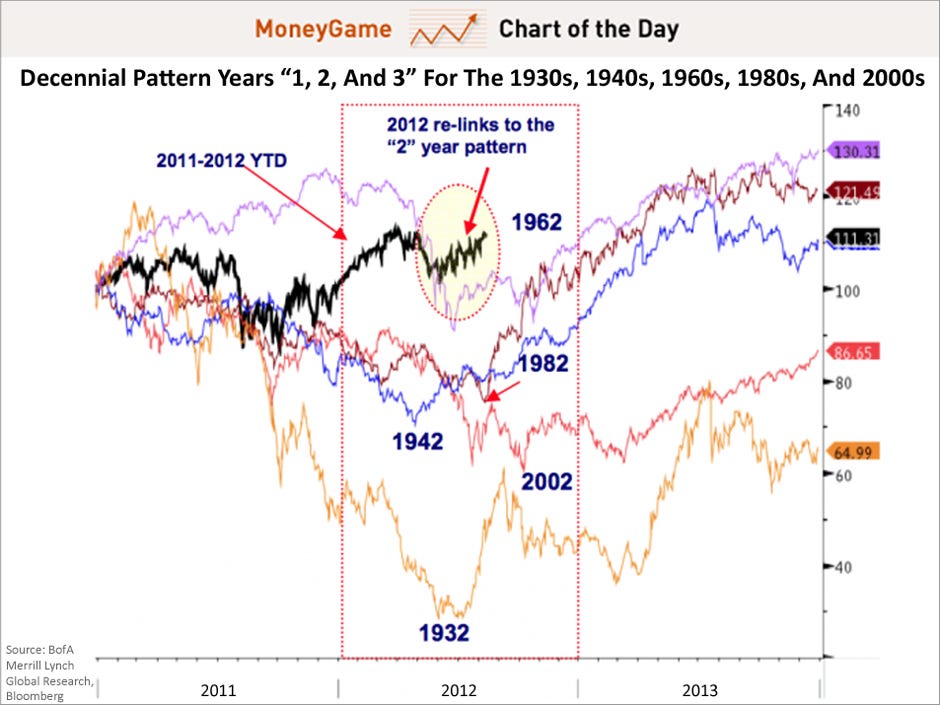

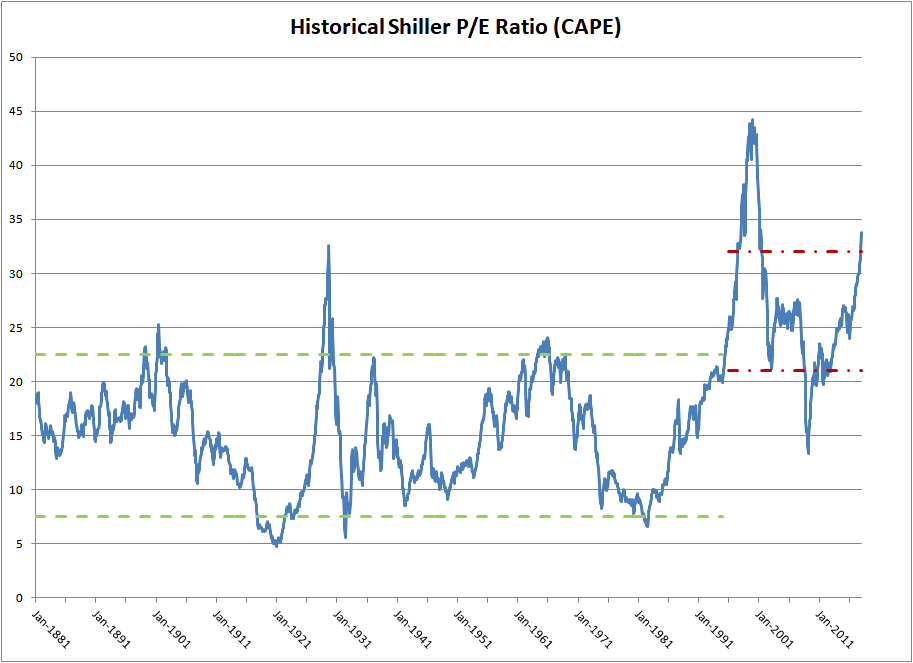

The Price-to-Earnings ratio (P/E ratio) is a crucial metric used to value a company's stock. It represents the price an investor pays for each dollar of a company's earnings. A high P/E ratio generally suggests that the market anticipates strong future earnings growth. BofA's analysis shows that current P/E ratios across the broad market are significantly higher than historical averages, indicating potentially overvalued conditions.

- Comparison of current P/E ratios across different sectors: BofA's report likely highlights variations in P/E ratios across different sectors. Technology stocks, for example, often command higher P/E ratios than more established, cyclical industries due to expectations of rapid future growth.

- Discussion of the impact of low interest rates on P/E ratios: Low interest rates can inflate stock valuations. With lower returns available from bonds, investors often seek higher returns in the stock market, driving up demand and consequently, P/E ratios. BofA's analysis likely factored this dynamic into its conclusions.

- Mention any specific companies or indices highlighted in the BofA report: While specific details would require access to the full BofA report, the analysis probably points to specific companies or market indices (like the S&P 500 or Nasdaq Composite) that exhibit particularly high P/E ratios, suggesting potential overvaluation in those areas.

The Role of Interest Rates and Monetary Policy:

Interest rates play a crucial role in influencing stock valuations. Higher interest rates tend to decrease stock valuations, as they increase the attractiveness of bonds and other fixed-income investments. Conversely, lower interest rates often lead to higher stock valuations. BofA's assessment of future interest rate trajectories is vital to understanding its conclusions on market valuations.

- Potential scenarios for interest rate hikes and their effect on stock prices: BofA's analysis likely models different scenarios regarding interest rate increases by the Federal Reserve. Higher interest rates could lead to a market correction, impacting stock prices negatively.

- Discussion of quantitative easing and its influence on valuations: Quantitative easing (QE), a monetary policy tool used to stimulate the economy, can impact stock valuations. By increasing the money supply, QE can lead to higher inflation and potentially higher stock prices. BofA's analysis would need to consider the past impact and potential future implications of QE.

- Mention any predictions made by BofA regarding monetary policy: BofA's report likely includes predictions about future monetary policy actions and how they could influence market valuations, offering valuable insights into the outlook for the economy and the market.

Impact of Economic Growth and Corporate Earnings:

The relationship between economic growth, corporate earnings, and stock valuations is undeniable. Strong economic growth generally leads to higher corporate earnings, boosting stock prices. Conversely, slowing economic growth can negatively impact corporate profits, dampening stock valuations. BofA's analysis likely examines these relationships to inform its view on current market valuations.

- BofA's forecast for GDP growth and its impact on stock prices: BofA's GDP growth forecasts are crucial to understanding its valuation conclusions. A strong GDP growth forecast might support current valuations, while a weak forecast could suggest overvaluation.

- Analysis of projected earnings growth across various sectors: BofA's sector-specific earnings growth projections are vital. High growth projections in certain sectors might justify higher valuations in those areas, even if the overall market is considered overvalued.

- Discussion of potential risks to economic growth and their impact on valuations: Identifying potential economic risks, like inflation or geopolitical uncertainty, is crucial. These risks can impact corporate earnings and stock valuations negatively.

Investment Strategies in a High-Valuation Environment

Navigating a high-valuation market requires a strategic approach. Investors need to consider both defensive and potentially growth-oriented strategies to manage risk and potentially seize opportunities.

Defensive Investment Strategies:

In a high-valuation environment, a defensive investment approach is often prudent. This involves strategies that aim to mitigate risk and preserve capital.

- Examples of defensive stocks and sectors: Defensive stocks, such as those in the consumer staples or utility sectors, are often less sensitive to economic downturns and can provide relative stability during market corrections.

- Advantages and disadvantages of each defensive strategy: Value investing, focused on undervalued companies, offers potential upside but requires careful research. Dividend investing provides income but may offer lower growth potential. Diversification spreads risk but doesn't eliminate it.

- Tips for building a diversified portfolio: A diversified portfolio across asset classes (stocks, bonds, real estate, etc.) and sectors reduces exposure to any single risk.

Growth Stock Considerations:

While growth stocks can offer significant returns, they carry higher risk in a high-valuation environment. Careful selection and risk management are crucial.

- Identifying high-growth potential companies: Identifying companies with sustainable competitive advantages and strong future growth prospects is key, but requires thorough due diligence.

- Assessing the risks of overvaluation in growth stocks: Growth stocks, by nature, often command higher valuations. Thoroughly analyzing these valuations to determine whether they are justified is crucial.

- Strategies for managing risk in growth stock investments: Diversification within the growth stock portfolio, setting stop-loss orders, and having a well-defined exit strategy are crucial risk management techniques.

Conclusion

BofA's analysis highlights the complexities of high stock market valuations. Understanding the interplay of interest rates, economic growth, and corporate earnings is vital for making informed investment decisions. While risks exist, employing defensive strategies and carefully selecting growth stocks can help investors navigate these challenges. By considering BofA's insights and adapting your investment strategy accordingly, you can better position yourself for success in this environment. Remember to consult with a financial advisor before making any investment decisions based on this analysis of high stock market valuations.

Featured Posts

-

A Papal Transition How The Conclave Will Define Pope Franciss Impact

Apr 22, 2025

A Papal Transition How The Conclave Will Define Pope Franciss Impact

Apr 22, 2025 -

Lab Owner Pleads Guilty To Falsifying Covid 19 Test Results

Apr 22, 2025

Lab Owner Pleads Guilty To Falsifying Covid 19 Test Results

Apr 22, 2025 -

New Security Partnership China And Indonesia

Apr 22, 2025

New Security Partnership China And Indonesia

Apr 22, 2025 -

Is Blue Origins Failure Larger Than Katy Perrys Career Setback A Comparative Analysis

Apr 22, 2025

Is Blue Origins Failure Larger Than Katy Perrys Career Setback A Comparative Analysis

Apr 22, 2025 -

Stock Market Valuations Bof A Explains Why Investors Shouldnt Panic

Apr 22, 2025

Stock Market Valuations Bof A Explains Why Investors Shouldnt Panic

Apr 22, 2025