Stock Market Valuations: BofA Explains Why Investors Shouldn't Panic

Table of Contents

H2: BofA's Current Assessment of Stock Market Valuations

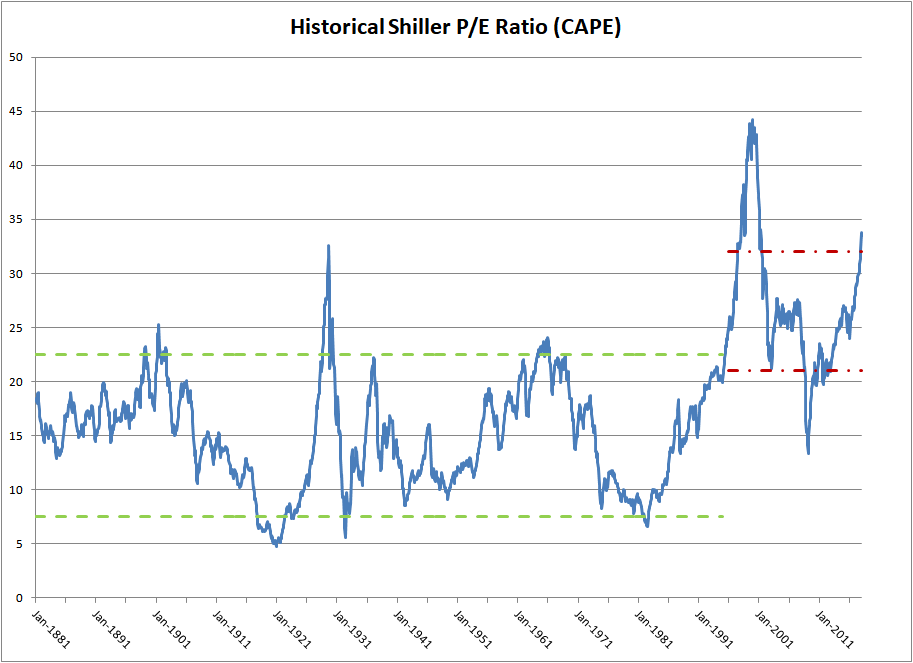

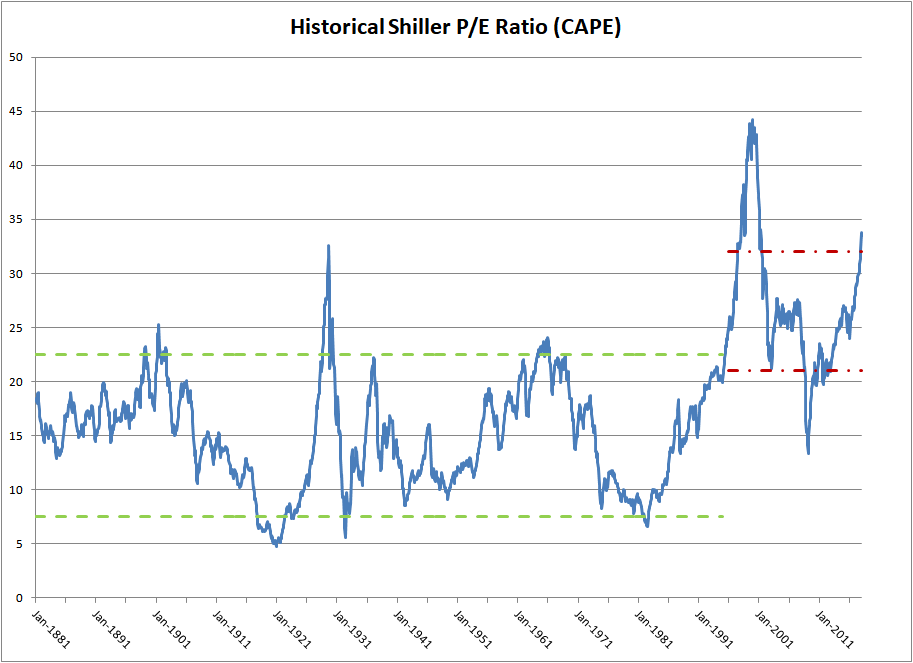

BofA employs sophisticated valuation models to assess the overall health of the stock market. These models consider various key metrics, including Price-to-Earnings (P/E) ratios, price-to-sales ratios, and dividend yields, to determine whether the market is overvalued, undervalued, or fairly valued. Their analysis incorporates a range of factors, from corporate earnings growth projections to prevailing interest rate environments.

-

Key Metrics Used: BofA's valuation analysis incorporates a multifaceted approach, utilizing a blend of traditional and forward-looking metrics. This includes analyzing historical P/E ratios in comparison to current values, examining price-to-sales ratios across various sectors, and evaluating the attractiveness of dividend yields in relation to prevailing bond yields.

-

BofA's Key Findings:

- Current valuations are not historically extreme: While certain sectors might appear expensive based on some metrics, the overall market valuation isn't at levels typically seen before significant corrections in history.

- Certain sectors are undervalued compared to historical averages: BofA's analysis points to specific sectors that offer attractive entry points for long-term investors. These sectors might have been disproportionately impacted by recent market downturns.

- Long-term growth potential remains strong despite short-term volatility: Despite the current uncertainty, BofA maintains a positive outlook for long-term economic growth, supporting the potential for continued stock market appreciation.

(Insert relevant chart or graph visualizing BofA's data here)

H2: Factors Influencing Current Market Sentiment and Stock Prices

Several macroeconomic factors and market events contribute to the current market sentiment and influence stock prices. Understanding these factors is crucial for making informed investment decisions.

-

Macroeconomic Factors:

- Inflation: Persistent inflation erodes purchasing power and impacts corporate profitability, influencing investor sentiment and stock valuations.

- Interest Rates: Federal Reserve policy directly impacts interest rates. Higher interest rates increase borrowing costs for businesses and can reduce corporate investment and consumer spending, potentially impacting stock valuations.

- Geopolitical Events: Global events, such as wars or political instability, create uncertainty in the market and can lead to increased volatility.

-

Market Events and News Headlines: Negative news headlines, even if not fundamentally impactful, can trigger sell-offs driven by fear and emotional reactions.

-

Market Psychology: Fear and greed significantly influence investor behavior. Panic selling, driven by fear, often creates artificial market downturns, presenting opportunities for long-term investors.

H2: Why a Long-Term Perspective is Crucial for Stock Market Success

Short-term market fluctuations are inevitable. History shows that even the most significant market downturns are eventually followed by periods of recovery and growth. Focusing on a long-term investment strategy mitigates the impact of short-term volatility.

- Benefits of a Long-Term Approach:

- Historical Data: Historical market cycles demonstrate that consistent, long-term investment strategies generally outperform attempts to time the market.

- Dollar-Cost Averaging: Regularly investing a fixed amount, regardless of market fluctuations, reduces the risk of buying high and selling low.

- Diversification: A diversified portfolio spread across different asset classes and sectors reduces the overall risk and protects against losses in any single investment.

H2: BofA's Recommendations for Investors

BofA advises investors to maintain a long-term perspective and avoid impulsive decisions based on short-term market noise. Their recommendations include:

- Maintain a long-term investment horizon: Don't let short-term volatility derail your long-term financial goals.

- Consider rebalancing your portfolio: Realign your asset allocation to maintain your desired risk profile.

- Explore opportunities in undervalued sectors: BofA's analysis identifies sectors that may offer attractive long-term growth potential despite recent market headwinds.

Conclusion: Maintaining Perspective on Stock Market Valuations

BofA's analysis suggests that current stock market valuations, while not historically cheap, are not indicative of an impending market crash. The current volatility is influenced by a number of factors, but a long-term perspective remains crucial. Avoid making impulsive decisions driven by fear; instead, focus on a well-diversified portfolio and a long-term investment strategy. To further refine your understanding of stock market valuations and create a personalized investment plan, consult with a qualified financial advisor. You can also research BofA's reports for deeper insights into stock market valuations and investment strategies.

Featured Posts

-

127 Years Of Brewing History Anchor Brewing Company Shuts Down

Apr 22, 2025

127 Years Of Brewing History Anchor Brewing Company Shuts Down

Apr 22, 2025 -

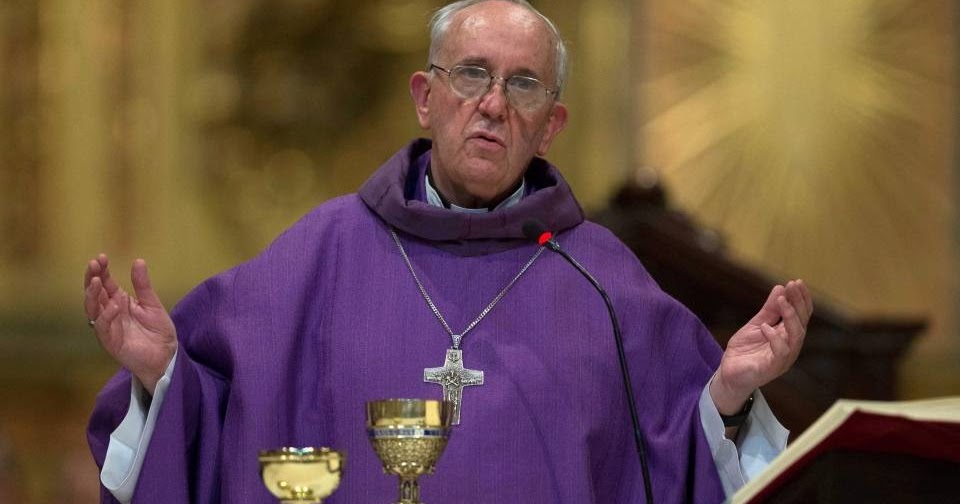

Pontiff Pope Francis Succumbs To Pneumonia At 88

Apr 22, 2025

Pontiff Pope Francis Succumbs To Pneumonia At 88

Apr 22, 2025 -

Papal Conclaves Explained The Process Of Electing A New Pope

Apr 22, 2025

Papal Conclaves Explained The Process Of Electing A New Pope

Apr 22, 2025 -

Over The Counter Birth Control A New Era Of Reproductive Healthcare

Apr 22, 2025

Over The Counter Birth Control A New Era Of Reproductive Healthcare

Apr 22, 2025 -

1 Billion Funding Cut Threat Looms Over Harvard Amid Trump Administration Dispute

Apr 22, 2025

1 Billion Funding Cut Threat Looms Over Harvard Amid Trump Administration Dispute

Apr 22, 2025