Hengrui Pharmaceuticals Receives Green Light For Hong Kong Share Offering

Table of Contents

2. Main Points:

2.1 Details of the Hong Kong Share Offering:

Offering Size and Pricing:

Hengrui Pharmaceuticals' Hong Kong share offering involves [Insert Number] shares, with an expected price range of [Insert Price Range] per share. This ambitious IPO aims to raise approximately [Insert Fundraising Goal] in capital. This substantial fundraising target reflects Hengrui's aggressive growth strategy and significant investment plans.

- Share Allocation: The share offering will be allocated between institutional and retail investors, with [Insert Percentage]% allocated to institutional investors and [Insert Percentage]% to retail investors. This strategy ensures broad participation and market interest.

- Early Bird Incentives: Potential investors may be offered early bird discounts or incentives, encouraging early commitment and maximizing the success of the offering. Specific details regarding these incentives will be released closer to the offering date.

- Keywords: IPO pricing, share allocation, fundraising, investment opportunity, Hong Kong IPO.

2.2 Strategic Implications for Hengrui Pharmaceuticals:

Access to International Capital:

This Hong Kong share offering provides Hengrui Pharmaceuticals with unparalleled access to a much broader pool of international capital. This capital infusion will be crucial in fueling the company's ambitious growth plans.

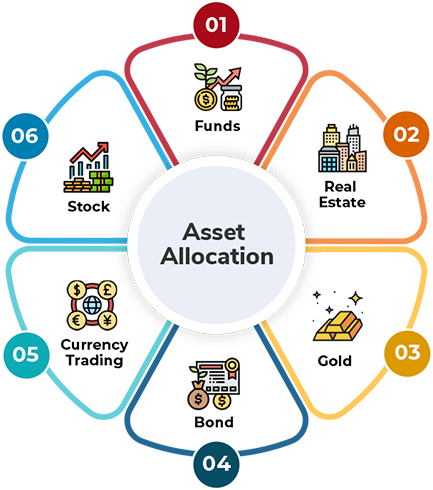

- Capital Allocation: The raised capital is expected to be used for several key initiatives, including:

- Accelerated research and development (R&D) of innovative new drugs and therapies.

- Expansion of existing manufacturing facilities and infrastructure to meet growing demand.

- Strategic acquisitions of promising pharmaceutical companies or technologies globally.

- Strengthening its global sales and distribution network.

- Diversification of Investor Base: By listing on the Hong Kong Stock Exchange, Hengrui diversifies its investor base beyond China, reducing reliance on domestic markets and attracting a wider range of international institutional and retail investors.

- Keywords: international expansion, R&D investment, capital raising, market diversification, global expansion.

2.3 Impact on the Hong Kong Stock Market and Investors:

Attracting International Investors:

Hengrui Pharmaceuticals' Hong Kong listing is expected to have a positive impact on the Hong Kong stock market, further enhancing its attractiveness to international investors.

- Increased Trading Volume: The offering is likely to increase trading volume and liquidity in the Hong Kong market, providing investors with more investment options within the pharmaceutical sector.

- Market Capitalization: The successful listing will likely increase the overall market capitalization of the Hong Kong Stock Exchange, solidifying its position as a leading global financial center.

- Investment Risks: As with any investment, there are inherent risks associated with investing in Hengrui Pharmaceuticals or any stock. Investors should conduct thorough due diligence and consider their own risk tolerance before making any investment decisions.

- Keywords: Hong Kong stock market, international investors, market capitalization, investment risks, stock market analysis, pharmaceutical stocks.

2.4 Regulatory Approvals and Timeline:

Regulatory Process and Future Plans:

The regulatory approval process for Hengrui Pharmaceuticals' Hong Kong share offering involved rigorous scrutiny by the relevant authorities, including the Securities and Futures Commission of Hong Kong and the Hong Kong Stock Exchange.

- Timeline: The timeline for the completion of the share offering is expected to be [Insert Expected Timeline], with the official listing on the Hong Kong Stock Exchange anticipated by [Insert Date].

- Next Steps: Following the successful completion of the share offering, Hengrui Pharmaceuticals plans to leverage the newly acquired capital to execute its ambitious growth strategy, focusing on R&D, expansion, and strategic acquisitions.

- Keywords: regulatory approval, timeline, Hong Kong Exchange, listing process, Securities and Futures Commission.

3. Conclusion: Investing in the Future of Hengrui Pharmaceuticals

Hengrui Pharmaceuticals' successful Hong Kong share offering marks a pivotal moment for the company, opening up significant opportunities for growth and expansion. This strategic move not only strengthens Hengrui's global presence but also adds significant value to the Hong Kong stock market, attracting further international investment. The offering presents a compelling investment opportunity for those seeking exposure to a leading player in the global pharmaceutical industry.

We encourage you to learn more about the Hengrui Pharmaceuticals Hong Kong share offering and consider investing if appropriate. Remember to conduct your own thorough research and seek professional financial advice before making any investment decisions. Investment involves risk, and the value of investments can go down as well as up.

Keywords: Hengrui Pharmaceuticals, Hong Kong IPO, investment opportunities, pharmaceutical stocks, Hengrui Pharmaceuticals Hong Kong share offering.

Featured Posts

-

Willie Nelson Announces New Album Details On Oh What A Beautiful World And Rodney Crowell Collaboration

Apr 29, 2025

Willie Nelson Announces New Album Details On Oh What A Beautiful World And Rodney Crowell Collaboration

Apr 29, 2025 -

Car Dealerships Step Up Opposition To Mandatory Ev Sales

Apr 29, 2025

Car Dealerships Step Up Opposition To Mandatory Ev Sales

Apr 29, 2025 -

Chainalysis Acquisition Of Alterya A Boost For Ai Powered Blockchain Security

Apr 29, 2025

Chainalysis Acquisition Of Alterya A Boost For Ai Powered Blockchain Security

Apr 29, 2025 -

Dsps Top India Fund Market Concerns Lead To Increased Cash Allocation

Apr 29, 2025

Dsps Top India Fund Market Concerns Lead To Increased Cash Allocation

Apr 29, 2025 -

Annie Nelson Addresses Misinformation In Recent Media Coverage

Apr 29, 2025

Annie Nelson Addresses Misinformation In Recent Media Coverage

Apr 29, 2025

Latest Posts

-

Country Legend Willie Nelson Releases 77th Solo Album At 91

Apr 29, 2025

Country Legend Willie Nelson Releases 77th Solo Album At 91

Apr 29, 2025 -

The Making Of Oh What A Beautiful World A Willie Nelson Album Story

Apr 29, 2025

The Making Of Oh What A Beautiful World A Willie Nelson Album Story

Apr 29, 2025 -

Willie Nelsons Oh What A Beautiful World Tracklist And Release Date

Apr 29, 2025

Willie Nelsons Oh What A Beautiful World Tracklist And Release Date

Apr 29, 2025 -

Willie Nelsons 4th Of July Picnic A Texas Tradition Returns

Apr 29, 2025

Willie Nelsons 4th Of July Picnic A Texas Tradition Returns

Apr 29, 2025 -

Willie Nelson Documentary Highlights The Unsung Heroes Of Touring

Apr 29, 2025

Willie Nelson Documentary Highlights The Unsung Heroes Of Touring

Apr 29, 2025