Guaranteed Approval Loans: No Credit Check Required, Direct Lender

Table of Contents

Understanding Guaranteed Approval Loans

Guaranteed approval loans, also sometimes referred to as no credit check loans or instant approval loans, are short-term loans designed to provide quick access to funds. Unlike traditional loans, these loans typically don't require a thorough credit check. This means individuals with bad credit or no credit history may still qualify. However, it's crucial to understand that "guaranteed approval" doesn't mean automatic approval for any amount. Lenders still assess your ability to repay, considering factors like income and employment.

Benefits:

- Speed and Convenience: These loans are known for their fast processing times, often providing funds within a few days. The application process is typically streamlined and can be completed online.

- Accessibility for Bad Credit: Individuals with poor credit or no credit history, who might be denied traditional loans, can find these loans more accessible.

Drawbacks:

- Higher Interest Rates: Because of the higher risk for lenders, guaranteed approval loans usually come with significantly higher interest rates compared to traditional loans.

- Shorter Repayment Periods: These loans typically have shorter repayment terms, meaning you'll need to repay the loan quickly. This can lead to higher monthly payments.

- Potential for Debt Traps: If not managed carefully, these loans can easily lead to a cycle of debt if you're unable to repay on time. Responsible borrowing is paramount.

Bullet Points:

- Faster processing times compared to traditional loans.

- Suitable for individuals with bad credit or no credit history.

- May have higher interest rates than traditional loans.

- Shorter repayment terms are common.

Finding a Direct Lender for Guaranteed Approval Loans

Working with a direct lender for your guaranteed approval loan offers several advantages over using a third-party broker. Direct lenders eliminate the middleman, reducing fees and increasing transparency. You'll have a clearer understanding of the terms and conditions upfront.

Importance of Direct Lenders:

- Reduced Fees: Avoid unnecessary broker fees by going directly to the lender.

- Increased Transparency: You'll have direct communication with the lender, improving clarity on the loan terms.

How to Identify Legitimate Lenders:

Choosing a trustworthy lender is critical to avoid scams. Always verify their legitimacy by:

- Checking online reviews and ratings from various sources. Look for consistent positive feedback.

- Verifying their licensing and registration with relevant authorities.

- Being wary of lenders demanding upfront fees. Legitimate lenders usually don't charge fees until after approval.

Bullet Points:

- Avoid upfront fees from lenders.

- Check online reviews and ratings.

- Verify the lender's licensing and registration.

- Compare interest rates and terms from multiple lenders.

The Application Process for No Credit Check Loans

The application process for no credit check loans is designed to be straightforward and quick. The lack of a credit check simplifies the process, but some information will still be required.

Simplified Application:

- Typically involves completing an online application form.

- Requires providing basic personal and financial information.

Required Documents:

While a credit check isn't required, you will need to provide documentation verifying your identity and income. Commonly requested documents include:

- Government-issued photo ID (e.g., driver's license or passport).

- Proof of income (e.g., pay stubs, bank statements).

Processing Time:

The processing time for these loans is usually much faster than traditional loans. You can often receive a decision within minutes or hours, and funds may be disbursed within a few days.

Bullet Points:

- Online application forms are usually available.

- Quick and easy submission of documents.

- Faster approval times than traditional loans.

- Funds may be disbursed within a few days.

Responsible Borrowing with Guaranteed Approval Loans

Even with the convenience of guaranteed approval loans, responsible borrowing practices are essential to avoid financial hardship.

Budgeting and Repayment:

Before applying for a loan, create a detailed budget to ensure you can comfortably afford the monthly payments. Understand the total cost of borrowing, including interest and fees, and make a realistic repayment plan.

Avoiding Debt Traps:

Only borrow what you absolutely need and can repay within the agreed-upon timeframe. Avoid taking on multiple loans simultaneously, as this can quickly lead to an unmanageable debt burden. Seek professional financial advice if you're struggling with debt or need help managing your finances.

Bullet Points:

- Create a repayment plan to avoid defaults.

- Understand the total cost of borrowing (including interest).

- Seek professional financial advice if needed.

- Explore alternative financial solutions if possible.

Conclusion

Guaranteed approval loans with no credit check offer a quick solution for urgent financial needs, particularly for those with poor credit. However, it's crucial to understand the higher interest rates and shorter repayment periods associated with them. Responsible borrowing is paramount to avoid falling into a debt trap. By carefully comparing lenders, understanding the terms, and creating a sound repayment plan, you can utilize these loans responsibly.

Need quick access to funds? Find a reputable lender offering guaranteed approval loans today and take control of your finances. Remember to always prioritize responsible borrowing practices.

Featured Posts

-

Record Etf Investments Why Investors Remain Confident Amidst Market Uncertainty

May 28, 2025

Record Etf Investments Why Investors Remain Confident Amidst Market Uncertainty

May 28, 2025 -

Cuaca Hari Ini Kalimantan Timur Ikn Balikpapan Samarinda Dan Sekitarnya

May 28, 2025

Cuaca Hari Ini Kalimantan Timur Ikn Balikpapan Samarinda Dan Sekitarnya

May 28, 2025 -

Ronaldonun Cirkinlik Hakkindaki Yorumuna Adanali Ronaldo Dan Gelen Yanit

May 28, 2025

Ronaldonun Cirkinlik Hakkindaki Yorumuna Adanali Ronaldo Dan Gelen Yanit

May 28, 2025 -

Lainahakemus Vertaile Lainoja Ja Loeydae Paras Tarjous Korkeiden Korkojen Keskellae

May 28, 2025

Lainahakemus Vertaile Lainoja Ja Loeydae Paras Tarjous Korkeiden Korkojen Keskellae

May 28, 2025 -

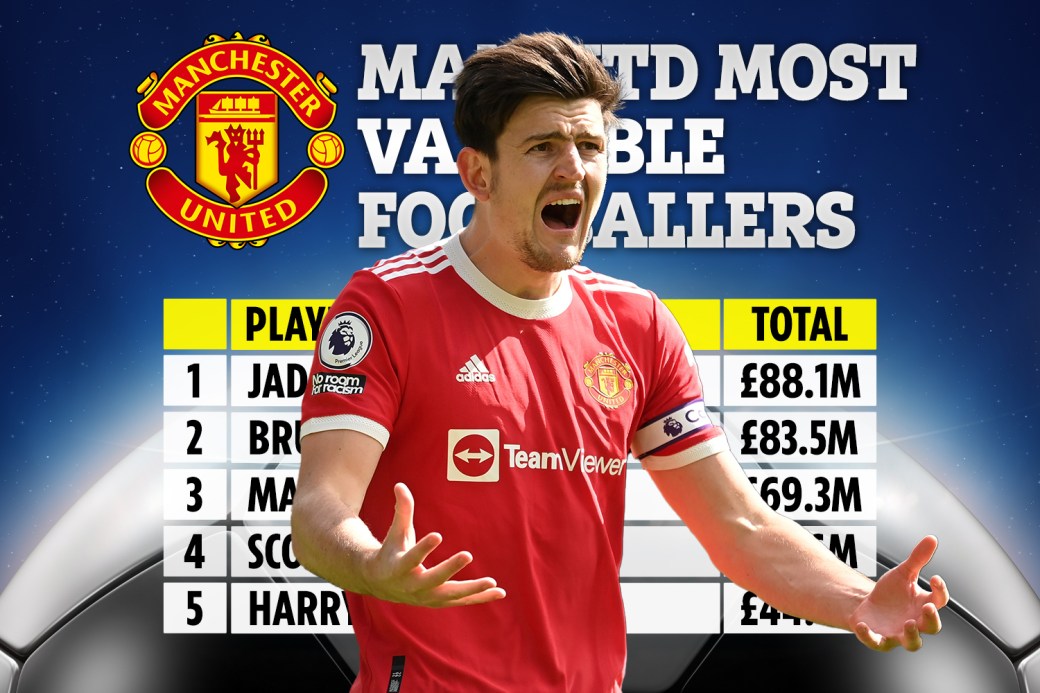

Is This The Biggest Clue Yet 50m Man Utd Players Home Up For Sale

May 28, 2025

Is This The Biggest Clue Yet 50m Man Utd Players Home Up For Sale

May 28, 2025