Record ETF Investments: Why Investors Remain Confident Amidst Market Uncertainty

Table of Contents

Before diving in, let's clarify what ETFs are. Exchange-Traded Funds are investment funds traded on stock exchanges, much like individual stocks. They offer investors a simple way to gain diversified exposure to a basket of assets, such as stocks, bonds, or commodities, making them a highly accessible and efficient investment vehicle.

The Appeal of ETF Diversification in Uncertain Markets

One key reason for the continued popularity of ETFs is their inherent diversification. Uncertain markets often feature unpredictable swings in individual stocks or sectors. ETFs mitigate this risk by offering broad exposure across various asset classes. Instead of putting all your eggs in one basket, you spread your investment across multiple assets, reducing the impact of any single asset's underperformance.

- Reduced risk through diversification: By holding a range of assets, ETFs lessen the volatility of your portfolio.

- Access to multiple market segments with a single investment: A single ETF can provide exposure to a whole sector (e.g., technology, healthcare) or even the entire stock market, simplifying investment strategy.

- Lower management fees compared to actively managed mutual funds: ETFs typically have lower expense ratios, meaning more of your investment works towards growth.

For example, during the recent market corrections, many investors found that their ETF holdings cushioned the blow compared to those who held individual, highly volatile stocks. The diversification inherent in ETFs helped them navigate the turbulent waters.

The Role of Low-Cost ETF Investing

In volatile markets, even small differences in fees can significantly impact long-term returns. ETFs are renowned for their cost-effectiveness, a significant advantage during uncertain times. Their low expense ratios allow investors to maximize their returns and minimize the impact of fees eating into their profits.

- Lower expense ratios leading to higher returns: Lower fees directly translate into higher potential returns over time.

- Transparent fee structures: Unlike some actively managed funds, ETF fees are clearly disclosed, providing investors with complete transparency.

- Accessibility to a wider range of investors: The low cost of entry makes ETFs accessible to a wider range of investors, including those with smaller investment amounts.

Consider this: An actively managed mutual fund might have an expense ratio of 1% or more, while many ETFs boast expense ratios of 0.1% or less. Over the long term, this seemingly small difference can compound dramatically, leading to substantial savings.

ETF Liquidity and Accessibility

Unlike some investment vehicles, ETFs boast exceptional liquidity. This means they can be easily bought and sold on major stock exchanges throughout the trading day. This flexibility is invaluable during market uncertainty, allowing investors to react swiftly to changing conditions.

- High liquidity ensures smooth trading: You can quickly buy or sell ETFs without significantly impacting their price.

- Ease of buying and selling throughout the trading day: Unlike mutual funds, which typically have a once-a-day pricing system, ETFs offer intraday trading.

- Availability through various brokerage accounts: Most brokerage accounts offer access to a wide range of ETFs, making them readily available to investors.

Compared to less liquid investments, such as real estate or private equity, ETFs provide a significant advantage in terms of accessibility and ease of trading.

The Growing Popularity of Thematic and Specialized ETFs

The ETF landscape is constantly evolving. Beyond broad market ETFs, there's a burgeoning category of thematic and specialized ETFs catering to niche investment interests. These ETFs focus on specific sectors, trends, or investment strategies, allowing investors to align their portfolios with their individual goals.

- Targeted investment opportunities: Focus on specific sectors like renewable energy, technology, or healthcare.

- Alignment with specific investment goals: Investors can choose ETFs that reflect their values (ESG investing) or their growth aspirations (technology ETFs).

- Ability to capitalize on emerging trends: Quickly access promising sectors or themes without extensive research.

For example, the increasing focus on sustainable investing has led to the proliferation of successful ESG ETFs, demonstrating the adaptability and responsiveness of this asset class.

Addressing Investor Concerns and Market Uncertainty

While ETFs offer many advantages, it's essential to address potential investor concerns. Market uncertainty is a reality, but historical data shows that ETFs have demonstrated resilience during market downturns.

- Reassurance of ETF resilience during market downturns: Analyzing historical performance reveals that while ETFs can experience losses, their diversification often limits the extent of those losses compared to individual stocks.

- Strategies for mitigating risk within ETF portfolios: Diversification across different asset classes and geographies can further reduce overall portfolio risk.

- Importance of long-term investment horizons: The short-term volatility of the market should not overshadow the long-term growth potential of well-chosen ETFs.

Analyzing historical ETF performance during market corrections shows a pattern of relative stability compared to individual stocks, reinforcing their role as a valuable tool for navigating market uncertainty.

Conclusion: Sustaining Confidence in Record ETF Investments

The record levels of ETF investments are a testament to their enduring appeal. Diversification, low costs, liquidity, and the growing availability of specialized options make ETFs an attractive investment choice, especially during times of market uncertainty. Their resilience during past market corrections further reinforces investor confidence. ETFs are a valuable tool for managing risk and building a well-diversified portfolio.

Ready to explore the benefits of record ETF investments for your portfolio? Start your research today and discover how ETFs can help you achieve your financial goals.

Featured Posts

-

Analysis Of The Stagnant Conversion Rate Of Vacant Commercial Buildings To Dwellings In The Netherlands

May 28, 2025

Analysis Of The Stagnant Conversion Rate Of Vacant Commercial Buildings To Dwellings In The Netherlands

May 28, 2025 -

Belfoeld Toebb Hullamban Erkezik A Csapadek De Megtartja A Tavaszias Meleget

May 28, 2025

Belfoeld Toebb Hullamban Erkezik A Csapadek De Megtartja A Tavaszias Meleget

May 28, 2025 -

Rent Freeze Housing Corporations Prepare Legal Action Against Minister

May 28, 2025

Rent Freeze Housing Corporations Prepare Legal Action Against Minister

May 28, 2025 -

Hujan Di Semarang Pukul 1 Siang Cek Prakiraan Cuaca Jawa Tengah 26 Maret

May 28, 2025

Hujan Di Semarang Pukul 1 Siang Cek Prakiraan Cuaca Jawa Tengah 26 Maret

May 28, 2025 -

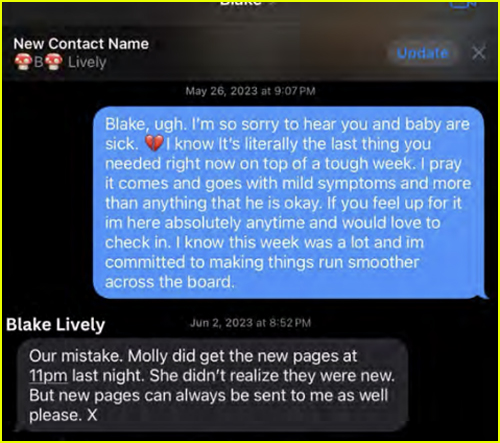

Unexpected Twist New A List Celebrity Involved In Lively Baldoni Lawsuit

May 28, 2025

Unexpected Twist New A List Celebrity Involved In Lively Baldoni Lawsuit

May 28, 2025