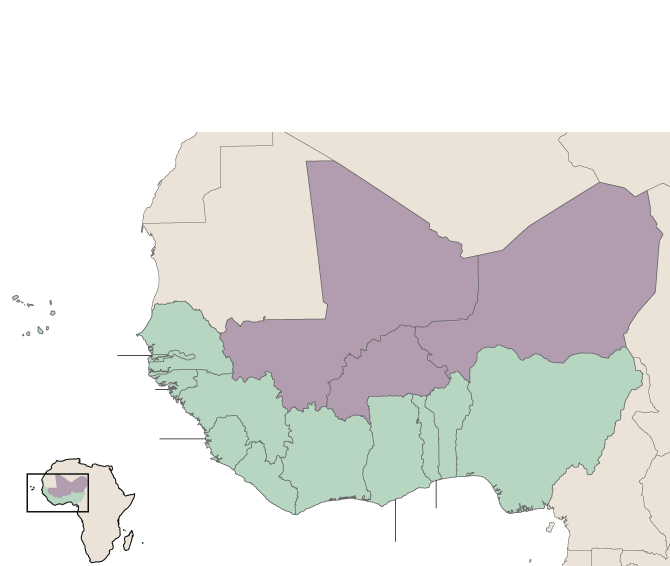

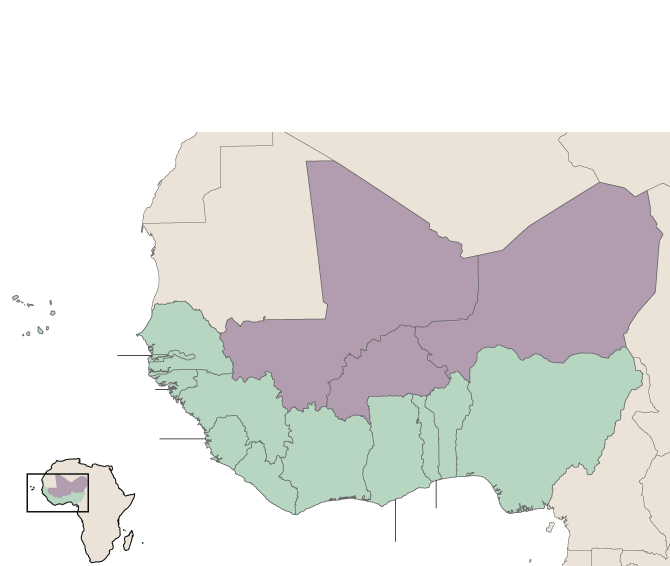

PwC's Withdrawal From Nine African Countries: A Detailed Analysis

Table of Contents

Reasons Behind PwC's Withdrawal from Nine African Countries

PwC's decision to leave nine African nations wasn't arbitrary. Several interconnected factors contributed to this strategic shift, affecting the PwC Africa strategy significantly. Key reasons include:

-

Economic challenges in the affected countries: Many of the countries from which PwC withdrew are grappling with economic instability, low growth rates, and unpredictable macroeconomic environments. This makes sustaining a profitable operation challenging. For example, fluctuating currency values and inflation can significantly impact the profitability of accounting services.

-

Increasing regulatory burdens and compliance costs: The African regulatory landscape, while evolving, often presents complexities for international firms. Navigating diverse and sometimes changing regulations increases compliance costs, potentially outweighing the financial returns in certain markets. This includes adhering to international financial reporting standards (IFRS) and local legislation.

-

Strategic reassessment of PwC's global footprint and resource allocation: As a global firm, PwC regularly assesses its portfolio to optimize resource allocation. This may involve prioritizing markets with higher growth potential and greater profitability, leading to a strategic decision to withdraw from less lucrative locations.

-

Potential profitability concerns in specific markets: While PwC hasn't explicitly stated specific profitability figures for the affected countries, the withdrawal suggests that the return on investment (ROI) in these markets didn't align with the firm's global targets. This is a common factor in business decisions to exit specific regions.

-

Focus shift towards larger and more lucrative markets: The global business environment is competitive, and firms tend to concentrate their resources on markets where they can achieve significant scale and profit. PwC may be refocusing its efforts on larger African economies or other regions with more promising growth prospects. This means a more concentrated PwC Africa presence in select countries.

Impact on Affected African Countries

The PwC Africa withdrawal has created significant ripple effects across the affected nations. The impact is multi-faceted and reaches beyond simply the loss of a single accounting firm:

-

Loss of auditing expertise and expertise in financial reporting: PwC's departure represents a loss of experienced professionals in auditing, financial reporting, and related consulting services, potentially creating a skills gap. This is particularly challenging for countries already facing capacity constraints in these areas.

-

Potential increase in costs for businesses seeking alternative services: With fewer major international players in the market, businesses may face higher costs for auditing and consulting services as remaining firms potentially adjust their pricing in a less competitive environment. Small and Medium Enterprises (SMEs) may be disproportionately impacted.

-

Impact on foreign investment and investor confidence: The withdrawal of a major international firm like PwC could be perceived negatively by potential foreign investors, impacting their confidence in the business environment of the affected countries. This perception can lead to a slowdown in foreign direct investment (FDI).

-

Ripple effects on related industries (e.g., legal, banking): Accounting firms often collaborate closely with legal and banking institutions. PwC's departure might create indirect impacts on these related sectors, potentially affecting their operations and creating uncertainty.

-

Increased pressure on remaining auditing firms: The remaining accounting firms in the affected countries will likely face increased workload and pressure to handle the clients previously served by PwC. This requires careful capacity planning and risk management.

Implications for the Future of Business in Africa

PwC's decision offers a broader lens through which to examine the future of business in Africa:

-

Attractiveness of Africa for international firms: While the PwC withdrawal may raise concerns, Africa still presents a vast potential market for international firms. The long-term attractiveness will depend on factors such as regulatory stability, economic growth, and infrastructure development.

-

The role of regulation in shaping the business environment: The regulatory landscape is a crucial determinant of the attractiveness of any market. Clear, consistent, and efficient regulations are vital to attracting and retaining international investment.

-

Competition among remaining accounting firms: The departure of PwC will intensify competition amongst the remaining firms. This could be positive, potentially driving innovation and efficiency improvements in the accounting industry.

-

Potential for growth of local accounting firms: PwC's exit presents an opportunity for local accounting firms to expand their operations and fill the market gap. This represents a chance to nurture indigenous talent and expertise.

-

Long-term implications for economic development in Africa: The long-term impact on economic development remains to be seen. It's crucial for African governments to create a business-friendly environment that attracts investment and encourages sustainable growth.

The Response from African Governments and Businesses

The PwC Africa withdrawal has prompted various reactions from African governments and businesses:

-

Statements and actions taken by affected governments: Many governments have likely issued statements addressing the situation and may be exploring measures to mitigate the negative impacts, such as proactively reaching out to other international firms.

-

Reactions from the African business community: The business community's reaction has probably been mixed, with concerns about the potential impact on service costs and access to expertise. However, it also creates opportunities for local firms.

-

Calls for regulatory reform or improvements: The situation may highlight the need for regulatory reforms to create a more attractive environment for international investment and reduce bureaucratic burdens.

-

Discussions around attracting other international firms: African governments may actively engage with other international accounting firms to encourage them to expand their presence in the affected countries.

-

Opportunities for local firms to fill the gap: The withdrawal has opened up space for local firms to compete for clients and gain market share, fostering growth and development of indigenous accounting expertise.

Conclusion

This analysis of PwC's withdrawal from nine African countries reveals a complex interplay of economic, regulatory, and strategic factors. The PwC Africa exit highlights the challenges faced by international firms operating in Africa, the importance of a stable regulatory environment conducive to attracting and retaining foreign investment, and the considerable opportunities for local businesses to expand their reach. Understanding the nuances of the PwC Africa withdrawal is crucial for businesses operating on the continent and those considering investment. Stay informed on the evolving landscape and its implications for your operations by continuing to research the latest developments surrounding the PwC Africa withdrawal and related issues affecting the African business environment.

Featured Posts

-

You Tubes Growing Appeal To Older Viewers A Resurgence Of Classic Shows

Apr 29, 2025

You Tubes Growing Appeal To Older Viewers A Resurgence Of Classic Shows

Apr 29, 2025 -

How To Get Capital Summertime Ball 2025 Tickets Tips And Strategies

Apr 29, 2025

How To Get Capital Summertime Ball 2025 Tickets Tips And Strategies

Apr 29, 2025 -

Managing Adhd Naturally Diet Exercise And Lifestyle Changes

Apr 29, 2025

Managing Adhd Naturally Diet Exercise And Lifestyle Changes

Apr 29, 2025 -

Jeff Goldblum And Emilie Livingstons Sons At Como 1907 Football Match

Apr 29, 2025

Jeff Goldblum And Emilie Livingstons Sons At Como 1907 Football Match

Apr 29, 2025 -

Chainalysis Acquisition Of Alterya A Strategic Move In The Blockchain Space

Apr 29, 2025

Chainalysis Acquisition Of Alterya A Strategic Move In The Blockchain Space

Apr 29, 2025

Latest Posts

-

Aiims A Growing Trend Of Adhd Diagnoses Among Young Patients

Apr 29, 2025

Aiims A Growing Trend Of Adhd Diagnoses Among Young Patients

Apr 29, 2025 -

Increase In Adhd Diagnoses At Aiims Investigating Environmental And Genetic Influences

Apr 29, 2025

Increase In Adhd Diagnoses At Aiims Investigating Environmental And Genetic Influences

Apr 29, 2025 -

Adhd In Young People Aiims Data Reveals A Growing Concern

Apr 29, 2025

Adhd In Young People Aiims Data Reveals A Growing Concern

Apr 29, 2025 -

The Rise Of Adhd Among Young Adults A Case Study From Aiims Opd

Apr 29, 2025

The Rise Of Adhd Among Young Adults A Case Study From Aiims Opd

Apr 29, 2025 -

Aiims Reports Increase In Young People With Adhd Understanding The Contributing Factors

Apr 29, 2025

Aiims Reports Increase In Young People With Adhd Understanding The Contributing Factors

Apr 29, 2025