Greg Abel: A Deep Dive Into Berkshire Hathaway's Future Leadership

Table of Contents

Greg Abel's Background and Career Progression at Berkshire Hathaway

Early Career and Key Roles

Greg Abel's journey within Berkshire Hathaway is a testament to his dedication and capabilities. His career wasn't a meteoric rise, but a steady climb marked by significant contributions at each stage. He joined the company in 1992 and steadily progressed through various roles, showcasing his aptitude for business management and financial acumen.

- Early 1990s – Early 2000s: Held various positions within Berkshire Hathaway Energy (formerly MidAmerican Energy), gaining experience in energy operations and management.

- 2000s – 2010s: Served as CEO of Berkshire Hathaway Energy, successfully overseeing its growth and diversification into renewable energy sources. This period demonstrated his strategic vision and ability to manage complex businesses.

- 2018: Appointed Vice Chairman of Berkshire Hathaway, solidifying his position as Buffett's likely successor. This appointment signaled the board's confidence in his ability to lead the conglomerate.

Key Skills and Expertise

Abel's success stems from a potent combination of leadership, financial management, and operational expertise. His skills are perfectly aligned with the diverse needs of Berkshire Hathaway's vast portfolio.

- Leadership: Abel's leadership style is characterized by collaboration, empowering his team to contribute their expertise. This fosters a culture of innovation and shared responsibility.

- Financial Acumen: Years of experience managing Berkshire Hathaway Energy honed his financial expertise. He possesses a deep understanding of financial markets, investment strategies, and risk management.

- Operational Expertise: His experience running a large, complex energy company has provided him with invaluable insights into operational efficiency, regulatory compliance, and strategic decision-making.

Mentorship Under Warren Buffett

Abel's relationship with Warren Buffett has been instrumental in shaping his leadership philosophy. Buffett's influence, while undoubtedly significant, doesn't dictate Abel’s approach. Instead, it appears to have provided a foundation of sound principles upon which he builds his own unique management style.

- Value Investing Principles: Buffett's emphasis on long-term value investing has clearly influenced Abel's decision-making processes.

- Decentralized Management: Buffett's hands-off approach to managing individual Berkshire Hathaway subsidiaries has seemingly informed Abel's own empowering leadership philosophy.

- Long-Term Perspective: The focus on long-term value creation, rather than short-term gains, appears to be a shared cornerstone of their approaches.

Greg Abel's Leadership Style and Management Philosophy

Comparison to Warren Buffett

While inheriting the mantle from Warren Buffett presents a formidable challenge, Greg Abel's leadership style presents a blend of similarities and differences. Both share a commitment to long-term value creation, but their approaches might differ in their pace and style.

- Similarities: Both emphasize a long-term investment horizon and focus on acquiring high-quality businesses with strong management teams.

- Differences: Buffett's more public and charismatic style contrasts with Abel’s more reserved and analytical approach. This difference doesn’t negate Abel’s capabilities, however; it simply reflects individual leadership styles.

Focus on Innovation and Adaptation

Navigating a rapidly changing global landscape requires adaptability and a willingness to embrace innovation. Abel’s leadership seems poised to guide Berkshire Hathaway through this transition.

- Renewable Energy Investments: His tenure at Berkshire Hathaway Energy showcases a commitment to renewable energy, reflecting a proactive approach to environmental sustainability and future growth opportunities.

- Technological Integration: While specific details are yet to emerge, it is expected that Abel will guide Berkshire Hathaway into a more technologically advanced future, leveraging data analytics and other innovations.

Emphasis on Corporate Social Responsibility

The increasing importance of ESG factors necessitates a robust commitment to corporate social responsibility. Abel’s likely approach to this is anticipated to build on Berkshire Hathaway's existing foundation.

- Environmental Sustainability: Continued investment in renewable energy sources and a reduction in carbon footprint are expected to be priorities.

- Social Responsibility: While past initiatives have laid a groundwork, a focus on enhancing social responsibility programs within their various subsidiaries will likely be a key aspect of his leadership.

The Challenges and Opportunities Facing Greg Abel as CEO

Succession Planning and Maintaining Berkshire's Culture

Stepping into Buffett's shoes presents a monumental challenge. Maintaining Berkshire Hathaway's unique culture and investor confidence requires skillful leadership.

- Maintaining Investor Confidence: The transition must be seamless to avoid market volatility and maintain trust among investors.

- Preserving Corporate Culture: The decentralized structure and focus on long-term value creation must be upheld to maintain Berkshire Hathaway's identity.

Navigating Economic Uncertainty and Market Volatility

The global economic landscape is subject to constant shifts and volatility. Abel must demonstrate his ability to steer Berkshire Hathaway through these turbulent waters.

- Risk Management: Maintaining a diversified portfolio and implementing effective risk management strategies are crucial.

- Strategic Investment Decisions: Making sound investment decisions, even during periods of uncertainty, will determine long-term success.

Diversification and Future Growth Strategies

Continued growth requires exploration of new avenues and diversification. Abel’s leadership will likely involve identifying new opportunities.

- Technological Investments: Expanding into technology sectors could offer significant growth potential.

- International Expansion: Further expansion into international markets can create new avenues for diversification and growth.

Conclusion: Greg Abel and the Future of Berkshire Hathaway

Greg Abel's ascension to the CEO position marks a significant turning point in Berkshire Hathaway's history. While he faces the immense challenge of succeeding Warren Buffett, his background, expertise, and leadership style suggest he is well-equipped to lead the company into the future. His ability to navigate economic uncertainty, foster innovation, and maintain Berkshire Hathaway's unique culture will be crucial for its long-term success. Understanding Greg Abel's leadership is crucial for understanding Berkshire Hathaway's future. Continue your exploration of Greg Abel and the future of Berkshire Hathaway by researching his past decisions and upcoming strategies. Understanding Greg Abel’s leadership is vital for any investor interested in Berkshire Hathaway’s future.

Featured Posts

-

Gigi Hadids 30th Birthday Instagram Post Confirms Relationship With Bradley Cooper

May 06, 2025

Gigi Hadids 30th Birthday Instagram Post Confirms Relationship With Bradley Cooper

May 06, 2025 -

Patrick Schwarzenegger Reflects On Failed Superman Audition

May 06, 2025

Patrick Schwarzenegger Reflects On Failed Superman Audition

May 06, 2025 -

30th Birthday Bash Gigi Hadid Makes Relationship With Bradley Cooper Instagram Official

May 06, 2025

30th Birthday Bash Gigi Hadid Makes Relationship With Bradley Cooper Instagram Official

May 06, 2025 -

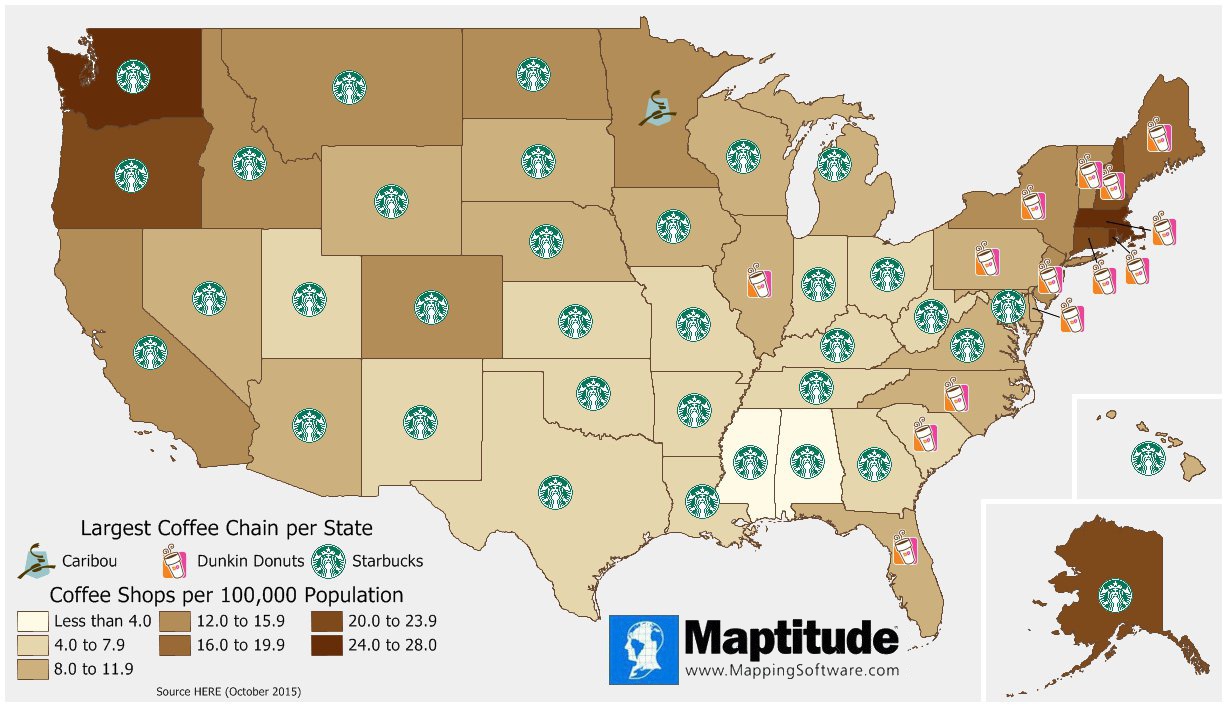

Top Business Locations In The Country A Comprehensive Map

May 06, 2025

Top Business Locations In The Country A Comprehensive Map

May 06, 2025 -

From Mistakes To Millions Warren Buffetts Path To Investing Mastery

May 06, 2025

From Mistakes To Millions Warren Buffetts Path To Investing Mastery

May 06, 2025

Latest Posts

-

76ers Vs Celtics Prediction Betting Preview Stats And Expert Picks For February 20 2025

May 06, 2025

76ers Vs Celtics Prediction Betting Preview Stats And Expert Picks For February 20 2025

May 06, 2025 -

Celtics Vs 76ers Prediction Expert Picks Odds And Best Bets Feb 20 2025

May 06, 2025

Celtics Vs 76ers Prediction Expert Picks Odds And Best Bets Feb 20 2025

May 06, 2025 -

Celtics Vs Knicks Live Stream Tv Channel And How To Watch

May 06, 2025

Celtics Vs Knicks Live Stream Tv Channel And How To Watch

May 06, 2025 -

Actor Chris Pratt On Patrick Schwarzeneggers White Lotus Appearance

May 06, 2025

Actor Chris Pratt On Patrick Schwarzeneggers White Lotus Appearance

May 06, 2025 -

Chris Pratt Discusses Patrick Schwarzeneggers White Lotus Nudity

May 06, 2025

Chris Pratt Discusses Patrick Schwarzeneggers White Lotus Nudity

May 06, 2025