From Mistakes To Millions: Warren Buffett's Path To Investing Mastery

Table of Contents

Early Life and Investing Beginnings

Warren Buffett's journey to becoming a legendary investor didn't begin in a Wall Street boardroom; it started with a paper route and an innate entrepreneurial spirit. His early life instilled crucial values that shaped his investment philosophy. He wasn't simply buying stocks; he was building a long-term relationship with businesses.

- Paper route and early business acumen: From a young age, Buffett displayed exceptional business savvy, starting his own paper route and later venturing into ventures like selling used golf balls and pinball machines. These experiences provided invaluable lessons in entrepreneurship, customer service, and managing finances.

- First stock purchase and early investment successes and failures: His first stock purchase at age 11 marked the beginning of his lifelong passion for investing. Early experiences, both profitable and unprofitable, instilled the importance of thorough research and risk assessment crucial to his future Warren Buffett investing success. He learned firsthand the realities of market volatility and the importance of patience.

- Influence of Benjamin Graham and the development of his value investing philosophy: Buffett's education at Columbia University, where he studied under the legendary investor Benjamin Graham, was pivotal. Graham's teachings on value investing – buying undervalued assets with a margin of safety – became the cornerstone of Buffett's approach. This philosophy remains central to effective Warren Buffett investing.

- Importance of long-term investing perspective: Early on, Buffett embraced a long-term perspective, emphasizing patience and avoiding the pitfalls of short-term market speculation. This focus on long-term value creation is a key differentiator in his Warren Buffett investing strategies.

Key Principles of Warren Buffett's Investing Strategy

Buffett's investment success isn't due to luck; it's the result of diligently adhering to a set of core principles. Understanding these tenets is crucial for anyone seeking to emulate his success in Warren Buffett investing.

- Understanding intrinsic value and margin of safety: Buffett's approach centers on identifying undervalued companies, meaning their market price is significantly lower than their intrinsic value (the true worth of the business). He always seeks a "margin of safety," a cushion to protect against unforeseen circumstances. This careful assessment of intrinsic value is the bedrock of all successful Warren Buffett investing.

- Focus on long-term investments and avoiding short-term market fluctuations: Ignoring short-term market noise and focusing on the long-term potential of a company is a hallmark of Buffett's strategy. This "buy and hold" approach allows for the power of compounding returns to work its magic.

- Importance of thorough due diligence and company analysis: Buffett meticulously researches companies before investing, analyzing their financial statements, competitive landscape, and management team. This due diligence is a critical component of effective Warren Buffett investing.

- Seeking out companies with strong competitive advantages (moats): Buffett looks for companies with sustainable competitive advantages, often referred to as "moats," that protect them from competition and allow them to generate consistent profits over the long term. Identifying these moats is a key skill in Warren Buffett investing.

- The power of compounding returns: Buffett's long-term approach allows the power of compounding to significantly amplify returns over time. This is a fundamental principle behind his remarkable wealth accumulation and a crucial element of Warren Buffett investing.

Notable Investments and Strategic Decisions

Buffett's investment history is a masterclass in strategic decision-making. Examining his successful investments reveals the underlying principles of his approach. Learning from these examples improves understanding of Warren Buffett investing.

- Berkshire Hathaway acquisition and its strategic importance: Buffett's acquisition of Berkshire Hathaway wasn't just an investment; it was a strategic move that provided a platform for his long-term investment strategy. Berkshire Hathaway became the vehicle for his diverse holdings and helped to build his renowned reputation.

- Successful investments in Coca-Cola, American Express, and other blue-chip companies: Buffett's investments in Coca-Cola and American Express, among others, exemplify his focus on quality businesses with strong competitive advantages and enduring brand recognition. These successful examples showcase the long-term value creation central to Warren Buffett investing.

- Analysis of his investment strategy in different market conditions: Buffett's approach has remained relatively consistent across various market conditions, demonstrating the enduring power of his value investing principles. He adapts his strategy when necessary but remains faithful to his fundamental approach to Warren Buffett investing.

- Understanding his approach to diversification and concentration: While diversification is often recommended, Buffett's portfolio is known for its concentration in a relatively small number of well-researched companies. He believes in concentrating on what he understands best.

Learning from Buffett's Mistakes

Even the Oracle of Omaha has made investment mistakes. Analyzing these missteps provides valuable insights into risk management and the importance of adaptability in Warren Buffett investing.

- Discussion of less successful investments and the lessons learned: Buffett has openly acknowledged instances where his investments haven't performed as expected, emphasizing the importance of acknowledging mistakes and learning from them. Understanding these mistakes is integral to successful Warren Buffett investing.

- Importance of risk management and diversification: Although Buffett concentrates his investments, the necessity of carefully managing risk is paramount. Understanding risk and its mitigation is essential for Warren Buffett investing.

- The role of emotional discipline in investing: Avoiding emotional decision-making, such as panic selling during market downturns, is crucial. Maintaining emotional discipline is a significant factor in effective Warren Buffett investing.

- Adaptability to changing market conditions: While sticking to core principles, adaptability is key. Responding to evolving market conditions is important for sustained success in Warren Buffett investing.

Applying Buffett's Principles to Your Investment Strategy

Incorporating Buffett's principles requires discipline and a long-term perspective. It's not a get-rich-quick scheme. Applying the principles requires understanding the underlying philosophies.

- Steps to value investing: Start by identifying undervalued companies by thoroughly analyzing their financial statements and comparing them to industry peers.

- Importance of fundamental analysis: Master fundamental analysis to accurately assess a company's intrinsic value. Understanding the business is as important as understanding the numbers.

- Developing a long-term investment plan: Create a diversified portfolio aligned with your long-term financial goals, focusing on quality businesses rather than chasing short-term gains.

- Resources to further your Warren Buffett investing knowledge: Read Buffett's annual letters to shareholders, explore books on value investing, and follow reputable financial news sources.

Conclusion

This article explored the remarkable journey of Warren Buffett, demonstrating how his dedication to value investing, coupled with meticulous research and a long-term perspective, has led him to unparalleled success. We analyzed his core principles, his notable investments, and even his mistakes, emphasizing that consistent learning and adaptation are key to effective Warren Buffett investing.

Ready to embark on your own path to financial mastery? Start learning from the best by applying the Warren Buffett investing strategies outlined in this article and begin building your own portfolio for long-term success! Further your knowledge by researching his annual letters and other resources on value investing. Start your Warren Buffett investing journey today!

Featured Posts

-

Understanding Westpacs Wbc Profit Decrease The Role Of Margin Squeezes

May 06, 2025

Understanding Westpacs Wbc Profit Decrease The Role Of Margin Squeezes

May 06, 2025 -

Benchmarking Excellence Does This Sequel Website Measure Up

May 06, 2025

Benchmarking Excellence Does This Sequel Website Measure Up

May 06, 2025 -

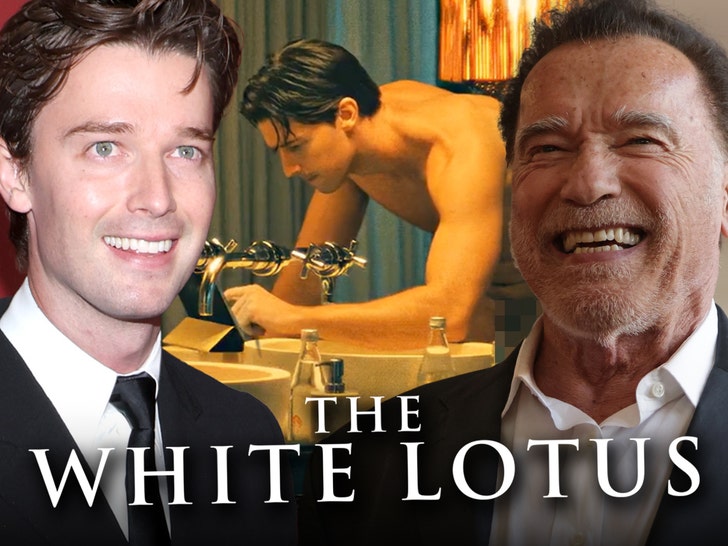

Why Did Patrick Schwarzenegger Delay His Wedding To Abby Champion

May 06, 2025

Why Did Patrick Schwarzenegger Delay His Wedding To Abby Champion

May 06, 2025 -

Private Credit Jobs 5 Dos And Don Ts To Secure Your Next Role

May 06, 2025

Private Credit Jobs 5 Dos And Don Ts To Secure Your Next Role

May 06, 2025 -

Addressing The Staffing Crisis At Newark Airport A 7 Day Delay Analysis

May 06, 2025

Addressing The Staffing Crisis At Newark Airport A 7 Day Delay Analysis

May 06, 2025

Latest Posts

-

Arnold Schwarzenegger Supports Son Patricks Nude Role

May 06, 2025

Arnold Schwarzenegger Supports Son Patricks Nude Role

May 06, 2025 -

Patrick Schwarzeneggers Nudity Arnold Schwarzenegger Weighs In

May 06, 2025

Patrick Schwarzeneggers Nudity Arnold Schwarzenegger Weighs In

May 06, 2025 -

Joseph Baena Arnold Schwarzenegger Bueszke Fianak Utja A Sikerhez

May 06, 2025

Joseph Baena Arnold Schwarzenegger Bueszke Fianak Utja A Sikerhez

May 06, 2025 -

Arnold Schwarzenegger Bueszkeseg Es Oeroem A Fiaval Kapcsolatban

May 06, 2025

Arnold Schwarzenegger Bueszkeseg Es Oeroem A Fiaval Kapcsolatban

May 06, 2025 -

Shvartsenegger I Chempion Fotosessiya Dlya Kim Kardashyan

May 06, 2025

Shvartsenegger I Chempion Fotosessiya Dlya Kim Kardashyan

May 06, 2025