Government Actions Against Delinquent Student Loan Borrowers: A Comprehensive Guide

Table of Contents

Wage Garnishment and Tax Refund Offset

One of the most significant actions the government takes against delinquent student loan borrowers is wage garnishment. This process involves the government legally seizing a portion of your wages directly from your employer to pay off your outstanding debt. The amount garnished depends on several factors, including your disposable income and the total amount owed.

- Percentage of Wages Garnishable: The amount garnished typically cannot exceed 15% of your disposable earnings, though state laws may vary. Disposable income is your earnings after required deductions like taxes and Social Security.

- Legal Protections and Exemptions: Certain individuals may be eligible for exemptions from wage garnishment, but these are limited. Consult a financial advisor or legal professional to understand your options.

- Dispute a Wage Garnishment: If you believe a wage garnishment is incorrect or unlawful, you can dispute it by providing evidence to the relevant agency. This may involve demonstrating financial hardship or proving an error in the calculation of the garnished amount.

- State-Specific Laws: State laws may add additional protections or limitations regarding wage garnishments. It is essential to be aware of your specific state's regulations.

In addition to wage garnishment, the government utilizes the Treasury Offset Program (TOP) to intercept federal tax refunds. This program automatically deducts a portion of your tax refund to apply towards your delinquent student loan debt.

- Treasury Offset Program (TOP): The TOP is an automated process, so you may not receive a prior warning.

- Amount of Refund Offset: The entire refund may be offset, depending on the amount of your delinquent debt.

- Notification Process: While the process is largely automated, you will usually receive notification from the IRS before the offset occurs.

- Appealing a Tax Refund Offset: If you believe there's an error or you're eligible for an exemption, you can appeal the offset.

Credit Bureau Reporting and Impact on Credit Score

Delinquent student loans significantly impact your credit score. When you fail to make payments, the lender reports this negative information to major credit bureaus (Equifax, Experian, and TransUnion).

- Impact on FICO Score: A delinquent student loan can severely damage your FICO score, making it harder to obtain credit in the future.

- Difficulty Obtaining Credit: A low credit score can make it challenging to secure loans, credit cards, mortgages, and even some rental agreements.

- Length of Time Negative Information Remains: Negative information related to delinquent student loans typically remains on your credit report for seven years from the date of delinquency.

Strategies for improving your credit score after delinquency include:

- Credit Counseling Services: Credit counseling agencies can help you create a budget and develop a repayment plan.

- Debt Consolidation Options: Consolidating your student loan debt into a single payment may make it more manageable.

- Dispute Inaccurate Information: If you find any inaccurate information on your credit report, dispute it with the credit bureaus immediately.

Legal Actions: Lawsuits and Defaults

Defaulting on federal student loans carries severe legal consequences. Default occurs when you fail to make payments for 270 days or more.

- Legal Proceedings and Court Judgments: The government can sue you to recover the debt, resulting in court judgments and wage garnishments.

- Wage Garnishment and Bank Levy: The government can garnish your wages and levy your bank accounts to recover the debt.

- Potential Legal Fees and Costs: You may be responsible for paying legal fees and court costs associated with the lawsuit.

- Impact on Future Federal Benefits: Defaulting on student loans can affect your eligibility for federal benefits, such as Social Security and tax refunds.

Loan rehabilitation can help mitigate these consequences.

- Requirements for Loan Rehabilitation: You must make nine on-time payments within 20 days of their due date.

- Impact on Credit Score: Your credit score will improve once the default is removed.

- Removal of Default Status: Successful loan rehabilitation removes the default status from your credit report.

Collection Agencies and Their Practices

The Department of Education often works with collection agencies to recover delinquent student loan debt.

- Communication with Collection Agencies: Keep detailed records of all communications with collection agencies.

- Understanding Their Rights and Limitations: Collection agencies are bound by the Fair Debt Collection Practices Act (FDCPA).

- Negotiating Repayment Plans: You may be able to negotiate a repayment plan with the collection agency.

- Identifying and Avoiding Scams: Beware of scams impersonating collection agencies; verify their legitimacy before sharing any personal information.

The Fair Debt Collection Practices Act (FDCPA) protects you from abusive debt collection practices. It prohibits harassment, misrepresentation, and unfair practices by collection agencies.

Protecting Yourself from Aggressive Collection Tactics

Aggressive collection tactics are unfortunately common. To protect yourself:

- Documenting All Communication: Keep records of all phone calls, emails, and letters from collection agencies.

- Knowing Your Rights: Familiarize yourself with your rights under the FDCPA.

- Seeking Legal Counsel: If you face aggressive or harassing collection tactics, seek legal counsel.

Conclusion

Understanding the government's actions against delinquent student loan borrowers is crucial for avoiding severe financial and legal consequences. From wage garnishment and tax refund offsets to credit damage and potential lawsuits, the repercussions can be significant. However, by proactively addressing your delinquency, understanding your rights, and exploring available repayment options, you can mitigate these risks. Don't let delinquent student loan debt control your future. Take action today and explore resources to manage your debt and avoid the harsh realities of government actions against delinquent student loan borrowers. Learn more about your options and regain control of your finances. Contact a financial advisor or student loan counselor for personalized assistance with your delinquent student loan situation.

Featured Posts

-

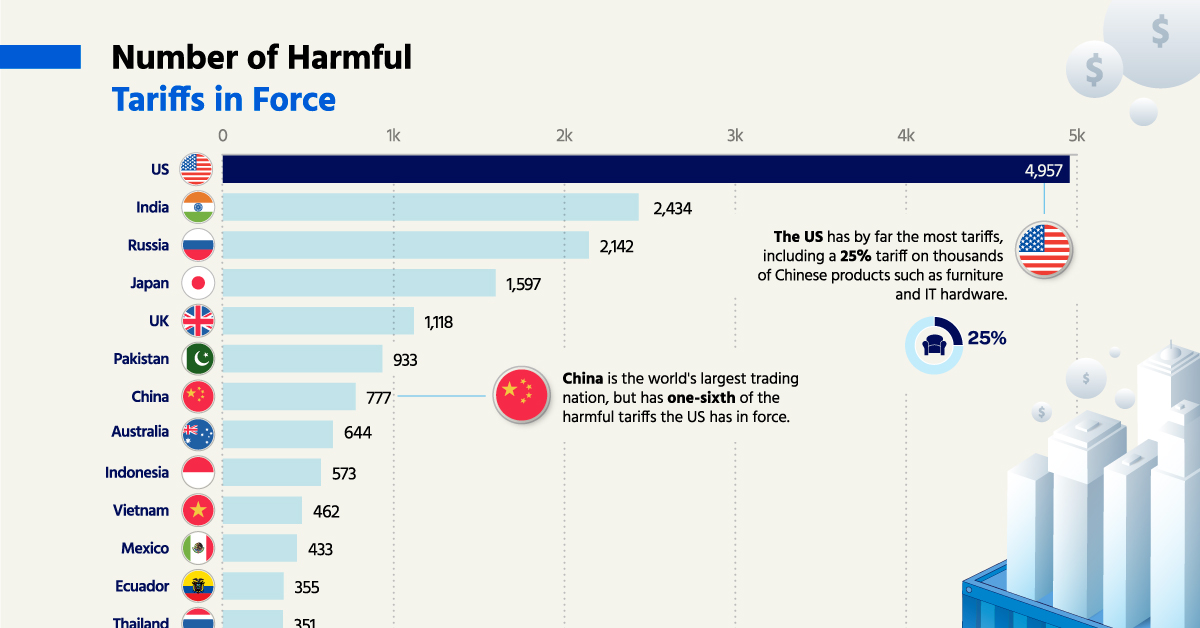

14 6 Billion Deficit How Tariffs Impact Ontarios Economy

May 17, 2025

14 6 Billion Deficit How Tariffs Impact Ontarios Economy

May 17, 2025 -

Josh Harts Wife Reacts To Jaylen Browns Game 5 Performance

May 17, 2025

Josh Harts Wife Reacts To Jaylen Browns Game 5 Performance

May 17, 2025 -

Nba Addresses Missed Call Impacting Pistons In Game 4

May 17, 2025

Nba Addresses Missed Call Impacting Pistons In Game 4

May 17, 2025 -

Best Crypto Casinos 2024 Jack Bits Instant Withdrawal Feature

May 17, 2025

Best Crypto Casinos 2024 Jack Bits Instant Withdrawal Feature

May 17, 2025 -

Luxury Real Estate A Recession Proof Investment For High Net Worth Individuals

May 17, 2025

Luxury Real Estate A Recession Proof Investment For High Net Worth Individuals

May 17, 2025

Latest Posts

-

Fortnite The Latest Icon Skin Addition

May 17, 2025

Fortnite The Latest Icon Skin Addition

May 17, 2025 -

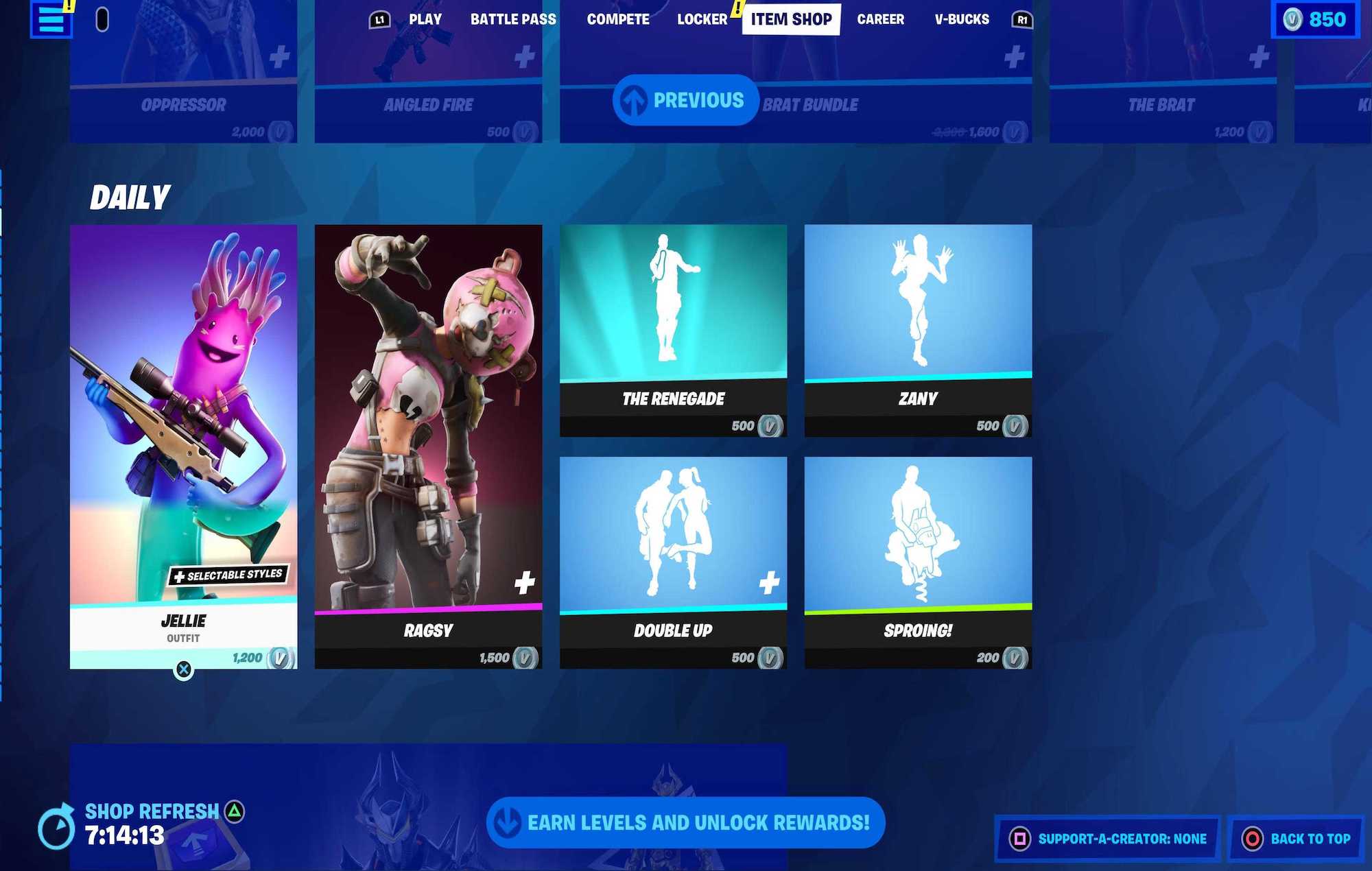

Fortnites Item Shop A New Feature To Help Players

May 17, 2025

Fortnites Item Shop A New Feature To Help Players

May 17, 2025 -

Fortnite Cowboy Bebop Collaboration How To Get The Freebies

May 17, 2025

Fortnite Cowboy Bebop Collaboration How To Get The Freebies

May 17, 2025 -

Leaked Fortnite Icon Skin First Look And Speculation

May 17, 2025

Leaked Fortnite Icon Skin First Look And Speculation

May 17, 2025 -

Fortnite Item Shop Enhanced A Helpful New Feature Explained

May 17, 2025

Fortnite Item Shop Enhanced A Helpful New Feature Explained

May 17, 2025