Google Ad Tech Monopoly: US Demands Forced Asset Sale

Table of Contents

H2: The Department of Justice's Case Against Google's Ad Tech Practices

The DOJ's antitrust lawsuit against Google centers on its alleged abuse of its dominant position in various ad tech segments. The core argument is that Google leverages its control over key technologies and platforms to stifle competition, ultimately harming advertisers, publishers, and consumers. The lawsuit specifically targets products like Google Ad Manager (formerly Google Ad Exchange), AdSense, and DV360 (Display & Video 360).

- Stifling Competition: The DOJ alleges Google uses its dominance to manipulate the bidding process, ensuring its own ad products receive preferential treatment, thus disadvantaging competitors. This alleged bid rigging creates an uneven playing field, limiting innovation and choice.

- Anti-Competitive Practices: The lawsuit highlights Google's alleged use of exclusive contracts, tying its various ad tech products together, making it difficult for publishers and advertisers to use competing services. This practice allegedly locks in clients and creates barriers to entry for new players in the ad tech market.

- Specific Examples: The lawsuit cites numerous instances of Google allegedly prioritizing its own products in ad auctions, manipulating auction results, and using its vast data resources to gain an unfair advantage over competitors. These details are crucial to understanding the depth and breadth of the alleged anti-competitive practices.

H2: The Potential Impacts of a Forced Asset Sale on the Ad Tech Ecosystem

A forced asset sale could significantly reshape the ad tech landscape, impacting various stakeholders:

- Advertisers:

- Lower Ad Costs: Increased competition could potentially drive down ad costs, offering better value for advertisers' budgets.

- Increased Innovation: A more fragmented market might foster innovation, leading to the development of more sophisticated and targeted advertising solutions.

- Greater Transparency: A more competitive environment could increase transparency in ad pricing and bidding processes.

- Publishers:

- Revenue Stream Changes: Publishers might need to adapt to a more competitive ad marketplace, potentially adjusting their strategies to maximize revenue from diverse ad platforms.

- Market Adaptation: Navigating a more fragmented market may require publishers to build relationships with a wider range of ad tech providers.

- New Revenue Opportunities: Increased competition might unlock new revenue opportunities through partnerships and diverse ad formats.

- Consumers:

- Increased Choice: Consumers might benefit from a greater variety of online advertising, leading to improved ad relevance and less intrusive ad experiences.

- Data Privacy: The impact on targeted advertising and data privacy remains uncertain, necessitating close monitoring of how various platforms handle user data post-divestiture.

- Improved Ad Experiences: Increased competition could lead to better-quality ads, reducing the prevalence of intrusive or irrelevant advertisements.

H2: Arguments for and Against the Forced Asset Sale

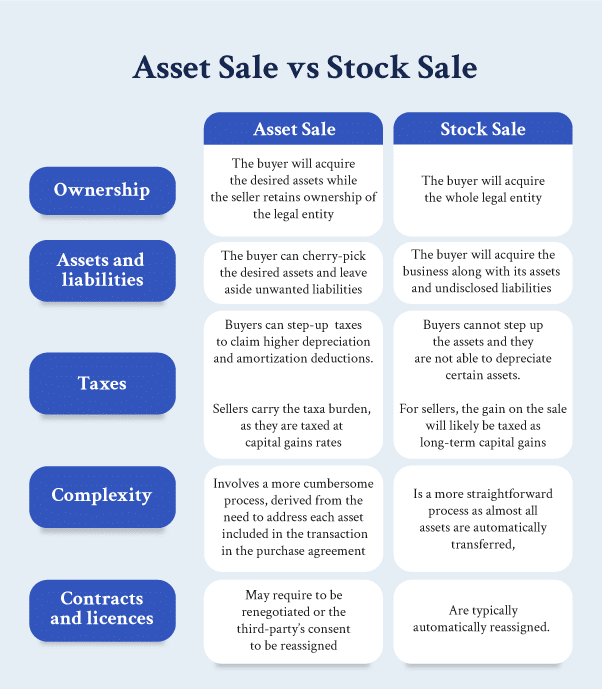

The proposed asset sale sparks a vigorous debate:

- Arguments for:

- Boosting Competition: Breaking up Google's ad tech monopoly would foster competition and innovation, benefiting both advertisers and publishers.

- Fairness and Transparency: A more competitive market could lead to fairer pricing, increased transparency, and a level playing field for all players.

- Consumer Protection: The sale aims to protect consumers from the potential harms of monopolistic practices.

- Arguments against:

- Ecosystem Disruption: Divesting Google's ad tech assets could create significant disruption in the existing ecosystem, leading to uncertainty and potential instability.

- Restructuring Costs: The restructuring process could be expensive and complex, potentially impacting Google's operations and potentially harming its employees.

- Effectiveness Concerns: Some argue that asset divestiture might not be an effective solution and other regulatory measures could achieve the same goals with less disruption.

H2: Alternatives to a Forced Asset Sale and Their Potential Outcomes

While a forced asset sale is a drastic measure, other regulatory alternatives exist:

- Behavioral Remedies: Imposing strict regulations on Google's ad tech practices, without requiring a sale, could address anti-competitive conduct. This approach might involve restrictions on preferential treatment, data usage, and exclusive contracts.

- Stricter Regulations: Implementing stricter regulations on the entire ad tech industry could prevent future monopolies from forming. This might involve measures to enhance transparency, improve data portability, and limit the power of dominant players.

Compared to a forced asset sale, these alternatives offer less disruption but might be less effective in addressing Google's current dominance. The success of these alternatives would hinge on their ability to enforce compliance and prevent future anti-competitive behavior.

3. Conclusion: The Future of Google's Ad Tech Empire and the Fight Against Monopolies

The US government's demand for a forced asset sale to address the "Google Ad Tech Monopoly" represents a significant challenge to Google's dominance in digital advertising. The potential impacts on advertisers, publishers, and consumers are far-reaching and complex. While the forced sale offers a path to increased competition and innovation, it also carries the risk of significant disruption. Alternative regulatory measures offer a less disruptive but potentially less effective solution. The long-term effects of this legal battle will significantly shape the digital advertising landscape. Stay informed about the developments in the Google Ad Tech Monopoly case and its effects on the digital advertising landscape. [Link to relevant resources, e.g., DOJ press releases, news articles].

Featured Posts

-

Europes Public Transport Hydrogen Fuel Cell Buses Vs Battery Electric Buses

May 07, 2025

Europes Public Transport Hydrogen Fuel Cell Buses Vs Battery Electric Buses

May 07, 2025 -

Svedsko Na Ms S 18 Hraci Nhl Vyhoda Proti Nemecku

May 07, 2025

Svedsko Na Ms S 18 Hraci Nhl Vyhoda Proti Nemecku

May 07, 2025 -

Why Powell Risks Delaying Interest Rate Cuts Balancing Inflation And Political Pressure

May 07, 2025

Why Powell Risks Delaying Interest Rate Cuts Balancing Inflation And Political Pressure

May 07, 2025 -

5 Publikacji Jacka Harlukowicza Z Onetu O Najwiekszym Zasiegu W 2024

May 07, 2025

5 Publikacji Jacka Harlukowicza Z Onetu O Najwiekszym Zasiegu W 2024

May 07, 2025 -

Nikki Fargas On The Aces Community Impact 2025 Season Outlook And More

May 07, 2025

Nikki Fargas On The Aces Community Impact 2025 Season Outlook And More

May 07, 2025

Latest Posts

-

Bancheros 24 Points Lead Magic Past Cavaliers

May 07, 2025

Bancheros 24 Points Lead Magic Past Cavaliers

May 07, 2025 -

Cleveland Cavaliers Dominant Performance Mitchell And Mobley Shine

May 07, 2025

Cleveland Cavaliers Dominant Performance Mitchell And Mobley Shine

May 07, 2025 -

Celtics Cavaliers Rivalry A Stars Perspective On Crucial Takeaways

May 07, 2025

Celtics Cavaliers Rivalry A Stars Perspective On Crucial Takeaways

May 07, 2025 -

Did Ke Huy Quan Appear In The White Lotus Season 3 A Deep Dive

May 07, 2025

Did Ke Huy Quan Appear In The White Lotus Season 3 A Deep Dive

May 07, 2025 -

Orlando Magic Snap Cavaliers 16 Game Win Streak

May 07, 2025

Orlando Magic Snap Cavaliers 16 Game Win Streak

May 07, 2025