Why Powell Risks Delaying Interest Rate Cuts: Balancing Inflation And Political Pressure

Table of Contents

The Stubborn Persistence of Inflation

Headline inflation, while showing signs of cooling, remains stubbornly elevated despite the Federal Reserve's aggressive interest rate hikes. This persistence is a major factor influencing Powell's reluctance to cut rates.

- Headline inflation: Although declining, it's still above the Fed's target of 2%.

- Core inflation: Excluding volatile food and energy prices, core inflation shows a slower but still concerning pace of decrease. This signals that underlying inflationary pressures are not yet fully under control.

- Supply chain disruptions: While easing, lingering supply chain issues continue to contribute to higher prices for various goods.

- Wage growth: Robust wage growth, while positive for workers, can fuel inflation if it outpaces productivity increases. This creates a wage-price spiral risk.

- Key data points: The Consumer Price Index (CPI), Producer Price Index (PPI), employment reports, and wage growth data are meticulously analyzed by the Fed to gauge the effectiveness of its monetary policy.

The Economic Slowdown and Recessionary Fears

The aggressive interest rate hikes implemented by the Fed, while intended to curb inflation, also increase the risk of an economic recession. This presents a significant dilemma for Powell.

- Inverted yield curve: A persistent inversion of the yield curve (where short-term interest rates exceed long-term rates) is a historically reliable predictor of recessions.

- High borrowing costs: Increased interest rates make borrowing more expensive for businesses and consumers, potentially dampening investment and spending.

- Impact on businesses: Higher borrowing costs can lead to reduced investment, hiring freezes, and even business closures.

- Consumer spending: Increased interest rates can also lead to reduced consumer spending, as higher mortgage rates and loan costs impact household budgets.

- Powell's tightrope walk: The Fed Chairman must carefully navigate this challenging situation, aiming to avoid triggering a severe recession while successfully combating inflation.

Political Pressure for Rate Cuts

Powell faces significant political pressure to cut interest rates, particularly as the economy slows and the potential for a recession looms. This pressure can come from various sources and adds another layer of complexity to his decision-making.

- Election cycles: Political figures may advocate for rate cuts to stimulate economic growth and boost their chances in upcoming elections.

- Accusations of hardship: The Fed could face accusations of exacerbating economic hardship if interest rates remain high for an extended period.

- Maintaining independence: The Fed's independence is crucial in navigating these political pressures. Yielding to short-term political gains could compromise long-term economic stability.

- Price stability: Powell must effectively communicate the importance of maintaining price stability, even if it means enduring short-term economic pain.

The Data-Driven Approach of the Federal Reserve

The Federal Reserve's decision-making process is fundamentally data-driven. Powell and the FOMC rely heavily on economic indicators to inform their monetary policy decisions.

- Economic indicators: Inflation reports (CPI and PPI), employment data (nonfarm payrolls, unemployment rate), and other key metrics are meticulously analyzed.

- Forward guidance: The Fed provides forward guidance through statements and press conferences to communicate its assessment of the economic situation and its policy intentions.

- Transparency and communication: Clear communication and transparency are crucial to maintain public trust and ensure the effectiveness of monetary policy.

- Credibility: Powell's commitment to a data-driven approach strengthens the Fed's credibility and helps to anchor inflation expectations.

Potential Consequences of Delaying Interest Rate Cuts

Delaying interest rate cuts, while potentially necessary to curb inflation, carries considerable risks. The potential consequences of this approach need careful consideration.

- Deepening recession: Prolonged high interest rates could exacerbate the economic slowdown and push the economy into a deeper recession.

- Increased unemployment: Higher interest rates can lead to job losses and increased unemployment.

- Damaged confidence: Continued economic uncertainty can damage consumer and business confidence, further hindering economic growth.

- Political backlash: A prolonged period of economic hardship could lead to increased political backlash against the Fed.

- Balancing act: The challenge lies in finding the right balance to mitigate the potential negative outcomes of both delaying and prematurely cutting interest rates.

Conclusion: Navigating the Tightrope: Powell's Decision on Interest Rate Cuts

Chairman Powell's decision on interest rate cuts is a high-stakes balancing act. He must carefully weigh the need to control inflation against the risks of triggering a recession and succumbing to political pressures. The timing of interest rate cuts will significantly impact the economic landscape. Understanding the complexities involved is crucial for investors, policymakers, and the public. Stay informed on the latest developments regarding interest rate cuts and their economic impact by following reputable financial news sources. The future direction of monetary policy, particularly concerning interest rate cuts, will significantly shape the economic landscape.

Featured Posts

-

Section 230 And Banned Chemicals A Judges Ruling On E Bay Listings

May 07, 2025

Section 230 And Banned Chemicals A Judges Ruling On E Bay Listings

May 07, 2025 -

Lewis Capaldi Makes Unexpected Appearance At Tom Walker Charity Event

May 07, 2025

Lewis Capaldi Makes Unexpected Appearance At Tom Walker Charity Event

May 07, 2025 -

Nhl 25 Arcade Mode Makes A Comeback This Week

May 07, 2025

Nhl 25 Arcade Mode Makes A Comeback This Week

May 07, 2025 -

Hd 7

May 07, 2025

Hd 7

May 07, 2025 -

Washington Capitals Legend Alex Ovechkins Advice To Young Russian Nhl Players

May 07, 2025

Washington Capitals Legend Alex Ovechkins Advice To Young Russian Nhl Players

May 07, 2025

Latest Posts

-

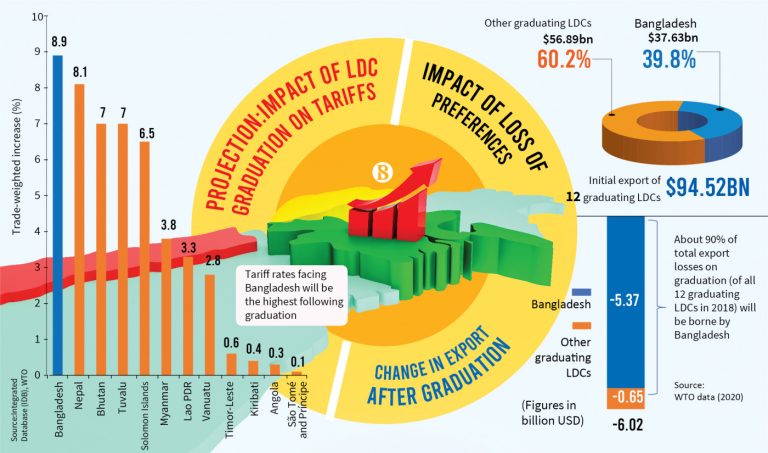

Accelerating Ldc Graduation A Comprehensive Guide For Chartered Accountants

May 07, 2025

Accelerating Ldc Graduation A Comprehensive Guide For Chartered Accountants

May 07, 2025 -

22 Point Loss For Chicago Bulls Against Cleveland Cavaliers

May 07, 2025

22 Point Loss For Chicago Bulls Against Cleveland Cavaliers

May 07, 2025 -

Zambia To Host Ldcs Future Forum 2025 Shaping A Sustainable Future For Least Developed Countries

May 07, 2025

Zambia To Host Ldcs Future Forum 2025 Shaping A Sustainable Future For Least Developed Countries

May 07, 2025 -

Nba Game Recap Cavaliers Defeat Bulls By 22 Points

May 07, 2025

Nba Game Recap Cavaliers Defeat Bulls By 22 Points

May 07, 2025 -

Is There A Bigger Playoff Threat To The Cavs Than Boston

May 07, 2025

Is There A Bigger Playoff Threat To The Cavs Than Boston

May 07, 2025