Gold's Record High: Understanding The Trade War Impact On Bullion

Table of Contents

The Safe-Haven Effect of Gold During Trade Wars

Gold has long been recognized as a safe-haven asset, a haven for investors seeking refuge during times of economic uncertainty and geopolitical instability. Trade wars, with their inherent unpredictability and potential for disrupting global markets, amplify this safe-haven effect. When trade disputes escalate, investors often react by shifting their investments away from riskier assets like stocks and bonds, towards perceived safer options such as gold.

- Increased volatility in stock markets due to trade disputes: Trade wars introduce significant uncertainty, leading to increased volatility and potential losses in the stock market.

- Investors seeking refuge in less risky assets like gold: Gold's historical stability, even during periods of crisis, makes it an attractive alternative investment.

- Weakening of the US dollar, making gold (priced in USD) more attractive: Trade tensions can weaken the US dollar, making gold, which is priced in US dollars, relatively cheaper for investors holding other currencies, thus boosting demand.

- Examples of historical instances where gold prices rose during periods of geopolitical instability: The 2008 financial crisis and various past geopolitical events demonstrate a clear correlation between global instability and increased gold prices.

Recent data shows a strong correlation between escalating trade war rhetoric and subsequent increases in gold prices. For instance, [insert specific example with data and source]. This demonstrates the tangible impact of trade uncertainty on investor behavior and the consequent demand for gold bullion. Key economic indicators, like the VIX volatility index, often spike during trade war escalations, further highlighting the link between market fear and the rise in gold prices.

Impact of Currency Devaluation on Gold Prices

Trade wars frequently lead to currency devaluation. When countries impose tariffs or engage in trade disputes, it can negatively impact their economies, weakening their respective currencies. This currency devaluation directly affects the price of gold, a globally traded commodity priced predominantly in US dollars.

- Explain the mechanics of currency fluctuations and their impact on commodity pricing: A weaker currency makes imported goods, including gold, more expensive for domestic consumers and investors.

- Examples of countries involved in trade disputes and the subsequent effect on their currencies: [Insert specific examples with data and credible sources, linking currency fluctuations to specific trade disputes].

- Mention potential inflation and its influence on gold’s value: Currency devaluation often contributes to inflationary pressures, further boosting gold's appeal as an inflation hedge.

The relationship between currency fluctuations and gold price movements is demonstrably strong. [Insert chart or data visualization showing the correlation between currency movements – e.g., USD weakening – and increases in gold prices]. This data underscores the significant role of currency dynamics in shaping the gold market during periods of trade conflict.

Inflationary Pressures and Gold as a Hedge

Trade wars can contribute to inflationary pressures through several mechanisms, including supply chain disruptions and increased import costs. This inflationary environment makes gold an attractive hedge.

- Define inflation and its impact on purchasing power: Inflation erodes the purchasing power of money, making goods and services more expensive.

- Explain how gold's value tends to rise during inflationary periods: Historically, gold has served as a store of value, retaining its purchasing power even when fiat currencies depreciate due to inflation.

- Discuss the role of central bank actions (interest rate changes) in influencing both inflation and gold prices: Central banks often respond to inflation by raising interest rates, which can impact both inflation and gold prices (higher interest rates can make holding non-interest bearing assets like gold less attractive).

Numerous historical periods demonstrate a positive correlation between inflation and gold prices. [Insert examples with data and source]. This historical evidence strengthens the case for gold as a crucial element in a diversified investment portfolio during periods of inflationary pressure fueled by trade disputes.

Investing in Gold During Times of Trade Uncertainty

Investors seeking to capitalize on the safe-haven appeal of gold during trade uncertainties have several options:

- Physical gold: Buying and storing physical gold bars or coins offers tangible ownership but requires secure storage.

- Gold ETFs (Exchange Traded Funds): These funds track the price of gold, offering convenient and liquid access to the gold market.

- Gold mining stocks: Investing in companies that mine and produce gold can offer leveraged exposure to gold price movements, but comes with greater risk.

Pros and Cons of each gold investment method: [Detailed comparison table of each investment method, outlining its advantages and disadvantages]. It’s crucial to carefully consider your risk tolerance and investment goals when choosing a suitable approach.

Risk management strategies for gold investments: Diversification is key; don’t put all your eggs in one basket. Consider diversifying your portfolio across different asset classes to mitigate potential losses.

Importance of diversification in an investment portfolio: A well-diversified portfolio, including gold as one component, can help mitigate risk and enhance overall investment performance.

Conclusion: Navigating the Gold Market in a Time of Trade Wars

The strong correlation between trade wars, economic uncertainty, and the rise in gold prices is undeniable. Gold's role as a safe-haven asset and an inflation hedge has been reinforced during these periods of increased geopolitical and economic risk. Understanding the impact of trade wars on gold's record high is crucial for informed investment decisions. Learn more about incorporating gold into your investment strategy today! [Link to relevant resources, e.g., investment guides, reputable financial news sources].

Featured Posts

-

Florida A Cnn Anchors Favorite Vacation Spot

Apr 26, 2025

Florida A Cnn Anchors Favorite Vacation Spot

Apr 26, 2025 -

Colgates Q Quarter Earnings Sales And Profit Decline Due To Tariffs

Apr 26, 2025

Colgates Q Quarter Earnings Sales And Profit Decline Due To Tariffs

Apr 26, 2025 -

White House Cocaine Incident Secret Service Concludes Investigation

Apr 26, 2025

White House Cocaine Incident Secret Service Concludes Investigation

Apr 26, 2025 -

Why Is Gold Soaring Trade Wars And The Bullion Market

Apr 26, 2025

Why Is Gold Soaring Trade Wars And The Bullion Market

Apr 26, 2025 -

Ukraines Nato Future Weighing Trumps Influence

Apr 26, 2025

Ukraines Nato Future Weighing Trumps Influence

Apr 26, 2025

Latest Posts

-

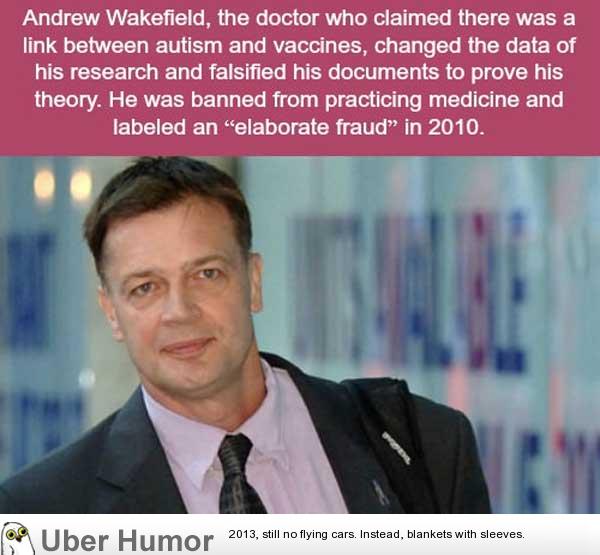

Public Health Concerns Anti Vaxxer Appointed To Head Autism Research

Apr 27, 2025

Public Health Concerns Anti Vaxxer Appointed To Head Autism Research

Apr 27, 2025 -

Autism Study Controversy Anti Vaccination Advocate Takes The Lead

Apr 27, 2025

Autism Study Controversy Anti Vaccination Advocate Takes The Lead

Apr 27, 2025 -

Governments Choice Of Anti Vaxxer For Autism Research Sparks Outrage

Apr 27, 2025

Governments Choice Of Anti Vaxxer For Autism Research Sparks Outrage

Apr 27, 2025 -

Federal Government Appoints Anti Vaxxer To Lead Autism Study

Apr 27, 2025

Federal Government Appoints Anti Vaxxer To Lead Autism Study

Apr 27, 2025 -

Un Ano De Salario Para Madres Tenistas El Nuevo Estandar Wta

Apr 27, 2025

Un Ano De Salario Para Madres Tenistas El Nuevo Estandar Wta

Apr 27, 2025