Why Is Gold Soaring? Trade Wars And The Bullion Market

Table of Contents

Global Trade Wars and Economic Uncertainty

Global trade wars inject significant uncertainty into global markets, prompting investors to seek out safe haven assets like gold. This uncertainty stems from a number of factors directly related to these trade disputes.

Increased Market Volatility

Trade wars introduce volatility through various mechanisms:

- Tariffs: Increased tariffs on imported goods lead to higher prices for consumers and businesses, impacting economic growth and market confidence.

- Sanctions: Sanctions imposed on specific countries or industries disrupt supply chains and create further uncertainty about future trade relations.

- Retaliatory Measures: The tit-for-tat nature of trade wars, with countries imposing retaliatory tariffs and sanctions, further destabilizes markets.

The impact is clear: periods of intense trade tension often correlate with heightened market volatility. For example, [Insert data point: e.g., a statistic showing increased market volatility during a specific period of trade tension, citing a reputable source]. This volatility makes investors nervous and drives them towards assets perceived as stable and less susceptible to short-term fluctuations.

Weakening Currencies

Trade disputes frequently lead to weakening national currencies. When a country faces trade restrictions or retaliatory measures, its currency can depreciate, making imports more expensive and exports less competitive.

- Examples: [Insert bullet points: Examples of currencies that have weakened due to trade wars, citing specific examples and dates].

- Data Points: [Insert data points: Charts or graphs illustrating currency fluctuations against the US dollar and their correlation with gold price movements, citing reputable sources like the World Bank or IMF].

This currency weakness makes gold, typically priced in US dollars, a more attractive investment for international investors seeking to hedge against currency risk.

Safe Haven Asset Demand

Gold's historical performance during times of crisis solidifies its reputation as a safe haven asset. Unlike stocks or bonds, which can be heavily impacted by market downturns, gold tends to hold or even increase its value during periods of economic and geopolitical instability.

- Historical Performance: [Insert bullet points: Examples of gold's performance during past economic crises, including specific dates and percentage changes, citing reputable sources].

- Data Points: [Insert data points: Comparative performance charts of gold versus other assets (like stocks and bonds) during periods of uncertainty, citing reputable sources].

Investor Sentiment and Gold Demand

The soaring price of gold is not just a reaction to global trade wars; it's also driven by a shift in investor sentiment and a significant increase in demand.

Flight to Safety

When economic uncertainty reigns, investors often engage in a "flight to safety," moving their capital into assets perceived as less risky. Gold, with its long history as a store of value, becomes a prime beneficiary of this behavior.

- Investor Behavior: [Insert bullet points: Examples of investor behavior during past trade conflicts, highlighting shifts toward gold investments, citing news articles or research reports].

- Data Points: [Insert data points: Statistics on increased gold investment during periods of uncertainty, citing data from reputable sources like the World Gold Council].

This flight to safety significantly boosts demand for gold, pushing prices higher.

Central Bank Purchases

Central banks play a crucial role in influencing gold prices through their buying and selling activities. Many central banks hold significant gold reserves as part of their foreign exchange reserves. Increased purchases by these institutions can directly impact market prices.

- Examples: [Insert bullet points: Examples of significant central bank gold purchases in recent years, citing news reports or official statements].

- Data Points: [Insert data points: Charts showing central bank gold holdings over time, illustrating trends and increases in purchases, citing sources like the World Gold Council].

These strategic purchases often signal confidence in gold as a reliable asset, further fueling demand.

Inflationary Pressures

Trade wars can contribute to inflationary pressures. Tariffs increase the cost of imported goods, and disrupted supply chains lead to shortages and higher prices. Gold, historically viewed as an inflation hedge, becomes even more attractive in such environments.

- Inflationary Mechanisms: [Insert bullet points: Explanation of how tariffs and supply chain disruptions fuel inflation].

- Data Points: [Insert data points: Inflation statistics correlated with trade war events, citing reputable sources like national statistics offices or the IMF].

The Bullion Market's Response to Gold Soaring

The bullion market is directly affected by the surge in gold prices. The increased demand and price volatility are reshaping the market landscape.

Price Fluctuations

Gold prices have experienced significant increases directly correlated with major trade war developments.

- Price Increases: [Insert bullet points: Significant price increases and their timing related to specific trade events, citing specific gold price data sources].

- Data Points: [Insert data points: Gold price charts showcasing recent trends, clearly illustrating the correlation between trade events and price changes, citing reliable sources like Bloomberg or Kitco].

These price swings highlight the sensitivity of the bullion market to geopolitical and economic events.

Increased Trading Volume

The increased investor interest in gold translates to higher trading volumes in the bullion market. More investors are buying and selling gold, leading to increased market activity.

- Trading Activity: [Insert bullet points: Examples of increased trading activity in the gold market, citing news articles or reports from financial institutions].

- Data Points: [Insert data points: Trading volume statistics for the gold market, illustrating the recent surge in activity, citing reliable sources].

This increased activity further contributes to price volatility and market dynamism.

Impact on Gold Mining Companies

Soaring gold prices directly benefit gold mining companies, boosting their profitability and stock performance. Higher gold prices mean higher revenues and profits for these companies.

- Benefiting Companies: [Insert bullet points: Examples of mining companies benefiting from higher gold prices, citing specific examples and their stock performance, citing reliable financial news sources].

- Data Points: [Insert data points: Stock price performance charts of major gold mining companies, showing the positive correlation with gold prices].

Conclusion

Why is gold soaring? The answer is multifaceted, but the link between escalating global trade wars, resulting economic uncertainty, and the subsequent surge in demand for gold as a safe haven asset is undeniable. Investors are seeking protection against market volatility, currency fluctuations, and inflationary pressures, driving gold prices to record highs. Key takeaways include the undeniable impact of trade wars on market volatility, the consequent investor "flight to safety," and the resulting surge in gold demand. Understanding why gold is soaring is crucial for informed investment decisions. Stay informed about global trade developments and consider diversifying your portfolio with gold to mitigate risks. Learn more about gold investment strategies today!

Featured Posts

-

Trumps Tariffs Ceo Concerns And Consumer Impact

Apr 26, 2025

Trumps Tariffs Ceo Concerns And Consumer Impact

Apr 26, 2025 -

Point72s Focused Emerging Market Fund Closes Traders Exit

Apr 26, 2025

Point72s Focused Emerging Market Fund Closes Traders Exit

Apr 26, 2025 -

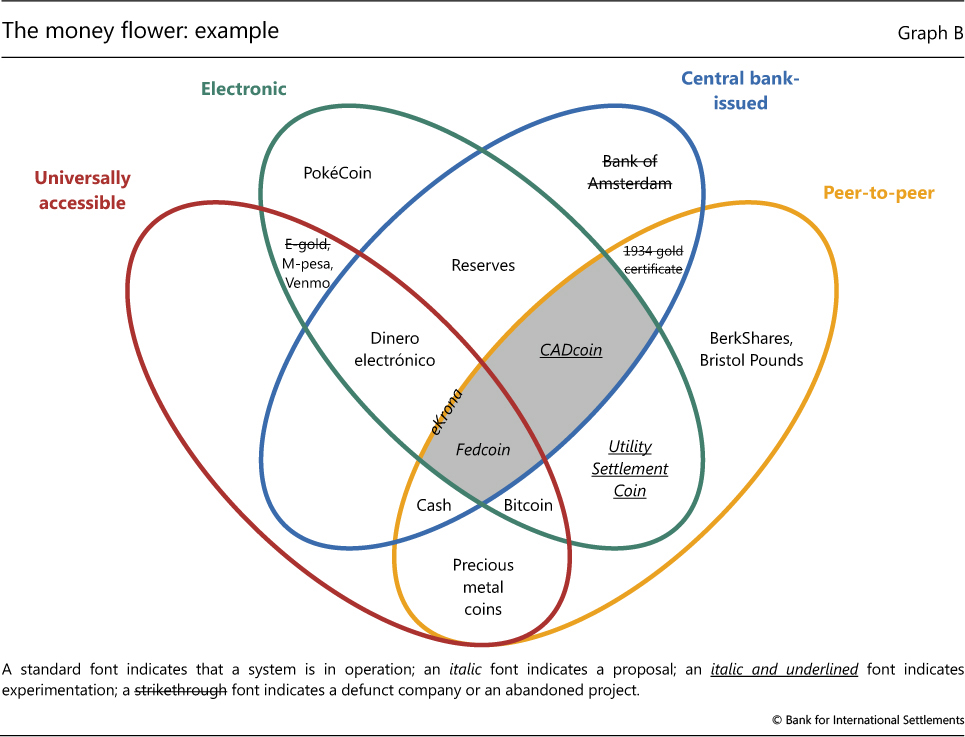

Chinese Car Exports Impact On The Global Automotive Landscape

Apr 26, 2025

Chinese Car Exports Impact On The Global Automotive Landscape

Apr 26, 2025 -

Florida A Cnn Anchors Favorite Vacation Spot

Apr 26, 2025

Florida A Cnn Anchors Favorite Vacation Spot

Apr 26, 2025 -

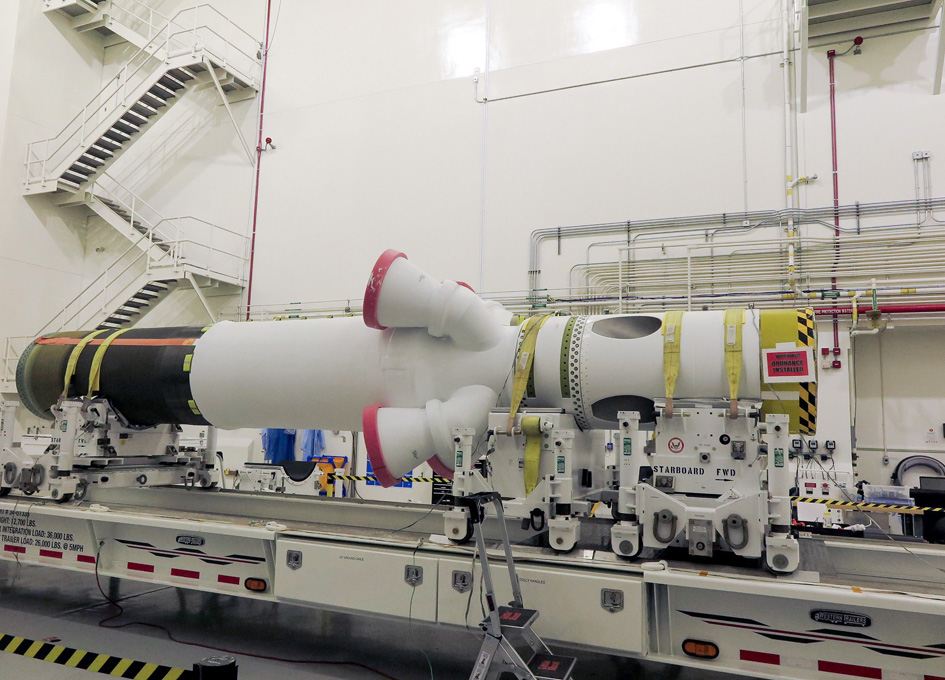

Blue Origins Launch Abort Details On The Subsystem Failure

Apr 26, 2025

Blue Origins Launch Abort Details On The Subsystem Failure

Apr 26, 2025

Latest Posts

-

Charleston Open Pegulas Dramatic Victory Against Collins

Apr 27, 2025

Charleston Open Pegulas Dramatic Victory Against Collins

Apr 27, 2025 -

Us Open 2024 Svitolinas Impressive First Round Win

Apr 27, 2025

Us Open 2024 Svitolinas Impressive First Round Win

Apr 27, 2025 -

Former Dubai Champ Svitolinas Strong Us Open Start

Apr 27, 2025

Former Dubai Champ Svitolinas Strong Us Open Start

Apr 27, 2025 -

Pegulas Charleston Open Comeback Stunning Victory Over Collins

Apr 27, 2025

Pegulas Charleston Open Comeback Stunning Victory Over Collins

Apr 27, 2025 -

Wta Tennis Final Matches Set In Austria And Singapore

Apr 27, 2025

Wta Tennis Final Matches Set In Austria And Singapore

Apr 27, 2025