Goldman Sachs Compensation Controversy: The Role Of The CEO's Background

Table of Contents

David Solomon's Background and its Impact on Compensation Philosophy

Solomon's Career Trajectory

David Solomon's path to becoming CEO of Goldman Sachs provides valuable insight into his management style and views on compensation. His career, marked by success in investment banking and a notable parallel career as a DJ, has undeniably shaped his leadership approach. This unique background, while showcasing entrepreneurial spirit and diversification, has also been subject to criticism, especially regarding its perceived impact on his priorities within the firm. His experience in investment banking, while equipping him with traditional financial expertise, might have also fostered a mindset focused on short-term gains and performance-based rewards.

Compensation Structure under Solomon

Under Solomon's leadership, Goldman Sachs' compensation structure has faced significant criticism for its perceived lack of fairness. High fixed salaries, combined with substantial bonuses heavily reliant on short-term performance metrics, have drawn considerable negative attention. This structure, critics argue, prioritizes immediate profits over long-term strategic growth and potentially encourages excessive risk-taking.

- Specific examples of controversial compensation packages: Several instances have surfaced where particularly high bonuses were awarded despite questionable performance or even significant losses in specific business units. These cases have fuelled the ongoing Goldman Sachs Compensation Controversy.

- Comparison to compensation structures at competing firms: A comparison with compensation structures at peer investment banks reveals that Goldman Sachs’ executive pay often surpasses that of competitors, further escalating the controversy.

- Statistics illustrating the disparity between executive and employee compensation: Data highlighting the vast gap between executive compensation and that of average Goldman Sachs employees underscores the fairness concerns at the heart of this debate.

Historical Context: Comparing CEO Backgrounds and Compensation Practices

Lloyd Blankfein Era

Comparing Solomon's approach to that of his predecessor, Lloyd Blankfein, provides further context. Blankfein, a veteran of the investment banking world, fostered a more traditional approach to compensation, although it still faced its share of criticism. Analyzing the differences in compensation philosophy and outcomes between the Blankfein and Solomon eras allows for a clearer understanding of the evolving dynamics of the Goldman Sachs Compensation Controversy.

The Impact of Leadership Style

Different leadership styles directly influence compensation decisions and priorities. Blankfein's tenure, characterized by a more traditional investment banking focus, likely shaped a different compensation approach than Solomon’s, which incorporates a broader vision encompassing areas beyond core investment banking. This shift in leadership style might explain some of the perceived changes in compensation strategy.

- Key differences in compensation strategies under different CEOs: A detailed comparison reveals shifts in the weighting of long-term versus short-term incentives, bonus structures, and the overall philosophy towards executive reward.

- Long-term versus short-term performance incentives under different leaders: Analyzing the emphasis placed on long-term versus short-term performance under each CEO highlights contrasting managerial philosophies and their implications for overall compensation strategy.

- Impact of regulatory changes on compensation practices: Changes in regulatory environment and associated compliance costs have also affected compensation strategies throughout the years.

The Role of Corporate Governance in Addressing the Controversy

The Board of Directors and Compensation Committees

The board of directors and its compensation committees play a crucial role in setting compensation levels. However, potential conflicts of interest can arise, leading to concerns about the objectivity of their decisions. Greater transparency and stricter guidelines are essential in addressing these concerns and mitigating the Goldman Sachs Compensation Controversy.

Shareholder Activism and its Influence

Shareholder activism has emerged as a powerful tool in influencing Goldman Sachs’ compensation policies. Pressure from shareholders demanding greater fairness and accountability has forced the company to address some of the criticisms. This highlights the importance of shareholder engagement in corporate governance.

- Specific examples of shareholder proposals related to executive compensation: Several shareholder proposals have directly challenged the existing compensation structure, advocating for greater alignment of executive pay with long-term company performance.

- Analysis of the board's response to shareholder concerns: Examining the board's response to these proposals reveals the extent to which shareholder pressure has influenced compensation policies.

- Discussion of any changes made to compensation policies in response to criticism: While some adjustments have been made, significant systemic changes are still required to fully address the underlying concerns.

The Public Perception and its Consequences

Media Coverage and Public Opinion

Extensive media coverage has fueled public outrage regarding Goldman Sachs' compensation practices. Negative media portrayals have significantly impacted the company's reputation and brand image, highlighting the substantial consequences of the Goldman Sachs Compensation Controversy.

Potential Impact on Employee Morale and Retention

The ongoing compensation controversy has the potential to negatively impact employee morale and retention. A perception of unfairness within the compensation system can demoralize employees and lead to difficulties in attracting and retaining top talent.

- Examples of media coverage highlighting the controversy: Numerous articles and reports have detailed the outrage over executive pay at Goldman Sachs, illustrating the extent of public concern.

- Analysis of social media sentiment surrounding Goldman Sachs compensation: Social media sentiment analysis reveals overwhelmingly negative public opinion regarding the company's executive compensation practices.

- Potential impact on recruiting and retaining top talent: The negative publicity associated with the controversy could hinder Goldman Sachs' ability to attract and retain high-performing employees.

Conclusion: Understanding the Goldman Sachs Compensation Controversy

The Goldman Sachs Compensation Controversy is a multifaceted issue deeply intertwined with the CEO's background, compensation philosophy, and corporate governance practices. David Solomon's unique career trajectory, combined with the current compensation structure at Goldman Sachs, has contributed significantly to the ongoing debate. Addressing these concerns requires increased transparency, greater accountability from the board of directors, and a more robust system of corporate governance that prioritizes fairness and long-term sustainable growth over short-term gains. The public perception and potential impact on employee morale further underscore the urgency of addressing this issue. We encourage readers to delve deeper into the specific details of the compensation packages awarded at Goldman Sachs and investigate similar controversies within other financial institutions to gain a broader understanding of this crucial issue and its implications for corporate governance and executive compensation.

Featured Posts

-

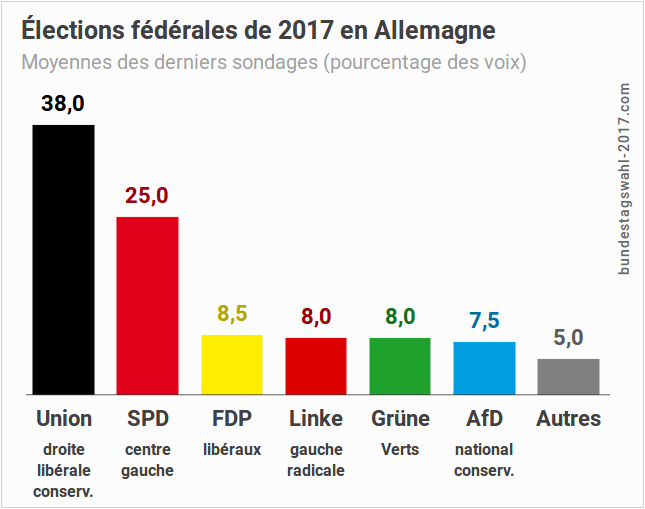

Elections Legislatives Allemandes Decryptage A J 6

Apr 23, 2025

Elections Legislatives Allemandes Decryptage A J 6

Apr 23, 2025 -

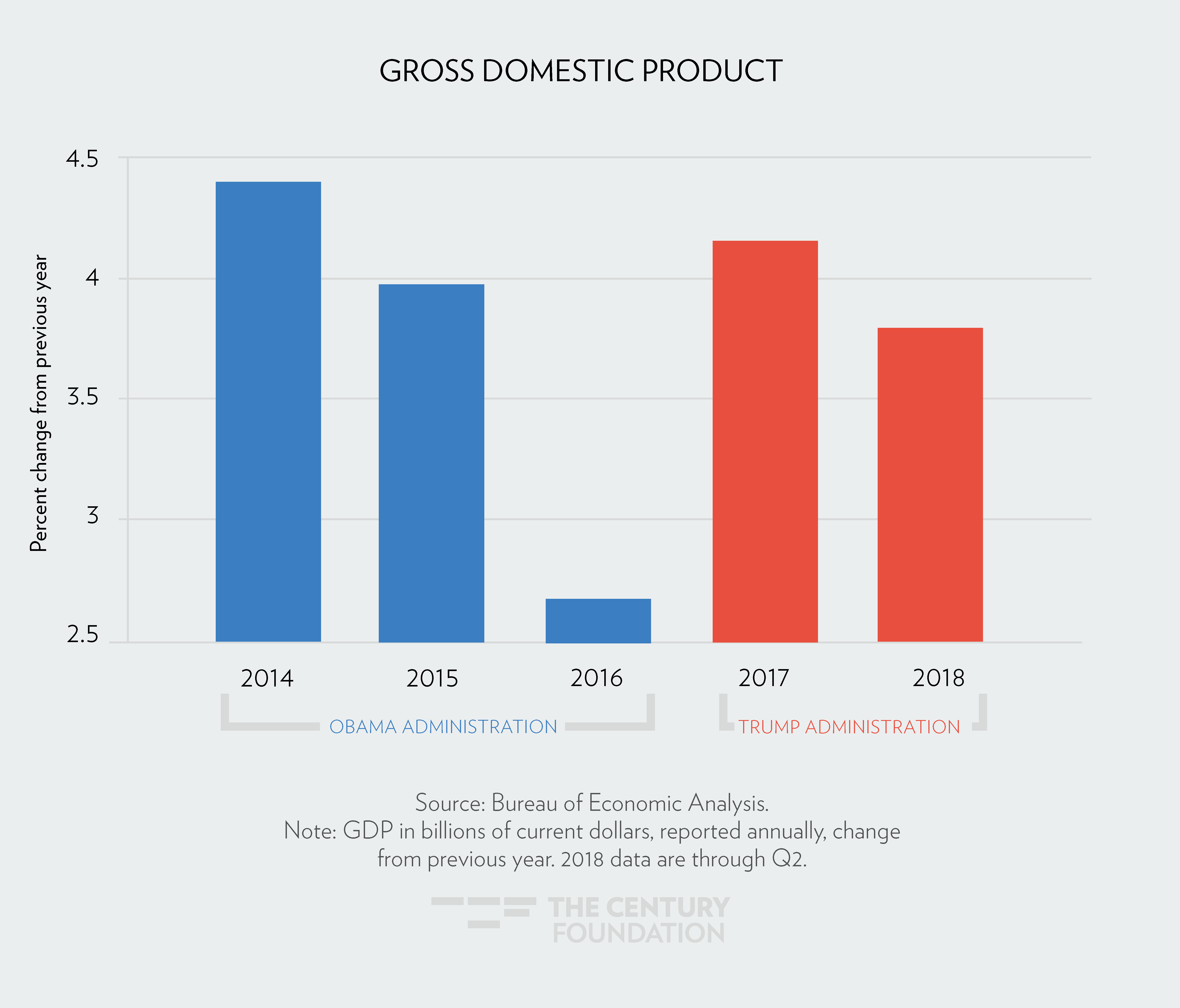

Economic Data Under Trump A Comprehensive Review

Apr 23, 2025

Economic Data Under Trump A Comprehensive Review

Apr 23, 2025 -

Cincinnati Reds Tie All Time Mlb Record In Another Close Loss

Apr 23, 2025

Cincinnati Reds Tie All Time Mlb Record In Another Close Loss

Apr 23, 2025 -

Burky Guia A Rayadas A La Victoria Con Dos Goles

Apr 23, 2025

Burky Guia A Rayadas A La Victoria Con Dos Goles

Apr 23, 2025 -

2 Brewers Players We Ll Miss In 2024 2 We Wont

Apr 23, 2025

2 Brewers Players We Ll Miss In 2024 2 We Wont

Apr 23, 2025