Economic Data Under Trump: A Comprehensive Review

Table of Contents

GDP Growth and Economic Expansion Under Trump

Annual GDP Growth Rates

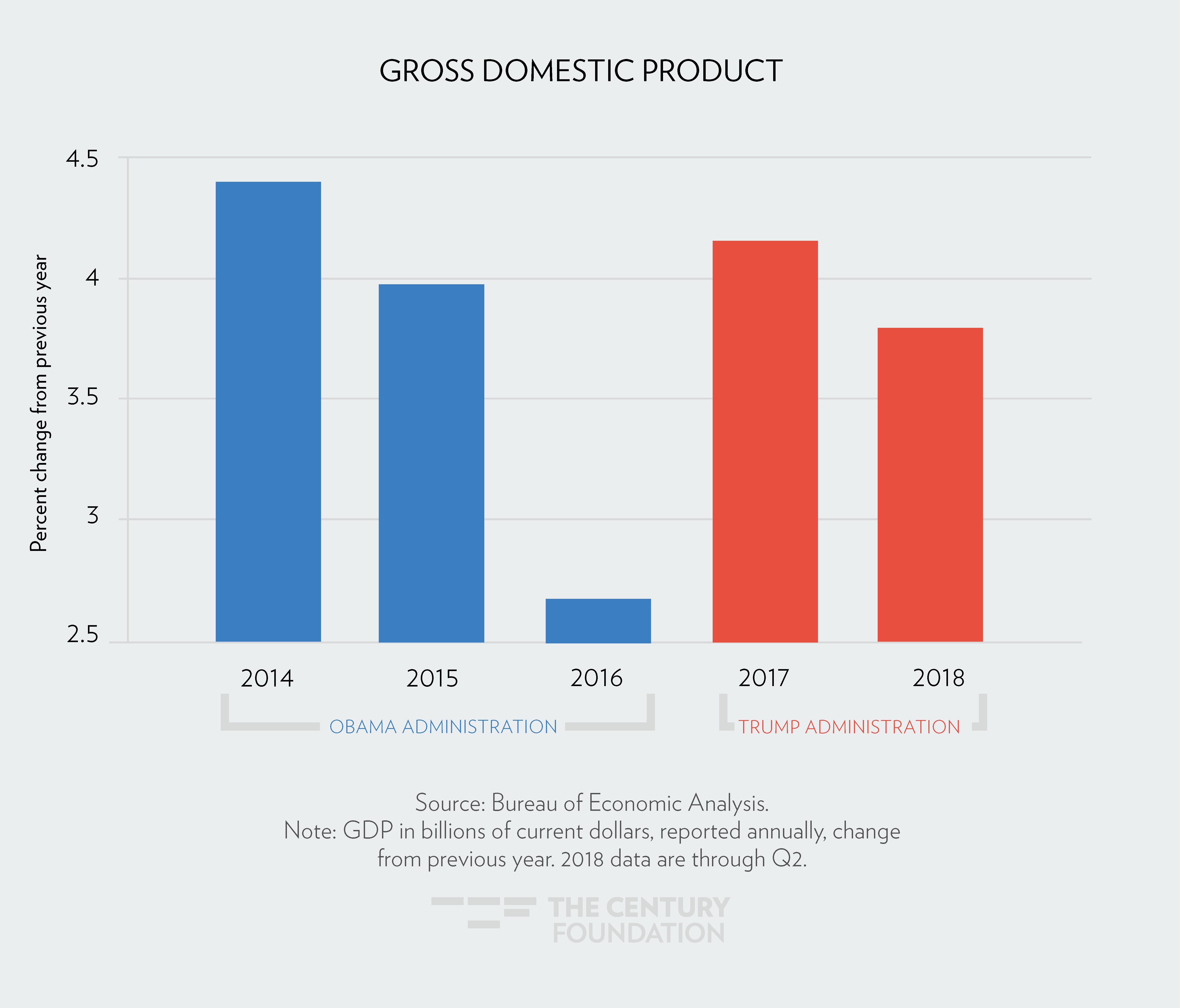

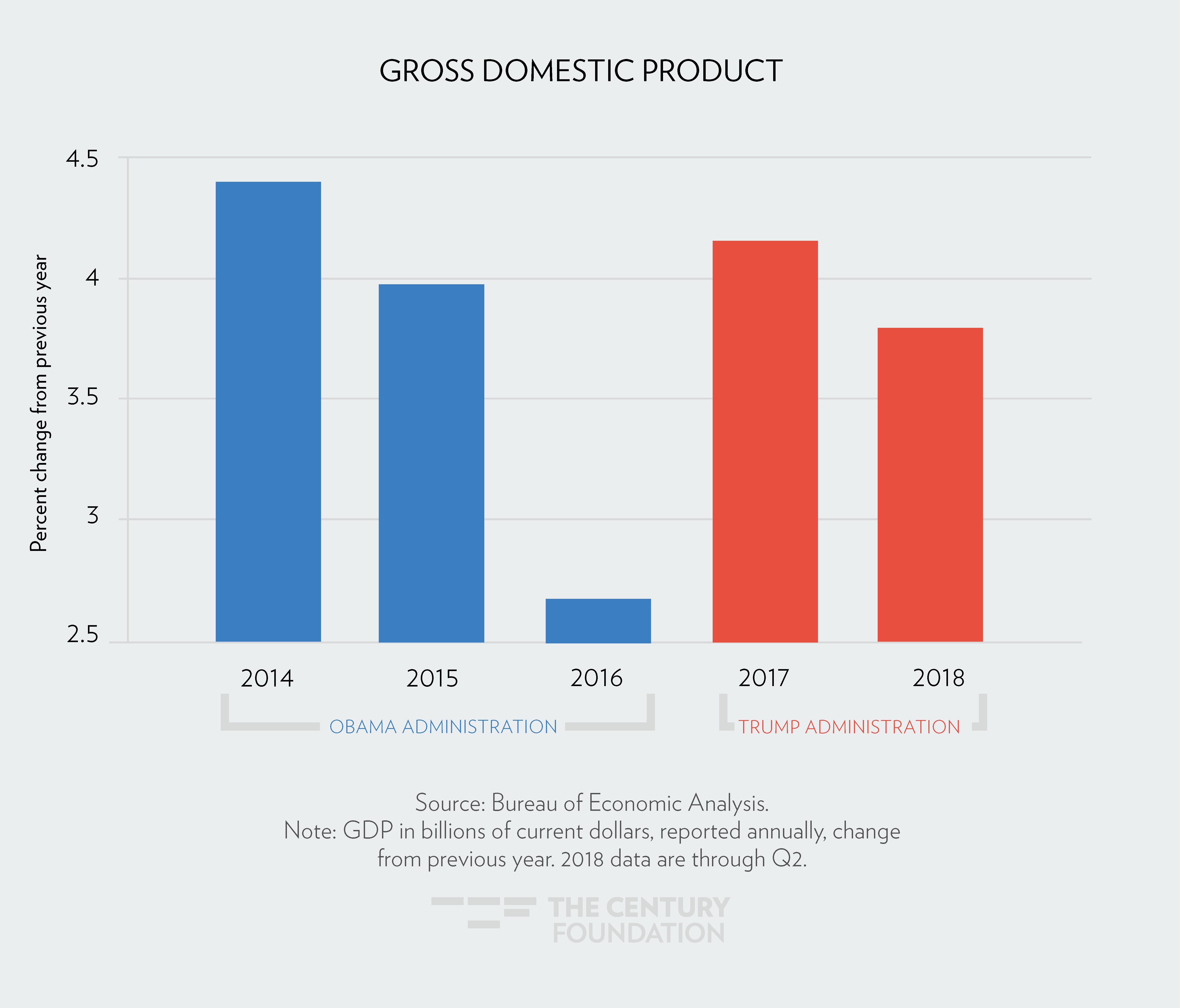

Analyzing the annual GDP growth rates during the Trump administration offers a crucial starting point for understanding its economic impact. While the economy experienced periods of robust growth, it's essential to compare these figures to previous administrations to establish a proper context.

- 2017: GDP growth registered a healthy increase, boosted by the passage of the Tax Cuts and Jobs Act.

- 2018: Growth continued, though at a slightly slower pace.

- 2019: Growth began to moderate.

- 2020: The COVID-19 pandemic triggered a sharp decline, the most significant drop since the Great Depression.

- 2021: A rebound occurred, partially driven by government stimulus measures.

The Bureau of Economic Analysis (BEA) provides the official GDP data. Comparing these figures to the Obama administration's GDP growth reveals a mixed picture. While Trump's early years saw strong growth, this was followed by a period of slower expansion, culminating in the COVID-19 recession. The impact of the 2017 tax cuts on this growth trajectory remains a subject of ongoing debate among economists.

Impact of Tax Cuts and Jobs Act

The Tax Cuts and Jobs Act of 2017, a cornerstone of Trump's economic policy, significantly lowered corporate and individual income tax rates. Proponents argued this would stimulate investment, job creation, and economic growth.

- Short-Term Impacts: The tax cuts initially led to a surge in corporate profits and a temporary boost in business investment.

- Long-Term Impacts: The long-term effects remain a subject of ongoing debate. Some studies suggest the tax cuts did not generate the projected economic growth, while others highlight potential benefits like increased business investment.

- Criticisms: Critics point to the increased national debt as a major consequence and argue the benefits were disproportionately skewed towards higher-income earners, exacerbating income inequality.

Analyzing the economic data surrounding the Tax Cuts and Jobs Act requires considering both the intended and unintended consequences, alongside varying economic perspectives.

Job Market Performance During the Trump Presidency

Job Creation and Unemployment Rates

Examining job creation numbers and unemployment rates under Trump offers insights into the health of the labor market. The Bureau of Labor Statistics (BLS) provides comprehensive data on these critical indicators.

- Unemployment Rates: Unemployment rates generally declined during Trump's presidency, reaching a 50-year low before the pandemic.

- Job Creation: Significant job creation occurred across various sectors, particularly in the service industry.

- Sectoral Variations: While some sectors thrived, others faced challenges due to automation and global trade dynamics.

Comparing these figures with previous administrations reveals periods of both strong and weak job growth. The pandemic severely impacted job numbers, but a subsequent recovery ensued.

Wage Growth and Income Inequality

While job creation was a positive aspect, examining wage growth and income inequality provides a more nuanced picture of the economic benefits' distribution.

- Wage Growth: Wage growth was moderate during most of the Trump administration, lagging behind productivity growth in some periods.

- Income Inequality: Studies suggest that income inequality may have widened during this time, with the benefits of economic growth disproportionately accruing to higher-income earners.

- Tax Cuts Impact: The tax cuts' impact on different income brackets played a significant role in this trend.

Understanding the dynamics of wage growth and income inequality is vital for assessing the overall effectiveness of the Trump administration's economic policies.

Trade Policies and Their Economic Consequences

Impact of Tariffs and Trade Wars

Trump's administration pursued protectionist trade policies, imposing tariffs on goods from China and other countries. These actions triggered trade wars, significantly impacting businesses, consumers, and global trade.

- Trade Disputes: Major trade disputes arose with China, the European Union, and other nations, resulting in retaliatory tariffs and economic disruptions.

- Impact on Businesses: Many businesses faced increased costs due to tariffs, affecting their competitiveness and profitability.

- Impact on Consumers: Consumers experienced higher prices on imported goods.

Analyzing the economic data related to these trade wars requires careful consideration of both short-term impacts and long-term consequences.

Trade Deficits and the Balance of Payments

Examining trade deficits and the balance of payments offers further insight into the effects of Trump's trade policies.

- Trade Deficits: The US trade deficit with China and other major trading partners remained substantial during this period.

- Balance of Payments: The overall balance of payments was affected by the trade disputes and the resulting fluctuations in capital flows.

The relationship between trade policies and these macroeconomic indicators requires thorough analysis to understand the long-term economic implications.

Government Spending and the National Debt

Government Spending Under Trump

Analyzing government spending levels during the Trump administration provides a crucial perspective on fiscal policy.

- Spending Levels: Government spending increased during this period, driven partly by increased military spending and tax cuts.

- Sectoral Breakdown: Significant increases were seen in defense spending, while other sectors experienced varied levels of change.

Comparing these levels to previous administrations highlights the shifts in government priorities and spending patterns.

National Debt and Deficit Trends

The impact of increased government spending on the national debt and deficit is a crucial aspect of evaluating the Trump administration's economic performance.

- National Debt Growth: The national debt grew significantly during this period.

- Factors Contributing to Debt Growth: Factors such as tax cuts, increased spending, and the economic slowdown caused by the pandemic all contributed to the rising debt levels.

- Long-Term Sustainability: The long-term sustainability of the national debt is a pressing concern, with implications for future economic stability.

Conclusion

Analyzing the "Economic Data Under Trump" reveals a complex picture. While periods of strong GDP growth and job creation occurred, other trends, such as rising national debt and income inequality, present a more nuanced perspective. The impact of the Tax Cuts and Jobs Act, trade wars, and the COVID-19 pandemic all significantly shaped economic performance. Understanding the multifaceted nature of these economic indicators requires deep dives into specific data sets and critical evaluation of various economic models and perspectives. To further your understanding of the complexities of "Economic Data Under Trump," explore resources from the BEA, BLS, Congressional Budget Office, and independent economic research organizations. A thorough understanding of this period is vital to informing future economic policy debates.

Featured Posts

-

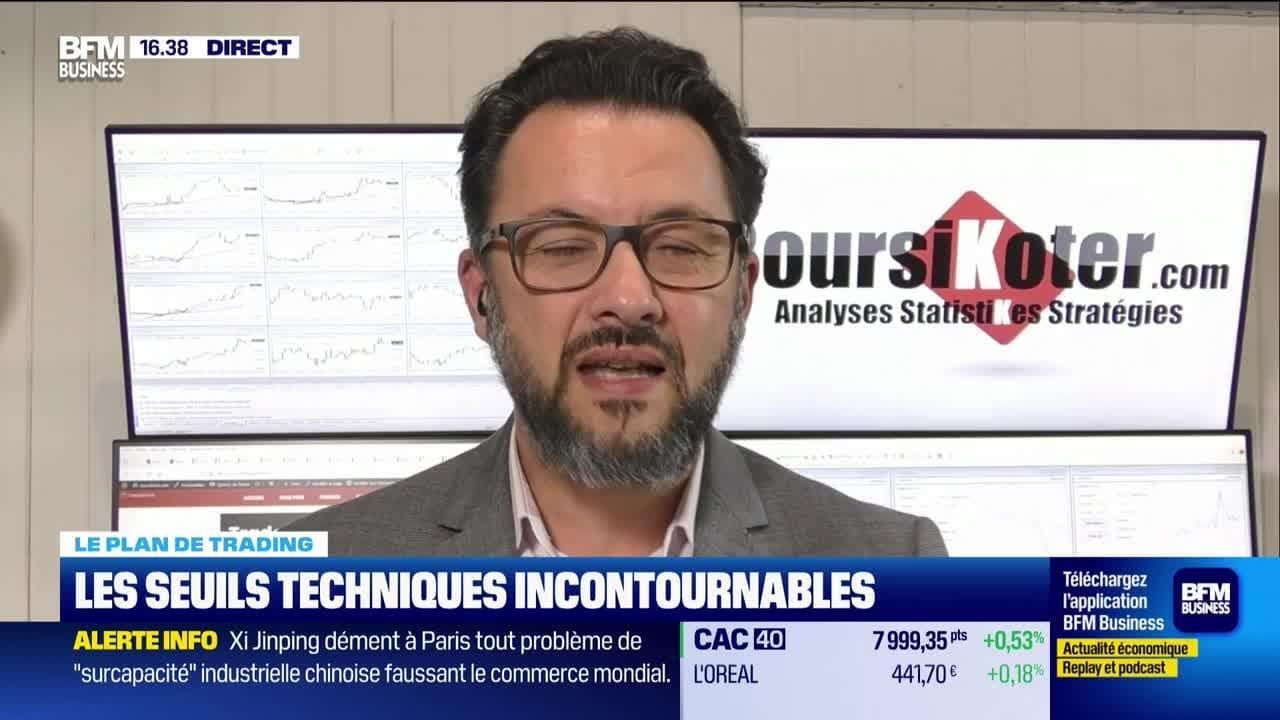

Alerte Trader Maitriser Les Seuils Techniques Pour Le Trading

Apr 23, 2025

Alerte Trader Maitriser Les Seuils Techniques Pour Le Trading

Apr 23, 2025 -

Komoly Forgalmi Problemak Az M3 Ason Tervezett Korlatozasok

Apr 23, 2025

Komoly Forgalmi Problemak Az M3 Ason Tervezett Korlatozasok

Apr 23, 2025 -

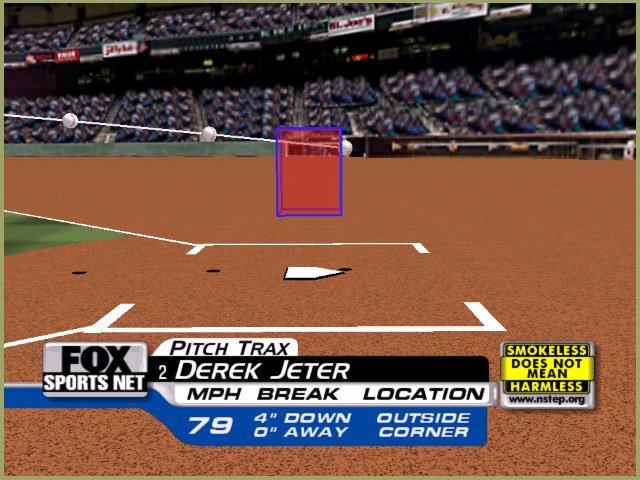

Tigers Manager Challenges Plate Umpires Call Mlb Review Requested

Apr 23, 2025

Tigers Manager Challenges Plate Umpires Call Mlb Review Requested

Apr 23, 2025 -

Reds Historic Losing Streak A 1 0 Loss Sets A Peculiar Mlb Mark

Apr 23, 2025

Reds Historic Losing Streak A 1 0 Loss Sets A Peculiar Mlb Mark

Apr 23, 2025 -

Mlb Power Rankings Fan Graphss Assessment March 27th April 6th

Apr 23, 2025

Mlb Power Rankings Fan Graphss Assessment March 27th April 6th

Apr 23, 2025