Goldman Sachs CEO Pay: Banker Or Private Equity Titan?

Table of Contents

David Solomon's Compensation Package: A Deep Dive

Base Salary vs. Bonuses

David Solomon's compensation is a complex structure encompassing a base salary and significant performance-based bonuses. His base salary, while substantial, constitutes only a fraction of his total compensation.

- Base Salary: While the exact figure fluctuates slightly year to year, his base salary typically falls within the range of several million dollars, placing it at the higher end of CEO base salaries for major financial institutions. This is in line with industry averages for CEOs of comparable firms.

- Bonus Structure: The majority of Solomon's compensation comes from performance-based bonuses, heavily reliant on Goldman Sachs' annual performance. These bonuses are linked to various metrics, including revenue generation, profitability, and stock price performance.

- Stock Options and Restricted Stock Units (RSUs): A significant portion of his compensation is tied to stock options and RSUs, incentivizing him to boost Goldman Sachs' stock price. These awards vest over time, further aligning his interests with those of shareholders. The value of these options and RSUs is directly affected by Goldman Sachs' market capitalization.

Keywords: Base salary, bonus structure, performance-based compensation, stock options, restricted stock units, executive compensation, Goldman Sachs CEO salary.

The Impact of Goldman Sachs' Performance

Goldman Sachs' yearly performance – its revenue, profits, and stock price – directly impacts David Solomon's total compensation. This strong correlation is a common feature of executive compensation packages in the financial industry.

- Correlation between Success and Compensation: In years where Goldman Sachs experiences significant growth and profitability, Solomon's compensation reflects this success. Conversely, years of lower performance result in a commensurate reduction in his bonus.

- Rationale Behind Linking Pay to Performance: This structure is intended to align the CEO's interests with those of shareholders. The belief is that incentivizing the CEO through performance-based bonuses will drive him to prioritize strategies that maximize shareholder value.

- Criticisms of the System: This system, however, has drawn criticism. Some argue that it can lead to excessive risk-taking if the short-term focus on maximizing profits outweighs long-term sustainability. Others argue that such compensation packages are excessive, regardless of performance.

Keywords: Firm performance, revenue, profit, stock price, executive pay, performance-based incentives, shareholder value, Goldman Sachs CEO pay.

Comparison to Peers

Comparing David Solomon's compensation to CEOs at other major investment banks and private equity firms provides further context.

- Comparative Table: (Note: A table would be inserted here comparing Solomon's total compensation to CEOs at JPMorgan Chase, Morgan Stanley, and other relevant firms. Data would need to be sourced from public financial filings.)

- Analysis of Differences: Differences in compensation packages often reflect variations in firm size, performance, and strategic focus. The significant influence of private equity within Solomon’s compensation package, for example, distinguishes it from some of his peers.

Keywords: CEO compensation comparison, peer comparison, investment banking, private equity, JPMorgan Chase CEO, Morgan Stanley CEO, competitor analysis, Wall Street compensation.

The Private Equity Influence on Goldman Sachs' Strategy and CEO Pay

Solomon's Background and Private Equity Ties

David Solomon's background and experience significantly influence his compensation structure.

- Career Trajectory: Before becoming CEO, Solomon headed Goldman Sachs' investment banking division and had considerable experience in the music industry. This diverse background provides a broader perspective.

- Private Equity Involvement: While not directly involved in a private equity firm, Solomon's leadership has overseen the expansion of Goldman Sachs' presence within the private equity space. This focus has implications for the overall compensation structure. This focus on private equity, with its typically higher return potential, could justify a higher pay level than a traditional investment banker might receive.

Keywords: David Solomon background, private equity experience, investment banking, strategic direction, Goldman Sachs strategy, leadership style.

The Growing Role of Private Equity within Goldman Sachs

The increasing importance of private equity within Goldman Sachs' business model is reflected in the CEO's compensation.

- Expansion of Private Equity Activities: Goldman Sachs has significantly expanded its private equity investments and activities in recent years. This diversification has become a major contributor to revenue and profitability.

- Influence on CEO Compensation: The success of this private equity division directly impacts Goldman Sachs' overall financial performance and thus, contributes to Solomon's compensation package. The higher earning potential associated with private equity likely justifies a higher level of compensation.

Keywords: Private equity, investment banking, asset management, Goldman Sachs business model, diversification, revenue streams, profit margins.

Conclusion

David Solomon's compensation package at Goldman Sachs is substantial and multifaceted. While his base salary is comparable to industry averages for similar roles, a significant portion of his earnings stems from performance-based bonuses and stock-based compensation, deeply entwined with Goldman Sachs' financial performance and growth in private equity. Comparing his compensation to peers reveals that while similar in some respects to traditional banking CEOs, his compensation more closely aligns with that seen in the high-earning world of private equity, due to both the firm's expanding activities in this area and Solomon's own experience and leadership in this domain. This analysis highlights the complexities of CEO compensation in the financial industry, raising ongoing questions regarding the balance between performance-based incentives, shareholder value, and the overall societal impact of these immense financial rewards. To further understand the implications of Goldman Sachs CEO pay, continued research and open dialogue are crucial. Keep exploring the intricacies of Goldman Sachs CEO pay and its impact on the financial industry.

Featured Posts

-

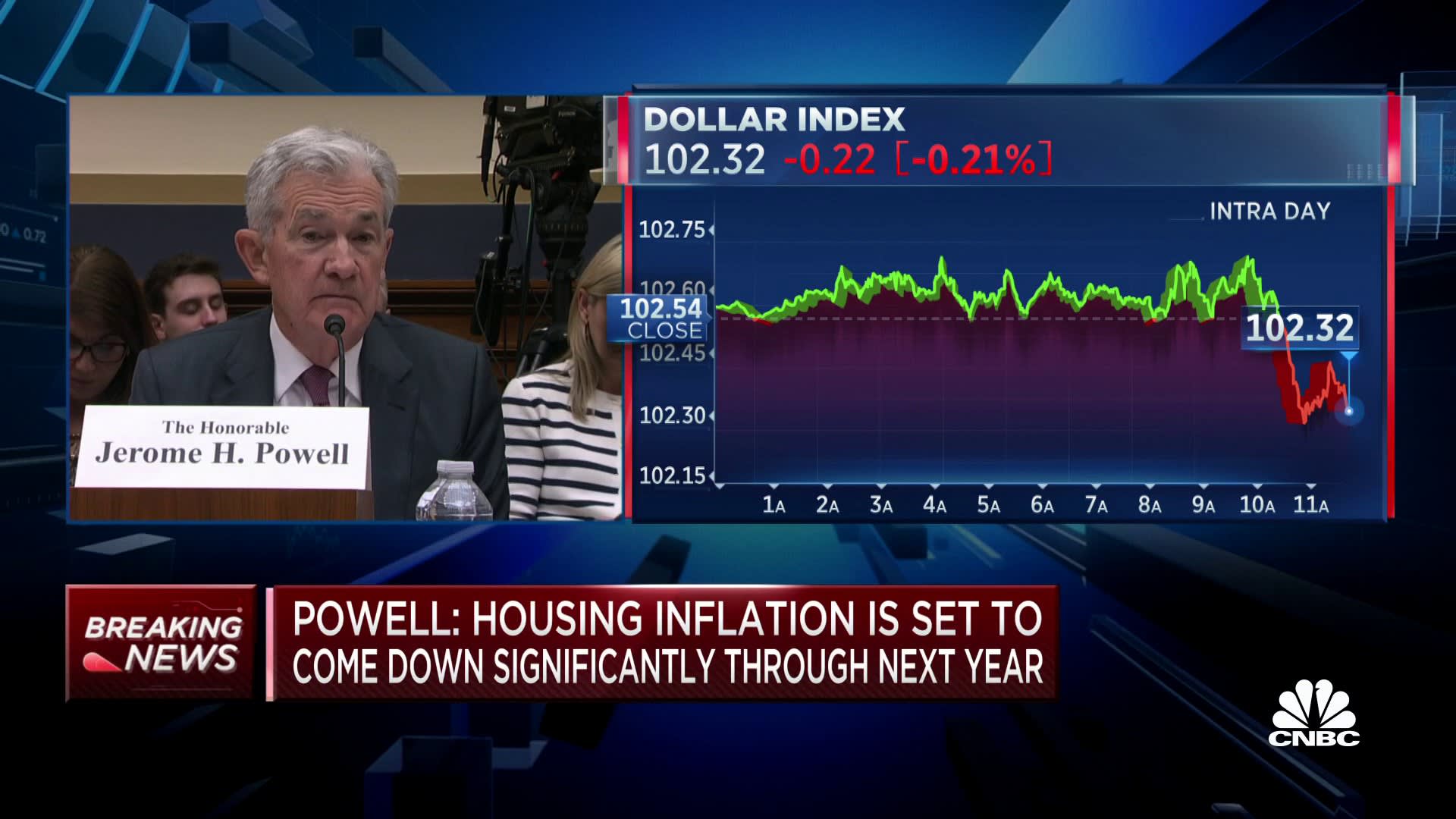

President Trump Renews Criticism Of Fed Chair Jerome Powell

Apr 23, 2025

President Trump Renews Criticism Of Fed Chair Jerome Powell

Apr 23, 2025 -

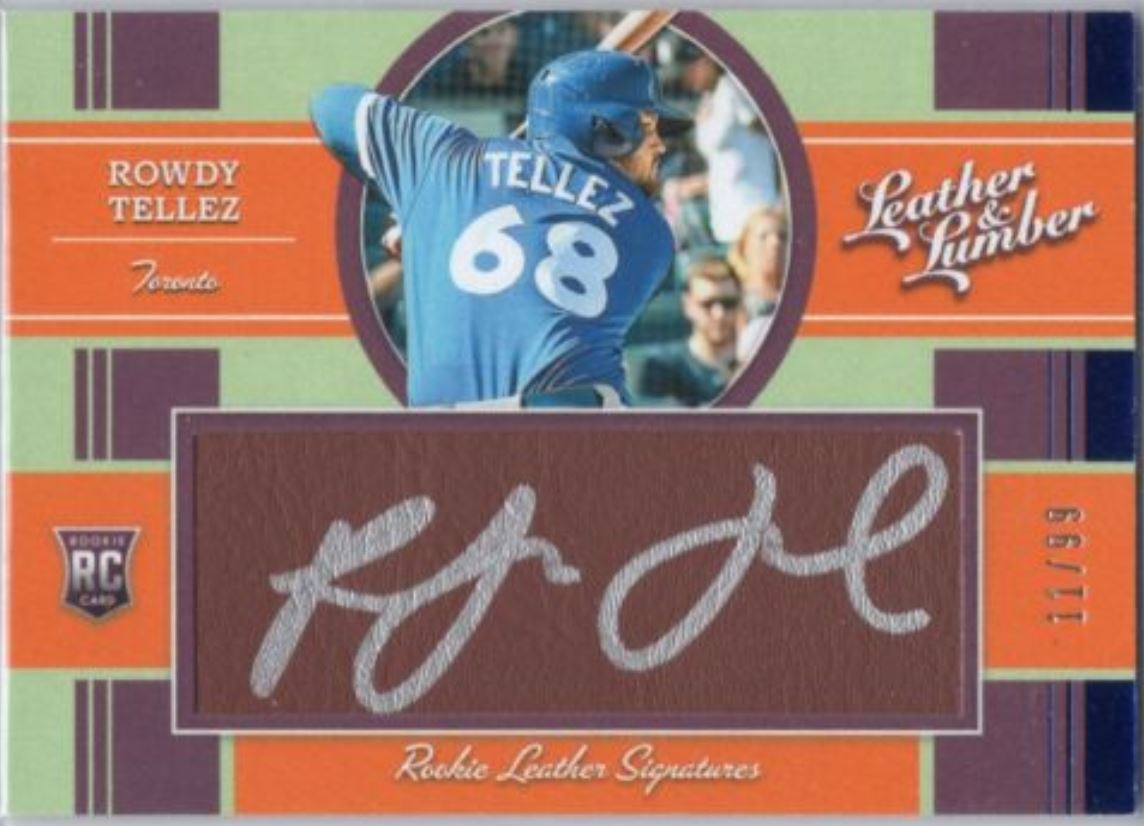

Rowdy Tellez Revenge Watch Him Get Even Against His Former Team

Apr 23, 2025

Rowdy Tellez Revenge Watch Him Get Even Against His Former Team

Apr 23, 2025 -

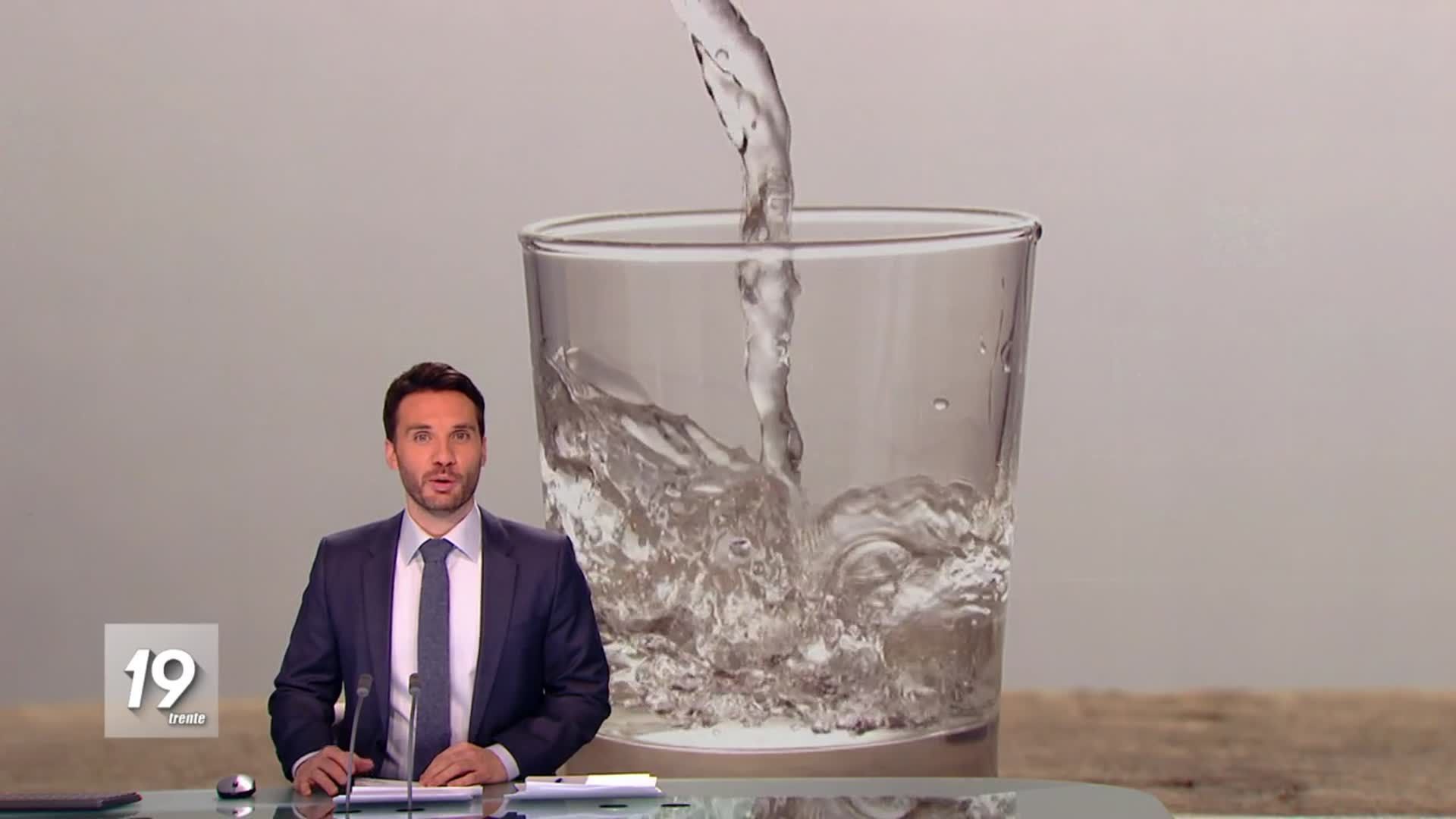

Sans Alcool Dry January Tournee Minerale Et Les Opportunites Economiques

Apr 23, 2025

Sans Alcool Dry January Tournee Minerale Et Les Opportunites Economiques

Apr 23, 2025 -

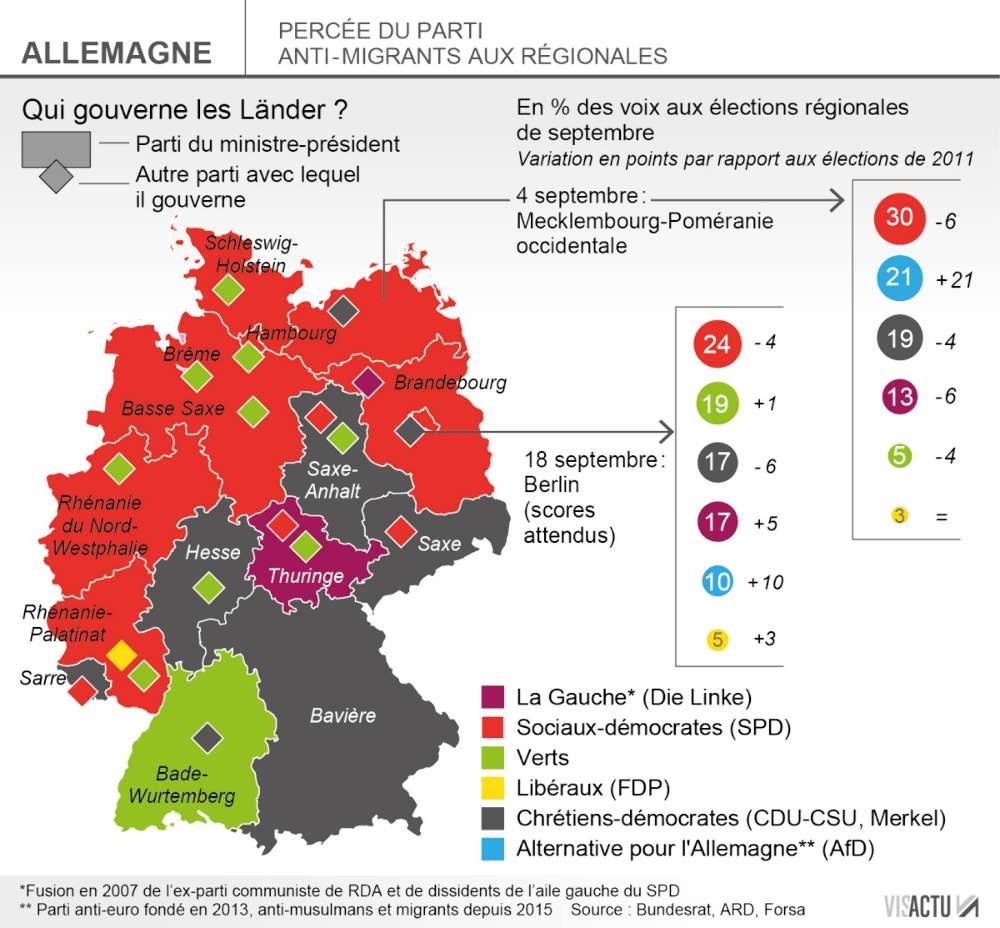

Allemagne Elections Legislatives A J 6 Les Derniers Enjeux

Apr 23, 2025

Allemagne Elections Legislatives A J 6 Les Derniers Enjeux

Apr 23, 2025 -

China Diversifies Oil Imports Canada Benefits From Us China Trade War

Apr 23, 2025

China Diversifies Oil Imports Canada Benefits From Us China Trade War

Apr 23, 2025