Gold (XAUUSD) Price Rebound: Weak US Data Fuels Rate Cut Expectations

Table of Contents

Weak US Economic Data and its Impact on Gold Prices

Weaker-than-anticipated US economic data has played a pivotal role in the recent gold (XAUUSD) price rebound. This data suggests a potential shift in the Federal Reserve's monetary policy stance.

Inflationary Pressures Ease

Recent economic indicators point towards easing inflationary pressures. This could influence the Fed's approach to interest rate hikes.

- CPI figures: The Consumer Price Index (CPI) has shown signs of moderation, indicating a slowdown in inflation.

- PPI figures: Producer Price Index (PPI) data also reflects a cooling trend in inflationary pressures.

- Employment data: While the unemployment rate remains low, there are signs of cooling in the labor market, potentially easing wage pressures that contribute to inflation.

- Impact on market sentiment: This easing of inflation has shifted market sentiment, leading investors to reassess their expectations for future interest rate increases.

Lower inflation reduces the pressure on the Fed to maintain aggressively high interest rates. This potential shift towards a less hawkish monetary policy is a significant factor contributing to the gold price rebound. It's important to remember the inverse relationship between interest rates and gold prices: lower interest rates generally support higher gold prices.

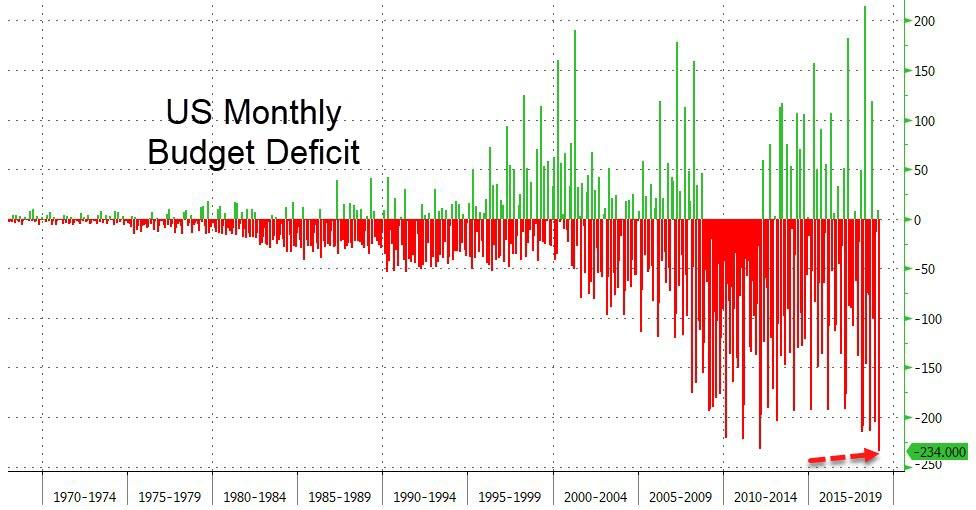

Recessionary Fears

Alongside easing inflation, concerns about slowing economic growth and a potential recession are also contributing to the gold price increase.

- GDP growth rates: Recent GDP growth figures have been underwhelming, fueling recessionary fears.

- Consumer confidence indices: Consumer confidence indices have fallen, suggesting a decrease in consumer spending and overall economic optimism.

- Manufacturing data: Weakening manufacturing data points to a slowdown in industrial activity.

- Impact on safe-haven demand for gold: In times of economic uncertainty, investors often flock to gold as a safe-haven asset, driving up demand and consequently, the price.

The perceived safety net that gold offers during economic downturns is a key driver of the current price surge. As investors seek to protect their portfolios from potential losses, they are increasingly turning to gold as a hedge against economic volatility.

Federal Reserve Rate Cut Expectations and Gold's Sensitivity

Market participants are keenly anticipating the Federal Reserve's future interest rate decisions. The expectation of potential rate cuts is significantly impacting the gold (XAUUSD) price.

Market Speculation and Future Fed Moves

The market is buzzing with speculation regarding the Fed's next moves. Analysts are closely scrutinizing every statement from the Federal Reserve for clues about future monetary policy.

- Analysis of Fed statements: Statements from Fed officials are carefully dissected for hints about future rate adjustments.

- Predictions from financial analysts: Financial analysts are offering varied predictions about the likelihood and timing of rate cuts.

- Impact of potential rate cuts on the US dollar: Rate cuts would likely weaken the US dollar, making gold (priced in dollars) more attractive to international investors.

- Gold's inverse relationship to the dollar: Gold and the US dollar generally share an inverse relationship; a weaker dollar usually supports a higher gold price.

The anticipation of rate cuts is a significant driver of the current gold price rally. A weaker dollar enhances gold's appeal to global investors, further pushing prices upward.

Impact on Gold Investment Strategies

The changing market conditions are influencing diverse investment strategies related to gold.

- Long-term vs. short-term gold investments: Investors are reassessing their long-term and short-term gold investment strategies based on the current market dynamics.

- Hedging strategies: Gold is increasingly utilized as a hedge against inflation and economic uncertainty.

- Diversification strategies: Many investors are incorporating gold into their portfolios to diversify and mitigate risk.

- Potential risks and rewards: Investors must carefully weigh the potential risks and rewards associated with gold investments.

Investors have various options for participating in the gold market, including physical gold, gold ETFs (Exchange Traded Funds), and gold mining stocks. Each option presents a unique set of risks and rewards.

Technical Analysis of the Gold (XAUUSD) Price Rebound

Technical analysis provides further insight into the gold (XAUUSD) price rebound. Examining chart patterns and technical indicators can help in predicting future price movements. (Note: Charts would be included here in an actual published article)

Chart Patterns and Support Levels

Analysis of the gold price chart reveals key support and resistance levels.

- Support and resistance levels: Identifying these levels helps in determining potential price reversals or breakouts.

- Moving averages: Moving averages provide insights into the trend direction.

- RSI (Relative Strength Index): RSI helps gauge the momentum and potential overbought or oversold conditions.

- MACD (Moving Average Convergence Divergence): MACD identifies potential buy or sell signals based on momentum changes.

- Potential price targets: Based on technical analysis, potential price targets can be projected.

Trading Strategies Based on Technical Indicators

Technical indicators can inform trading strategies, but risk management remains crucial.

- Buy signals: Technical indicators can signal potential buy opportunities.

- Sell signals: Similarly, indicators can signal potential sell opportunities.

- Stop-loss orders: Stop-loss orders help limit potential losses.

- Take-profit orders: Take-profit orders help lock in profits.

- Risk-reward ratios: A proper risk-reward ratio should be maintained in any trading strategy.

It is crucial to remember that this information is for educational purposes only and does not constitute financial advice. Always consult with a qualified financial professional before making any investment decisions.

Conclusion

The recent rebound in the gold (XAUUSD) price is largely driven by weaker-than-expected US economic data and expectations of potential Federal Reserve rate cuts. This makes gold an attractive safe-haven asset and a hedge against inflation and economic uncertainty. Understanding the relationship between US economic indicators, Fed policy, and technical analysis is key to navigating the gold market. Stay informed about the latest developments concerning gold (XAUUSD) price movements to make well-informed decisions. Remember to consult with a qualified financial advisor before making any investment decisions related to the XAUUSD gold price or any other investment.

Featured Posts

-

Analyst Mike Breens Banter With Mikal Bridges The Latest Nba Commentary Snippet

May 17, 2025

Analyst Mike Breens Banter With Mikal Bridges The Latest Nba Commentary Snippet

May 17, 2025 -

Josh Harts Wife Reacts To Jaylen Browns Game 5 Performance

May 17, 2025

Josh Harts Wife Reacts To Jaylen Browns Game 5 Performance

May 17, 2025 -

List Of Celebrities Whose Homes Were Destroyed In The La Palisades Fires

May 17, 2025

List Of Celebrities Whose Homes Were Destroyed In The La Palisades Fires

May 17, 2025 -

Celebrity Misconduct Analyzing Red Carpet Rule Violations

May 17, 2025

Celebrity Misconduct Analyzing Red Carpet Rule Violations

May 17, 2025 -

Ontario Budget 14 6 Billion Deficit Due To Tariffs And Other Factors

May 17, 2025

Ontario Budget 14 6 Billion Deficit Due To Tariffs And Other Factors

May 17, 2025

Latest Posts

-

Breaking Moto News Gncc Mx Sx Flat Track And Enduro Action

May 17, 2025

Breaking Moto News Gncc Mx Sx Flat Track And Enduro Action

May 17, 2025 -

The Josh Cavallo Effect Increased Lgbtq Inclusion In Sport

May 17, 2025

The Josh Cavallo Effect Increased Lgbtq Inclusion In Sport

May 17, 2025 -

Controversial Non Call Crew Chiefs Admission In Pistons Loss To Knicks

May 17, 2025

Controversial Non Call Crew Chiefs Admission In Pistons Loss To Knicks

May 17, 2025 -

Your Daily Dose Of Moto News Gncc Mx Sx Flat Track And Enduro

May 17, 2025

Your Daily Dose Of Moto News Gncc Mx Sx Flat Track And Enduro

May 17, 2025 -

Nba Analyst Perkins Advises Knicks Brunson On Podcast

May 17, 2025

Nba Analyst Perkins Advises Knicks Brunson On Podcast

May 17, 2025