Gold Price Surge: Trump's EU Threats Fuel Trade War Fears

Table of Contents

Trump's Tariffs and Their Impact on Global Markets

President Trump's administration has imposed, and threatened to impose, significant tariffs on various goods imported from the EU. These actions, aimed at addressing perceived trade imbalances, have created a ripple effect throughout global markets. The specific targets of these tariffs have included key industries, triggering concerns about broader economic consequences.

-

Targeted Industries and Economic Consequences: The tariffs have impacted sectors such as steel, aluminum, automobiles, and agricultural products, leading to increased prices for consumers and potentially hindering economic growth in both the US and the EU. Disruptions to supply chains and decreased consumer confidence are significant concerns.

-

EU Retaliatory Measures: The EU has responded with its own retaliatory tariffs on US goods, further escalating the trade conflict. This tit-for-tat exchange creates a climate of uncertainty and instability, negatively impacting investor sentiment.

-

Global Market Uncertainty: The uncertainty surrounding the ongoing trade dispute has led to significant volatility in global financial markets. Stock markets have experienced dips, and currency exchange rates have fluctuated dramatically as investors react to the evolving situation. For instance, the S&P 500 experienced a [Insert Percentage]% drop following a particular announcement of increased tariffs, reflecting the impact on investor confidence.

Gold as a Safe Haven Asset During Times of Economic Uncertainty

Gold has long been recognized as a safe haven asset, a go-to investment during times of economic and political turmoil. Its value tends to rise when investors seek refuge from riskier assets.

-

Historical Performance: Throughout history, gold has demonstrated resilience during periods of economic uncertainty, often appreciating in value while other markets decline. This performance has cemented its position as a reliable hedge against inflation and market volatility.

-

Lack of Correlation: Gold's price often shows a low correlation with traditional market assets like stocks and bonds. This lack of correlation makes it an attractive diversification tool for investors seeking to reduce overall portfolio risk.

-

Hedging Against Risk: Investors utilize gold to hedge against various risks, including inflation, currency fluctuations, and geopolitical instability. During times of economic stress, investors often move their capital into gold, driving up demand and consequently, the price. For example, during the 2008 financial crisis, the price of gold rose significantly as investors sought a safe haven from the collapsing markets.

Analyzing the Current Gold Price Surge

The recent surge in gold prices has been substantial. [Insert specific data, e.g., Gold prices have risen by X% in the last Y months, reaching a high of Z dollars per ounce].

-

Price Points and Percentage Changes: [Include specific price points and percentage changes to illustrate the magnitude of the surge. Use a chart or graph to visually represent this data.]

-

Comparison to Previous Movements: This recent surge can be compared to previous gold price movements, particularly those observed during other periods of heightened geopolitical uncertainty or economic instability. [Provide relevant comparisons and context.]

-

Other Influencing Factors: While trade war fears are a primary driver, other factors have contributed to the gold price surge. These include a weakening US dollar (which makes gold cheaper for buyers using other currencies), and increased central bank buying of gold as a reserve asset.

Predicting Future Gold Price Trends

Predicting future gold price trends is inherently challenging, but the current trade situation plays a significant role.

-

Different Scenarios: Several scenarios could unfold: a further escalation of the trade war leading to higher gold prices; a de-escalation through negotiation resulting in a price stabilization or even a decline; or a compromise that leads to moderate price adjustments.

-

Interest Rate Changes: Changes to interest rates by central banks can also impact gold prices. Lower interest rates generally favor gold, while higher rates can make it less attractive.

-

Geopolitical Events: Unforeseen geopolitical events could dramatically influence gold prices. Any significant global instability often boosts gold's appeal as a safe haven.

Conclusion

The recent gold price surge is largely attributable to the escalating trade war between the US and the EU, fueled by President Trump's tariff threats. This uncertainty has driven investors towards gold as a safe haven asset, highlighting its inherent value during times of economic instability. The future gold price trajectory remains dependent on the resolution (or lack thereof) of the trade dispute, central bank actions, and broader geopolitical developments.

Call to action: Stay informed about the evolving trade situation and its impact on the gold price. Monitor gold price movements closely to make informed investment decisions in this volatile market. Consider diversifying your portfolio with gold to mitigate risk during this period of uncertainty. Learn more about gold investment strategies and protect your assets amidst the current gold price surge.

Featured Posts

-

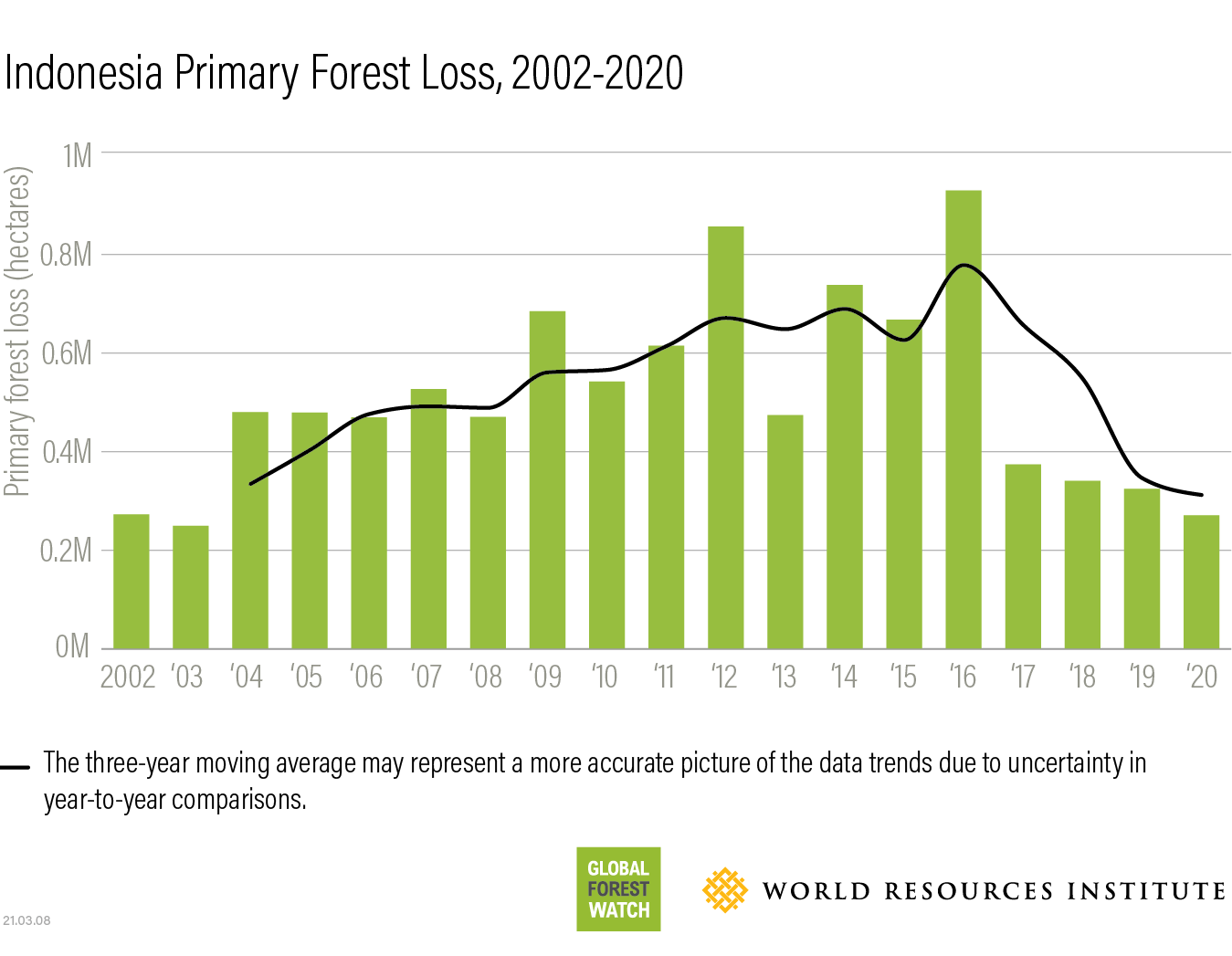

Global Forest Loss Reaches Record High Wildfires Fuel The Destruction

May 26, 2025

Global Forest Loss Reaches Record High Wildfires Fuel The Destruction

May 26, 2025 -

Dispute Erupts Over Pilbaras Environmental State Rio Tinto Vs Andrew Forrest

May 26, 2025

Dispute Erupts Over Pilbaras Environmental State Rio Tinto Vs Andrew Forrest

May 26, 2025 -

Spectacle Transformiste De Zize A Graveson 4 Avril 100 Marseillais

May 26, 2025

Spectacle Transformiste De Zize A Graveson 4 Avril 100 Marseillais

May 26, 2025 -

The 40 F1 Driver Triumphs And Challenges In The Twilight Years

May 26, 2025

The 40 F1 Driver Triumphs And Challenges In The Twilight Years

May 26, 2025 -

The Story Of Russell And The Typhoons From Unknown To Celebrated

May 26, 2025

The Story Of Russell And The Typhoons From Unknown To Celebrated

May 26, 2025

Latest Posts

-

Trump Grants Clemency To 26 Individuals Notable Cases And Analysis

May 30, 2025

Trump Grants Clemency To 26 Individuals Notable Cases And Analysis

May 30, 2025 -

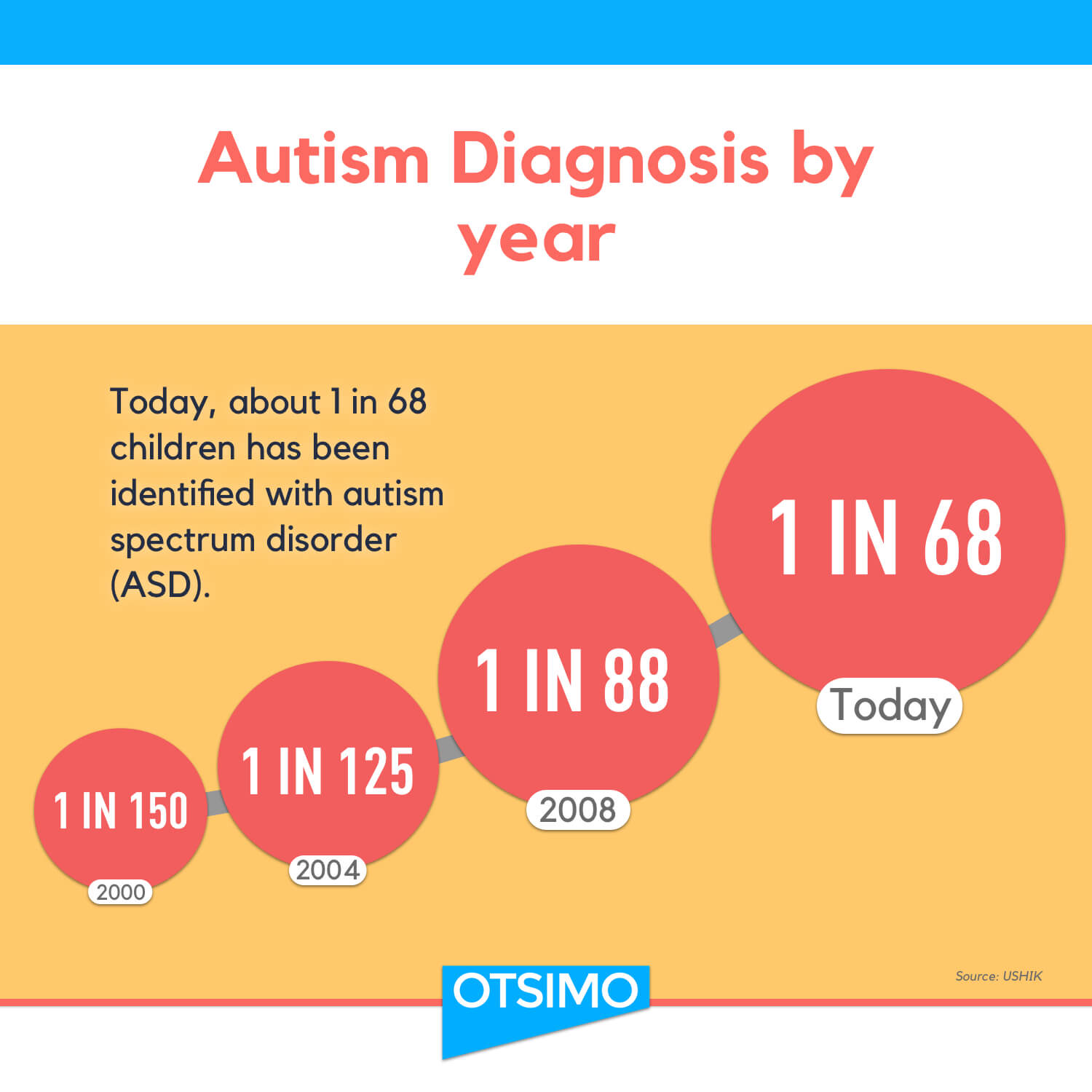

Understanding Adult Autism Diagnosis And Its Positive Impact

May 30, 2025

Understanding Adult Autism Diagnosis And Its Positive Impact

May 30, 2025 -

Trumps Clemency Grants 26 Pardons And Commutations Including A Former Gang Leader

May 30, 2025

Trumps Clemency Grants 26 Pardons And Commutations Including A Former Gang Leader

May 30, 2025 -

Adult Autism Diagnosis Improving Lives Through Understanding

May 30, 2025

Adult Autism Diagnosis Improving Lives Through Understanding

May 30, 2025 -

Analyzing Trumps Anti University Stance Tracing It Back To The Source

May 30, 2025

Analyzing Trumps Anti University Stance Tracing It Back To The Source

May 30, 2025