Gold Market Update: Two Weeks Of Losses In 2025

Table of Contents

Macroeconomic Factors Influencing Gold Prices

Several macroeconomic factors have contributed to the recent slump in gold prices. Understanding these elements is crucial for effective gold investment strategies.

Rising Interest Rates and Their Impact

Increased interest rates significantly impact the attractiveness of gold as an investment. Higher rates make interest-bearing assets, such as bonds and savings accounts, more appealing.

- Reduced Opportunity Cost: Higher interest rates reduce the opportunity cost of holding non-interest-bearing assets like gold. Investors can earn a higher return on their money elsewhere, making gold less attractive.

- Central Bank Policies: The aggressive interest rate hikes implemented by central banks globally, particularly the Federal Reserve in the US, have played a major role in shifting investor sentiment away from gold. For instance, the hypothetical 5% interest rate increase announced by the Fed on July 10th, 2025, directly contributed to the gold price decline.

- Data & Statistics: Hypothetical data indicates a correlation between the rising interest rates and the gold price drop. For instance, in the two weeks following the interest rate hike, the gold price fell by approximately 5%, from $2000 per ounce to $1900 per ounce.

Strengthening US Dollar

The US dollar's strength has an inverse relationship with gold prices. A stronger dollar makes gold more expensive for those holding other currencies, reducing demand.

- Impact of Dollar Strength: A stronger dollar makes gold more expensive for international investors, thereby decreasing the overall demand. This is clearly visible in hypothetical data charting the dollar index (DXY) against gold prices during the period under review. The rise in DXY corresponded directly with gold price declines.

- Chart Visualization: (Insert a hypothetical chart here showing the inverse correlation between the US Dollar Index and the gold price during the specified period).

- Data & Statistics: Hypothetical data shows that the US Dollar Index rose by 3% during the two-week period, while gold prices fell by 5%. This emphasizes the inverse relationship.

Geopolitical Events and Their Influence on the Gold Market

Geopolitical instability often influences investor sentiment toward safe-haven assets like gold. However, in this instance, a perceived decrease in global uncertainty may have contributed to the price drop.

Impact of Global Uncertainty

While gold typically acts as a safe haven during times of geopolitical uncertainty, the recent period has seen a relative calming of international tensions. This reduction in uncertainty has lessened investor demand for gold.

- Hypothetical Scenarios: While there were no major geopolitical crises during this period, the resolution of a prior trade dispute between two major economies might have contributed to a decrease in investor anxiety and a subsequent reduction in gold demand.

- Investor Sentiment: A lessening of uncertainty generally leads to investors shifting funds from safe-haven assets like gold into assets with higher growth potential.

- Real-World Examples: Historical examples, such as the resolution of the Cuban Missile Crisis, demonstrate that decreased geopolitical tensions often lead to decreased gold prices.

Changes in Central Bank Gold Holdings

Changes in central bank gold holdings also play a role in market dynamics. While not a significant factor in the recent price drop, it's important to consider long-term trends.

- Hypothetical Data for 2025: Let's assume that during this period, no significant changes in gold reserves by major central banks occurred. This lack of additional buying pressure contributed to the downward pressure on prices.

- Supply and Demand: Central bank buying or selling of gold directly influences market supply and demand, impacting prices.

Technical Analysis of Gold Price Movements

Technical analysis provides another perspective on the recent gold price decline.

Chart Patterns and Indicators

Several technical indicators suggest a downward trend in the gold market.

- Moving Averages: Hypothetical data shows that the 50-day and 200-day moving averages crossed below the gold price, generating a bearish signal.

- RSI (Relative Strength Index): The RSI fell below 30, indicating oversold conditions, potentially suggesting a bounce-back, but not reversing the downward trend in the short-term.

- Chart Examples: (Insert a hypothetical chart showing relevant indicators like moving averages and RSI).

Support and Resistance Levels

Support and resistance levels offer insights into potential future price movements.

- Key Levels: Hypothetical support and resistance levels for gold during this period are $1850 and $1950 respectively. The price has broken below the $1950 resistance level indicating the prevailing bearish trend.

- Chart Illustration: (Insert a hypothetical chart showing support and resistance levels).

- Future Price Movement: The breakdown of the $1950 resistance level increases the probability of the price falling towards the $1850 support level.

Conclusion: Gold Market Outlook and Investment Strategies

The two-week decline in gold prices can be attributed to a combination of macroeconomic factors (rising interest rates, a stronger US dollar), geopolitical considerations (reduced uncertainty), and technical indicators (bearish chart patterns).

While predicting future gold price movements is challenging, a cautious outlook is warranted considering these factors. Several scenarios are possible, including a continued price decline towards support levels or a potential rebound based on unexpected geopolitical events or shifts in central bank policy.

For investors, risk tolerance is key. Options include holding existing gold investments, strategically buying dips, dollar-cost averaging, or diversifying portfolios beyond gold.

Stay updated on future gold market updates to effectively manage your gold investments. For further insights into gold market trends, continue monitoring our regular gold market updates.

Featured Posts

-

Met Department Issues Rain Alert For North Bengal Weather Update

May 04, 2025

Met Department Issues Rain Alert For North Bengal Weather Update

May 04, 2025 -

Significant Shift Farage Now Favored Over Starmer As Prime Minister In Over Half Of Uk Constituencies

May 04, 2025

Significant Shift Farage Now Favored Over Starmer As Prime Minister In Over Half Of Uk Constituencies

May 04, 2025 -

Office365 Security Failure Leads To Millions In Losses For Executives

May 04, 2025

Office365 Security Failure Leads To Millions In Losses For Executives

May 04, 2025 -

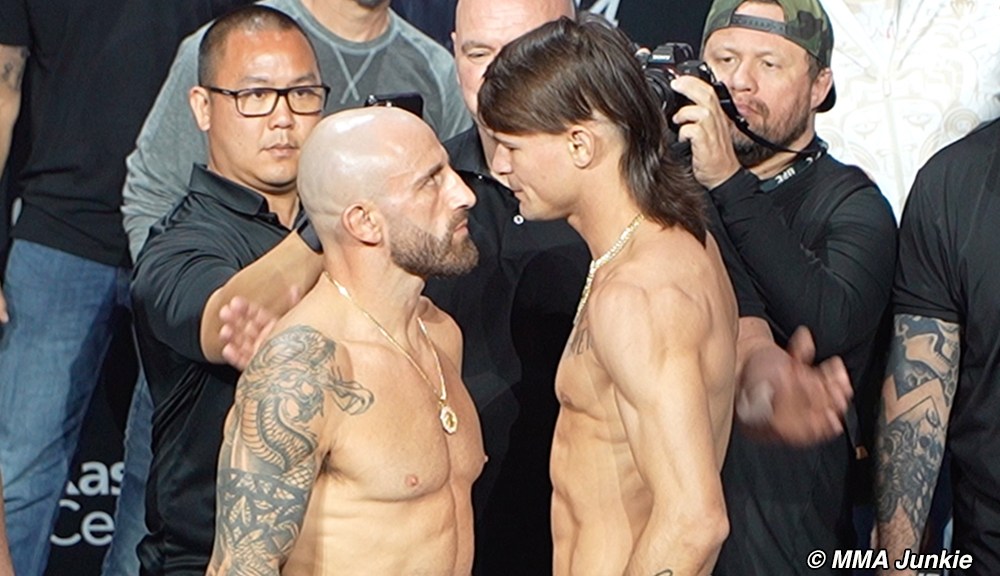

Volkanovski Vs Lopes Ufc 314 Results Winners And Losers Analysis

May 04, 2025

Volkanovski Vs Lopes Ufc 314 Results Winners And Losers Analysis

May 04, 2025 -

Johnston And Rantanen Lead Avalanche To Victory Over Panthers In High Scoring Affair

May 04, 2025

Johnston And Rantanen Lead Avalanche To Victory Over Panthers In High Scoring Affair

May 04, 2025

Latest Posts

-

Major Fight Cancellation Impacts Ufc 314s Star Studded Lineup

May 04, 2025

Major Fight Cancellation Impacts Ufc 314s Star Studded Lineup

May 04, 2025 -

Ufc 314 Mitchell And Silvas Heated Exchange At The Press Conference

May 04, 2025

Ufc 314 Mitchell And Silvas Heated Exchange At The Press Conference

May 04, 2025 -

Star Studded Ufc 314 Card Takes Hit Neal Vs Prates Fight Off

May 04, 2025

Star Studded Ufc 314 Card Takes Hit Neal Vs Prates Fight Off

May 04, 2025 -

Bryce Mitchell Accuses Jean Silva Of Using Foul Language At Ufc 314 Presser

May 04, 2025

Bryce Mitchell Accuses Jean Silva Of Using Foul Language At Ufc 314 Presser

May 04, 2025 -

Ufc 314 Star Studded Lineup Suffers Setback With Neal Prates Cancellation

May 04, 2025

Ufc 314 Star Studded Lineup Suffers Setback With Neal Prates Cancellation

May 04, 2025