US Tariffs Halt Shein's Planned London IPO

Table of Contents

The Impact of US Tariffs on Shein's Financial Projections

The imposition of US tariffs has dramatically altered Shein's financial landscape, presenting serious challenges to its projected IPO valuation. The increased costs and resulting uncertainty are key factors affecting its prospects.

Increased Costs and Reduced Profitability

US tariffs have significantly increased Shein's import costs, directly impacting its already razor-thin profit margins.

- Clothing: Tariffs on clothing items have risen by an estimated X%, significantly increasing the cost of goods sold (COGS).

- Accessories: Similar increases are seen in accessories, further squeezing profitability.

- Shoes: The impact on footwear imports is also substantial, contributing to the overall financial strain.

This necessitates either absorbing these costs, leading to reduced profitability, or passing them onto consumers, potentially impacting Shein's competitive pricing strategy and market share. Industry analysts predict a potential Y% decrease in profit margins due to these tariffs.

Investor Sentiment and Market Uncertainty

The tariff situation has created significant uncertainty in the eyes of potential investors. This uncertainty translates to:

- Lower Valuation: Shein's anticipated valuation for its IPO is likely to be significantly lower than initially projected due to the added risk associated with the US tariffs.

- Investor Reluctance: Investors are hesitant to invest in a company facing substantial and unpredictable trade barriers, impacting the overall success of the IPO.

- Market Volatility: The fluctuating nature of US trade policy adds to the market volatility surrounding Shein's IPO prospects, making it a riskier investment.

Financial analysts have expressed concerns, with some suggesting a potential delay or even cancellation of the IPO if the tariff situation remains unresolved.

Shein's Strategic Response to US Tariff Challenges

Faced with this significant hurdle, Shein must adapt its strategies to mitigate the negative impact of US tariffs. This requires a multi-pronged approach encompassing supply chain diversification and political engagement.

Diversification of Supply Chains

Shein is likely exploring options to diversify its manufacturing base, moving beyond its heavy reliance on China. This could involve:

- Shifting Production: Relocating manufacturing facilities to countries with more favorable trade relations with the US, such as Vietnam or Bangladesh.

- Increased Costs of Relocation: This diversification, however, presents substantial challenges, including increased logistical costs and potential disruptions to its established supply chains.

- Labor Practices Scrutiny: A shift in manufacturing locations will also bring renewed scrutiny of Shein's labor practices in these alternative locations.

This strategic shift is a complex and costly undertaking, but crucial for long-term survival in the face of persistent US tariffs.

Lobbying and Political Engagement

Shein may also engage in lobbying efforts to influence US trade policy. This could involve:

- Direct Lobbying: Employing lobbyists to engage with US policymakers and advocate for tariff reductions or exemptions.

- Industry Alliances: Forming alliances with other businesses affected by US tariffs to present a stronger united front.

- Political Contributions: This may involve contributing to political campaigns or organizations that align with Shein's trade policy interests.

Navigating the complexities of US trade regulations is a significant challenge, requiring considerable resources and expertise.

Alternative IPO Options and Future Outlook for Shein

Given the challenges posed by US tariffs, Shein might explore alternative avenues for its IPO. Furthermore, the long-term impact on its growth trajectory remains uncertain.

Exploring Alternative IPO Venues

Shein could consider alternative stock exchanges less affected by US tariffs, such as:

- Hong Kong Stock Exchange: Offering access to a large pool of Asian investors.

- Singapore Exchange: A well-established exchange with a robust regulatory framework.

Each option presents unique advantages and disadvantages regarding regulatory environments, investor bases, and overall market access.

Long-Term Implications for Shein's Growth

The long-term impact of US tariffs on Shein's growth is uncertain but presents several potential scenarios:

- Business Model Adaptation: Shein may need to adjust its business model to account for higher costs and reduced profitability.

- Increased Competition: The tariff situation could intensify competition from other fast-fashion brands less reliant on Chinese manufacturing.

- Price Increases: Shein may be forced to increase prices, potentially alienating its price-sensitive customer base.

Conclusion: The Future of Shein's IPO After US Tariff Delays

US tariffs have significantly impacted Shein's IPO plans, forcing a reevaluation of its strategies and long-term prospects. The increased costs, investor uncertainty, and potential need for supply chain diversification pose significant challenges. The long-term consequences for Shein's growth and the broader fast-fashion industry remain to be seen. Stay tuned for further updates on Shein's IPO plans and the ongoing impact of US tariffs on the global fashion industry and the Shein IPO. Continue following this story as we monitor developments related to Shein's future and the effects of US trade policies on the Shein IPO and similar companies.

Featured Posts

-

Timnas U 20 Indonesia Vs Yaman Prediksi Dan Peluang Kemenangan

May 06, 2025

Timnas U 20 Indonesia Vs Yaman Prediksi Dan Peluang Kemenangan

May 06, 2025 -

Blockchain Analytics Leader Chainalysis Expands With Alterya Acquisition

May 06, 2025

Blockchain Analytics Leader Chainalysis Expands With Alterya Acquisition

May 06, 2025 -

Azerbaydzhanskie Kovry I Cheshskiy Khrustal Paralleli Traditsiy V Dome Kultury

May 06, 2025

Azerbaydzhanskie Kovry I Cheshskiy Khrustal Paralleli Traditsiy V Dome Kultury

May 06, 2025 -

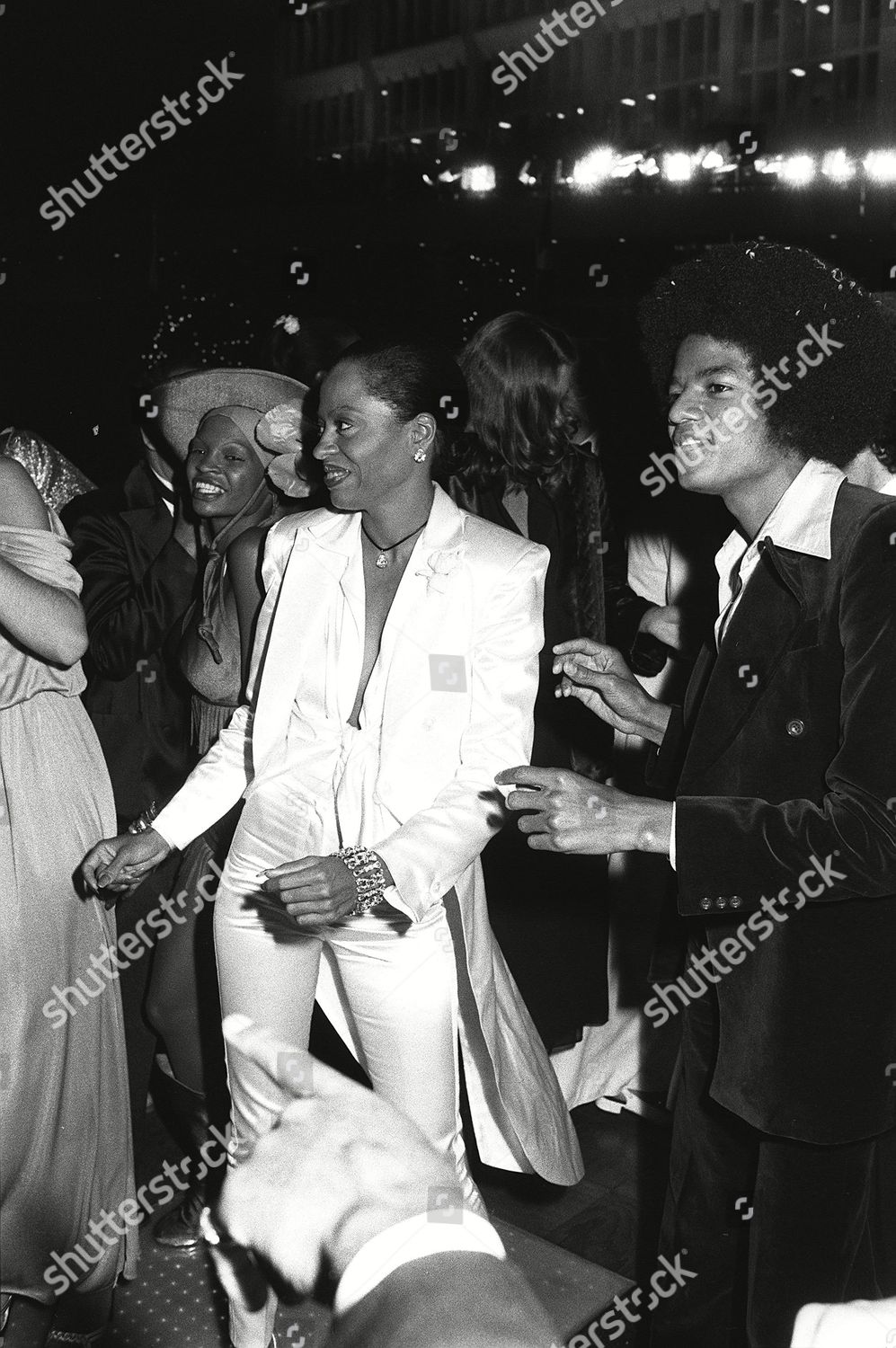

Diana Rosss Promise To Michael Jackson Revealed

May 06, 2025

Diana Rosss Promise To Michael Jackson Revealed

May 06, 2025 -

Sabrina Carpenters Snl Surprise A Fun Size Reunion

May 06, 2025

Sabrina Carpenters Snl Surprise A Fun Size Reunion

May 06, 2025

Latest Posts

-

Strengthening The Us Israel Azerbaijan Trilateral Partnership Benefits And Challenges

May 06, 2025

Strengthening The Us Israel Azerbaijan Trilateral Partnership Benefits And Challenges

May 06, 2025 -

Nachalos Ocherednoe Plenarnoe Zasedanie Milli Medzhlisa Glavnye Resheniya I Itogi

May 06, 2025

Nachalos Ocherednoe Plenarnoe Zasedanie Milli Medzhlisa Glavnye Resheniya I Itogi

May 06, 2025 -

Natanyahvo Aliyevi Baryekhvos Linyely Trampi Mvot I Nch Npataknyer E Hyetapndvo M

May 06, 2025

Natanyahvo Aliyevi Baryekhvos Linyely Trampi Mvot I Nch Npataknyer E Hyetapndvo M

May 06, 2025 -

Inch Yenq Kvorcryel Hayastani Zijvo Mnyery Adrbyejanin 2020 Ic Hyetvo

May 06, 2025

Inch Yenq Kvorcryel Hayastani Zijvo Mnyery Adrbyejanin 2020 Ic Hyetvo

May 06, 2025 -

The Importance Of The Us Israel Azerbaijan Strategic Partnership A Geopolitical Analysis

May 06, 2025

The Importance Of The Us Israel Azerbaijan Strategic Partnership A Geopolitical Analysis

May 06, 2025