Global Risk Rally: Stocks Surge On U.S.-China Trade Deal

Table of Contents

Understanding the US-China Trade Deal's Impact

The US-China trade deal represents a pivotal moment in global trade relations. Its positive implications for global markets are far-reaching. The agreement encompasses several key aspects crucial to understanding the resulting global risk rally.

-

Reduced Tariffs on Specific Goods: The deal led to a reduction in tariffs on a wide range of goods, easing the burden on businesses and stimulating trade. This tariff reduction directly alleviated cost pressures and boosted profitability for many companies.

-

Increased Market Access for Both Countries: Both the US and China gained increased access to each other's markets. This expanded market access opens up new opportunities for businesses, leading to increased competition and potentially lower prices for consumers.

-

Agreements on Intellectual Property Rights: The deal includes provisions designed to protect intellectual property rights, creating a more stable and predictable environment for innovation and technological advancement. This bolsters investor confidence in the long-term prospects of certain sectors.

-

Commitments to Purchase Specific Quantities of Goods: The agreement includes commitments from China to purchase specific quantities of US goods. This commitment injects a significant boost to US agricultural and manufacturing exports, driving economic growth and influencing the global risk rally.

These components of the trade deal, collectively, contribute significantly to the improved investor sentiment and the resulting global risk rally. The reduction in trade war uncertainty has dramatically shifted the market landscape and reduced the overall geopolitical risk.

Analysis of the Global Risk Rally: Factors Contributing to Stock Market Gains

While the US-China trade deal served as a primary catalyst, several other factors contributed to the global risk rally and the subsequent stock market gains.

-

Improved Investor Sentiment: The deal significantly improved investor sentiment, boosting confidence and encouraging increased investment activity. This positive sentiment spread globally, stimulating economic activity.

-

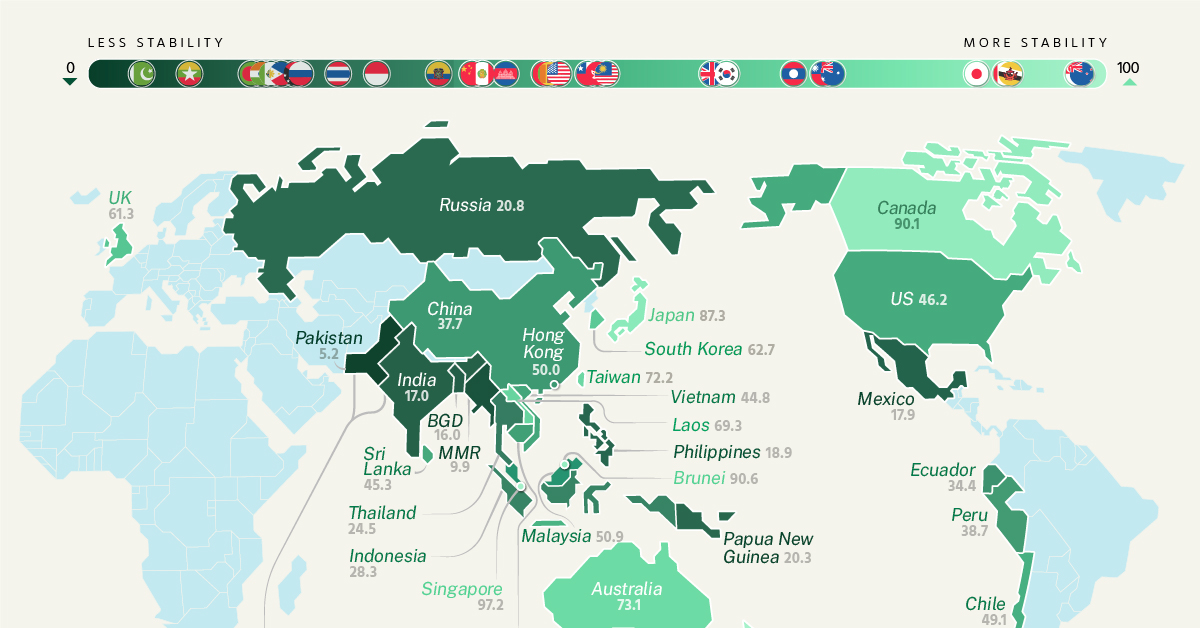

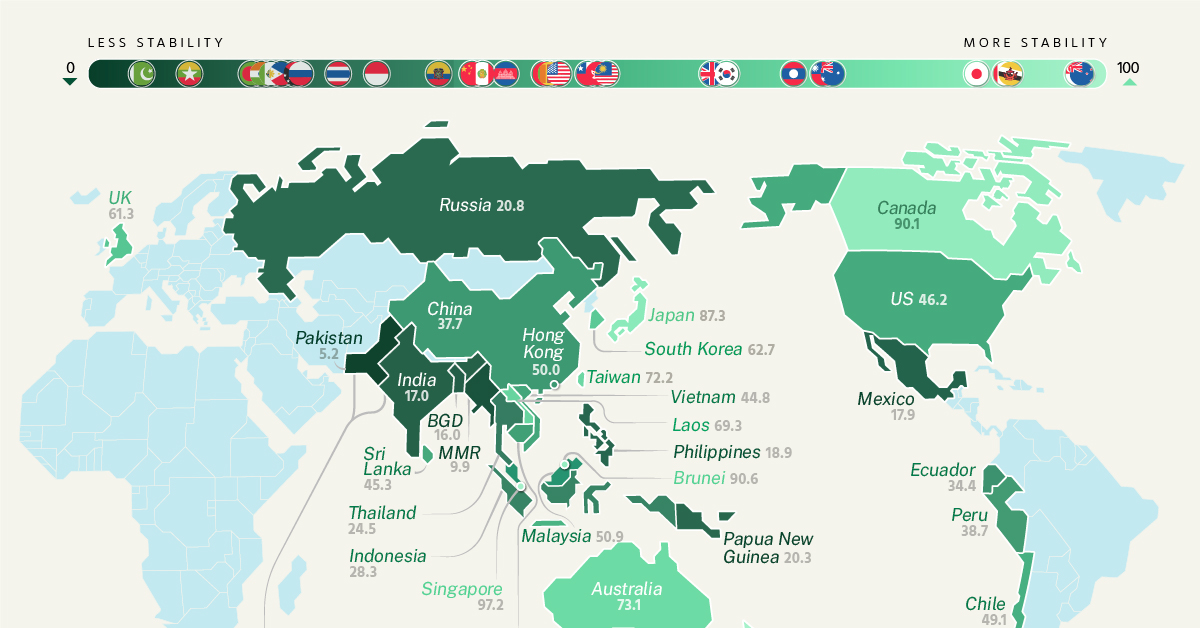

Easing of Geopolitical Tensions: The successful negotiation of the trade deal helped to ease broader geopolitical tensions, reducing uncertainty and improving investor risk appetite. Specific examples of reduced tensions, if applicable, can be highlighted here.

-

Stronger-than-Expected Economic Data from Key Regions: Positive economic data from major economies, including strong GDP growth and employment figures, added to the overall optimistic market outlook and fueled the global risk rally.

-

Central Bank Monetary Policies: Supportive monetary policies adopted by central banks in various countries, such as low interest rates, further contributed to the positive market environment and fueled investor confidence.

These factors, interacting synergistically with the positive impact of the trade deal, created a powerful force driving the global risk rally and leading to substantial stock market gains.

Sector-Specific Performance During the Global Risk Rally

The global risk rally did not impact all market sectors equally. Some sectors experienced significantly greater gains than others.

-

Technology Stocks: Technology stocks generally performed very well, driven by increased investor confidence and expectations of future growth.

-

Energy Stocks: Energy stocks also saw significant gains, reflecting improving global economic conditions and increased demand.

-

Financials: The financial sector benefited from the overall positive market sentiment and improved economic outlook, exhibiting healthy growth during the rally.

-

Consumer Goods: Consumer goods companies experienced positive performance, indicating increased consumer spending and improved economic confidence.

The variation in sector performance is largely attributed to the differing sensitivity of each sector to global economic conditions, the impact of tariff reductions, and investor sentiment. Understanding these nuances is crucial for developing effective investment strategies.

Potential Risks and Future Outlook: Maintaining the Global Risk Rally

While the global risk rally presents significant opportunities, it is crucial to acknowledge potential risks that could threaten its sustainability.

-

Market Volatility: Market volatility can quickly reverse positive gains. Unexpected geopolitical events, economic downturns, or shifts in investor sentiment can easily impact the market.

-

Economic Uncertainty: Despite positive economic data, lingering economic uncertainties remain. Unexpected economic slowdowns in key regions could negatively impact market performance.

-

Investment Risks: All investments carry inherent risks, and the current market environment is no exception. Investors should carefully assess their risk tolerance and diversify their portfolios accordingly.

-

Future Market Outlook: The sustainability of the current market conditions is uncertain. Future challenges, such as renewed trade tensions or unforeseen global events, could significantly alter the outlook.

Navigating the current market requires a cautious and informed approach, recognizing both the opportunities and the inherent risks.

Conclusion: Navigating the Global Risk Rally – Invest Wisely

The global risk rally, primarily driven by the US-China trade deal and other positive economic factors, has led to a significant stock market surge. However, understanding the contributing factors and potential future risks is crucial for making sound investment decisions. The various sectors responded differently, reflecting unique vulnerabilities and opportunities. Investors should maintain a balanced portfolio, diversifying their investments to mitigate risks associated with market volatility and economic uncertainty. Understanding the dynamics of the global risk rally and the US-China trade deal impact is paramount for navigating the current market environment effectively. Stay informed and invest wisely!

Featured Posts

-

Choosing Your First Friend A Guide To The Best Starter Pokemon

May 14, 2025

Choosing Your First Friend A Guide To The Best Starter Pokemon

May 14, 2025 -

4 8 Miljoonaa Euroa Eurojackpotista Voitto Suomeen

May 14, 2025

4 8 Miljoonaa Euroa Eurojackpotista Voitto Suomeen

May 14, 2025 -

Steel Industry Decarbonization The Impact Of Eramets Era Low

May 14, 2025

Steel Industry Decarbonization The Impact Of Eramets Era Low

May 14, 2025 -

Tommy Fury And Molly Mae Did His Stage Performance Cause Regret

May 14, 2025

Tommy Fury And Molly Mae Did His Stage Performance Cause Regret

May 14, 2025 -

Mondays Top Business News Highlights Your 1 Am Et Briefing

May 14, 2025

Mondays Top Business News Highlights Your 1 Am Et Briefing

May 14, 2025