Gensol Promoters Face PFC Action Following Submission Of Fake Documents

Table of Contents

The Allegations: What Fake Documents Were Submitted?

The heart of the matter lies in the alleged submission of fraudulent documents to [mention the recipient of the documents, e.g., regulatory body, investors]. These forged documents, intended to misrepresent Gensol's financial position and operational status, are alleged to include:

- Financial Statements: Falsely inflated revenue figures and understated expenses are reportedly included in the submitted financial statements, painting a misleading picture of Gensol's profitability.

- Contracts: Fake contracts with purported clients have also surfaced, suggesting partnerships and business deals that never existed. This deception aimed to inflate the company’s perceived value and secure further investments.

- Internal Memos: Internal documents allegedly falsified to create a false narrative of operational efficiency and strong internal controls.

The falsification was reportedly discovered during a routine audit by [mention the auditing firm or body, if known] who uncovered discrepancies between the submitted documents and other available evidence. The exact financial figures involved are still under investigation but preliminary estimates suggest a potential misrepresentation of [mention approximate figures, if available, e.g., tens of millions of dollars].

The PFC Action: What Measures Are Being Taken?

Following the discovery of the fake documents, the PFC launched a full-scale investigation into Gensol and its promoters. The measures currently underway include:

- Freezing of Assets: The PFC has reportedly frozen assets belonging to the implicated promoters, preventing the dissipation of funds potentially obtained through fraudulent means.

- Seizure of Documents: Authorities have seized numerous documents and electronic data related to Gensol's operations, aiming to uncover the full extent of the fraud.

- Witness Interviews: Investigations are ongoing, with multiple individuals connected to Gensol being interviewed to gather evidence and corroborate information.

- Legal Proceedings: Formal legal proceedings are anticipated, with potential criminal charges against the promoters for fraud, market manipulation, and other relevant offenses. The PFC is also exploring avenues to compensate affected investors.

The penalties faced by the promoters could be significant, ranging from substantial fines to imprisonment, depending on the outcome of the investigation and the court's verdict.

Impact on Gensol and Investors

The scandal surrounding Gensol has had a devastating impact on the company and its investors:

- Stock Price Plunge: Gensol's stock price has plummeted since the allegations surfaced, wiping out significant shareholder value. [Include percentage drop if available].

- Investor Confidence Erosion: Investor confidence in Gensol has been severely eroded, with many investors seeking to divest their holdings.

- Potential Lawsuits: Investors are exploring legal avenues to recover their losses, potentially leading to costly class-action lawsuits against Gensol and its promoters.

- Reputational Damage: The long-term damage to Gensol's reputation is undeniable, potentially hindering its future growth and prospects.

The scandal underscores the importance of thorough due diligence for investors and highlights the risks associated with investing in companies with questionable transparency and governance practices.

Potential for Further Regulatory Scrutiny

Beyond the PFC action, the possibility of further regulatory scrutiny from other bodies, such as the [mention relevant regulatory bodies e.g., Securities and Exchange Commission (SEC) if applicable], cannot be ruled out. This emphasizes the far-reaching consequences of corporate fraud and the interconnectedness of various regulatory agencies in safeguarding market integrity. The incident underscores the critical need for robust corporate governance, transparent financial reporting, and strict compliance measures to prevent similar incidents in the future. Improved transparency and strengthened regulatory oversight are essential to rebuild investor confidence and maintain the stability of the financial markets.

Conclusion

The Gensol case serves as a stark reminder of the severe consequences of submitting fake documents and engaging in fraudulent activities. The PFC action, along with the potential for further regulatory scrutiny and legal repercussions, highlights the importance of accountability in the corporate world. The impact on Gensol, its investors, and the broader market underscores the need for stricter oversight and increased transparency. Stay updated on the Gensol investigation and the implications of submitting fake documents to protect your investments. Understanding the risks and practicing due diligence are crucial steps in navigating the complexities of the stock market. For more information on the ongoing investigation and related news, refer to [link to relevant news sources or official statements].

Featured Posts

-

Three Set Thriller Rybakina Triumphs Over Jabeur In Abu Dhabi

Apr 27, 2025

Three Set Thriller Rybakina Triumphs Over Jabeur In Abu Dhabi

Apr 27, 2025 -

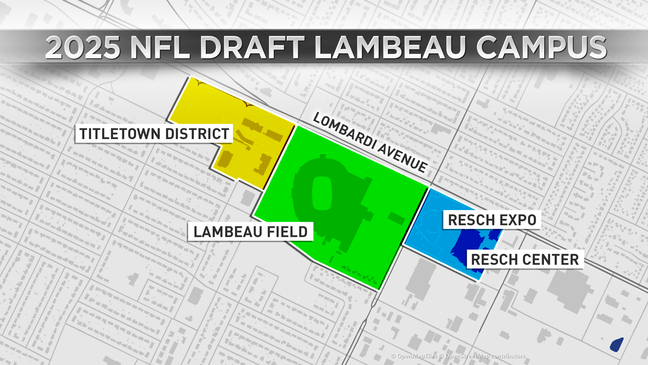

Nfl International Series 2025 Green Bay Packers Potential Participation

Apr 27, 2025

Nfl International Series 2025 Green Bay Packers Potential Participation

Apr 27, 2025 -

Motherhood And Triumph Bencic In The Abu Dhabi Final

Apr 27, 2025

Motherhood And Triumph Bencic In The Abu Dhabi Final

Apr 27, 2025 -

Pago De Licencia De Maternidad Para Tenistas De La Wta

Apr 27, 2025

Pago De Licencia De Maternidad Para Tenistas De La Wta

Apr 27, 2025 -

Wta Roundup Austria And Singapore Stage Final Matches

Apr 27, 2025

Wta Roundup Austria And Singapore Stage Final Matches

Apr 27, 2025

Latest Posts

-

Analysis Teslas Price Adjustments And Pre Tariff Inventory In Canada

Apr 27, 2025

Analysis Teslas Price Adjustments And Pre Tariff Inventory In Canada

Apr 27, 2025 -

Understanding Teslas Canadian Price Increase And Inventory Strategy

Apr 27, 2025

Understanding Teslas Canadian Price Increase And Inventory Strategy

Apr 27, 2025 -

Teslas Canadian Price Hike A Strategic Move To Clear Pre Tariff Stock

Apr 27, 2025

Teslas Canadian Price Hike A Strategic Move To Clear Pre Tariff Stock

Apr 27, 2025 -

Tesla Canada Price Increase Pre Tariff Inventory Push Explained

Apr 27, 2025

Tesla Canada Price Increase Pre Tariff Inventory Push Explained

Apr 27, 2025 -

440 Million Deal Cma Cgm Acquires Major Turkish Logistics Company

Apr 27, 2025

440 Million Deal Cma Cgm Acquires Major Turkish Logistics Company

Apr 27, 2025