G-7 Mulls Lowering De Minimis Tariffs On Chinese Imports

Table of Contents

Current State of De Minimis Tariffs on Chinese Imports

Currently, G7 nations maintain varying levels of de minimis tariffs on goods imported from China. These tariffs determine the value threshold below which imported goods are exempt from customs duties. The exact levels vary significantly, leading to inconsistencies and complexities for businesses involved in international trade.

-

Current tariff rates for various product categories: Rates differ widely depending on the product category, with some consumer goods enjoying lower thresholds than industrial components. For example, some countries might have a $800 de minimis value for clothing while others have a lower threshold for electronics. These inconsistencies create challenges for businesses needing to comply with diverse regulations across G7 nations.

-

Impact of current tariffs on businesses importing from China: The current de minimis tariff system adds complexities to supply chains and import operations. Businesses face challenges in calculating tariffs, managing customs paperwork, and predicting costs accurately. Smaller businesses often face disproportionately high compliance burdens.

-

Existing challenges faced by importers due to current tariff levels: Importers often struggle with navigating the varying regulations across different G7 countries. This can lead to delays, increased administrative costs, and potential penalties for non-compliance. Lack of standardization creates significant uncertainty.

-

Specific G7 countries and their current policies: While specific details are not publicly available for all G7 countries, it's understood that variations exist, necessitating a case-by-case assessment for accurate compliance. The US, Canada, Japan, Germany, France, Italy, and the UK all have unique import processes and regulations.

Proposed Changes to De Minimis Tariffs and Their Rationale

The G7 is proposing a significant reduction in the de minimis tariff thresholds for Chinese imports. The exact proposed reductions vary depending on the country and product category, but the overarching goal is to simplify trade and potentially lower costs.

-

Specific proposed reduction in tariff thresholds: While precise figures are still under negotiation, it's anticipated that several G7 nations will raise their de minimis thresholds substantially, potentially exceeding $1000 for a wide range of products.

-

Reasons behind the proposed lowering of tariffs: The rationale behind the proposed changes includes boosting consumer spending by making imported goods cheaper, reducing costs for businesses, and addressing supply chain bottlenecks by streamlining the import process.

-

Potential economic benefits for both G7 countries and China: Lower tariffs could stimulate economic growth in G7 nations through increased consumption and reduced prices. China might also benefit from increased export volume.

-

Potential political motivations behind the proposal: The proposal may reflect broader geopolitical considerations, potentially aiming to strengthen economic ties with China while managing other aspects of the bilateral relationship.

Potential Economic Impacts of Lowering De Minimis Tariffs

Lowering de minimis tariffs could have significant economic repercussions, both positive and negative.

-

Impact on consumer prices: Lower tariffs generally translate to lower prices for consumers, increasing purchasing power and potentially stimulating consumer spending.

-

Effects on businesses importing goods from China: Businesses could see reduced import costs, improving profitability and competitiveness. However, some businesses may experience increased competition.

-

Changes in the competitiveness of domestic industries: Domestic industries producing comparable goods might face increased competition from cheaper imports, potentially leading to job losses in certain sectors.

-

Potential effects on employment in both G7 nations and China: While lower prices could benefit consumers and potentially boost employment in the retail and service sectors, there are potential negative impacts on domestic manufacturing jobs. China may see an increase in manufacturing jobs.

-

Analysis of potential trade surpluses or deficits: The impact on trade balances remains uncertain, dependent on the elasticity of demand and supply for imported goods.

Concerns and Counterarguments Regarding the Proposed Changes

Despite potential benefits, the proposed reduction in de minimis tariffs faces significant opposition.

-

Potential negative impact on domestic industries: Concerns remain that a significant reduction in tariffs will harm domestic industries that compete with imported goods from China, leading to job losses and business closures.

-

Concerns about unfair competition: There are worries that Chinese businesses might engage in unfair trade practices, leveraging lower tariffs to gain an unfair advantage in G7 markets.

-

Arguments related to national security and trade imbalances: Some argue that lower tariffs could exacerbate trade imbalances and pose risks to national security if reliance on imports increases excessively.

-

Potential exploitation by Chinese businesses: Opponents express concern that lower tariffs could be exploited by Chinese companies to undercut domestic businesses through dumping or other unfair trade practices.

-

Discussion of alternative approaches to trade policy: Critics suggest exploring alternative trade policies that support domestic industries while fostering fair competition and protecting national interests.

Conclusion

The G7's consideration of lowering de minimis tariffs on Chinese imports presents a complex issue with far-reaching economic and political ramifications. While a reduction in tariffs could benefit consumers and businesses through lower prices and increased access to goods, concerns regarding domestic industries and fair trade practices must be carefully considered. The potential impact of this decision will require ongoing monitoring and analysis. Staying informed about developments concerning de minimis tariffs and their effects on international trade is crucial for all stakeholders. To stay updated on this crucial topic and the latest developments in the ongoing discussion on de minimis tariffs, continue to follow reputable news sources and economic analyses. Understanding the intricacies of de minimis tariffs is key to navigating the changing global trade landscape.

Featured Posts

-

Elena Rybakina Otsenka Sobstvennoy Igry I Planov Na Buduschee

May 24, 2025

Elena Rybakina Otsenka Sobstvennoy Igry I Planov Na Buduschee

May 24, 2025 -

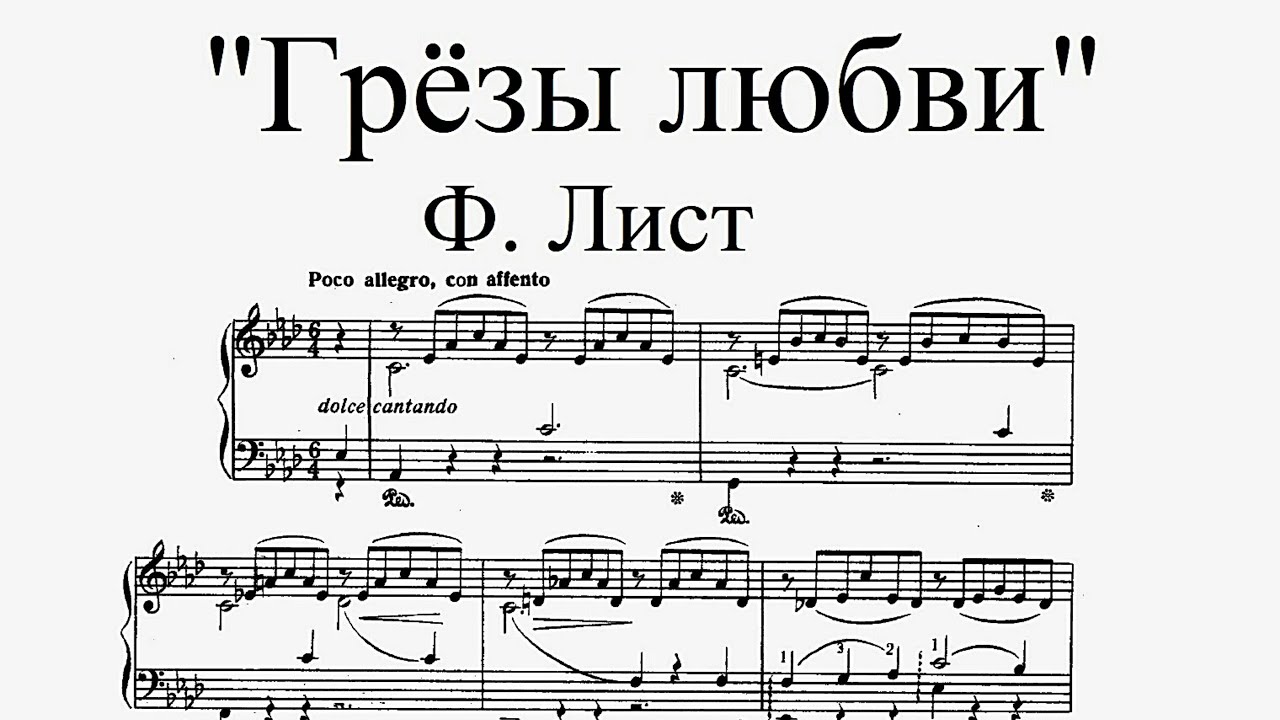

Gryozy Lyubvi Ili Ilicha V Gazete Trud Polniy Obzor

May 24, 2025

Gryozy Lyubvi Ili Ilicha V Gazete Trud Polniy Obzor

May 24, 2025 -

Elena Rybakina Chestniy Razgovor O Tekuschikh Trudnostyakh

May 24, 2025

Elena Rybakina Chestniy Razgovor O Tekuschikh Trudnostyakh

May 24, 2025 -

Tuukka Taponen F1 Debyytti Jo Taenae Vuonna Jymypaukku Odottaa

May 24, 2025

Tuukka Taponen F1 Debyytti Jo Taenae Vuonna Jymypaukku Odottaa

May 24, 2025 -

Negative Close For Frankfurt Dax Below 24 000 Points

May 24, 2025

Negative Close For Frankfurt Dax Below 24 000 Points

May 24, 2025

Latest Posts

-

Memorial Day 2025 Sales Event Top Deals And Where To Find Them

May 24, 2025

Memorial Day 2025 Sales Event Top Deals And Where To Find Them

May 24, 2025 -

Memorial Day Weekend Rain Forecast For New York City

May 24, 2025

Memorial Day Weekend Rain Forecast For New York City

May 24, 2025 -

The Stitchpossible Weekend A Look At Potential 2025 Box Office Success

May 24, 2025

The Stitchpossible Weekend A Look At Potential 2025 Box Office Success

May 24, 2025 -

Analyzing The Stitchpossible Phenomenon 2025 Box Office Projections

May 24, 2025

Analyzing The Stitchpossible Phenomenon 2025 Box Office Projections

May 24, 2025 -

Box Office Battle Stitchpossibles Potential For Record Breaking Weekend In 2025

May 24, 2025

Box Office Battle Stitchpossibles Potential For Record Breaking Weekend In 2025

May 24, 2025