Negative Close For Frankfurt DAX: Below 24,000 Points

Table of Contents

Factors Contributing to the DAX Decline

Several interconnected economic and geopolitical factors contributed to the DAX's sharp decline below 24,000 points. These factors combined to create a perfect storm of negative market sentiment.

-

Rising Inflation and Interest Rates: Persistent inflation in Germany and the Eurozone forced the European Central Bank (ECB) to implement aggressive interest rate hikes. These higher rates increase borrowing costs for businesses, hindering investment and potentially slowing economic growth. This directly impacts the profitability of companies listed on the DAX, leading to decreased stock prices.

-

Geopolitical Risks and Energy Crisis: The ongoing war in Ukraine continues to exert significant pressure on the global economy. The energy crisis, exacerbated by reduced Russian gas supplies, has created significant uncertainty and increased energy costs for German businesses, impacting their profitability and dampening investor confidence in the DAX.

-

Weak Earnings Reports: Several major German companies have released weaker-than-expected earnings reports in recent weeks, further contributing to the negative sentiment surrounding the DAX. These reports highlight the struggles businesses are facing in the current economic climate, impacting investor confidence.

-

Decreased Investor Confidence: The combination of inflation, rising interest rates, geopolitical instability, and weak earnings has significantly eroded investor confidence. This has led to increased risk aversion, prompting many investors to sell off their DAX holdings, driving the index below 24,000 points.

-

Specific Sectors Affected: The energy sector, in particular, has been severely impacted by the energy crisis, experiencing substantial losses. The technology sector also felt the pressure, with investor concerns over slowing growth affecting valuations.

Analysis of Trading Volume and Volatility

The session leading to the DAX closing below 24,000 points was characterized by [high/low – choose one based on actual data] trading volume and significant volatility.

- Trading Volume: [Describe the trading volume – e.g., High trading volume indicated a significant number of investors actively participating in the market, many likely selling their holdings.]

- Price Fluctuations: The DAX index experienced sharp price swings throughout the day, reflecting the uncertainty and nervousness in the market.

- Technical Analysis: [Mention specific chart patterns or technical indicators observed, such as a breakdown of a key support level, or bearish candlestick patterns, if applicable. Example: A clear break below the 24,000 support level triggered stop-loss orders, accelerating the decline.]

- Short Selling: Increased short-selling activity could have also amplified the downward pressure on the DAX, as investors bet against further declines in the index.

Impact on Investors and the German Economy

The Frankfurt DAX closing below 24,000 points has significant implications for investors and the German economy.

- Investor Losses: Investors holding DAX-related assets, including mutual funds and ETFs tracking the index, experienced substantial portfolio losses.

- Retirement Funds and Pension Plans: Many retirement funds and pension plans hold DAX-related investments, meaning the decline could impact the retirement savings of millions of Germans.

- Economic Consequences: A weakening DAX can signal broader economic slowdowns. Reduced investor confidence and decreased business investment could negatively impact German GDP growth.

- Market Outlook: Experts offer varying opinions on the short-term and long-term outlook. Some predict a continued decline, while others anticipate a potential rebound depending on economic and geopolitical developments.

- Government Intervention: The German government may implement measures to stimulate the economy and boost investor confidence, but the effectiveness of such measures remains uncertain.

Comparison with Other Major Indices

The decline in the Frankfurt DAX needs to be viewed within the context of global market performance. While [compare the DAX's performance to other major indices like the Dow Jones, FTSE 100, and S&P 500, noting whether they experienced similar declines or if the DAX's performance was particularly pronounced. Provide data points to support your comparison.], highlighting whether the decline was unique to the German market or part of a broader global trend.

Conclusion

The Frankfurt DAX closing below 24,000 points reflects a complex interplay of economic factors, geopolitical risks, and investor sentiment. Rising inflation, increasing interest rates, the ongoing war in Ukraine, and weak earnings reports all contributed to the negative close, impacting investors and raising concerns about the German economy. While the short-term outlook remains uncertain, understanding these contributing factors is crucial for navigating the current market conditions.

Call to Action: Stay updated on the latest developments in the Frankfurt DAX and make informed decisions regarding your investment strategies. Monitor the Frankfurt DAX closely for potential market reversals or continued negative trends. Consult with a qualified financial advisor before making any significant investment decisions related to the Frankfurt DAX or the broader German stock market. Careful analysis of market trends and economic indicators is vital for mitigating risk and making informed choices concerning your investments in the Frankfurt DAX.

Featured Posts

-

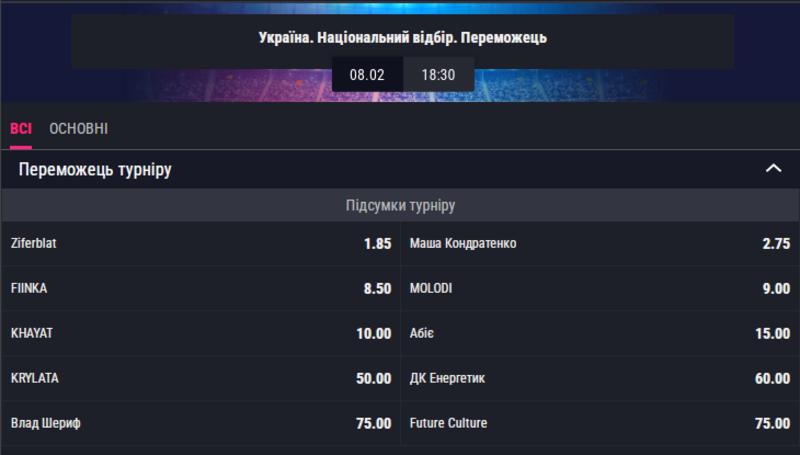

Prognoz Konchiti Vurst Peremozhtsi Yevrobachennya 2025

May 24, 2025

Prognoz Konchiti Vurst Peremozhtsi Yevrobachennya 2025

May 24, 2025 -

Escape To The Country Real Estate And Relocation Advice

May 24, 2025

Escape To The Country Real Estate And Relocation Advice

May 24, 2025 -

Confirmed Glastonbury 2025 Performers Olivia Rodrigo The 1975 And Legends

May 24, 2025

Confirmed Glastonbury 2025 Performers Olivia Rodrigo The 1975 And Legends

May 24, 2025 -

Experience The Ferrari Challenge Racing Days In South Florida

May 24, 2025

Experience The Ferrari Challenge Racing Days In South Florida

May 24, 2025 -

The Busiest Days To Fly Around Memorial Day 2025 A Travelers Guide

May 24, 2025

The Busiest Days To Fly Around Memorial Day 2025 A Travelers Guide

May 24, 2025

Latest Posts

-

Ai And The Future Of Healthcare Key Findings From The Philips Future Health Index 2025

May 24, 2025

Ai And The Future Of Healthcare Key Findings From The Philips Future Health Index 2025

May 24, 2025 -

Dutch Economy Feels The Heat Stocks Fall On Us Trade Dispute

May 24, 2025

Dutch Economy Feels The Heat Stocks Fall On Us Trade Dispute

May 24, 2025 -

Philips Future Health Index 2025 Urgent Call To Action On Ai In Healthcare

May 24, 2025

Philips Future Health Index 2025 Urgent Call To Action On Ai In Healthcare

May 24, 2025 -

Philips Future Health Index 2025 Ais Transformative Potential In Global Healthcare

May 24, 2025

Philips Future Health Index 2025 Ais Transformative Potential In Global Healthcare

May 24, 2025 -

Heinekens Strong Revenue Growth Outlook Unchanged Despite Tariff Challenges

May 24, 2025

Heinekens Strong Revenue Growth Outlook Unchanged Despite Tariff Challenges

May 24, 2025