Future Of Gaming Uncertain: FTC Challenges Microsoft-Activision Deal

Table of Contents

The FTC's Concerns: Stifling Competition and Monopolies

The FTC's core argument centers on the assertion that Microsoft's acquisition of Activision Blizzard would create an illegal monopoly, significantly harming competition and ultimately disadvantaging gamers. They argue this merger violates antitrust laws and would give Microsoft undue control over a significant portion of the gaming market. Specific concerns include:

- Control over key franchises: Activision Blizzard owns immensely popular franchises like Call of Duty, Candy Crush, and World of Warcraft. Microsoft acquiring these would give them an unfair competitive advantage.

- Potential exclusion of competitors from Game Pass: The FTC worries Microsoft could leverage Game Pass, its subscription service, to exclude rival games and consolidate market power. This could limit consumer choice and stifle innovation from smaller developers.

- Higher prices for gamers: Reduced competition often leads to higher prices for consumers. The FTC argues that Microsoft's control over key titles could result in price increases for games and subscriptions.

- Reduced innovation due to lack of competition: A lack of competition can stifle innovation. Without the pressure of rivals, Microsoft might have less incentive to improve its games or services.

The FTC's proposed remedies likely involve either blocking the acquisition entirely or demanding significant concessions from Microsoft to mitigate the competitive concerns. [Link to relevant FTC document]. The FTC's case hinges on demonstrating significant "monopoly power" and "competitive harm" resulting from the merger.

Microsoft's Defense: Synergies, Innovation, and Consumer Benefits

Microsoft counters the FTC's claims, arguing that the acquisition will foster innovation, expand access to games through Game Pass, and ultimately benefit consumers. Their defense rests on several key pillars:

- Expansion of Game Pass with Activision Blizzard titles: Microsoft emphasizes the addition of popular Activision Blizzard titles to Game Pass, expanding its library and offering greater value to subscribers. This, they argue, increases consumer choice.

- Increased investment in game development: Microsoft promises increased investment in the development of Activision Blizzard games, leading to higher-quality titles and more innovative gameplay.

- Bringing games to more platforms: Microsoft contends the acquisition will lead to wider availability of games across various platforms, potentially benefiting a larger gaming audience.

- Commitment to keeping Call of Duty on PlayStation: A crucial element of Microsoft's defense is its repeated commitment to keeping Call of Duty available on PlayStation, directly addressing the FTC's concerns about exclusivity.

Microsoft executives have repeatedly stressed the "synergies" between their company and Activision Blizzard, emphasizing the potential for innovation and improved consumer experiences. [Link to Microsoft statement].

The Potential Outcomes and Implications for the Gaming Industry

Several scenarios could unfold following the FTC's challenge:

- FTC blocking the acquisition: This outcome would be a significant setback for Microsoft and could set a precedent for future large-scale mergers in the tech industry.

- FTC accepting the acquisition with conditions: The FTC might approve the merger but only if Microsoft agrees to specific conditions, such as divesting certain assets or making commitments regarding pricing and platform availability.

- Microsoft winning the case: If Microsoft wins, it would signal a less interventionist approach to mergers in the gaming sector, potentially leading to further consolidation of the market.

Each outcome has significant implications for:

- Game prices: A blocked merger might lead to continued price competition, while an unfettered merger could lead to price increases.

- Game availability: The availability of specific titles and the expansion of subscription services will be directly affected by the court's decision.

- Competition in the gaming market: The degree of competition will vary dramatically depending on the outcome, influencing innovation and consumer choice.

- The future of cloud gaming: The future direction of cloud gaming, a rapidly growing sector, will be influenced by the resulting market structure. The impact on "market share" and "gaming market consolidation" is crucial to consider. "Merger control" and "regulatory approval" are central to the whole process.

The Role of Call of Duty in the Debate

The Call of Duty franchise plays a central role in this dispute. Its massive market dominance makes it a key factor in assessing the potential for anti-competitive behavior. Microsoft's control of Call of Duty could allow them to leverage its popularity to gain an unfair advantage, potentially impacting other game developers and potentially leading to exclusive deals, impacting competition significantly.

Conclusion: The Future of Gaming Remains Uncertain

The FTC's challenge to the Microsoft Activision Blizzard acquisition presents a pivotal moment for the gaming industry. The FTC’s concerns about stifled competition and the creation of a monopoly are significant, while Microsoft’s defense emphasizes innovation and consumer benefits. The outcome will have far-reaching implications for game prices, availability, and the overall competitive landscape. The uncertainty surrounding this case underscores the importance of following its progression. Stay informed about the future of the Microsoft Activision Blizzard acquisition and its effects on the future of gaming. Keep an eye on this crucial "FTC antitrust case" and its impact on the "Microsoft Activision deal" and the "gaming industry future."

Featured Posts

-

Christina Aguilera Photoshopped Photos Spark Fan Outrage

May 02, 2025

Christina Aguilera Photoshopped Photos Spark Fan Outrage

May 02, 2025 -

Juridische Strijd Kampen Vecht Voor Stroomnetaansluiting Via Kort Geding

May 02, 2025

Juridische Strijd Kampen Vecht Voor Stroomnetaansluiting Via Kort Geding

May 02, 2025 -

Izletes Es Kivalo Minosegu Baromfi Kme Vedjegy A Garancia

May 02, 2025

Izletes Es Kivalo Minosegu Baromfi Kme Vedjegy A Garancia

May 02, 2025 -

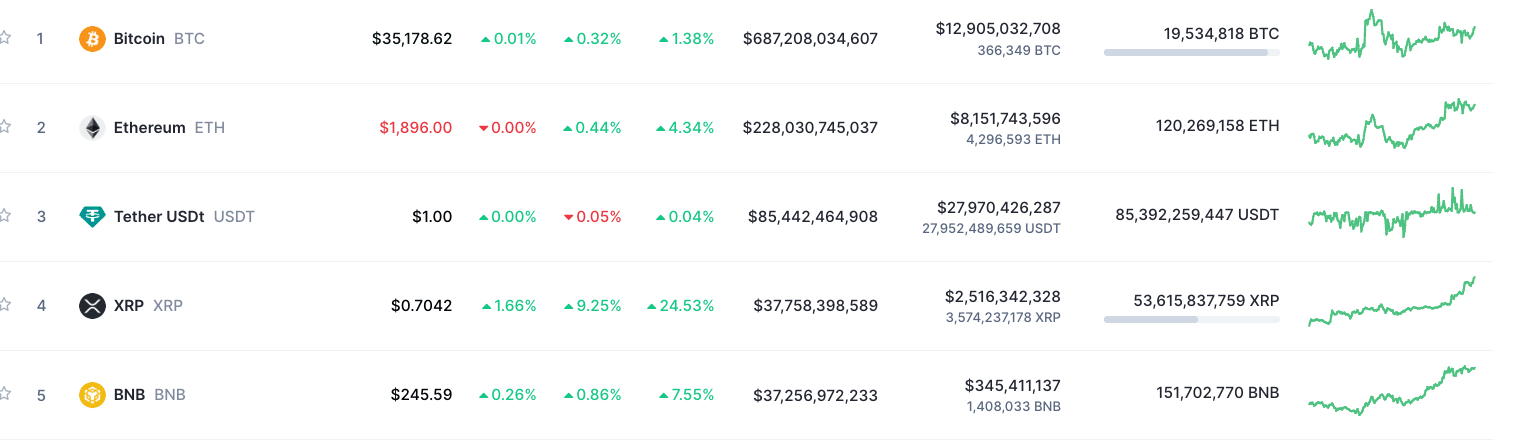

Could Xrps Rise To Fourth Largest Cryptocurrency Make You Rich

May 02, 2025

Could Xrps Rise To Fourth Largest Cryptocurrency Make You Rich

May 02, 2025 -

Is Fortnite Down Investigating Chapter 6 Season 2 Lawless Update Issues

May 02, 2025

Is Fortnite Down Investigating Chapter 6 Season 2 Lawless Update Issues

May 02, 2025

Latest Posts

-

London Fashion Week Kate And Lila Moss Twin In Elegant Lbds

May 02, 2025

London Fashion Week Kate And Lila Moss Twin In Elegant Lbds

May 02, 2025 -

Legendary Band Plays Only Under Life Or Death Circumstances

May 02, 2025

Legendary Band Plays Only Under Life Or Death Circumstances

May 02, 2025 -

Infuriating Glastonbury Stage Time Clashes Fan Reactions

May 02, 2025

Infuriating Glastonbury Stage Time Clashes Fan Reactions

May 02, 2025 -

Dublin Concert Loyle Carner At The 3 Arena

May 02, 2025

Dublin Concert Loyle Carner At The 3 Arena

May 02, 2025 -

Glastonbury 2024 Scheduling Conflicts Spark Fan Anger

May 02, 2025

Glastonbury 2024 Scheduling Conflicts Spark Fan Anger

May 02, 2025