FTC Appeals Activision Blizzard Merger Ruling: Microsoft Deal Uncertain

Table of Contents

The FTC's Arguments Against the Merger

The FTC's core concern revolves around Microsoft's potential to monopolize the gaming market by leveraging its acquisition of Activision Blizzard. Their primary argument centers on the potential for Microsoft to make key Activision Blizzard titles, most notably Call of Duty, exclusive to its Xbox ecosystem. This, they argue, would stifle competition and harm consumers.

- Loss of Competition in the Console Market: The FTC contends that the merger would significantly reduce competition in the console market, giving Microsoft an unfair advantage over competitors like Sony and Nintendo.

- Potential Harm to Players: The FTC argues that the merger could lead to higher prices for games, reduced game choices for consumers, and a less innovative gaming market overall.

- Concerns about Microsoft's Market Dominance: The FTC expresses concern about Microsoft's already substantial market share and the potential for the Activision Blizzard acquisition to further consolidate its power, creating a near-monopoly.

The FTC presented substantial evidence, including market share data and analysis of Microsoft's past acquisitions, to support its claim that the merger would be anti-competitive. They highlighted Microsoft’s history and its potential to leverage its vast resources to disadvantage competitors.

The Judge's Ruling and its Implications

A federal judge initially ruled against the FTC's attempt to block the acquisition, finding that the commission failed to convincingly demonstrate that the merger would substantially lessen competition.

- Summary of the Judge's Reasoning: The judge's decision emphasized the lack of sufficient evidence to prove that Microsoft would make Call of Duty exclusive to Xbox. The judge also considered Microsoft's proposed agreements to keep Call of Duty available on other platforms.

- Points Where the Judge Disagreed with the FTC's Arguments: The judge disagreed with the FTC's assessment of the market's competitive landscape and the likelihood of Microsoft abusing its market power.

- Significant Legal Precedents: The ruling referenced several legal precedents concerning mergers and acquisitions, highlighting the high bar required to prove anti-competitive behavior.

This initial ruling sent shockwaves through the tech industry, raising questions about the effectiveness of antitrust enforcement in the rapidly evolving digital marketplace. The implications extended beyond the immediate players, influencing how future large-scale tech mergers might be evaluated.

The FTC's Appeal and its Potential Outcomes

Undeterred by the initial setback, the FTC appealed the judge's decision, arguing that the court erred in its assessment of the evidence and the potential anti-competitive effects of the merger.

- Timeline for the Appeal Process: The appeal process is expected to be lengthy and complex, potentially taking several months or even years to resolve.

- Potential Outcomes: The possible outcomes include a successful appeal, leading to a blocked merger; a dismissal of the appeal, allowing the merger to proceed; or a negotiated settlement between the FTC and Microsoft.

- Impact on Microsoft's Plans and Stock Price: The uncertainty surrounding the appeal has undoubtedly impacted Microsoft's plans and its stock price, reflecting the considerable financial stakes involved.

Legal experts offer diverse opinions on the likelihood of the FTC's success on appeal, with some arguing that the FTC needs to present stronger evidence, while others believe the appeal has a reasonable chance of success given the potential impact on the market.

The Role of Call of Duty in the Debate

Call of Duty stands as the central focus of the antitrust debate. Its immense popularity and market dominance make it a critical factor in determining the potential anti-competitive effects of the merger.

- Call of Duty's Market Share and Influence: Call of Duty consistently ranks among the top-selling video games globally, wielding considerable influence over the gaming landscape.

- Microsoft's Proposed Agreements Regarding Call of Duty Availability: Microsoft has offered agreements to maintain Call of Duty availability on other platforms, attempting to allay concerns about exclusivity.

- Analysis of the Credibility of These Proposed Agreements: The credibility of these agreements and their enforceability are key aspects of the legal battle, with the FTC questioning their long-term viability.

The arguments surrounding Call of Duty's exclusivity highlight the complexities of balancing innovation and competition in the dynamic world of gaming.

Conclusion

The FTC's appeal of the Activision Blizzard merger ruling creates substantial uncertainty. The outcome will establish a significant precedent for future mega-mergers in the tech sector and will significantly shape the competitive dynamics of the console gaming market. The debate over Call of Duty's potential exclusivity remains central to the arguments. Monitoring the progress of this crucial legal battle concerning the Activision Blizzard merger is essential for anyone invested in the future of gaming. Stay informed and follow the updates as this significant case unfolds.

Featured Posts

-

Palavra De Amorim Bruno Fernandes Imovel No Manchester United

May 30, 2025

Palavra De Amorim Bruno Fernandes Imovel No Manchester United

May 30, 2025 -

Andre Agassis Professional Pickleball Debut Tournament Details

May 30, 2025

Andre Agassis Professional Pickleball Debut Tournament Details

May 30, 2025 -

Middle School Track Meet In Des Moines Canceled Following Nearby Shooting

May 30, 2025

Middle School Track Meet In Des Moines Canceled Following Nearby Shooting

May 30, 2025 -

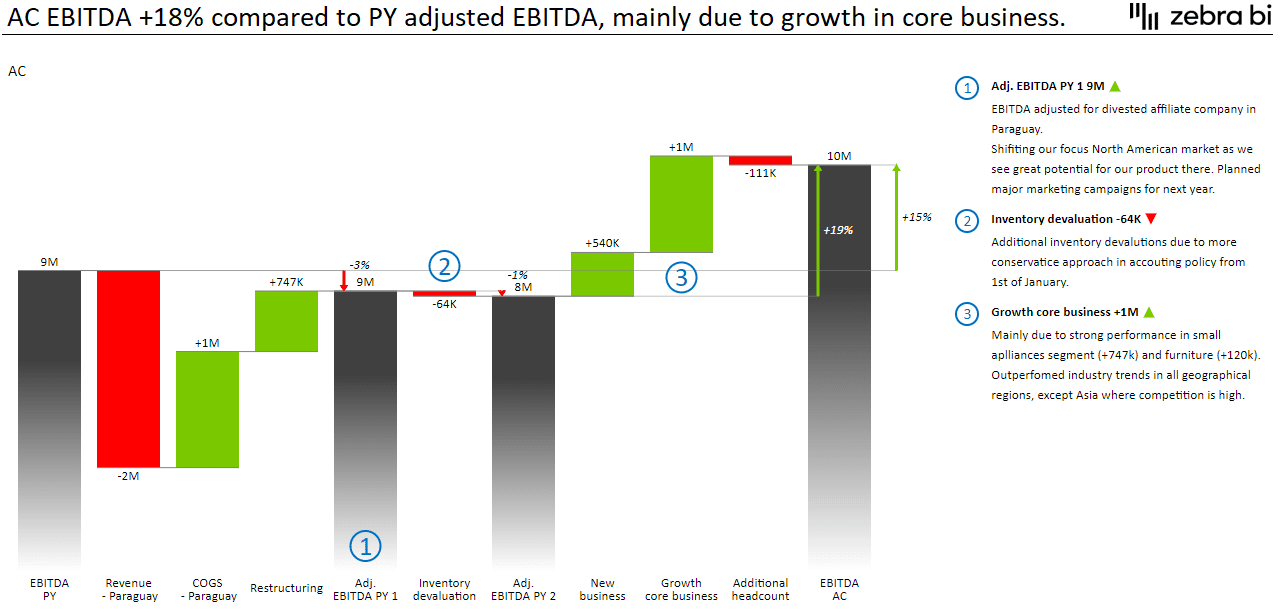

Cts Eventim Q1 Results Significant Increase In Adjusted Ebitda And Revenue

May 30, 2025

Cts Eventim Q1 Results Significant Increase In Adjusted Ebitda And Revenue

May 30, 2025 -

Data Center Security Breach Deutsche Bank Contractor And Unauthorized Access

May 30, 2025

Data Center Security Breach Deutsche Bank Contractor And Unauthorized Access

May 30, 2025

Latest Posts

-

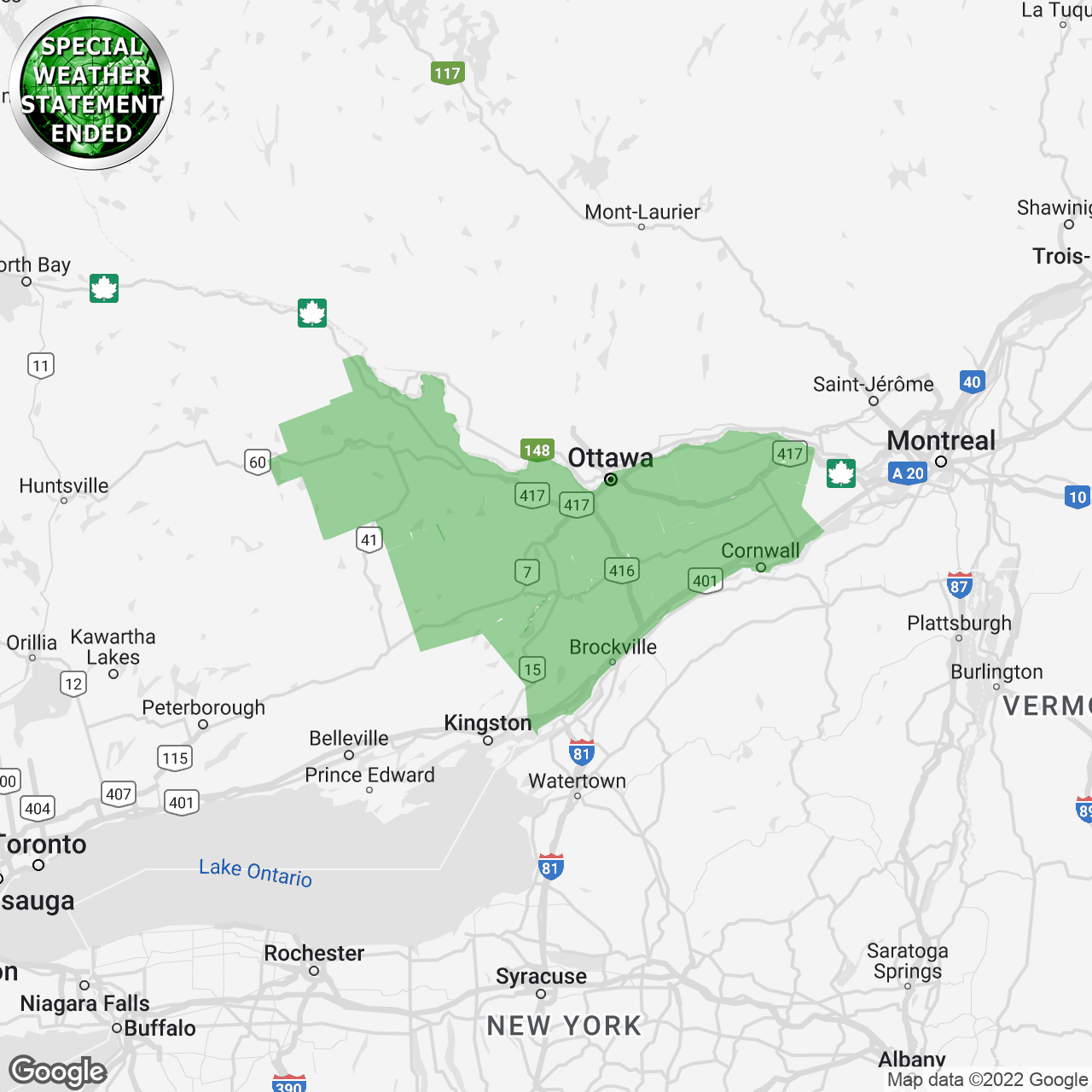

Special Weather Statement Increased Fire Risk In Cleveland And Akron

May 31, 2025

Special Weather Statement Increased Fire Risk In Cleveland And Akron

May 31, 2025 -

Increased Fire Risk Prompts Special Weather Statement In Cleveland Akron

May 31, 2025

Increased Fire Risk Prompts Special Weather Statement In Cleveland Akron

May 31, 2025 -

Northeast Ohio Weather Forecast Thursday Rain Returns

May 31, 2025

Northeast Ohio Weather Forecast Thursday Rain Returns

May 31, 2025 -

Cleveland And Akron Special Weather Statement High Fire Danger

May 31, 2025

Cleveland And Akron Special Weather Statement High Fire Danger

May 31, 2025 -

Elevated Fire Risk Special Weather Statement For Cleveland And Akron

May 31, 2025

Elevated Fire Risk Special Weather Statement For Cleveland And Akron

May 31, 2025