Front-Loading Strategies Mitigate Malaysian Ringgit (MYR) Risks For Exporters

Table of Contents

Understanding MYR Exchange Rate Volatility and its Impact on Exporters

The MYR's value is influenced by a complex interplay of global and local factors. Global economic conditions, particularly shifts in investor sentiment and commodity prices (as Malaysia is a significant commodity exporter), play a crucial role. Interest rate differentials between Malaysia and other major economies also influence the MYR's exchange rate. Furthermore, political stability and domestic economic performance impact investor confidence and, consequently, the Ringgit's value.

MYR depreciation significantly hurts exporters. A weaker Ringgit means that revenue earned in foreign currencies translates into fewer Malaysian Ringgit, directly impacting profit margins. This loss of competitiveness can lead to losing contracts to rivals from countries with more stable currencies. Proactive risk management is therefore crucial for mitigating these negative consequences.

- Decreased revenue in MYR: Currency fluctuations directly reduce the MYR value of export earnings.

- Difficulty in accurate financial forecasting: Unpredictable exchange rates make long-term financial planning challenging.

- Potential loss of contracts: Price instability due to MYR volatility can make Malaysian exporters less attractive to international buyers.

What is Front-Loading and How Does it Work for MYR Risk Mitigation?

Front-loading, in the context of foreign exchange risk management, involves accelerating the receipt of payments from export sales. This strategy aims to secure revenue earlier, ideally before significant MYR depreciation occurs. By locking in favorable exchange rates, exporters can protect their profit margins from adverse currency movements.

Exporters can implement front-loading through several practical steps:

- Negotiating earlier payment schedules with buyers: Agreeing on shorter payment terms, such as 30-day payment instead of 90-day payment, significantly reduces exposure to currency fluctuations.

- Adjusting pricing strategies: Build potential MYR depreciation into the pricing strategy to offset future losses.

- Utilizing forward contracts: These contracts lock in a specific exchange rate for a future transaction, hedging against potential depreciation.

- Exploring options like early shipment of goods: Shipping goods earlier than originally planned allows for quicker payment receipt.

Other Complementary Strategies to Enhance MYR Risk Management

While front-loading is a powerful tool, combining it with other risk mitigation techniques enhances its effectiveness. Diversification, for instance, spreads risk across multiple markets and customer bases. Hedging strategies using financial instruments like currency futures, options, and swaps offer further protection against adverse currency movements. Furthermore, seeking professional advice from financial institutions specializing in foreign exchange risk management is highly recommended.

- Currency hedging instruments: Options, forwards, and futures contracts offer sophisticated ways to manage currency risk.

- Diversification of export markets and customer base: Reduces reliance on single markets and mitigates risk associated with individual buyer defaults or market fluctuations.

- Seeking professional advice from financial institutions: Experts can provide tailored solutions and risk management strategies.

- Regular monitoring of the MYR exchange rate: Staying informed about market trends is essential for making timely decisions.

Case Studies: Successful Front-Loading Implementation by Malaysian Exporters

While specific company details are often confidential, anecdotal evidence suggests successful front-loading implementation across various sectors. For example, a Malaysian palm oil exporter (Company A) successfully negotiated shorter payment terms with key buyers in China. This reduced their MYR exposure, resulting in a 15% increase in profit margins during a period of significant Ringgit depreciation. Similarly, a technology company (Company B) utilized forward contracts to hedge against currency risks, securing a stable exchange rate for a large export order to Japan, protecting their revenue stream. These examples highlight the tangible benefits of proactive risk management through front-loading strategies.

Secure Your Export Profits: Mastering Front-Loading Strategies for MYR Risk

Effectively managing MYR exchange rate risk is paramount for Malaysian exporters seeking sustained profitability and growth. Front-loading strategies, when implemented strategically and complemented by other risk mitigation techniques like diversification and hedging, offer a powerful approach to securing export revenue. Proactive risk management, combined with a thorough understanding of the factors influencing the MYR exchange rate, is crucial for navigating the complexities of the global market. Contact a financial advisor today to learn more about implementing effective front-loading strategies for your Malaysian export business and minimizing your MYR risk. Alternatively, download our free guide on mitigating Malaysian Ringgit (MYR) risks for exporters.

Featured Posts

-

John Wick 5 Update Thrilling Developments Release Date A Mystery

May 07, 2025

John Wick 5 Update Thrilling Developments Release Date A Mystery

May 07, 2025 -

Mariners Spectacular Catch Outfielders Dedication Against Giants

May 07, 2025

Mariners Spectacular Catch Outfielders Dedication Against Giants

May 07, 2025 -

10 Week High Broken Is Bitcoins Us 100 000 Target Achievable

May 07, 2025

10 Week High Broken Is Bitcoins Us 100 000 Target Achievable

May 07, 2025 -

The Key To Marital Success Lessons From Ralph Macchio

May 07, 2025

The Key To Marital Success Lessons From Ralph Macchio

May 07, 2025 -

Xrp To 5 In 2025 A Comprehensive Look At The Possibilities

May 07, 2025

Xrp To 5 In 2025 A Comprehensive Look At The Possibilities

May 07, 2025

Latest Posts

-

De Andre Jordans Historic Performance Nuggets Vs Bulls

May 08, 2025

De Andre Jordans Historic Performance Nuggets Vs Bulls

May 08, 2025 -

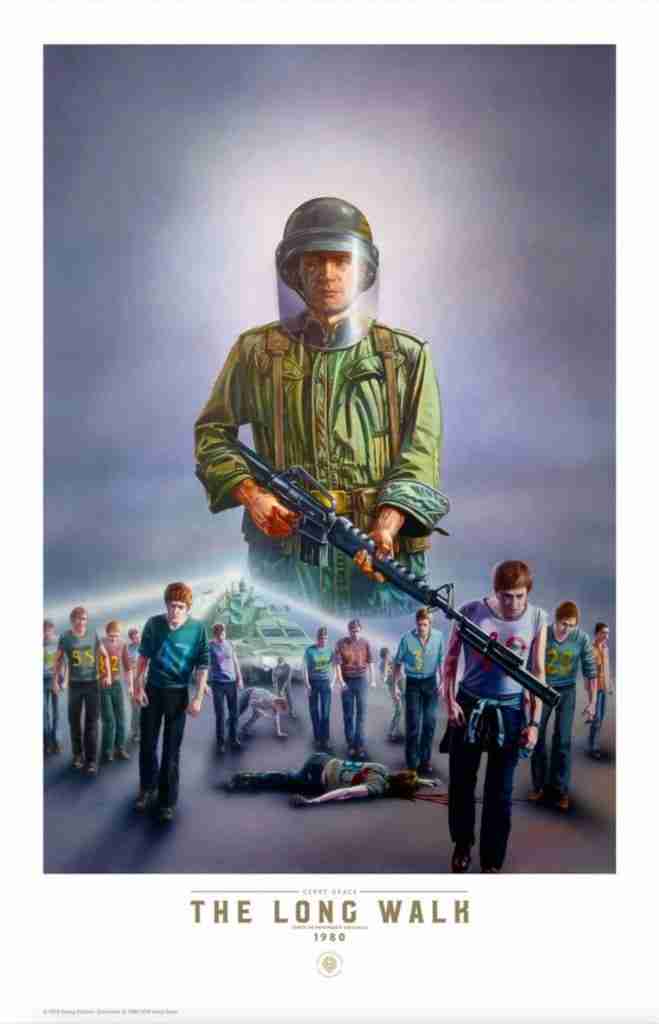

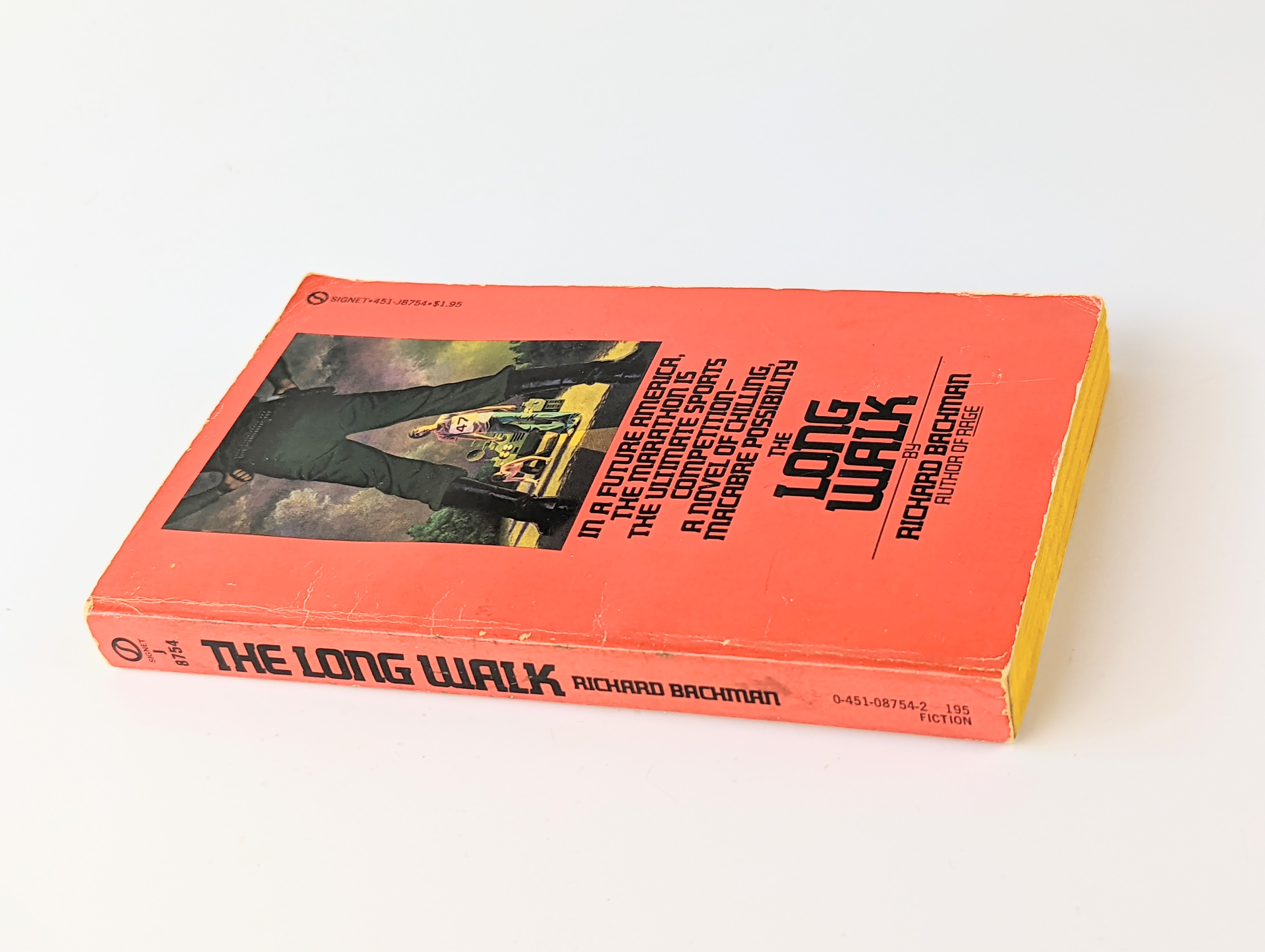

The Long Walk Stephen King Adaptation Official Trailer Debuts

May 08, 2025

The Long Walk Stephen King Adaptation Official Trailer Debuts

May 08, 2025 -

Stephen Kings The Long Walk First Trailer Released

May 08, 2025

Stephen Kings The Long Walk First Trailer Released

May 08, 2025 -

The Long Walk Trailer Mark Hamills Departure From Luke Skywalker

May 08, 2025

The Long Walk Trailer Mark Hamills Departure From Luke Skywalker

May 08, 2025 -

Mark Hamills The Long Walk A Stephen King Adaptation Trailer Breakdown

May 08, 2025

Mark Hamills The Long Walk A Stephen King Adaptation Trailer Breakdown

May 08, 2025