10-Week High Broken: Is Bitcoin's US$100,000 Target Achievable?

Table of Contents

Factors Supporting Bitcoin Reaching US$100,000

Several significant factors contribute to the ongoing discussion surrounding Bitcoin's US$100,000 target. Let's examine some key drivers:

Increasing Institutional Adoption

The growing involvement of institutional investors is a significant bullish signal for Bitcoin. Large corporations and investment firms are increasingly viewing Bitcoin as a valuable asset, bolstering its credibility and driving up demand.

- MicroStrategy's significant Bitcoin holdings: MicroStrategy, a business intelligence company, has made substantial investments in Bitcoin, showcasing its belief in the cryptocurrency's long-term potential. Their strategic approach has significantly influenced market sentiment.

- Tesla's foray into Bitcoin: Elon Musk's Tesla also invested heavily in Bitcoin, initially causing a significant price surge. While they later sold a portion of their holdings, their initial investment remains a landmark event for institutional adoption.

- Increased participation from hedge funds and pension funds: Many traditional financial institutions are now allocating a portion of their portfolios to Bitcoin, viewing it as a hedge against inflation and a potential diversification strategy. This increasing institutional adoption of Bitcoin significantly impacts the overall market sentiment and price action. This increased institutional interest in Bitcoin is a key factor in the ongoing discussion about Bitcoin's US$100,000 target.

Growing Global Demand and Scarcity

Bitcoin's inherent scarcity is a fundamental factor driving its value. With a fixed supply of only 21 million coins, increasing global demand naturally leads to price appreciation.

- Global adoption is on the rise: Countries worldwide are exploring and implementing Bitcoin and other cryptocurrencies into their financial systems, demonstrating growing acceptance and usage.

- Limited supply creates scarcity: The finite nature of Bitcoin contrasts sharply with traditional fiat currencies, which can be printed indefinitely. This scarcity creates a strong foundation for long-term value appreciation.

- Growing adoption in emerging markets: Developing nations are increasingly embracing Bitcoin as a means of payment, store of value, and a way to bypass traditional financial institutions. This factor contributes to the overall increasing demand for Bitcoin. The limited supply and ever-growing demand continue to fuel the conversation surrounding Bitcoin's US$100,000 target.

Technological Advancements and Network Upgrades

Ongoing improvements to Bitcoin's underlying technology enhance its scalability and efficiency, further supporting its price.

- The Lightning Network: This second-layer scaling solution significantly improves transaction speed and reduces fees, making Bitcoin more practical for everyday use.

- Taproot upgrade: This upgrade improves Bitcoin's privacy and smart contract capabilities, opening up new possibilities for developers and users.

- Ongoing development and community support: A robust and active developer community continuously works on improving Bitcoin's functionality and security, further strengthening its long-term prospects. These technological advancements are crucial factors to consider when discussing Bitcoin's potential to reach its US$100,000 target.

Challenges Hindering Bitcoin's US$100,000 Target

Despite the positive factors, several challenges could hinder Bitcoin's journey to US$100,000.

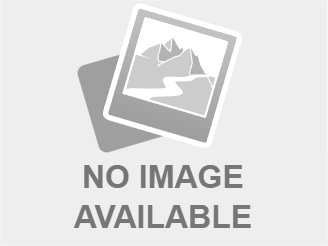

Regulatory Uncertainty and Government Intervention

Government regulations worldwide significantly impact Bitcoin's price and overall market stability.

- Varying regulatory approaches: Different countries have adopted varying regulatory frameworks, creating uncertainty and potentially hindering growth.

- Increased scrutiny from financial regulators: Governments are increasingly scrutinizing the cryptocurrency market, leading to potential restrictions and regulations.

- Taxation and compliance issues: The tax implications of Bitcoin trading and investment remain unclear in many jurisdictions, creating uncertainty for investors. Regulatory uncertainty surrounding Bitcoin remains a significant hurdle to consider when predicting if the US$100,000 target is achievable.

Market Volatility and Price Corrections

Bitcoin is known for its volatility, and significant price corrections are a recurring feature of the cryptocurrency market.

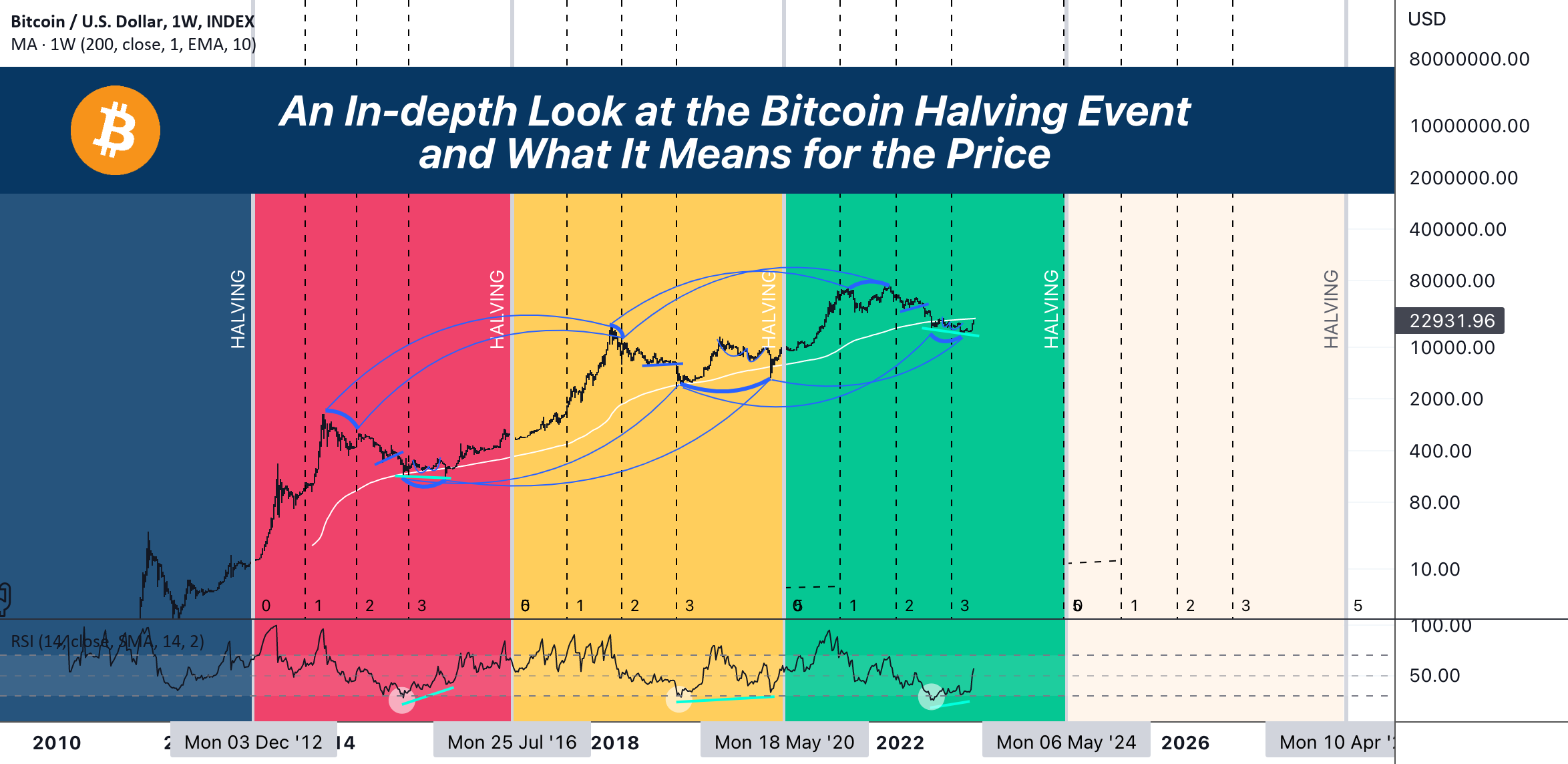

- Historical price swings: Bitcoin's history is marked by periods of dramatic price increases followed by sharp declines.

- Market cycles and bear markets: Bitcoin typically follows cyclical patterns, with periods of significant growth followed by corrections.

- Risk management is crucial: Investors need to be aware of the inherent risks and volatility before investing in Bitcoin. Understanding the market cycles and implementing effective risk management strategies are essential. The volatility inherent in the cryptocurrency market is a significant challenge that needs to be considered when discussing Bitcoin's US$100,000 target.

Competition from Other Cryptocurrencies

The cryptocurrency market is not limited to Bitcoin; numerous altcoins offer alternative functionalities and attract significant investor interest.

- Rise of Ethereum and other smart contract platforms: Ethereum and other platforms provide decentralized application (dApp) development capabilities, attracting significant attention and investment.

- Competition for market share: Bitcoin faces competition from other cryptocurrencies for investor attention and market dominance.

- Innovation in the altcoin space: The rapid pace of innovation in the cryptocurrency space means new and potentially disruptive technologies could emerge, challenging Bitcoin's dominance. The competitive landscape within the cryptocurrency market is a factor to consider when assessing Bitcoin's US$100,000 target.

Conclusion

The question of whether Bitcoin will reach US$100,000 remains a complex one. While factors such as increasing institutional adoption, growing global demand, and technological advancements provide strong support, challenges like regulatory uncertainty, market volatility, and competition from other cryptocurrencies cannot be ignored. A balanced perspective acknowledges both the potential and the risks involved. While the path to Bitcoin's US$100,000 target is uncertain, understanding the factors at play is crucial. Stay informed, conduct your own research, and make informed decisions about your Bitcoin investments. Remember to carefully consider all aspects before investing in Bitcoin or any other cryptocurrency.

Featured Posts

-

Sustainable Transformation In Ldcs Fostering Resilience Through Strategic Interventions

May 07, 2025

Sustainable Transformation In Ldcs Fostering Resilience Through Strategic Interventions

May 07, 2025 -

Microsoft Activision Merger Ftc Files Appeal Against Court Decision

May 07, 2025

Microsoft Activision Merger Ftc Files Appeal Against Court Decision

May 07, 2025 -

Gears Of War Remaster Officially Announced For Play Station And Xbox

May 07, 2025

Gears Of War Remaster Officially Announced For Play Station And Xbox

May 07, 2025 -

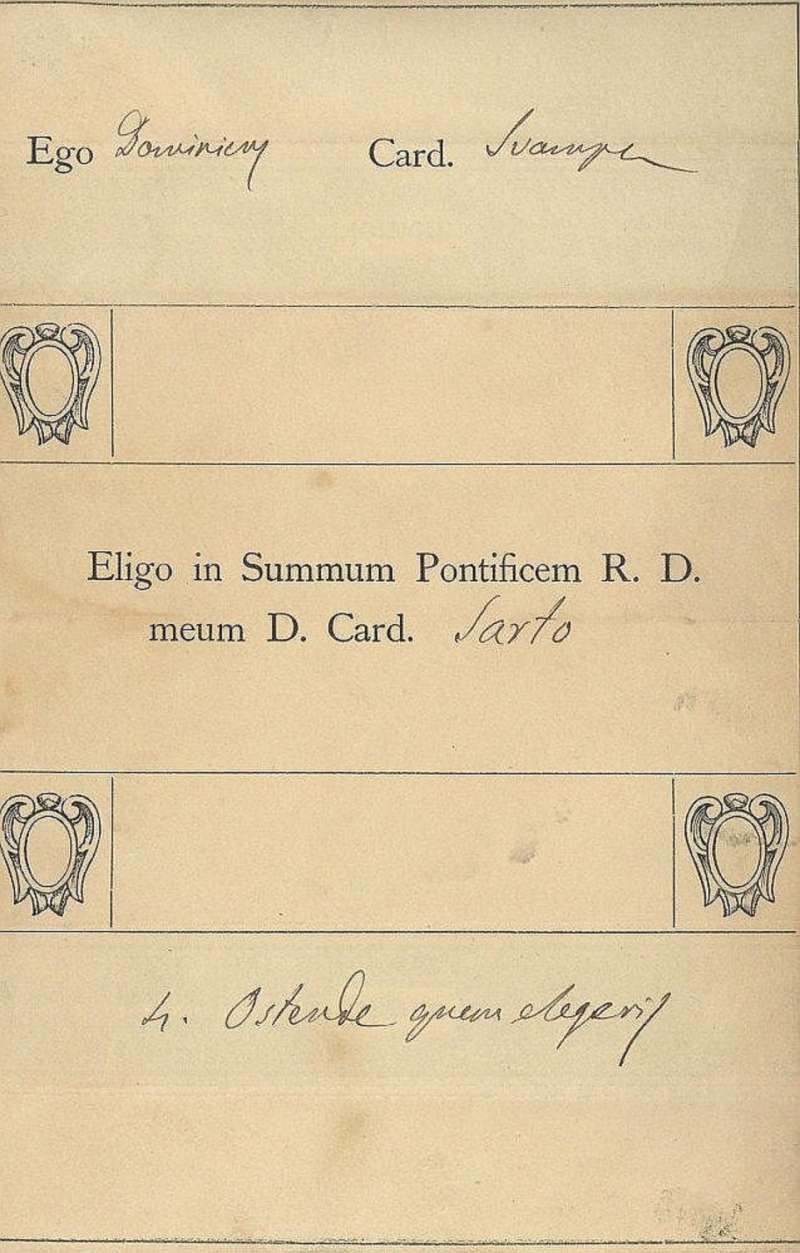

The Conclave Process And Procedures For Electing The Pope

May 07, 2025

The Conclave Process And Procedures For Electing The Pope

May 07, 2025 -

Lewis Capaldi Performs For The First Time Since 2023 At Tom Walkers Charity Concert

May 07, 2025

Lewis Capaldi Performs For The First Time Since 2023 At Tom Walkers Charity Concert

May 07, 2025

Latest Posts

-

76

May 08, 2025

76

May 08, 2025 -

2 0 76

May 08, 2025

2 0 76

May 08, 2025 -

76 2 0

May 08, 2025

76 2 0

May 08, 2025 -

The Night Inter Milan Beat Barcelona To Reach The Champions League Final

May 08, 2025

The Night Inter Milan Beat Barcelona To Reach The Champions League Final

May 08, 2025 -

Inters All Time Victory Reaching The Champions League Final By Defeating Barcelona

May 08, 2025

Inters All Time Victory Reaching The Champions League Final By Defeating Barcelona

May 08, 2025