Frankfurt Stock Market Closes Lower: DAX Below 24,000 Points

Table of Contents

Factors Contributing to the DAX Decline

Several interconnected factors contributed to the DAX's decline, creating a perfect storm of negative market sentiment.

Global Economic Uncertainty

The current global economic landscape is marked by considerable uncertainty, significantly impacting investor confidence and the Frankfurt Stock Market.

- Increased Inflation: Persistent high inflation rates in major economies, such as the US and UK, are eroding purchasing power and prompting central banks to aggressively raise interest rates. This increases borrowing costs for businesses, hindering investment and potentially slowing economic growth.

- Rising Interest Rates: The Federal Reserve and other central banks' efforts to combat inflation through interest rate hikes are dampening investor enthusiasm. Higher interest rates make borrowing more expensive, reducing corporate investment and potentially leading to slower economic growth. This directly affects the profitability of companies listed on the Frankfurt Stock Market.

- Geopolitical Tensions: The ongoing war in Ukraine, the energy crisis in Europe, and other geopolitical tensions create instability and uncertainty, prompting investors to seek safer havens for their capital, thus impacting the DAX. The disruption of global supply chains further exacerbates this uncertainty.

- The war in Ukraine has significantly impacted energy prices, impacting German businesses heavily reliant on Russian energy imports.

- Global supply chain disruptions have led to increased production costs and reduced availability of goods, impacting corporate profitability.

- The strengthening US Dollar: A strong US dollar makes Eurozone exports more expensive, negatively impacting the profitability of German companies that heavily rely on international trade.

Weak Corporate Earnings

Disappointing earnings reports from several key DAX companies have further fueled the market's downturn.

- Several large German companies reported lower-than-expected profits in their recent quarterly earnings releases, contributing to the negative sentiment. Specific examples should be cited here with links to relevant financial news sources. (e.g., "Volkswagen's Q3 results fell short of analyst expectations, contributing to a 2% drop in its share price.")

- Supply chain disruptions continue to plague many industries, impacting production efficiency and increasing costs, leading to reduced profitability for several DAX-listed companies.

- The ongoing energy crisis has dramatically increased energy costs for many businesses, squeezing profit margins.

Investor Sentiment and Market Volatility

The combination of global uncertainty and weak corporate earnings has led to increased risk aversion among investors.

- Many investors are shifting their investments from riskier assets, such as stocks listed on the Frankfurt Stock Market, to safer havens like government bonds.

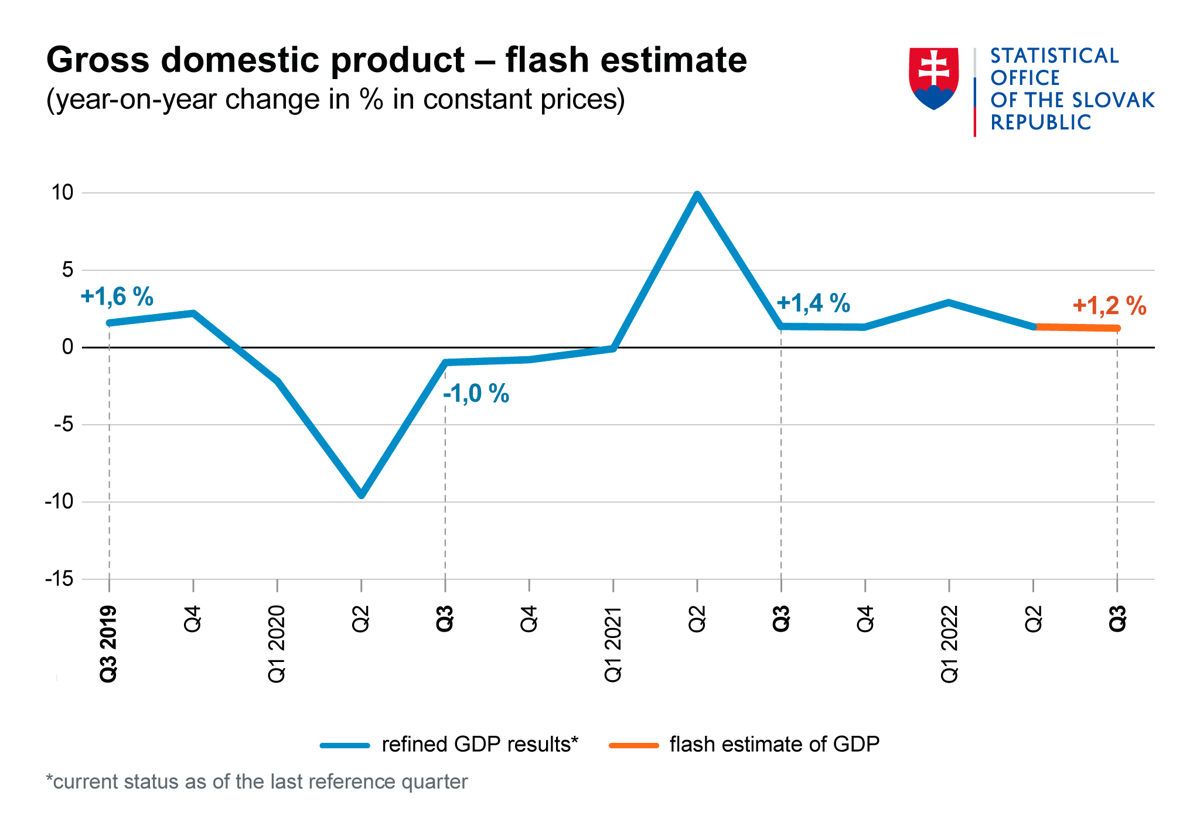

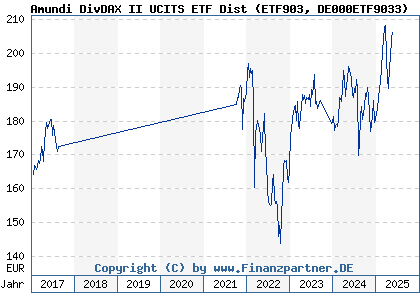

- The DAX has experienced increased volatility in recent weeks, reflecting the uncertainty and fear in the market. (A chart visualizing the DAX's volatility would be beneficial here).

- Trading volume has been relatively high, indicating significant activity and nervousness among investors. This high volume reflects the uncertainty in the market and the resulting trading activity of investors hedging their positions or taking profits.

Impact on the German Economy

The decline in the Frankfurt Stock Market and the DAX has significant implications for the German economy.

Consumer Confidence

The falling stock market can negatively affect consumer confidence, leading to reduced spending and impacting overall economic growth. Uncertainty in the markets can make consumers hesitant to spend, impacting retail sales and other consumer-driven industries.

Investment Decisions

The current market downturn could discourage both domestic and foreign investment in Germany, potentially hindering future economic growth. Businesses may postpone expansion plans or reduce investment in new projects due to the uncertain economic outlook.

Government Response

The German government may implement policy measures to mitigate the impact of the market decline on the economy. This could include fiscal stimulus packages or other measures to support businesses and boost consumer confidence. Observing government statements and announcements is essential to understanding the potential policy responses.

Outlook for the Frankfurt Stock Market

The outlook for the Frankfurt Stock Market remains uncertain, although a combination of factors could trigger a rebound.

Analyst Predictions

Analyst predictions vary, with some suggesting a potential continued downturn, while others anticipate a recovery in the coming months. It's crucial to reference reputable sources for analyst forecasts and opinions.

Potential Recovery Factors

Several factors could contribute to a market rebound:

- Easing inflation: A significant decrease in inflation could improve investor sentiment and encourage investment.

- Improved corporate earnings: Strong corporate earnings reports could boost investor confidence and drive up stock prices.

- Government intervention: Government policies aimed at stimulating economic growth could positively impact the market.

Investment Strategies

Investors should adopt a cautious approach and consider diversifying their portfolios to mitigate risk. Consulting a financial advisor is highly recommended for personalized investment advice.

Conclusion

The Frankfurt Stock Market's decline, with the DAX closing below 24,000 points, reflects a complex interplay of global and domestic factors. Global economic uncertainty, weak corporate earnings, and shifting investor sentiment have all contributed to this downturn. While the short-term outlook remains uncertain, understanding these contributing factors is crucial for navigating the current market volatility. Stay informed about the Frankfurt Stock Market and the DAX index to make well-informed investment decisions. Regularly check our website for updates on the Frankfurt Stock Market and its impact on the German economy. Monitor the DAX performance closely to capitalize on potential opportunities and mitigate risks associated with investing in the German Stock Market.

Featured Posts

-

Paris Luxury Goods Downturn Impacts Citys Finances

May 25, 2025

Paris Luxury Goods Downturn Impacts Citys Finances

May 25, 2025 -

Pandemic Resilience How Seattles Green Spaces Supported One Woman

May 25, 2025

Pandemic Resilience How Seattles Green Spaces Supported One Woman

May 25, 2025 -

Nemecke Firmy A Hromadne Prepustanie Situacia Na Trhu Prace

May 25, 2025

Nemecke Firmy A Hromadne Prepustanie Situacia Na Trhu Prace

May 25, 2025 -

Amundi Msci World Ii Ucits Etf Dist Nav Calculation And Implications For Investors

May 25, 2025

Amundi Msci World Ii Ucits Etf Dist Nav Calculation And Implications For Investors

May 25, 2025 -

Le Tariffe Trump Del 20 E Il Loro Effetto Sull Industria Della Moda Europea

May 25, 2025

Le Tariffe Trump Del 20 E Il Loro Effetto Sull Industria Della Moda Europea

May 25, 2025

Latest Posts

-

Aex Index 4 Drop Sends Market To 12 Month Low

May 25, 2025

Aex Index 4 Drop Sends Market To 12 Month Low

May 25, 2025 -

Successful Imcd N V Agm All Proposed Resolutions Adopted

May 25, 2025

Successful Imcd N V Agm All Proposed Resolutions Adopted

May 25, 2025 -

Relx Succes Ai Strategie Overwint Economische Uitdagingen

May 25, 2025

Relx Succes Ai Strategie Overwint Economische Uitdagingen

May 25, 2025 -

Economische Recessie Relx Blijft Groeien Met Behulp Van Ai

May 25, 2025

Economische Recessie Relx Blijft Groeien Met Behulp Van Ai

May 25, 2025 -

Sterke Resultaten Relx Ai Als Motor Voor Groei Tot 2025

May 25, 2025

Sterke Resultaten Relx Ai Als Motor Voor Groei Tot 2025

May 25, 2025