AEX Index: 4%+ Drop Sends Market To 12-Month Low

Table of Contents

Causes of the AEX Index's Sharp Decline

The dramatic fall in the AEX Index can be attributed to a confluence of factors, both global and specific to the Dutch market.

Global Economic Uncertainty

Rising inflation and interest rates globally are impacting investor sentiment negatively. The aggressive monetary tightening by central banks worldwide to combat inflation creates uncertainty about future economic growth. Geopolitical tensions, particularly the ongoing war in Ukraine, continue to exert pressure on the European economy, impacting energy prices and supply chains. These factors contribute to a broader sense of economic instability, leading investors to seek safer havens and reducing risk appetite.

- Specific examples: The ongoing energy crisis in Europe, increasing geopolitical instability, and the potential for a global recession are all contributing factors.

- Impact on AEX: These global headwinds negatively affect Dutch businesses reliant on international trade and energy supplies.

Sector-Specific Weakness

The downturn hasn't affected all sectors equally. The technology sector, particularly companies reliant on growth-driven valuations, experienced significant drops. Similarly, the financial sector, sensitive to interest rate changes and economic uncertainty, also faced considerable pressure.

- Underperforming companies: [Insert examples of specific AEX companies experiencing significant drops and reasons for their decline, e.g., Company X saw a 10% drop due to disappointing Q3 earnings, while Company Y's decline is linked to concerns about its exposure to the energy crisis.].

- Sectoral analysis: A deeper dive into the financial reports of these companies reveals specific vulnerabilities and challenges contributing to the market downturn.

Investor Sentiment and Market Psychology

Fear and uncertainty are driving the current sell-off. Negative news and pessimistic forecasts fuel a cycle of selling, creating a self-reinforcing downward spiral. Investors are exhibiting risk-averse behavior, leading to a flight to safety and reduced investment in equities.

- Market sentiment indicators: A decline in investor confidence, increased volatility in trading volumes, and a shift towards defensive assets all point towards a negative market sentiment.

- Trading patterns: We are witnessing increased short selling activity, indicating a bearish outlook among some investors.

Implications of the AEX Reaching a 12-Month Low

The AEX hitting a 12-month low has significant implications for both the Dutch economy and investors.

Impact on Dutch Businesses and Economy

The decline in the AEX Index translates to reduced valuations for Dutch companies, potentially impacting their ability to raise capital and invest in future growth. This can lead to slower economic growth and potentially impact employment levels. Consumer confidence may also suffer, leading to decreased spending and further economic slowdown.

- Ripple effects: The impact extends beyond listed companies, affecting smaller businesses and the overall economic climate in the Netherlands.

- Government response: The Dutch government might need to consider measures to support the economy and boost investor confidence.

Investor Concerns and Strategies

Investors are grappling with concerns about further market declines and are actively seeking ways to manage risk. Diversification across asset classes, geographical regions, and sectors is crucial. Risk management techniques, such as stop-loss orders and hedging strategies, become even more important during periods of high volatility.

- Investment approaches: Many investors are shifting towards more defensive assets, like government bonds, to protect their portfolios.

- Risk mitigation: Thorough due diligence and a well-defined investment strategy are paramount during these uncertain times.

Analyzing AEX Performance and Future Outlook

Analyzing the AEX's performance requires both technical and fundamental analysis.

Technical Analysis of the AEX Chart

A technical analysis of the AEX chart reveals recent trends and key support and resistance levels. [Insert relevant chart and technical indicators here, e.g., The AEX has broken below crucial support at X points, suggesting further downside potential. RSI and MACD indicators also point towards a bearish trend].

- Potential price movements: Based on the chart patterns and technical indicators, predictions can be made regarding potential future price movements. However, technical analysis is not foolproof.

- Support and resistance levels: Identifying these levels helps predict potential turning points in the market.

Fundamental Analysis of AEX Constituents

A fundamental analysis of the underlying companies within the AEX index is crucial to assess their long-term prospects. Analyzing their financial health, growth prospects, and earnings potential helps investors determine whether the current market price accurately reflects their intrinsic value.

- Strong vs. weak companies: [Insert examples of strong and weak AEX companies based on fundamental analysis. For example: Company A, with strong fundamentals, might present a buying opportunity despite the broader market downturn.].

- Valuation analysis: Assessing if the market is undervaluing or overvaluing specific companies is essential for making informed investment decisions.

Expert Opinions and Market Forecasts

Financial experts offer varying perspectives on the AEX's future. Some anticipate further declines, while others believe the current low represents a buying opportunity. Market forecasts often incorporate a range of scenarios based on various economic and political factors.

- Expert quotes: [Insert quotes from financial experts on their outlook for the AEX and Dutch economy.]

- Market predictions: [Summarize the range of predictions for the AEX in the coming months, acknowledging the inherent uncertainty in market forecasting].

Conclusion

The AEX Index's dramatic 4%+ drop, resulting in a 12-month low, highlights the significant volatility currently affecting the Dutch stock market. Understanding the underlying causes, from global economic uncertainty to sector-specific weaknesses, is crucial for navigating this challenging environment. Investors need to carefully consider their risk tolerance and employ appropriate strategies to mitigate potential losses. Staying informed about the AEX Index and its performance through reliable sources is paramount for making informed investment decisions. Keep monitoring the AEX Index for further updates and adjust your investment strategy accordingly. Don't hesitate to consult with a financial advisor for personalized guidance on managing your investments during this period of AEX volatility.

Featured Posts

-

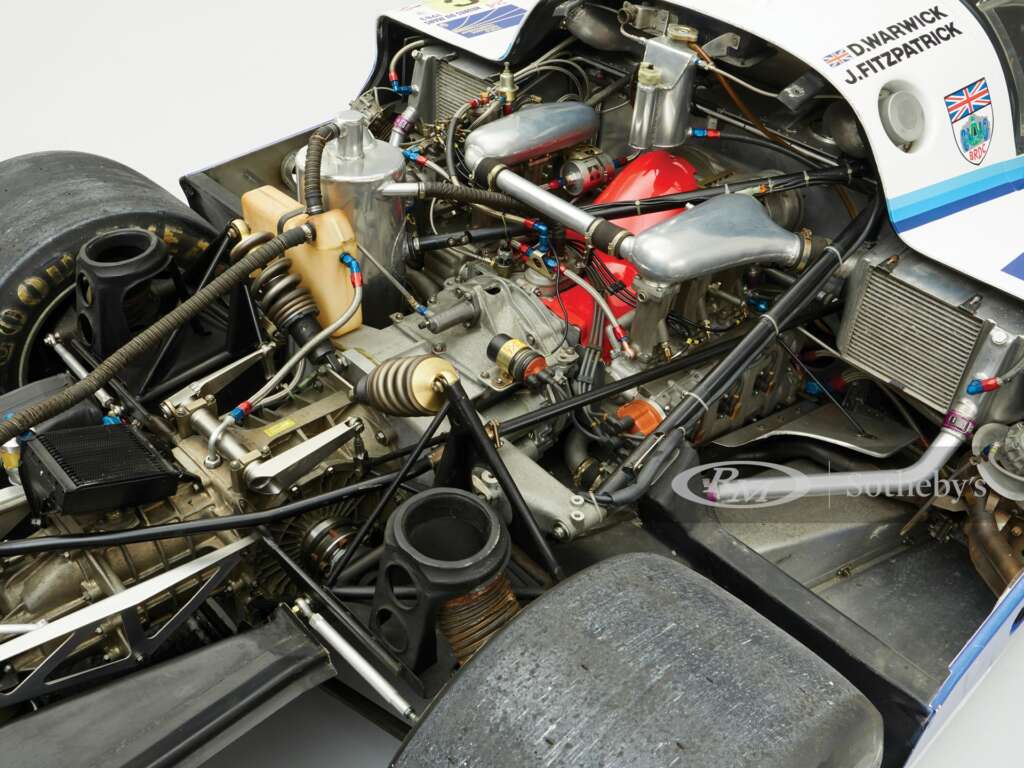

Porsche 956 Nin Tavanindan Asili Sergilenmesinin Teknik Sebepleri

May 25, 2025

Porsche 956 Nin Tavanindan Asili Sergilenmesinin Teknik Sebepleri

May 25, 2025 -

Lady Gaga And Michael Polansky Hand In Hand At Snl Afterparty

May 25, 2025

Lady Gaga And Michael Polansky Hand In Hand At Snl Afterparty

May 25, 2025 -

Lvmh Q1 Sales Figures Miss Expectations Shares Down 8 2

May 25, 2025

Lvmh Q1 Sales Figures Miss Expectations Shares Down 8 2

May 25, 2025 -

Slight Dip For Cac 40 At Weeks End March 7 2025 Update

May 25, 2025

Slight Dip For Cac 40 At Weeks End March 7 2025 Update

May 25, 2025 -

2025 Porsche Cayenne Interior And Exterior Images

May 25, 2025

2025 Porsche Cayenne Interior And Exterior Images

May 25, 2025

Latest Posts

-

Farrows Plea Hold Trump Accountable For Deporting Venezuelan Gang Members

May 25, 2025

Farrows Plea Hold Trump Accountable For Deporting Venezuelan Gang Members

May 25, 2025 -

Mia Farrows Plea Jail Trump For Handling Of Venezuelan Deportations

May 25, 2025

Mia Farrows Plea Jail Trump For Handling Of Venezuelan Deportations

May 25, 2025 -

Actress Mia Farrow Seeks Legal Action Against Trump Regarding Venezuelan Deportations

May 25, 2025

Actress Mia Farrow Seeks Legal Action Against Trump Regarding Venezuelan Deportations

May 25, 2025 -

Actress Mia Farrow Trump Should Face Charges For Venezuelan Deportation Actions

May 25, 2025

Actress Mia Farrow Trump Should Face Charges For Venezuelan Deportation Actions

May 25, 2025 -

The Fall From Grace 17 Celebrities Who Lost Everything Instantly

May 25, 2025

The Fall From Grace 17 Celebrities Who Lost Everything Instantly

May 25, 2025