Analyzing The Net Asset Value (NAV) Of The Amundi Dow Jones Industrial Average UCITS ETF

Table of Contents

What is Net Asset Value (NAV)?

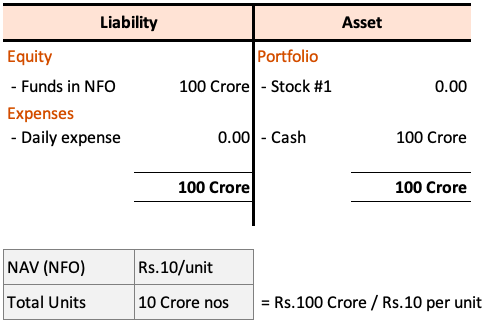

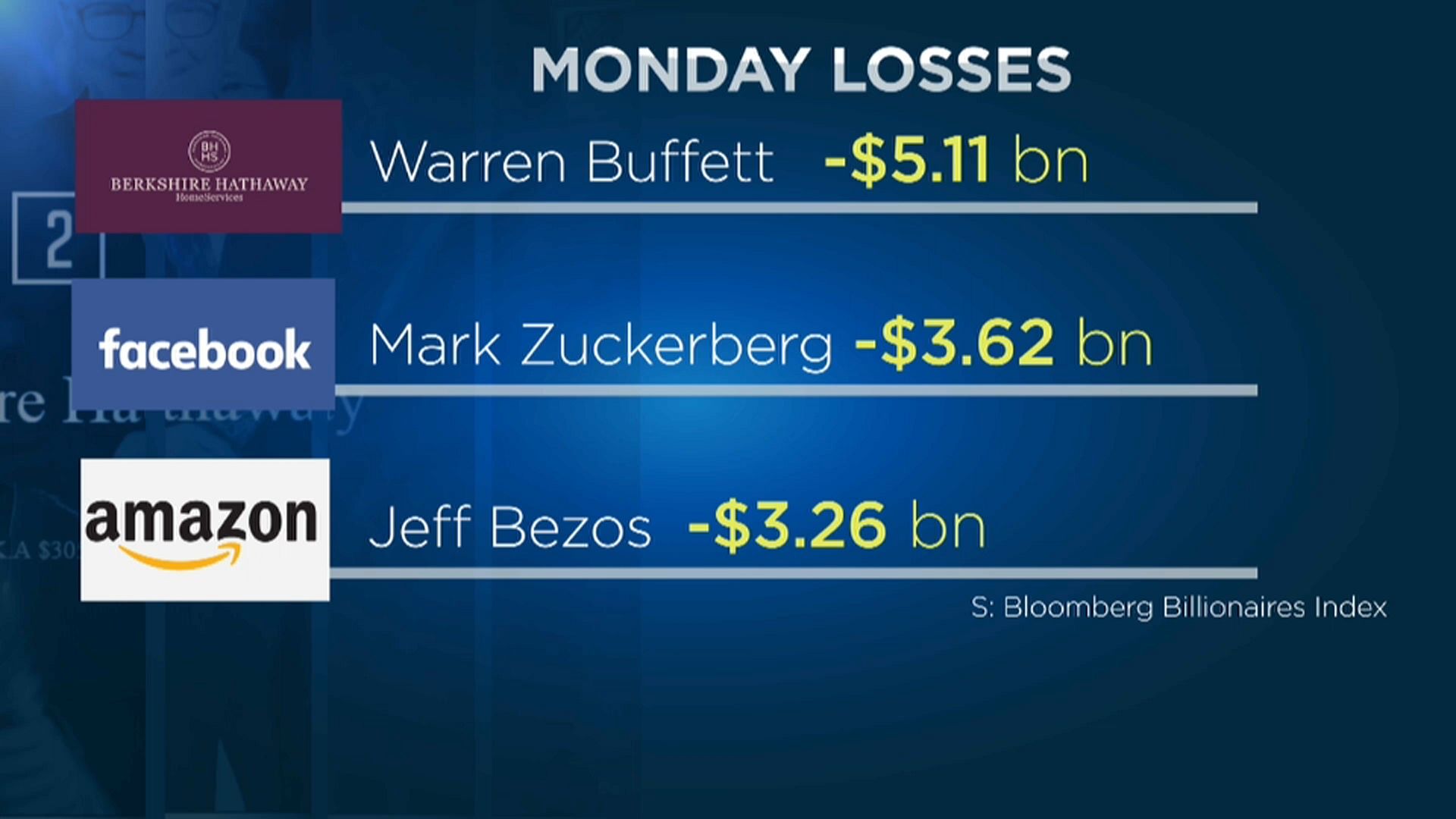

Net Asset Value (NAV) represents the net value of an ETF's assets minus its liabilities, per share. Think of it as the underlying worth of each share. For the Amundi Dow Jones Industrial Average UCITS ETF, the NAV reflects the collective value of the 30 constituent companies of the Dow Jones Industrial Average, adjusted for the ETF's expenses and other factors. Understanding the Amundi Dow Jones Industrial Average UCITS ETF NAV calculation is key to grasping its true value.

How the NAV of the Amundi Dow Jones Industrial Average UCITS ETF is Calculated

The Amundi Dow Jones Industrial Average UCITS ETF NAV calculation is a daily process that involves several steps. It's essentially a snapshot of the ETF's holdings at the market close.

- Daily Closing Prices: The daily closing prices of each of the 30 Dow Jones Industrial Average component stocks are gathered.

- Weighting: Each stock's value is weighted according to its proportion in the Dow Jones Industrial Average index. This means larger companies have a bigger influence on the overall NAV.

- Expenses: The ETF's expense ratio (a small annual fee) is deducted from the total value of the holdings. This expense ratio slightly reduces the NAV over time.

- Total Value: The weighted values of all 30 stocks are summed to arrive at the total value of the ETF's assets.

- NAV Calculation: The total value of assets, less liabilities (including expenses) is divided by the total number of outstanding ETF shares to arrive at the NAV per share.

Example: Let's simplify. Suppose the ETF holds only three stocks (A, B, C) with market values of $100, $200, and $300 respectively, and a total of 1000 shares outstanding. The total value is $600. After deducting a simplified expense of $10, the net asset value is ($600 - $10) / 1000 shares = $0.59 per share. This is a simplified example; the actual Amundi Dow Jones Industrial Average UCITS ETF NAV calculation is far more complex, involving precise weighting and accounting for all expenses and liabilities.

Factors Influencing the Amundi Dow Jones Industrial Average UCITS ETF NAV

Several factors influence the Amundi Dow Jones Industrial Average UCITS ETF price and its NAV. Understanding these factors allows for better investment decisions.

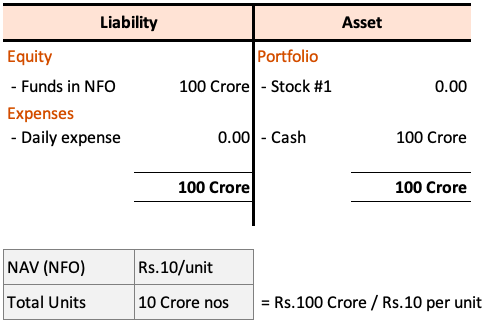

- Market Movements: The primary driver of the Amundi Dow Jones Industrial Average UCITS ETF NAV is the performance of the 30 companies within the Dow Jones Industrial Average. Positive market sentiment, economic growth, and strong corporate earnings usually lead to an increase in the NAV. Conversely, negative market events (e.g., recession fears, geopolitical instability) can cause a decrease.

- Dividend Payments: When underlying companies pay dividends, this contributes to the ETF's income, which generally increases the NAV.

- Corporate Actions: Stock splits, mergers, and acquisitions of the underlying companies all directly affect the ETF's composition and therefore the NAV.

- Expense Ratio: The expense ratio, while relatively small, continually erodes the NAV over time.

Where to Find the Amundi Dow Jones Industrial Average UCITS ETF NAV

Staying updated on the Amundi Dow Jones Industrial Average UCITS ETF NAV is straightforward. You can find this information from various sources:

- Amundi's Official Website: The most reliable source is Amundi's official website. Look for their ETF listings section.

- Financial News Websites: Many reputable financial news websites, such as Bloomberg, Yahoo Finance, and Google Finance, provide real-time or delayed ETF NAV data.

- Brokerage Platforms: If you hold the ETF through a brokerage account, the platform will typically display the current NAV alongside other market data.

Using NAV to Make Informed Investment Decisions

Understanding the Amundi Dow Jones Industrial Average UCITS ETF NAV is not just about knowing a number; it's a tool for strategic investing.

- Performance Tracking: By monitoring the NAV over time, you can easily track the ETF's performance and compare it to other investments.

- Buy and Sell Decisions: While not the sole determinant, NAV can assist in buy and sell decisions. A consistently rising NAV may suggest a strong upward trend, while a falling NAV could signal a potential need for reassessment.

- Risk Assessment: The volatility of the NAV reflects the inherent risk associated with investing in the ETF. Higher NAV fluctuations indicate higher risk.

Conclusion: Mastering the Amundi Dow Jones Industrial Average UCITS ETF NAV

Understanding the Amundi Dow Jones Industrial Average UCITS ETF NAV is crucial for making well-informed investment decisions. This article has detailed how the NAV is calculated, the key factors influencing it, where to find this information, and how it can help you with your investment strategy. Regularly monitoring the Amundi Dow Jones Industrial Average UCITS ETF NAV and gaining a deeper understanding of ETF investing will help you optimize your portfolio performance. Stay informed about the Amundi Dow Jones Industrial Average UCITS ETF NAV and make smarter investment choices today! [Link to Amundi's website here]

Featured Posts

-

Avrupa Piyasalarinda Karisik Bir Kapanis

May 24, 2025

Avrupa Piyasalarinda Karisik Bir Kapanis

May 24, 2025 -

Buffetts Succession At Berkshire Hathaway What Happens To Apple Investment

May 24, 2025

Buffetts Succession At Berkshire Hathaway What Happens To Apple Investment

May 24, 2025 -

Porsche Plecia Elektromobiliu Ikrovimo Tinkla Europoje

May 24, 2025

Porsche Plecia Elektromobiliu Ikrovimo Tinkla Europoje

May 24, 2025 -

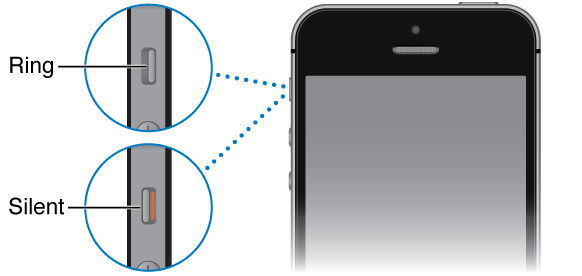

The Phones Silent Ring My Experience Waiting

May 24, 2025

The Phones Silent Ring My Experience Waiting

May 24, 2025 -

Krasivaya Data 89 Par Sozdali Semi Na Kharkovschine

May 24, 2025

Krasivaya Data 89 Par Sozdali Semi Na Kharkovschine

May 24, 2025

Latest Posts

-

Mia Farrow Demands Trump Be Prosecuted For Venezuelan Deportation

May 24, 2025

Mia Farrow Demands Trump Be Prosecuted For Venezuelan Deportation

May 24, 2025 -

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportation

May 24, 2025

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportation

May 24, 2025 -

Farrow Seeks Legal Action Against Trump Regarding Venezuelan Deportations

May 24, 2025

Farrow Seeks Legal Action Against Trump Regarding Venezuelan Deportations

May 24, 2025 -

Mia Farrow Demands Trumps Imprisonment For Deporting Venezuelan Gang Members

May 24, 2025

Mia Farrow Demands Trumps Imprisonment For Deporting Venezuelan Gang Members

May 24, 2025 -

Exploring Frank Sinatras Four Marriages And Their Significance

May 24, 2025

Exploring Frank Sinatras Four Marriages And Their Significance

May 24, 2025