Frankfurt Stock Exchange: DAX Ends Trading Below 24,000

Table of Contents

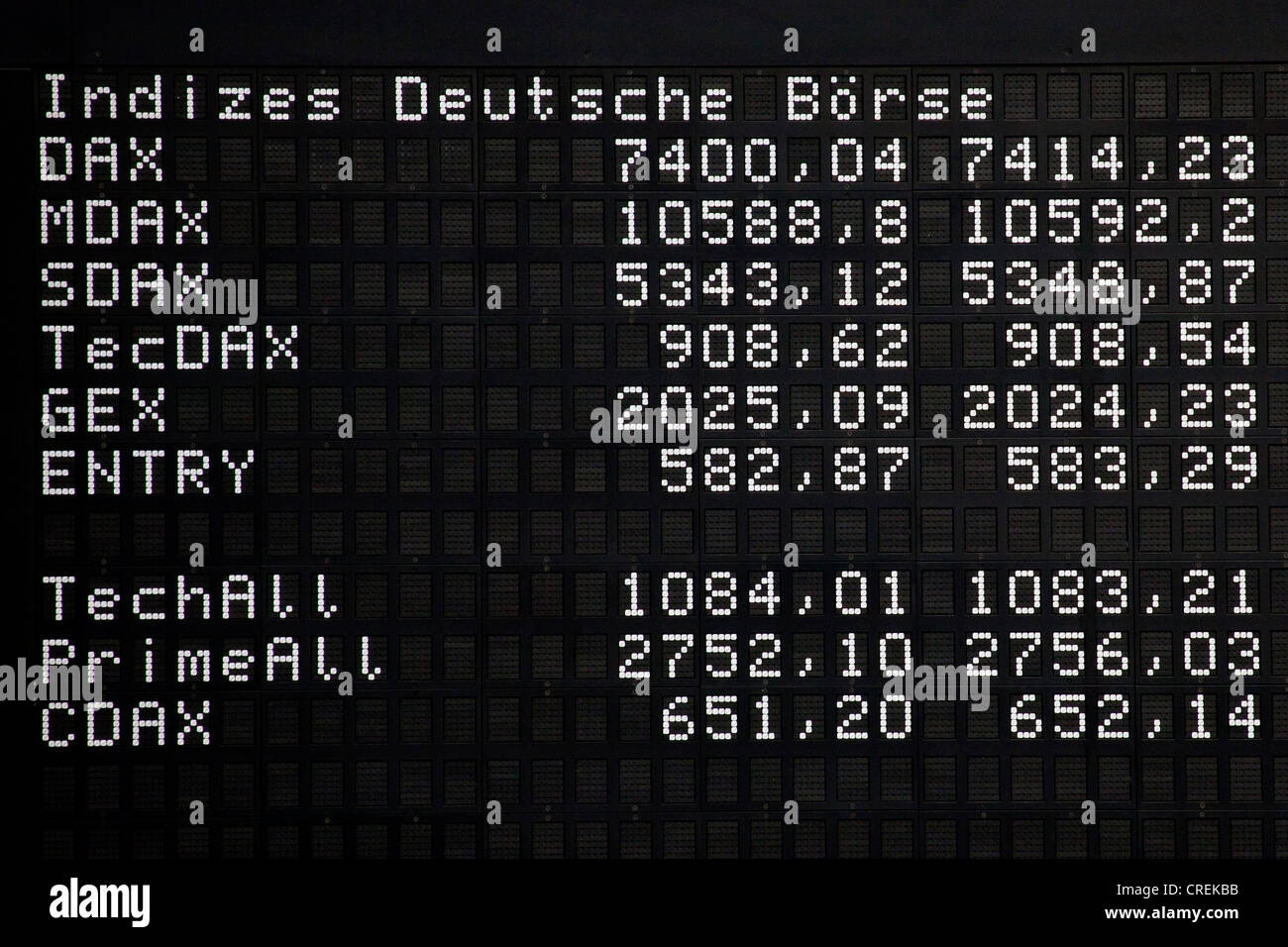

The German stock market experienced a downturn today, with the DAX, the leading index of the Frankfurt Stock Exchange, closing below the psychologically significant 24,000 point level. This marks a notable shift in the market, prompting analysis of the underlying factors and potential implications for investors. We will explore the key contributing factors to this decline and offer insights into potential future market movements. Understanding the fluctuations of the DAX is crucial for navigating the German market effectively.

Key Factors Contributing to DAX Decline

Impact of Global Economic Uncertainty

The DAX's decline is inextricably linked to prevailing global economic uncertainty. Several factors are at play, creating a challenging environment for investors. Rising inflation in major economies, particularly the US, is forcing central banks to implement aggressive interest rate hikes. These hikes, while aimed at curbing inflation, also increase borrowing costs for businesses and dampen economic growth, impacting corporate profits and investor sentiment.

- Rising US inflation: Persistent inflation in the US continues to impact global markets, creating uncertainty and affecting investor confidence in the DAX.

- European energy crisis: The ongoing energy crisis in Europe, stemming from geopolitical tensions, significantly impacts German businesses, many of which are energy-intensive. This adds to the pressure on the DAX.

- Geopolitical instability in Eastern Europe: The ongoing conflict in Eastern Europe fuels global uncertainty, leading to risk aversion among investors and impacting stock markets worldwide, including the DAX.

These global headwinds have caused a noticeable downturn in several sectors. For instance, the automotive sector, a significant component of the DAX, experienced a percentage decline of X% due to supply chain disruptions and decreased consumer demand. Similarly, the energy sector saw a Y% drop reflecting the volatile energy prices.

Performance of Specific DAX Companies

The overall DAX decline is also a reflection of the individual performance of its constituent companies. Several major players experienced significant stock price drops.

- Volkswagen: Volkswagen's stock price fell by Z% due to concerns about [mention specific reason, e.g., supply chain issues, declining sales, etc.].

- Siemens: Siemens, a major industrial conglomerate, saw its stock price decrease by A% amidst [mention specific reason, e.g., weaker-than-expected earnings, global economic slowdown, etc.].

- BMW: BMW's stock performance was affected by [mention specific reason, e.g., chip shortages, increased competition, etc.], leading to a B% decrease.

These individual company performances, combined with the broader market sentiment, contributed significantly to the DAX's fall below 24,000. Analyzing the financial reports and news surrounding these companies provides valuable insights into the market's current state.

Investor Sentiment and Market Volatility

Market volatility is a key indicator of investor sentiment. The recent decline in the DAX is accompanied by increased market volatility, reflecting a shift in investor behavior from risk-on to risk-off. Higher trading volumes in options and futures markets suggest investors are hedging against potential further losses.

- Increased trading volume: The surge in trading volume reflects heightened investor activity and uncertainty, suggesting increased caution.

- Options and Futures Market Activity: The increased use of hedging strategies through options and futures contracts indicates investors are attempting to mitigate potential risks.

These factors underscore a significant shift in investor confidence. Visualizing this volatility through charts and graphs showing the DAX's daily fluctuations highlights the market's uncertain state.

Implications for Investors and the German Economy

Short-Term Outlook

The short-term outlook for the DAX remains uncertain. While a potential rebound is possible, further decline cannot be ruled out. Market analysts offer varied predictions, with some suggesting a period of consolidation before any significant directional move.

- Potential rebound: Positive economic news or shifts in global sentiment could trigger a rebound in the DAX.

- Further decline: Persistent global economic uncertainty and negative corporate earnings could contribute to a continued decline.

- Consolidation: The market may consolidate around current levels before exhibiting a clear upward or downward trend.

It is important to remember that market predictions are inherently uncertain, and unexpected events can significantly impact market movements.

Long-Term Implications

The long-term implications of this DAX decline extend beyond the stock market, potentially impacting the broader German economy. Decreased investor confidence could impact consumer spending, slowing economic growth. However, this downturn could also present long-term investment opportunities for those with a long-term perspective.

- Impact on consumer confidence: A sustained decline in the DAX could negatively impact consumer confidence and spending.

- Economic growth concerns: Lower stock prices and reduced investor confidence can slow economic growth.

- Long-term investment opportunities: The decline presents potential opportunities for long-term investors to acquire assets at discounted prices.

Monitoring relevant economic reports and forecasts from organizations like the German Federal Statistical Office (Destatis) will provide further insights into the long-term effects.

Conclusion

The DAX closing below 24,000 reflects a confluence of global and domestic factors impacting investor confidence. Global economic uncertainty, the performance of individual DAX companies, and fluctuating investor sentiment all played significant roles in this market downturn. Understanding these complex interactions is key to navigating the complexities of the German stock market.

Call to Action: Stay informed about the evolving situation on the Frankfurt Stock Exchange and the performance of the DAX. Continuously monitor the DAX index and related news for timely insights and strategic investment decisions. Understanding the fluctuations of the DAX and the factors influencing its performance is crucial for effective investment strategies in the German market. Regularly analyze DAX components and global economic indicators to make informed decisions about your investments.

Featured Posts

-

Borsa Europea Prudenza In Attesa Della Fed Piazza Affari E Le Banche

May 25, 2025

Borsa Europea Prudenza In Attesa Della Fed Piazza Affari E Le Banche

May 25, 2025 -

Live Updates M6 Crash Causes Significant Traffic Disruption

May 25, 2025

Live Updates M6 Crash Causes Significant Traffic Disruption

May 25, 2025 -

Bailed Teen Rearrested Shop Owners Fatal Stabbing

May 25, 2025

Bailed Teen Rearrested Shop Owners Fatal Stabbing

May 25, 2025 -

The Ferrari Challenge South Floridas Premier Racing Event

May 25, 2025

The Ferrari Challenge South Floridas Premier Racing Event

May 25, 2025 -

Frankfurt Stock Exchange Dax Holds Following Record Run

May 25, 2025

Frankfurt Stock Exchange Dax Holds Following Record Run

May 25, 2025

Latest Posts

-

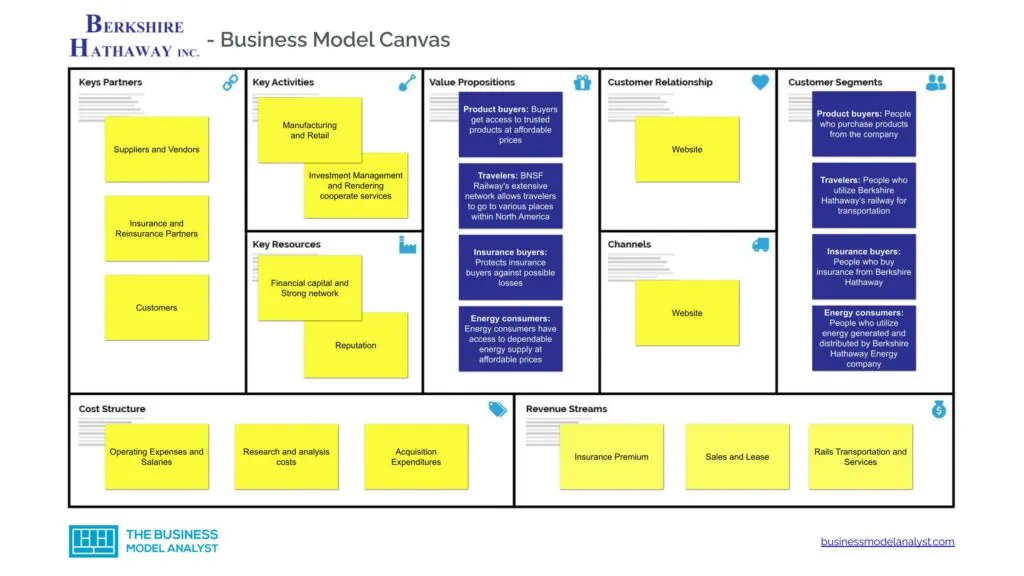

Buffetts Retirement What Happens To Berkshire Hathaways Apple Investment

May 25, 2025

Buffetts Retirement What Happens To Berkshire Hathaways Apple Investment

May 25, 2025 -

Will Berkshire Hathaway Sell Apple Stock After Buffetts Departure

May 25, 2025

Will Berkshire Hathaway Sell Apple Stock After Buffetts Departure

May 25, 2025 -

Re Energizing Relations Bangladesh And Europes Path To Shared Growth

May 25, 2025

Re Energizing Relations Bangladesh And Europes Path To Shared Growth

May 25, 2025 -

Berkshire Hathaway And Apple Will Buffetts Succession Impact Apple Stock

May 25, 2025

Berkshire Hathaway And Apple Will Buffetts Succession Impact Apple Stock

May 25, 2025 -

Le Ces Unveiled Europe A Amsterdam Un Evenement Technologique Majeur

May 25, 2025

Le Ces Unveiled Europe A Amsterdam Un Evenement Technologique Majeur

May 25, 2025