Analysis: The House's Passage Of The Revised Trump Tax Bill

Table of Contents

Key Changes in the Revised Trump Tax Bill

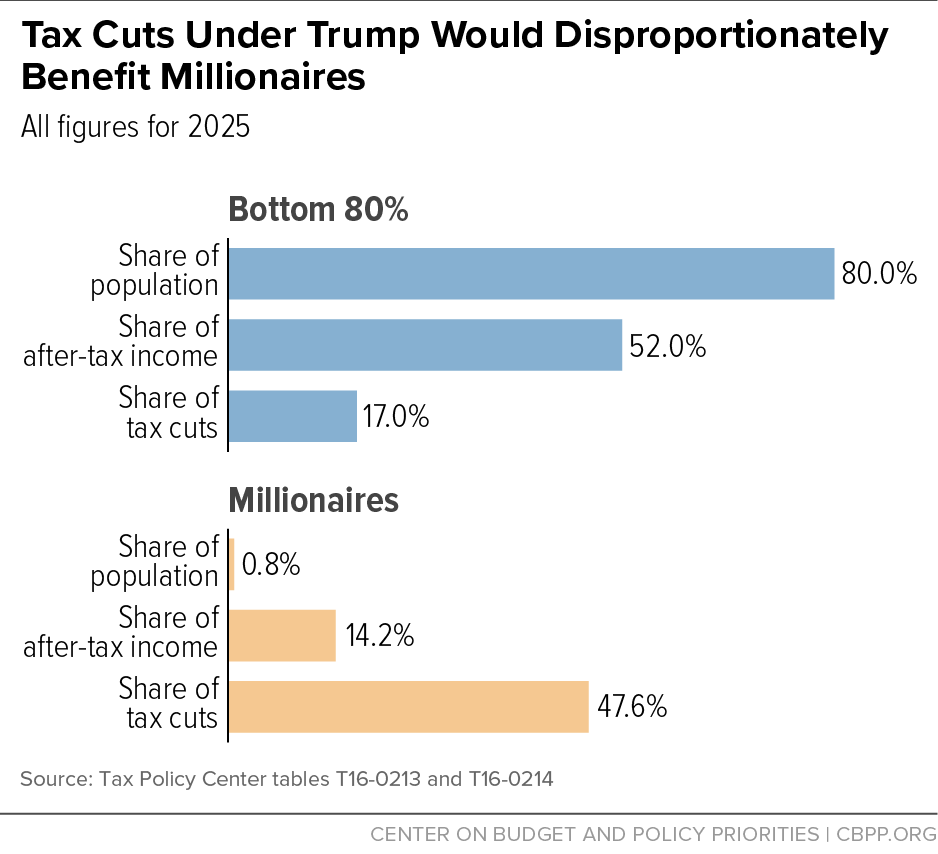

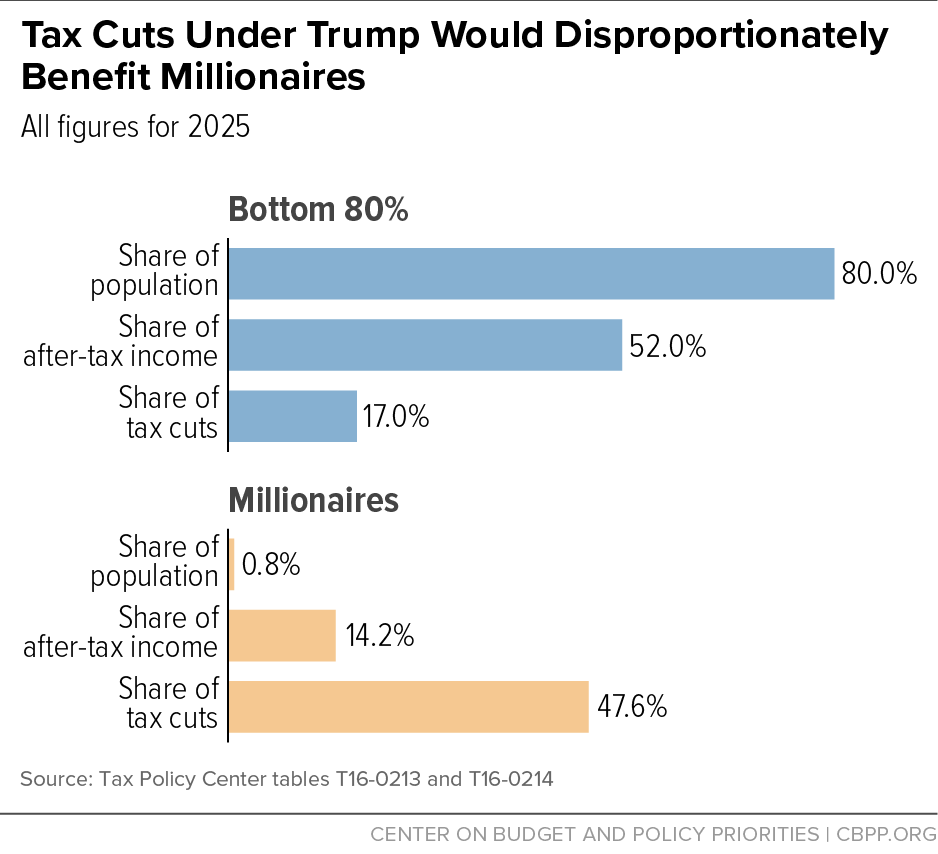

The revised Trump Tax Bill introduces several key changes impacting both individual and corporate taxpayers. These alterations significantly modify the tax burden for many Americans.

Individual Income Tax Rates

The revised bill adjusted individual income tax brackets and rates. These changes directly affect the tax liability of millions of Americans.

- Lower Rates for Some Brackets: Specific lower rates were implemented for certain income levels, potentially offering tax relief to some taxpayers. (Specific numbers and bracket ranges should be inserted here based on the actual bill).

- Higher Rates for Others: Conversely, higher tax rates were implemented for other income brackets, increasing the tax burden for some high-income earners. (Specific numbers and bracket ranges should be inserted here based on the actual bill).

- Comparison to Previous Versions: Compared to previous iterations of the bill and the initial Trump tax plan, these changes represent a significant shift in tax policy, either increasing or decreasing tax liabilities depending on the income bracket.

The net effect on individual tax liability varies greatly depending on income, deductions, and other factors. Careful review of your personal tax situation is recommended to determine your precise tax impact under the revised Trump Tax Bill.

Corporate Tax Rate Modifications

The revised Trump Tax Bill also adjusted the corporate tax rate, a significant alteration for businesses of all sizes.

- Revised Corporate Tax Rate: The corporate tax rate was revised to (insert the revised rate here), a change compared to previous legislation. This aims to incentivize business investment and economic growth.

- Impact on Corporate Profitability: This lower rate could enhance corporate profitability, potentially leading to increased investment and job creation. However, the actual impact will depend on various economic factors.

- Effects on Investment and Job Creation: The expectation is that the reduced corporate tax rate will stimulate investment, leading to increased job creation and economic expansion. However, this remains a subject of ongoing debate among economists. Some argue that the benefits will primarily accrue to shareholders, rather than being translated into job growth or wage increases.

The long-term impact of the corporate tax rate modification on the US economy remains to be seen. More detailed economic analyses are needed to predict long-term effects fully.

Alterations to Deductions and Credits

Significant changes were made to various deductions and tax credits, impacting taxpayers' overall tax burdens.

- Standard Deduction: The standard deduction was (increased/decreased - insert relevant change here), potentially affecting millions of taxpayers who utilize this deduction.

- Itemized Deductions: Significant changes were made to itemized deductions. For example, the (mention specific changes to mortgage interest deduction, state and local tax (SALT) deduction etc.). This could drastically alter the tax liability for those who itemize.

- Child Tax Credit and Earned Income Tax Credit: Adjustments were made to the Child Tax Credit and Earned Income Tax Credit, potentially affecting low- and middle-income families. (Specific details of adjustments should be included here).

These changes to deductions and credits create complexity for taxpayers, necessitating careful review of their personal circumstances to assess the overall impact on their tax liability.

Economic Impact of the Revised Trump Tax Bill

The revised Trump Tax Bill is expected to have significant economic ramifications, impacting various aspects of the American economy.

Projected Effects on GDP Growth

Economists project that the revised Tax Bill will (increase/decrease – insert projected effect here) GDP growth.

- Economic Forecasts: Various economic forecasting models project different levels of growth, reflecting differing assumptions about the bill's effects. (Cite reputable sources and their forecasts).

- Multiplier Effects: The impact of the bill may extend beyond the direct effects of tax cuts, producing multiplier effects on economic activity through increased consumer spending and business investment.

- Inflationary Pressures: The potential for increased inflationary pressures is a significant concern, as increased spending could outpace the economy's capacity to produce goods and services.

The actual impact on GDP growth will depend on numerous economic factors, making accurate prediction challenging.

Impact on the National Debt

The revised Trump Tax Bill is expected to increase the national debt.

- Projected Deficit Increases: The bill is projected to increase the federal deficit by (insert projected amount here) over (insert time frame here).

- Long-Term Fiscal Sustainability: These deficit increases raise concerns about long-term fiscal sustainability and the potential for future economic instability.

- Offsetting Measures: While the bill's proponents argue for economic growth to offset the increased deficit, this remains a point of ongoing debate and requires close monitoring.

Careful analysis of the long-term fiscal implications is crucial to understand the full cost of the revised Tax Bill.

Job Creation and Investment

The bill’s proponents believe it will stimulate job creation and investment.

- Corporate Tax Rates and Investment: The lower corporate tax rate is expected to incentivize businesses to invest more, leading to increased job creation and higher wages.

- Effects on Wages and Employment: However, the extent to which these benefits materialize remains uncertain, dependent on businesses' decisions on reinvesting profits.

- Economic Studies and Models: Different economic models yield varying predictions about the employment effects of the revised Tax Bill. More research is needed to ascertain the actual effects.

Political Implications and Public Opinion

The revised Trump Tax Bill’s passage is deeply intertwined with the political landscape and public sentiment.

Congressional Support and Opposition

The bill’s passage was (characterize the level of bipartisan support – e.g., contentious, largely party-line, etc.).

- Bipartisan Support or Opposition: The bill attracted (insert specifics about bipartisan or partisan support and opposition).

- Lobbying Efforts: Powerful lobbying groups significantly influenced the bill's final form, reflecting the inherent political pressures surrounding tax legislation.

Understanding the political dynamics surrounding the bill’s passage offers valuable context for interpreting its implications.

Public Reaction and Future Prospects

Public opinion on the revised Trump Tax Bill is (characterize the public sentiment - e.g., divided, largely negative, largely positive etc.).

- Polls and Surveys: Public opinion polls and surveys reflect a (summarize findings from reputable polls).

- Future Legislative Action: The bill's passage could lead to future legislative actions, either modifying the bill further or introducing counter-measures.

Conclusion

The House’s passage of the revised Trump Tax Bill represents a substantial shift in US tax policy. This analysis has explored the key changes, their potential economic consequences, and the related political ramifications. The long-term effects remain uncertain, requiring continuous monitoring and further analysis. Understanding the intricacies of this revised Trump Tax Bill is crucial for both individuals and businesses to effectively manage their financial planning.

Call to Action: Stay informed about the implications of the revised Trump Tax Bill and its potential impact on your financial planning. Further research into specific aspects of the Revised Tax Bill is highly encouraged to ensure you fully understand its ramifications and can adapt accordingly.

Featured Posts

-

Konchita Vurst Ot Evrovideniya 2014 K Mechte Stat Devushkoy Bonda Istoriya Uspekha

May 24, 2025

Konchita Vurst Ot Evrovideniya 2014 K Mechte Stat Devushkoy Bonda Istoriya Uspekha

May 24, 2025 -

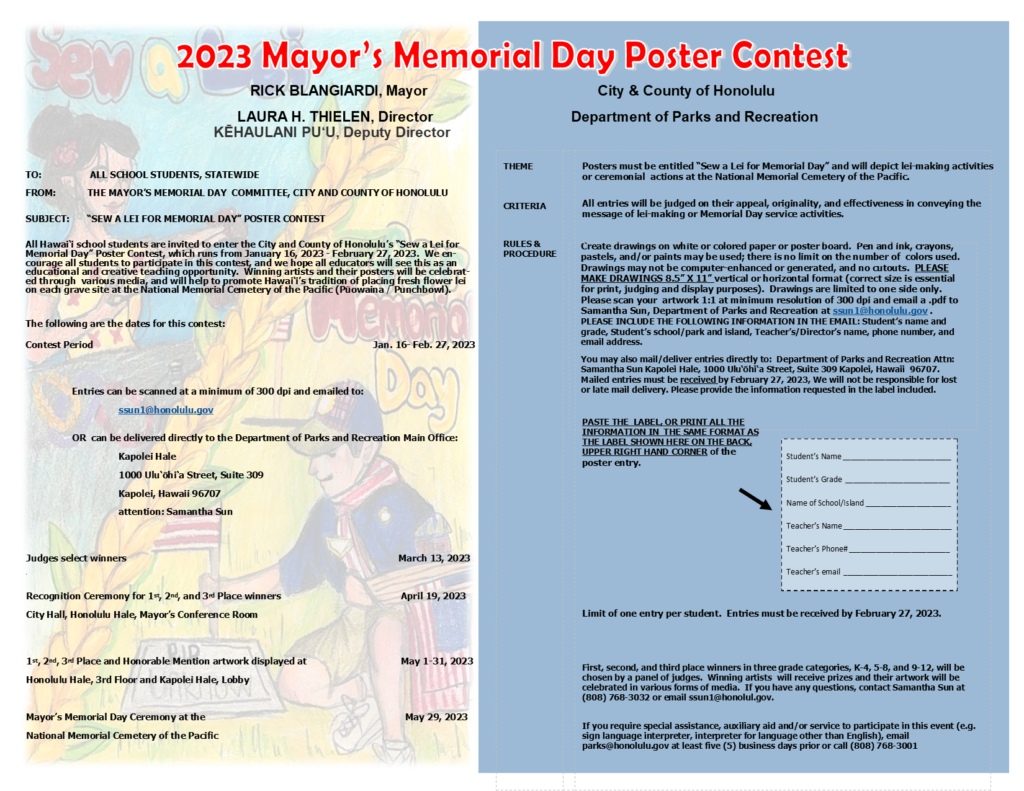

Memorial Day Poster Contest Hawaii Keiki Celebrate With Lei Making Art

May 24, 2025

Memorial Day Poster Contest Hawaii Keiki Celebrate With Lei Making Art

May 24, 2025 -

Tracking The Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Dist

May 24, 2025

Tracking The Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Dist

May 24, 2025 -

South Florida Hosts Electrifying Ferrari Challenge Racing Days

May 24, 2025

South Florida Hosts Electrifying Ferrari Challenge Racing Days

May 24, 2025 -

Ferrari Challenge Racing South Floridas Premier Motorsport Event

May 24, 2025

Ferrari Challenge Racing South Floridas Premier Motorsport Event

May 24, 2025

Latest Posts

-

Etoile Gideon Glick And Jonathan Groff Reunite In Hilarious Spring Awakening Scene

May 24, 2025

Etoile Gideon Glick And Jonathan Groff Reunite In Hilarious Spring Awakening Scene

May 24, 2025 -

Jonathan Groffs Show Name A Night Of Support From Fellow Stars

May 24, 2025

Jonathan Groffs Show Name A Night Of Support From Fellow Stars

May 24, 2025 -

Broadways Best Jonathan Groff Celebrates Opening Night With Famous Friends

May 24, 2025

Broadways Best Jonathan Groff Celebrates Opening Night With Famous Friends

May 24, 2025 -

Jonathan Groffs Just In Time A Night Of Stellar Support From Broadway Friends

May 24, 2025

Jonathan Groffs Just In Time A Night Of Stellar Support From Broadway Friends

May 24, 2025 -

Broadways Best Celebrate Jonathan Groffs Just In Time Opening Night

May 24, 2025

Broadways Best Celebrate Jonathan Groffs Just In Time Opening Night

May 24, 2025