Foreign Airlines Acquire 25% Of WestJet, Onex Exits Investment

Table of Contents

Details of the Acquisition

The acquisition of the 25% stake in WestJet involved several prominent international airlines, although the exact names and their precise contributions haven't been publicly disclosed in full. This strategic move represents a substantial financial investment, valuing WestJet at a significant figure (the exact amount remains under wraps pending official disclosures). The deal culminated after months of intense negotiations and required substantial regulatory approvals from both Canadian and international bodies. The timeline is crucial: negotiations likely began in [Insert estimated start date], with the final agreement reached and publicly announced on [Insert date of announcement].

- Airline Involvement: [Insert names of airlines involved as they become available]

- Percentage Stake: [Insert percentage stake held by each airline as they become available]

- Total Investment: [Insert total investment amount as it becomes available]

- Announcement Date: [Insert date of announcement]

- Regulatory Approvals: [List regulatory bodies involved]

Onex's Exit Strategy and Reasons

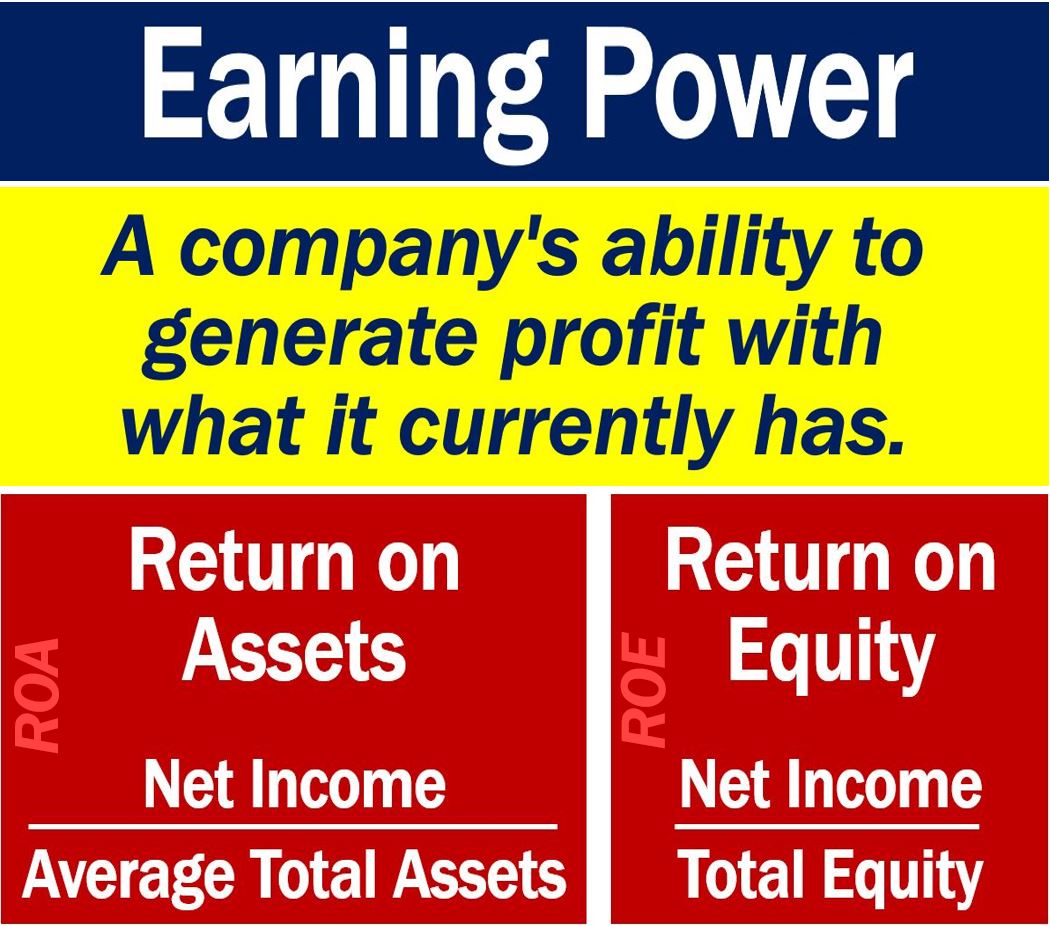

Onex Corporation's decision to divest its stake in WestJet after [Insert Number] years of ownership signals a strategic shift for the private equity firm. While Onex hasn't explicitly outlined its reasons, it's likely a combination of factors influenced their decision. These include maximizing their return on investment (ROI) after a successful period of growth and potentially capitalizing on favorable market conditions to secure a profitable exit. Analysts will closely scrutinize Onex's ROI, considering their initial investment and the eventual sale price. Broader market trends, such as fluctuating fuel prices and increased global competition within the airline industry, also undoubtedly played a significant role in Onex's strategic decision.

- Initial Onex Investment: [Insert amount of initial investment]

- Investment Length: [Insert number of years Onex held the stake]

- Stated Reasons for Exiting: [Insert Onex's official statements if available]

- Projected ROI: [Insert projected ROI if available; otherwise, state "To be determined"]

Impact on WestJet's Operations and Future

The acquisition of this significant stake by foreign airlines could usher in substantial changes to WestJet's operations. While the specifics remain uncertain, potential alterations include adjustments to flight routes, expansion into new international markets, modifications to the airline's fleet, and possible changes in management and leadership structures. The impact on WestJet's employees is a significant consideration. While job losses are not necessarily anticipated, there could be shifts in roles and responsibilities as the airline adapts to the new ownership structure. The changes may also affect WestJet's customer loyalty programs and the overall customer experience.

- Potential Route Changes: [Speculate on potential changes based on the airlines involved]

- Fleet Impact: [Speculate on changes based on the airlines involved]

- Management Changes: [Speculate on potential management changes]

- Customer Loyalty Program Changes: [Speculate on potential changes]

Implications for the Canadian Aviation Industry

The entrance of foreign airlines into WestJet’s ownership structure has significant implications for the Canadian aviation industry as a whole. Increased competition could lead to both benefits and drawbacks for Canadian consumers, including potentially lower airfares but also potentially reduced service levels depending on the strategies of the new investors. The government’s reaction to this acquisition will also be a key factor, as regulations and policies may be implemented to safeguard the interests of Canadian consumers and the domestic airline industry. Job creation or potential job displacement are also important considerations, along with the ripple effect on related industries.

- Increased Competition: [Discuss the implications of increased competition in the Canadian market]

- Impact on Airfares: [Discuss the potential impact on airfares for Canadian consumers]

- Job Creation/Loss: [Discuss the potential for job creation or loss]

- Government Response: [Discuss the potential government response and regulatory oversight]

Conclusion: Analyzing the Foreign Investment in WestJet

The acquisition of a 25% stake in WestJet by foreign airlines represents a pivotal moment in Canadian aviation history. The deal marks not only Onex's exit but also a significant injection of foreign capital into a major Canadian company. The "Foreign Airlines Acquire 25% of WestJet" news is likely to have long-lasting consequences for WestJet's operations, its competitive standing within the Canadian market, and the overall landscape of the Canadian airline industry. The coming months and years will be crucial in observing the impacts of this significant shift.

What are your predictions for WestJet's future following this significant investment by foreign airlines? What impact do you believe this acquisition will have on the Canadian aviation industry? Share your thoughts below!

Featured Posts

-

Adam Sandlers Massive Net Worth A Look At Comedys Earning Power

May 12, 2025

Adam Sandlers Massive Net Worth A Look At Comedys Earning Power

May 12, 2025 -

Manon Fiorots Rise Overcoming Early Setback For Uninterrupted Success

May 12, 2025

Manon Fiorots Rise Overcoming Early Setback For Uninterrupted Success

May 12, 2025 -

Jurickson Profar And The 80 Game Ped Suspension Analysis And Reaction

May 12, 2025

Jurickson Profar And The 80 Game Ped Suspension Analysis And Reaction

May 12, 2025 -

Ludogorets Zatvrzhdava Sstava Si S Antoan Baroan

May 12, 2025

Ludogorets Zatvrzhdava Sstava Si S Antoan Baroan

May 12, 2025 -

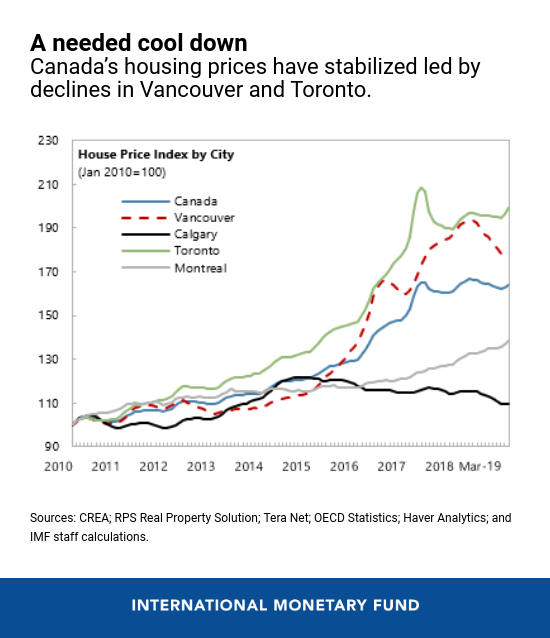

Low Mortgage Rates A Catalyst For Canadas Housing Market Recovery

May 12, 2025

Low Mortgage Rates A Catalyst For Canadas Housing Market Recovery

May 12, 2025

Latest Posts

-

The Hertha Bsc Crisis Boateng And Kruses Assessments

May 13, 2025

The Hertha Bsc Crisis Boateng And Kruses Assessments

May 13, 2025 -

Herthas Season Contrasting Opinions From Boateng And Kruse

May 13, 2025

Herthas Season Contrasting Opinions From Boateng And Kruse

May 13, 2025 -

Boateng And Kruse Offer Different Views On Herthas Problems

May 13, 2025

Boateng And Kruse Offer Different Views On Herthas Problems

May 13, 2025 -

Ofitsialnoe Razreshenie Rpts Smozhet Osuschestvlyat Religioznuyu Deyatelnost V Myanme

May 13, 2025

Ofitsialnoe Razreshenie Rpts Smozhet Osuschestvlyat Religioznuyu Deyatelnost V Myanme

May 13, 2025 -

Rpts I Myanma Razreshenie Na Religioznuyu Deyatelnost

May 13, 2025

Rpts I Myanma Razreshenie Na Religioznuyu Deyatelnost

May 13, 2025