Low Mortgage Rates: A Catalyst For Canada's Housing Market Recovery?

Table of Contents

The Impact of Low Mortgage Rates on Affordability

Lower mortgage rates directly translate to lower monthly payments for homebuyers. This reduction in financial burden significantly increases purchasing power, making homeownership more accessible to a wider range of potential buyers. As a result, we see an increase in buyer demand, potentially stimulating market activity.

- Lower monthly payments increase purchasing power: A lower interest rate on a mortgage can mean hundreds, even thousands, of dollars less per month in payments, freeing up funds for other expenses.

- More potential buyers enter the market: Increased affordability attracts buyers who were previously priced out of the market, leading to higher competition.

- Increased competition can drive up prices: Ironically, this increased demand, fueled by low mortgage rates, can lead to higher home prices, potentially negating some of the initial affordability gains.

- Recent data analysis: Recent affordability indices show a correlation between decreased mortgage rates and increased home sales, although the impact varies depending on location and other market conditions. For example, while Toronto might see a spike in activity, smaller markets might not experience the same level of impact.

Other Factors Influencing the Housing Market Recovery

While low mortgage rates play a significant role, they are not the sole determinant of Canada's housing market recovery. Several other factors, both positive and negative, contribute to the overall picture:

- Government policies and incentives: First-time homebuyer programs and other government initiatives can significantly influence affordability and demand.

- Immigration levels and population growth: Increased immigration contributes to population growth, boosting demand for housing in specific regions.

- Economic growth and employment rates: A strong economy with high employment generally translates to increased consumer confidence and purchasing power, stimulating the housing market.

- Inventory levels – supply and demand dynamics: A shortage of available homes can drive up prices regardless of interest rates. Conversely, a surplus of inventory can depress prices.

- Inflation and its impact on borrowing costs and consumer confidence: High inflation can erode purchasing power and increase borrowing costs, negatively impacting the housing market.

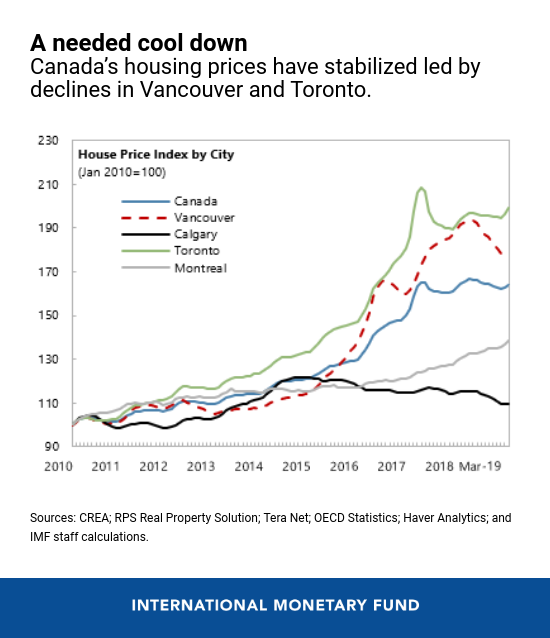

Regional Variations in Market Recovery

The impact of low mortgage rates and the overall housing market recovery varies significantly across Canada. Market conditions are influenced by local economic factors, population density, and unique regional characteristics.

- Comparison of major Canadian cities: Toronto and Vancouver, for example, often experience different market trends compared to Montreal or Calgary due to varying levels of population growth, economic strength, and housing supply.

- Regional variations in mortgage rates and affordability: Mortgage rates might be slightly different across regions due to local market conditions and lender practices. Affordability, therefore, also varies considerably.

- Local economic factors: The strength of a local economy will dictate the strength of the housing market. Areas experiencing economic downturns will naturally have weaker housing markets, regardless of national mortgage rates.

Potential Risks and Challenges

Relying solely on low mortgage rates to stimulate the housing market carries potential risks.

- Risk of a housing bubble: If demand significantly outpaces supply, it can lead to unsustainable price increases and the formation of a housing bubble, which is extremely vulnerable to a market correction.

- Vulnerability to interest rate hikes: A sudden increase in interest rates can dramatically impact affordability and trigger a market correction, potentially leading to price drops and decreased market activity.

- Concerns about household debt levels: High levels of household debt can make the Canadian economy vulnerable to economic shocks.

- Impact of potential changes in government policies: Changes in government policies related to housing can significantly alter market dynamics.

Conclusion: Low Mortgage Rates and the Future of Canada's Housing Market

Low mortgage rates undeniably influence Canada's housing market recovery, impacting affordability and buyer demand. However, this is only one piece of a much larger and more complex puzzle. Factors such as government policies, immigration levels, economic growth, inventory levels, and inflation all play significant, interwoven roles. Understanding the interplay of these elements is crucial for accurately predicting the market's trajectory. While low mortgage rates can provide a short-term boost, relying on them alone for sustained recovery is risky. It’s important to consider both the potential benefits and inherent risks associated with current trends. Stay informed about low mortgage rates and their continuing impact on the Canadian housing market by subscribing to our updates or consulting with a real estate professional. Understanding the complex relationship between low mortgage rates and Canada's housing market is crucial for making informed decisions in this dynamic environment.

Featured Posts

-

Osunas Injunction Denied Future With Tennessee Baseball Uncertain For 2025

May 12, 2025

Osunas Injunction Denied Future With Tennessee Baseball Uncertain For 2025

May 12, 2025 -

Federal Investigation Hackers Multi Million Dollar Office365 Exploit

May 12, 2025

Federal Investigation Hackers Multi Million Dollar Office365 Exploit

May 12, 2025 -

Chantal Ladesou Ou Elle Se Ressource En Famille

May 12, 2025

Chantal Ladesou Ou Elle Se Ressource En Famille

May 12, 2025 -

Analyzing John Wick Chapter 3s Rotten Tomatoes Score A Critical Examination

May 12, 2025

Analyzing John Wick Chapter 3s Rotten Tomatoes Score A Critical Examination

May 12, 2025 -

Uruguays Offshore Oil And Gas Exploration Challenges And Opportunities

May 12, 2025

Uruguays Offshore Oil And Gas Exploration Challenges And Opportunities

May 12, 2025

Latest Posts

-

Autism And Adhd In Britain Could You Be One Of 3 Million

May 13, 2025

Autism And Adhd In Britain Could You Be One Of 3 Million

May 13, 2025 -

Untapped Potential Are You One Of The 3 Million Brits With Autism Or Adhd

May 13, 2025

Untapped Potential Are You One Of The 3 Million Brits With Autism Or Adhd

May 13, 2025 -

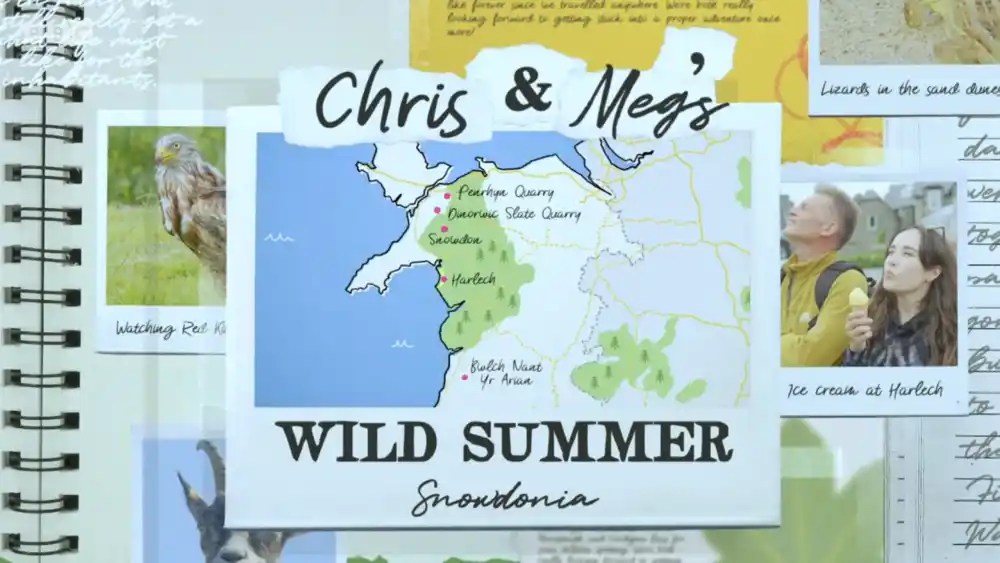

Documenting Chris And Megs Wild Summer

May 13, 2025

Documenting Chris And Megs Wild Summer

May 13, 2025 -

Cherry Blossom Viewing In Japan Your Springwatch Itinerary

May 13, 2025

Cherry Blossom Viewing In Japan Your Springwatch Itinerary

May 13, 2025 -

Chris And Megs Summer Of Wild Experiences

May 13, 2025

Chris And Megs Summer Of Wild Experiences

May 13, 2025