Bear Market Bets Backfire: Wall Street's Unexpected Comeback And What It Means

Table of Contents

The Unexpected Market Rally: A Deep Dive

The recent market upswing has been nothing short of dramatic. Major indices like the S&P 500 and the Nasdaq Composite have seen significant gains, defying predictions of a sustained bear market. This rally is particularly noteworthy given the persistent concerns about inflation, rising interest rates, and geopolitical instability.

Bullet Points:

- Unexpected strength in specific sectors: The technology sector, in particular, has shown remarkable resilience, with many tech giants posting better-than-expected earnings and driving significant market gains. Consumer discretionary stocks have also experienced a robust rebound, indicating increased consumer confidence.

- Impact of positive economic indicators: Lower-than-expected inflation figures and robust employment data have boosted investor sentiment, suggesting a more resilient economy than previously anticipated. These positive economic indicators have fueled optimism and encouraged further investment.

- Role of central bank policies: While interest rate hikes were initially expected to dampen market growth, central bank policies have also played a part in shaping investor behavior. The pace of interest rate increases has slowed in some regions, lessening the immediate impact on the market.

- Increased investor confidence: The combination of positive economic data and moderated central bank actions has significantly boosted investor confidence, leading to a renewed appetite for risk and driving the market rally.

Analyzing the Factors Fueling the Comeback

Several specific events contributed to this unexpected market turnaround. Strong corporate earnings reports from major companies, particularly in the tech sector, have significantly impacted market sentiment. Positive geopolitical developments, while often fleeting, have also contributed to periods of increased market optimism. The interplay between these factors, along with the overall improved economic outlook, has created a powerful tailwind for the market's resurgence. (Insert relevant chart/graph showing market index performance here)

The Downside of Bear Market Bets

The recent market rally has highlighted the significant risks associated with bearish investment strategies. Investors who bet heavily on a prolonged downturn have experienced substantial missed opportunities and, in some cases, significant losses.

Bullet Points:

- Lost opportunities due to missed market gains: Investors who remained heavily defensive or short-sold missed out on significant gains experienced during the unexpected rally. This emphasizes the difficulty of accurately timing the market.

- Potential losses from short selling or hedging strategies that backfired: Short selling, a strategy that profits from declining prices, can result in substantial losses if the market moves in the opposite direction. Similarly, hedging strategies designed to protect against market downturns may prove less effective during unexpected rallies.

- The challenges of accurately predicting market bottoms and timing the market: The recent surge underscores the inherent difficulty in accurately predicting market bottoms and timing the market perfectly. Market movements are often influenced by a complex interplay of factors that are difficult, if not impossible, to fully predict.

Re-evaluating Risk Management in Volatile Markets

The recent market volatility highlights the critical need for robust risk management strategies. A diversified investment portfolio, spread across different asset classes and sectors, is crucial to mitigate risk.

- Diversification: Diversification remains the cornerstone of successful long-term investing. Don't put all your eggs in one basket. Spread your investments across different asset classes (stocks, bonds, real estate, etc.) and sectors to reduce your exposure to any single market downturn.

- Long-term vs. Short-term Strategies: Long-term investment strategies, focused on steady growth over extended periods, are generally less susceptible to short-term market fluctuations. Avoid impulsive trading based on short-term market movements.

- Robust Risk Management Plan: A well-defined risk management plan should include diversification, appropriate asset allocation, and a clear understanding of your risk tolerance. Regularly review and adjust your strategy based on changing market conditions.

Looking Ahead: Navigating Uncertainty in the Post-Bear Market Era

The current market environment presents both risks and opportunities. While the recent rally is encouraging, it's crucial to remain cautious and prepared for potential market corrections.

Bullet Points:

- Potential for market correction or continued growth: The market's recent performance doesn't guarantee continued growth. A correction or period of consolidation is entirely possible.

- The impact of future economic data releases on investor sentiment: Future economic data releases will significantly influence investor sentiment and market direction.

- The ongoing role of geopolitical factors and their potential influence: Geopolitical events remain a significant source of market uncertainty. Developments in various regions could significantly impact market performance.

- Strategies for adapting investment portfolios to changing market conditions: Regularly review and adjust your investment portfolio to reflect changing market conditions and your own risk tolerance.

Conclusion

The unexpected comeback of Wall Street after widespread bear market predictions underscores the unpredictable nature of the market. The recent rally highlights the potential pitfalls of overly bearish bets and emphasizes the importance of adaptability and robust risk management. Don't let your bear market bets backfire. Develop a robust investment strategy that includes diversification, a long-term perspective, and a thorough understanding of your risk tolerance. Consult with a financial advisor to navigate the complexities of this evolving landscape and effectively manage your portfolio in the face of future market volatility. Learn more about adapting your investment strategy for a post-bear market environment.

Featured Posts

-

Nyt Strands Solutions Saturday March 15 Game 377

May 10, 2025

Nyt Strands Solutions Saturday March 15 Game 377

May 10, 2025 -

King Protiv Maska Pisatel Vernulsya V Sotsset X I Ne Stesnyalsya V Vyrazheniyakh

May 10, 2025

King Protiv Maska Pisatel Vernulsya V Sotsset X I Ne Stesnyalsya V Vyrazheniyakh

May 10, 2025 -

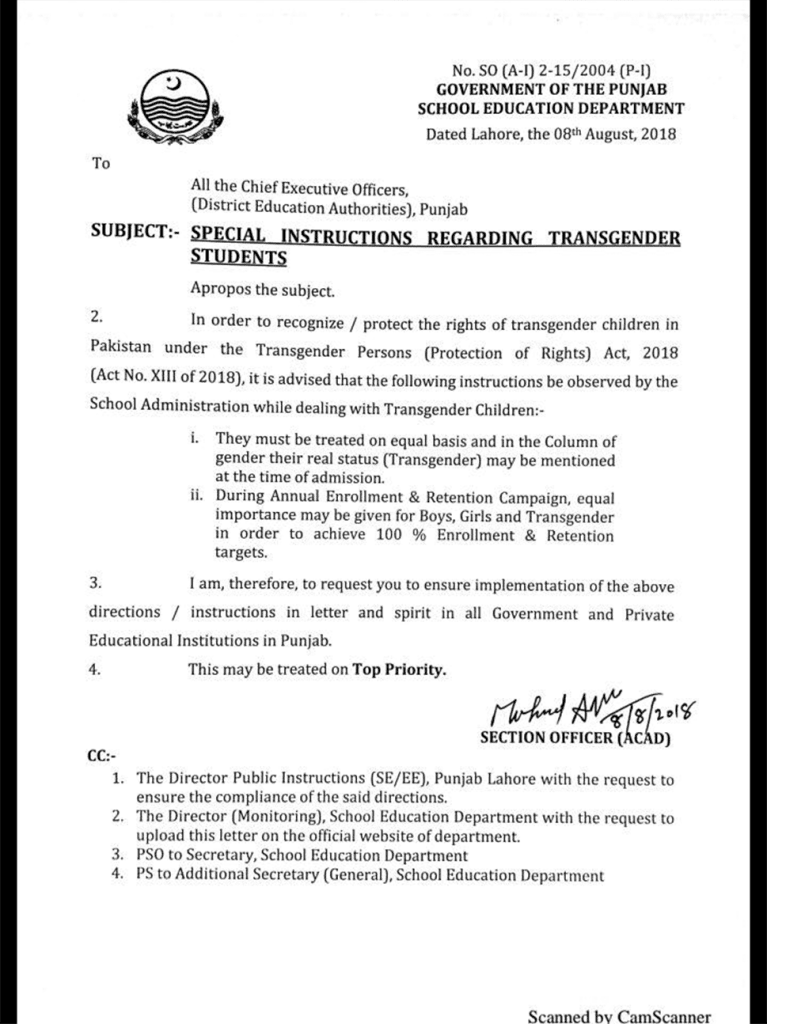

Empowering Transgenders In Punjab Through Technical Training

May 10, 2025

Empowering Transgenders In Punjab Through Technical Training

May 10, 2025 -

Can Anyone Break Ovechkins Record 9 Nhl Players With A Chance

May 10, 2025

Can Anyone Break Ovechkins Record 9 Nhl Players With A Chance

May 10, 2025 -

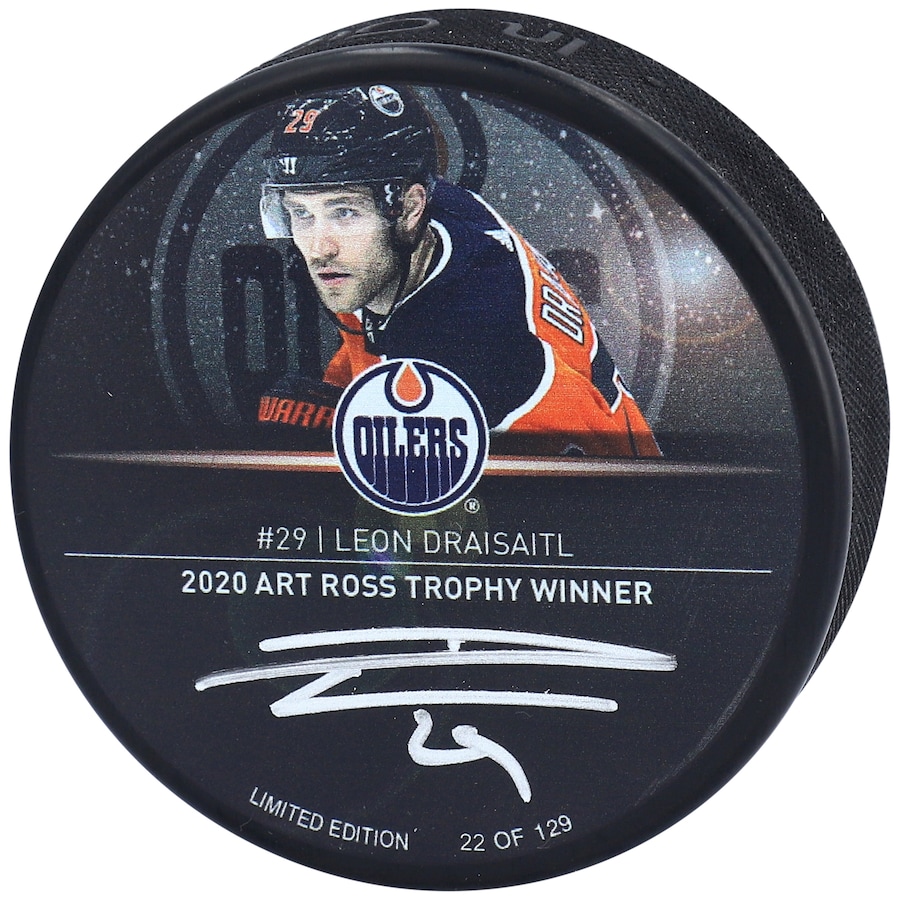

Leon Draisaitls Hart Trophy Nomination A Stellar Season For The Edmonton Oilers

May 10, 2025

Leon Draisaitls Hart Trophy Nomination A Stellar Season For The Edmonton Oilers

May 10, 2025