Florida Condo Market Crash: Why Owners Are Selling Now

Table of Contents

Rising Interest Rates and Mortgage Costs

Impact on Affordability

The Federal Reserve's aggressive interest rate hikes have significantly impacted the affordability of Florida condos. Higher mortgage rates translate directly into higher monthly payments, making condo ownership a less attractive proposition for many potential buyers.

- Higher monthly mortgage payments deter potential buyers. A seemingly small increase in the interest rate can add hundreds, even thousands, of dollars to a monthly mortgage payment, pushing many buyers out of the market.

- Increased borrowing costs reduce purchasing power. With higher interest rates, buyers can afford less expensive properties, leading to a decrease in demand for higher-priced condos.

- Fewer buyers lead to slower sales and price reductions. Reduced buyer demand inevitably results in longer time on market for sellers and, consequently, downward pressure on prices. This creates a negative feedback loop, further depressing the market.

This makes "mortgage rates Florida" a crucial factor to consider when evaluating the current market. The impact of the interest rate hike is undeniable and directly contributes to the perception of a Florida condo market crash.

Increased Insurance Premiums and Assessments

The Burden of Rising Costs

Beyond mortgage payments, Florida condo owners face another significant financial burden: escalating insurance premiums and condo association assessments.

- Hurricane damage and rising reinsurance costs drive up insurance premiums. Florida's vulnerability to hurricanes results in extremely high insurance costs, particularly for coastal properties.

- Special assessments for building repairs and renovations add financial strain. Many older condo buildings require significant repairs and renovations, leading to unexpected special assessments that can be substantial.

- Increased costs make owning a condo less attractive. The combined impact of higher insurance and assessments makes owning a Florida condo a less financially viable option for many, forcing them to sell.

Understanding "Florida condo insurance" costs and the implications of "condo association assessments" is crucial for anyone considering buying or selling in the current market.

Oversaturation of the Market

Supply and Demand Imbalance

The current "Florida condo market crash" is also fueled by an oversupply of condos. A high number of units available for sale is putting downward pressure on prices and extending selling times.

- Increased condo construction in recent years has led to a surplus of units. A construction boom in previous years has resulted in a significant increase in the number of available condos.

- High inventory puts downward pressure on prices. With more condos on the market than buyers, sellers are forced to lower their prices to attract offers.

- Owners face longer selling times and potentially lower offers. This surplus of "Florida condo inventory" creates a highly competitive selling environment, benefiting buyers and putting sellers at a disadvantage. This oversupply contributes significantly to the feeling of a market crash.

Shifting Market Demographics and Preferences

Changing Buyer Demands

The Florida real estate market is dynamic, and buyer preferences are constantly evolving. This shift in demand is contributing to the current challenges.

- Increased demand for single-family homes in certain areas. Some buyers are opting for the increased space and privacy offered by single-family homes over condos.

- Shift in preferences towards larger spaces and outdoor areas. Post-pandemic, many buyers prioritize larger living spaces and access to outdoor amenities.

- Desires for different amenities and community features. Buyer preferences for specific amenities and community features are also influencing the market. These changing "buyer demand Florida" preferences contribute to the slower movement in condo sales.

Economic Uncertainty and Recession Fears

Impact on Investor Confidence

Broader economic anxieties, including fears of a recession, are impacting investor confidence and pushing some condo owners to sell.

- Fear of a recession impacting property values. Concerns about a potential economic downturn are leading some owners to sell before a further drop in property values.

- Uncertainty about future income and job security. Economic uncertainty causes many to seek more liquid assets, leading to the sale of less liquid assets like condos.

- Desire to sell before potential further price drops. Proactive selling is a strategy employed by many to minimize potential future losses. This behavior is fueled by anxieties around "Florida real estate recession".

Conclusion

The "Florida Condo Market Crash" is a multifaceted issue driven by rising interest rates, increased insurance and assessment costs, market oversaturation, shifting demographics, and economic uncertainty. Understanding these factors is crucial for both buyers and sellers navigating this challenging market. To understand the Florida condo market crash and make smart moves, stay informed about market trends, consider consulting with experienced real estate professionals, and make informed decisions based on your individual circumstances. Don't let the perceived Florida condo market crash paralyze you; instead, use this knowledge to make sound investment choices.

Featured Posts

-

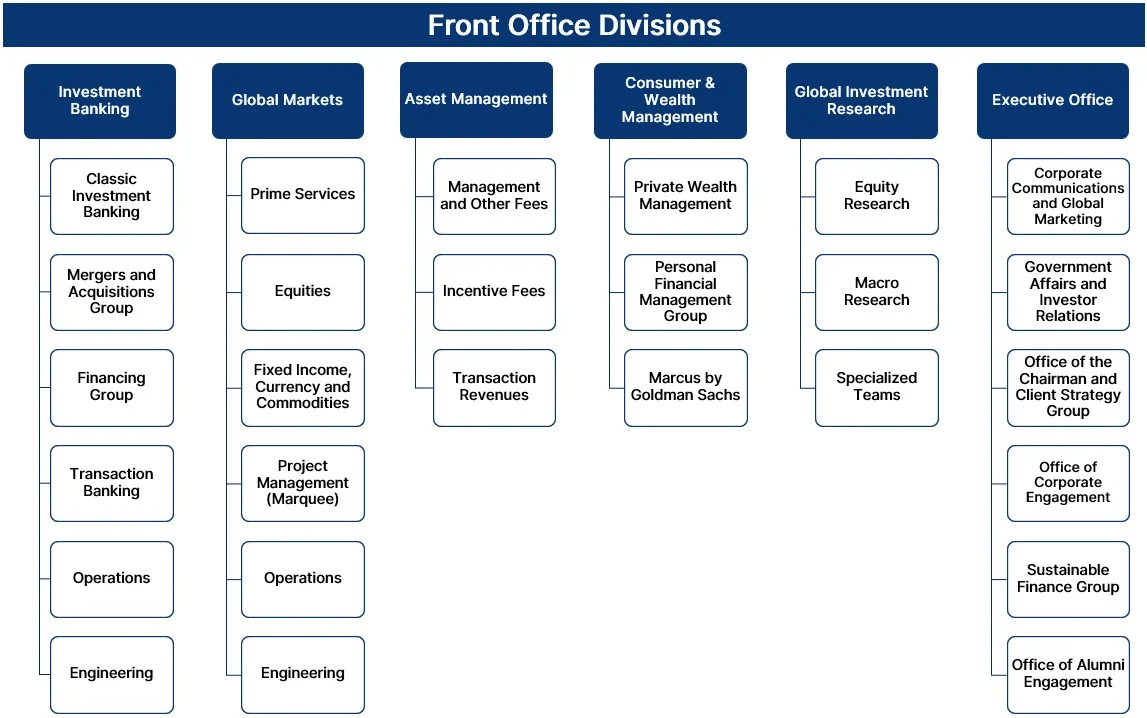

Goldman Sachs Internal Conflict The Ceos Compensation Debate

Apr 23, 2025

Goldman Sachs Internal Conflict The Ceos Compensation Debate

Apr 23, 2025 -

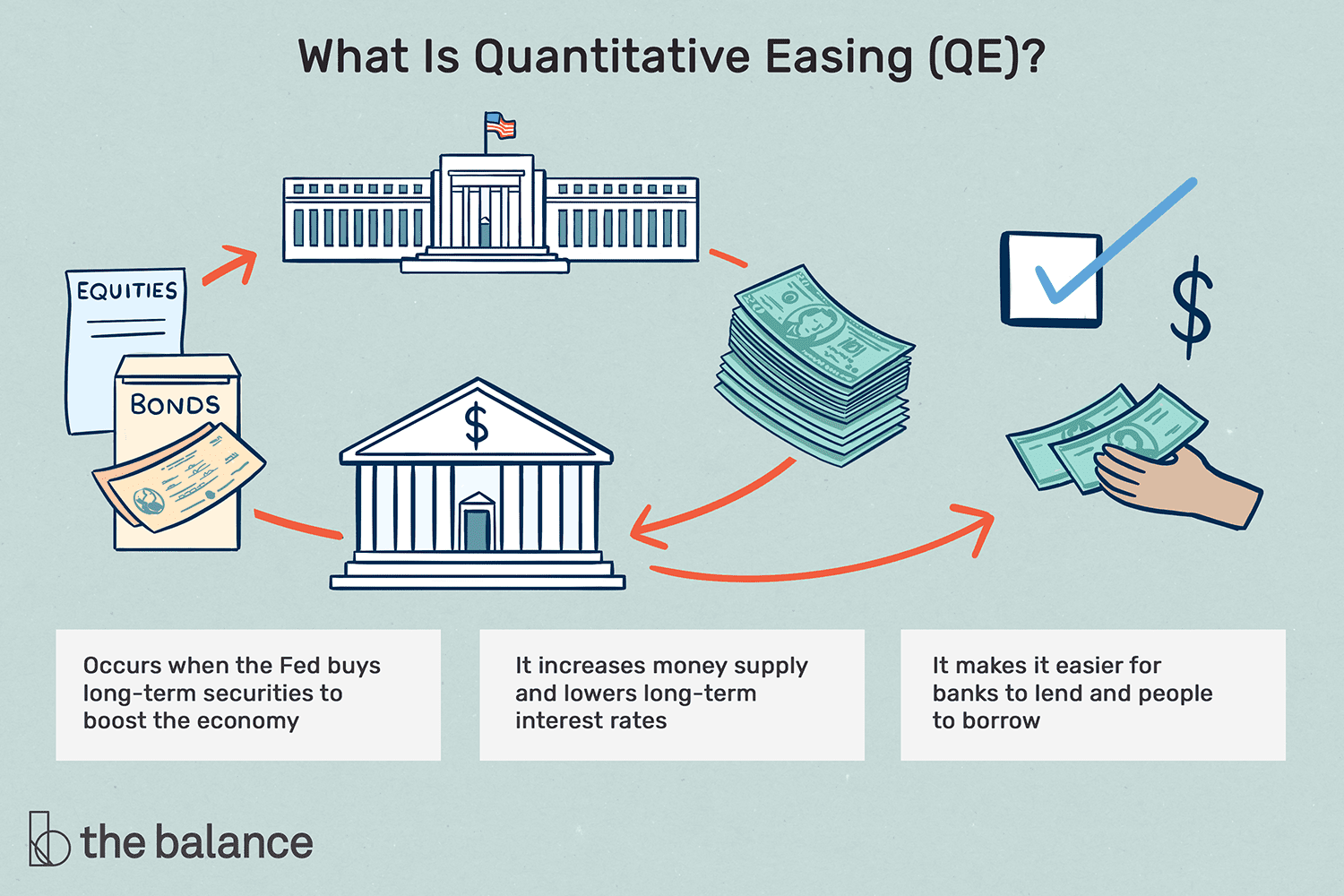

Boes Quantitative Easing Policy Greene Calls For More Targeted Interventions

Apr 23, 2025

Boes Quantitative Easing Policy Greene Calls For More Targeted Interventions

Apr 23, 2025 -

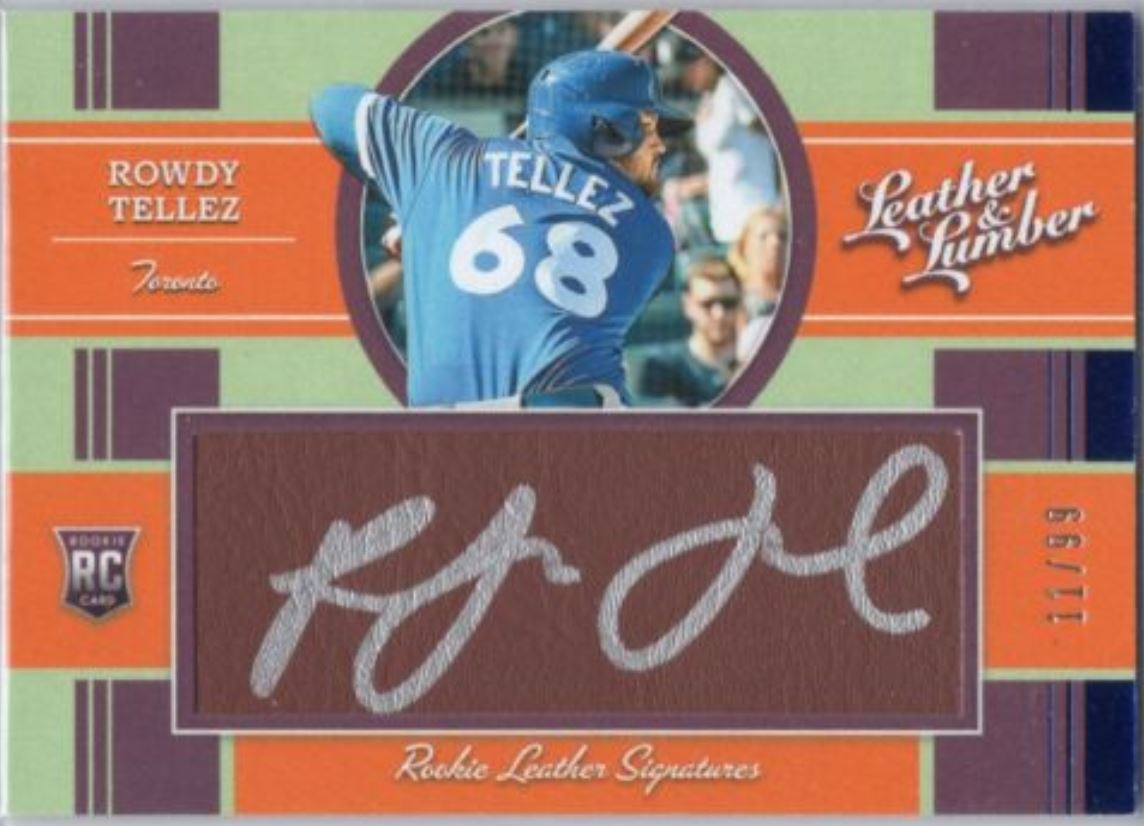

Rowdy Tellez Revenge Watch Him Get Even Against His Former Team

Apr 23, 2025

Rowdy Tellez Revenge Watch Him Get Even Against His Former Team

Apr 23, 2025 -

Le Parcours De Christelle Le Hir De La Vie Claire A Synadis Bio

Apr 23, 2025

Le Parcours De Christelle Le Hir De La Vie Claire A Synadis Bio

Apr 23, 2025 -

17 Subat Pazartesi Tv De Bu Aksam Yayinlanan Diziler

Apr 23, 2025

17 Subat Pazartesi Tv De Bu Aksam Yayinlanan Diziler

Apr 23, 2025