Goldman Sachs Internal Conflict: The CEO's Compensation Debate

Table of Contents

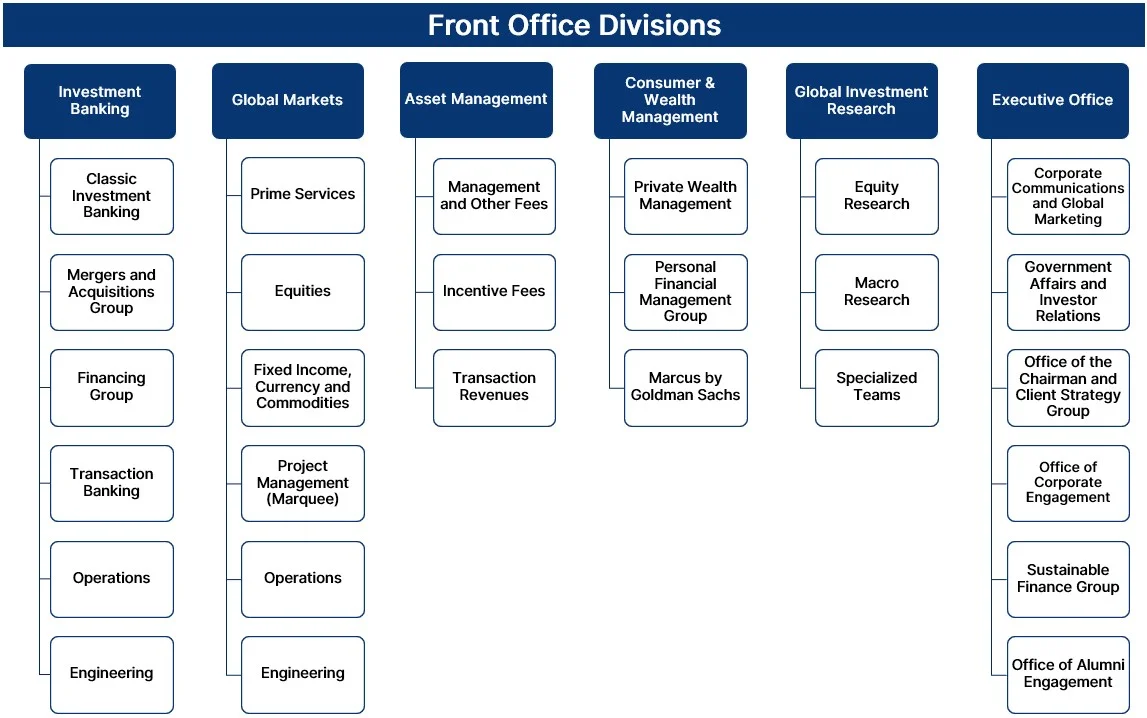

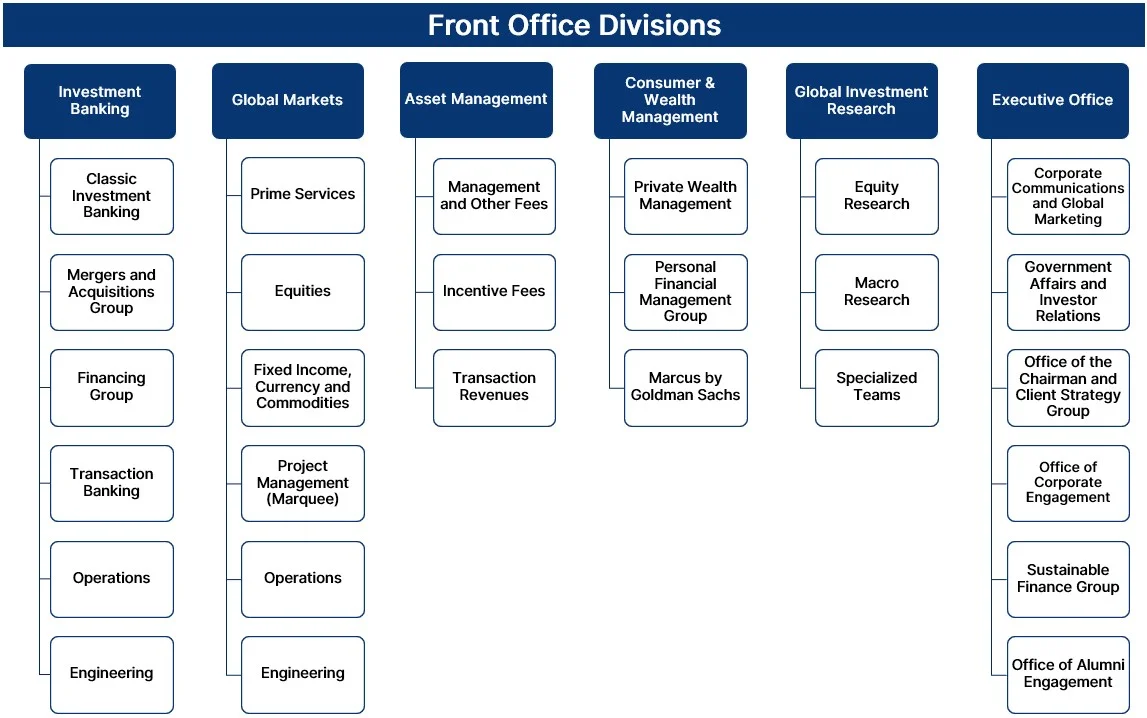

The Arguments for High CEO Compensation at Goldman Sachs

Performance-Based Incentives

Goldman Sachs justifies its high CEO pay by emphasizing a strong link between compensation and the company’s overall performance. The argument centers on the idea that performance-based incentives attract and retain top talent, driving exceptional results.

- Strong financial results: Goldman Sachs often points to years of significant profits and revenue growth as evidence of successful leadership.

- Market share gains: The CEO's strategic decisions are credited with increasing the firm's market share in key areas.

- Successful mergers & acquisitions: Strategic acquisitions, overseen by the CEO, have often contributed significantly to the firm's bottom line.

- Innovative initiatives: The introduction of new products and services, under the CEO's guidance, has driven innovation and expansion.

- Effective risk management: Successfully navigating periods of market volatility is often cited as a key justification for high CEO compensation.

To support these claims, Goldman Sachs often refers to its financial reports and press releases, highlighting key performance indicators (KPIs) linked directly to the CEO's contributions. For instance, successful navigation of the 2008 financial crisis is frequently cited as an example of strong leadership and effective risk management that justifies significant compensation.

Competitive Compensation

Attracting and retaining top-tier leadership in the highly competitive financial industry requires offering competitive compensation packages. Goldman Sachs argues that its CEO's salary must align with industry benchmarks to remain competitive.

- Industry benchmarks: Comparisons with CEO compensation at peer firms like JPMorgan Chase, Morgan Stanley, and Bank of America are regularly made to demonstrate the competitiveness of its compensation structure.

- Talent acquisition challenges: Securing and retaining experienced individuals with the necessary expertise requires offering lucrative compensation packages.

- The importance of retaining experienced leadership: The continuity of experienced leadership is crucial for maintaining stability and consistent performance.

Data comparing CEO compensation across major financial institutions often supports Goldman Sachs' claim that its CEO pay is within the competitive range. However, critics argue that these comparisons often fail to account for differences in company size, risk profiles, and overall performance.

The Arguments Against High CEO Compensation at Goldman Sachs

Pay Disparity and Inequality

A central criticism of Goldman Sachs' CEO compensation lies in the vast disparity between executive pay and that of the average employee. This significant gap fuels concerns about inequality and its impact on employee morale.

- Statistics highlighting the compensation disparity: The ratio between CEO pay and the median employee salary at Goldman Sachs is significantly higher than the national average, often exceeding hundreds or even thousands to one.

- Employee morale issues: Such extreme pay discrepancies can lead to decreased morale, reduced productivity, and increased employee turnover.

- Potential impact on company culture: A perceived lack of fairness in compensation can negatively impact the overall company culture and employee engagement.

Numerous reports and studies highlight the growing income inequality in the financial sector, fueling public debate about the ethical implications of such vast compensation disparities. This issue is often linked to broader societal concerns about wealth distribution and social justice.

Lack of Transparency and Accountability

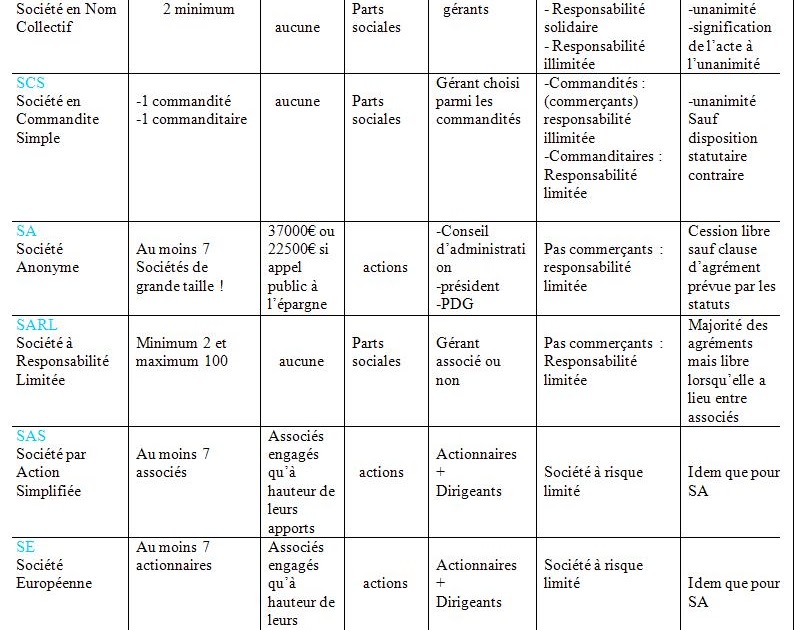

Critics argue that Goldman Sachs' CEO compensation structure lacks transparency and accountability. The complexity of the compensation packages makes it difficult to assess the true value of the compensation and to evaluate performance accurately.

- Complex compensation structures: The intricacies of bonus structures, stock options, and other benefits make it challenging to understand how the final compensation figure is determined.

- Difficulty in understanding performance metrics: The metrics used to justify CEO compensation are often complex and not readily understandable to shareholders or employees.

- Lack of shareholder input: Critics argue that shareholders lack sufficient input into the process of determining CEO compensation, leading to a lack of accountability.

Shareholder activism and criticisms from financial analysts often point to a lack of transparency and clear link between CEO performance and compensation. This lack of clear accountability reinforces concerns about potential conflicts of interest.

Societal Concerns and Ethical Implications

The debate surrounding Goldman Sachs CEO compensation extends beyond the internal dynamics of the firm. It raises broader ethical concerns about excessive executive pay and its impact on society.

- Public image issues: High CEO compensation can damage a company's public image, particularly in times of economic uncertainty or social unrest.

- Corporate social responsibility: Critics argue that excessive CEO pay detracts from a company’s commitment to corporate social responsibility and its responsibility to its employees and wider stakeholders.

- The potential for reputational damage: The negative publicity surrounding high executive pay can have a long-term impact on a company's reputation and its ability to attract investors and clients.

Articles discussing corporate social responsibility and the ethical responsibilities of large financial institutions often highlight the negative consequences of excessive executive pay, not only for employee morale but also for the firm's long-term sustainability.

The Impact of the Debate on Goldman Sachs' Reputation and Future

The ongoing debate surrounding Goldman Sachs CEO compensation has significant potential consequences for the firm.

- Impact on stock price: Negative publicity surrounding executive pay can negatively impact investor confidence and ultimately, the firm's stock price.

- Recruitment challenges: The controversy may make it more difficult for Goldman Sachs to attract and retain top talent who may be wary of associating with a company facing such public criticism.

- Potential for regulatory scrutiny: Increased scrutiny from regulators regarding executive compensation practices is a possibility.

- Changes in corporate governance: The debate may necessitate changes in Goldman Sachs' corporate governance structure to increase transparency and accountability in CEO compensation decisions.

Financial analysts and corporate governance specialists have weighed in on the potential long-term impact, suggesting that addressing this issue is crucial for maintaining investor confidence and ensuring the long-term sustainability of the firm.

Conclusion: Resolving the Goldman Sachs CEO Compensation Debate

The debate surrounding Goldman Sachs CEO compensation highlights a complex interplay between performance-based incentives, competitive compensation, pay disparity, transparency, accountability, and broader societal concerns. Key takeaways include the need for greater transparency in compensation structures, a more equitable distribution of wealth within the company, and a stronger emphasis on corporate social responsibility.

What is your opinion on the Goldman Sachs CEO compensation debate? Share your thoughts in the comments below and let's discuss how to achieve a fairer and more sustainable approach to executive pay at Goldman Sachs. Learn more about Goldman Sachs CEO compensation and stay informed on the ongoing debate surrounding Goldman Sachs executive pay.

Featured Posts

-

Synadis Bio Et La Vie Claire Sous La Direction De Christelle Le Hir

Apr 23, 2025

Synadis Bio Et La Vie Claire Sous La Direction De Christelle Le Hir

Apr 23, 2025 -

Tournee Minerale Et Dry January Un Marche Du Sans Alcool En Pleine Expansion

Apr 23, 2025

Tournee Minerale Et Dry January Un Marche Du Sans Alcool En Pleine Expansion

Apr 23, 2025 -

Resume Bfm Bourse 17 Fevrier 15h Et 16h

Apr 23, 2025

Resume Bfm Bourse 17 Fevrier 15h Et 16h

Apr 23, 2025 -

Uk Diy Store Showdown Best And Worst Ranked

Apr 23, 2025

Uk Diy Store Showdown Best And Worst Ranked

Apr 23, 2025 -

Good Morning Business Du 3 Mars Le Recapitulatif Complet

Apr 23, 2025

Good Morning Business Du 3 Mars Le Recapitulatif Complet

Apr 23, 2025