Finance Loans 101: A Practical Guide For Loan Applicants

Table of Contents

Understanding Different Types of Finance Loans

Choosing the right finance loan depends entirely on your specific needs and financial situation. Let's explore some common types:

Personal Loans

These unsecured loans are used for various purposes, from debt consolidation to home improvements or even covering unexpected expenses.

- Pros: Flexible repayment terms, often a quick approval process, and can be used for a variety of purposes.

- Cons: Higher interest rates compared to secured loans, requiring good credit for favorable terms.

Keywords: Personal loans, unsecured loans, debt consolidation loans, personal loan interest rates

Business Loans

Vital for starting or expanding a business, these loans can fund equipment purchases, operational costs, marketing initiatives, or even working capital. Different types of business loans exist, including:

-

Small Business Administration (SBA) loans: Backed by the government, these offer favorable terms but involve a more rigorous application process.

-

Term loans: These loans offer a fixed repayment schedule over a specified period.

-

Lines of credit: These provide access to funds as needed, up to a pre-approved limit.

-

Pros: Can significantly boost business growth and provide necessary capital for expansion or startup costs.

-

Cons: Requires a strong business plan, a good credit history, and often collateral.

Keywords: Business loans, small business loans, SBA loans, commercial loans, term loans, lines of credit, business loan applications

Mortgages

Used to purchase real estate, these secured loans are typically long-term and have lower interest rates than unsecured loans like personal loans. Several mortgage types exist, including:

-

Fixed-rate mortgages: Offer a consistent interest rate throughout the loan term.

-

Adjustable-rate mortgages (ARMs): Have interest rates that can change periodically based on market conditions.

-

Pros: Allows for homeownership, potential tax benefits (depending on your location), and relatively low interest rates compared to other loan types.

-

Cons: Large upfront costs (down payment, closing costs), a lengthy application process, and significant long-term financial commitment.

Keywords: Mortgages, home loans, mortgage rates, refinancing, fixed-rate mortgages, adjustable-rate mortgages, mortgage applications

Auto Loans

Used to finance the purchase of a vehicle, these loans are typically secured by the vehicle itself.

- Pros: Easier to get approved for than some other types of loans, especially if you have a good credit history.

- Cons: The car serves as collateral; if you default on the loan, you risk losing your vehicle. Interest rates can vary depending on your credit score and the terms of the loan.

Keywords: auto loans, car financing, vehicle loans, auto loan rates, car loan calculator

Improving Your Credit Score for Better Loan Terms

Your credit score significantly impacts the interest rates and terms you'll receive on any loan. Improving your credit score before applying can save you considerable money over the life of the loan.

Checking Your Credit Report

Regularly reviewing your credit report from all three major bureaus (Equifax, Experian, and TransUnion) is crucial. Identify and address any errors or fraudulent activity immediately. You can access your credit reports for free annually at AnnualCreditReport.com.

Keywords: Credit report, credit score, credit bureaus, credit monitoring, free credit report, credit report errors

Paying Bills on Time

Consistent on-time payments are the most significant factor influencing your credit score. Set up automatic payments or reminders to avoid late payments.

Keywords: On-time payments, credit history, payment history, credit score improvement

Managing Debt

Keeping your debt utilization ratio low (the amount of credit you use compared to your available credit) is essential. Aim to keep your utilization below 30%.

Keywords: Debt management, debt utilization ratio, credit utilization, credit card debt, reducing debt

The Loan Application Process: A Step-by-Step Guide

Applying for a finance loan involves several key steps:

Research and Comparison

Shop around and compare offers from different lenders (banks, credit unions, online lenders) to find the best interest rates and terms. Use online loan comparison tools to streamline this process.

Keywords: Loan comparison, interest rates, loan terms, loan lenders, online loan comparison

Gathering Required Documents

Prepare all necessary documents, such as proof of income (pay stubs, tax returns), identification (driver's license, passport), and bank statements. The specific documents required will vary depending on the loan type and lender.

Keywords: Loan application, required documents, income verification, proof of income, bank statements

Completing the Application

Fill out the application accurately and completely. Inaccurate information can delay or even deny your application.

Keywords: Loan application process, online application, loan approval, loan application form

Understanding Loan Terms and Fees

Before signing any loan agreement, understand all the terms and fees involved.

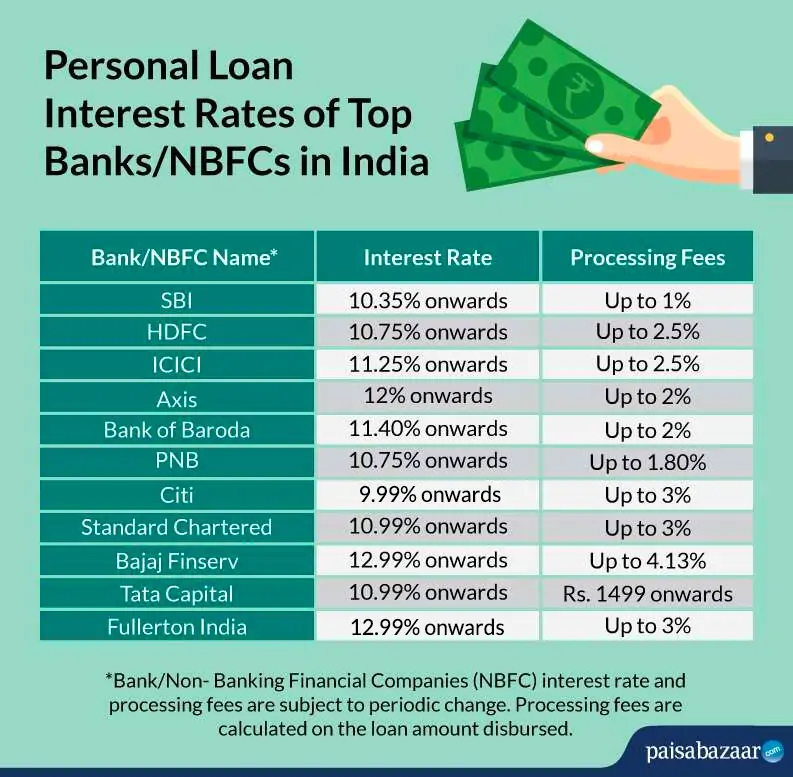

Interest Rates

The cost of borrowing money, expressed as a percentage (APR - Annual Percentage Rate). Lower interest rates mean lower overall loan costs.

Keywords: Interest rates, APR (Annual Percentage Rate), loan costs, interest rate comparison

Fees

Various fees may apply, such as origination fees (charged by the lender for processing the loan), late payment fees, and prepayment penalties (for paying off the loan early).

Keywords: Loan fees, origination fees, late fees, prepayment penalties, loan closing costs

Repayment Terms

Understand the loan's repayment schedule (amortization schedule), loan duration (term), and total cost (including interest and fees).

Keywords: Loan repayment, amortization schedule, loan duration, loan term, monthly payments

Conclusion

Securing finance loans requires careful planning and understanding. This "Finance Loans 101" guide has provided a foundational overview of different loan types, credit score importance, the application process, and key terms to consider. By diligently researching your options, improving your credit score, and understanding the loan terms, you can significantly increase your chances of approval and secure the best possible financing for your needs. Start your journey toward financial success by exploring various finance loan options today! Remember to always carefully review loan agreements before signing.

Featured Posts

-

Global Cities And Climate Whiplash Understanding The Risks And Impacts

May 28, 2025

Global Cities And Climate Whiplash Understanding The Risks And Impacts

May 28, 2025 -

Personal Loan Interest Rates Today Factors Affecting Your Rate

May 28, 2025

Personal Loan Interest Rates Today Factors Affecting Your Rate

May 28, 2025 -

Foinikiko Sxedio Premiera Apo Tis Kannes

May 28, 2025

Foinikiko Sxedio Premiera Apo Tis Kannes

May 28, 2025 -

Will Manchester United Sign Rayan Cherki This Summer

May 28, 2025

Will Manchester United Sign Rayan Cherki This Summer

May 28, 2025 -

Test Du Samsung Galaxy S25 Ultra 256 Go Un Top Produit

May 28, 2025

Test Du Samsung Galaxy S25 Ultra 256 Go Un Top Produit

May 28, 2025