Personal Loan Interest Rates Today: Factors Affecting Your Rate

Table of Contents

Your Credit Score: The Most Significant Factor

Your credit score is arguably the most significant factor determining your personal loan interest rates today. Lenders use your credit score, a three-digit number representing your creditworthiness, to assess your risk. A higher credit score indicates a lower risk to the lender, resulting in a lower interest rate. Conversely, a lower credit score suggests a higher risk, leading to higher interest rates.

- Example: A borrower with a credit score above 750 might qualify for a personal loan with an interest rate of 6%, while someone with a score around 600 might face an interest rate of 15% or higher for the same loan.

- Credit History Length and Payment History: The length of your credit history and your consistent on-time payment history significantly influence your score. A long history of responsible credit management demonstrates reliability and reduces perceived risk for lenders.

- Improving Your Credit Score: You can improve your credit score by paying bills on time, keeping your credit utilization low (the amount of credit you use compared to your total credit limit), and avoiding new credit applications unnecessarily. You can check your credit report for free annually from AnnualCreditReport.com.

Loan Amount and Term

The amount you borrow and the loan term (repayment period) also significantly impact your personal loan interest rates today. Generally, larger loan amounts come with higher interest rates because they represent a greater risk to the lender. The loan term also plays a role:

- Loan Amount: Borrowing $10,000 might result in a lower interest rate than borrowing $25,000, even with the same credit score.

- Loan Term Length: A shorter loan term (e.g., 12 months) will typically have a higher monthly payment but a lower overall interest paid compared to a longer term (e.g., 60 months). Shorter terms are viewed as less risky by lenders. Choosing the right balance between affordability and total interest cost is key.

Consider the trade-off carefully; a shorter loan term may mean higher monthly payments but significantly less interest paid over the life of the loan.

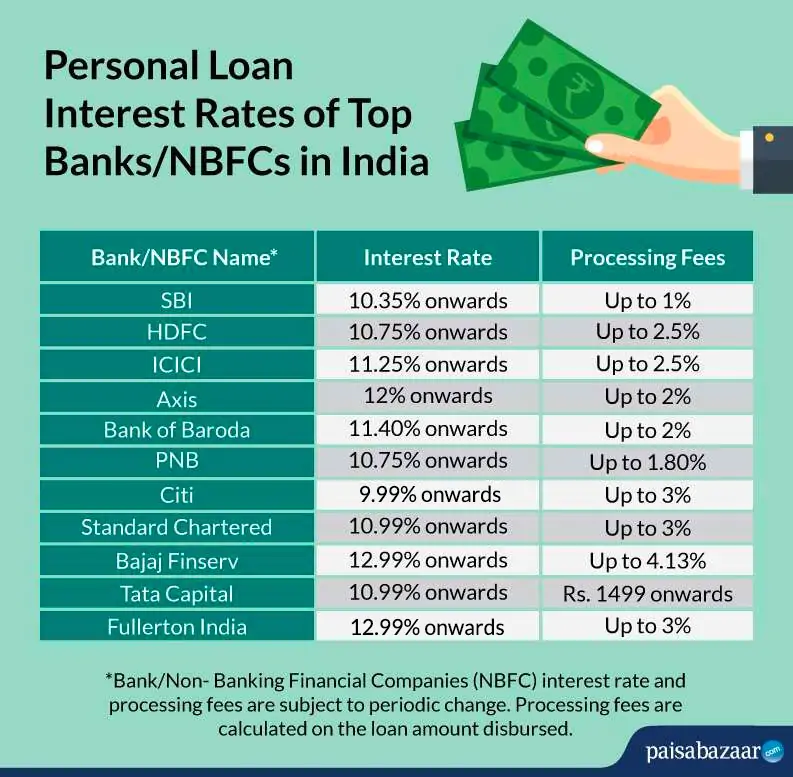

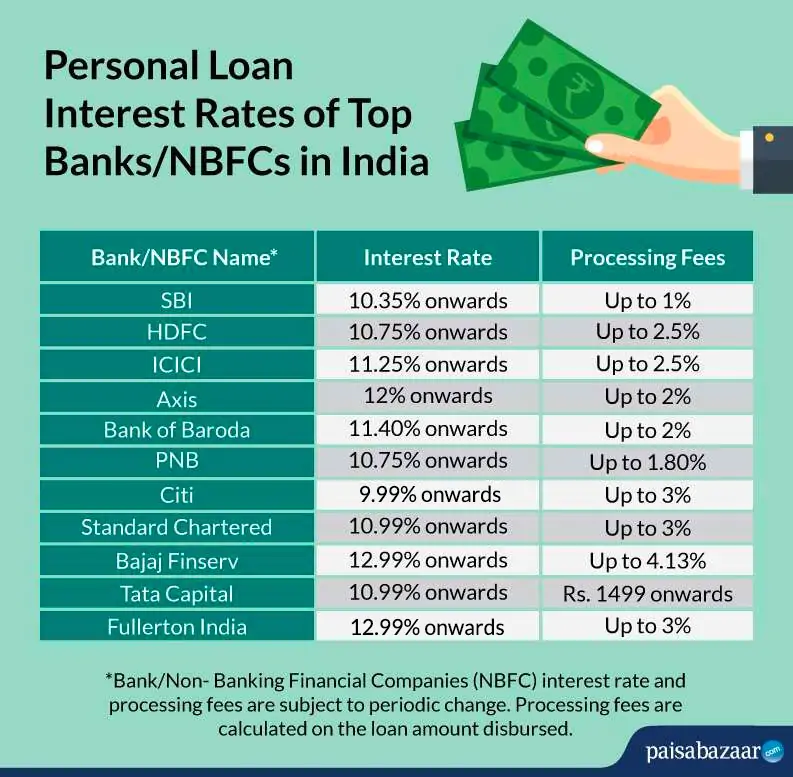

Lender Type and Interest Rate

Different lenders—banks, credit unions, and online lenders—offer varying personal loan interest rates today. Understanding these differences is critical to finding the best deal.

- Banks: Often have competitive rates but might require stricter eligibility criteria.

- Credit Unions: May offer lower rates than banks, particularly to their members, but their loan products might be more limited.

- Online Lenders: Can provide convenient and fast loan processing but may have higher interest rates than traditional lenders. Always carefully compare fees and hidden costs, which can significantly impact the total cost.

- Loan Comparison: It's crucial to compare offers from multiple lenders to secure the most favorable personal loan interest rates today.

Debt-to-Income Ratio (DTI): A Key Consideration

Your debt-to-income ratio (DTI) is a crucial factor affecting your loan eligibility and interest rates. DTI is the percentage of your gross monthly income that goes towards debt repayment. A high DTI indicates that a larger portion of your income is already committed to debt, increasing the risk for lenders and often leading to higher interest rates or even loan rejection.

- Calculating DTI: To calculate your DTI, add up your monthly debt payments (loans, credit cards, etc.) and divide by your gross monthly income.

- DTI Impact: A DTI above 43% is generally considered high and may make it difficult to secure a loan or result in higher interest rates.

- Improving DTI: You can improve your DTI by paying down existing debts, increasing your income, or both.

Other Factors Influencing Personal Loan Interest Rates Today

While less significant than the factors above, several other elements can subtly influence your personal loan interest rates today:

- Loan Type (Secured vs. Unsecured): Secured loans (backed by collateral) usually have lower interest rates than unsecured loans.

- Interest Rate Trends: Overall economic conditions and prevailing interest rate trends also affect rates.

- Income and Employment History: A stable income and a long employment history demonstrate financial stability and lower risk.

- Collateral Offered: If applicable, the value and type of collateral offered can influence interest rates.

Finding the Best Personal Loan Interest Rates Today

In conclusion, securing the best personal loan interest rates today involves understanding several key factors: your credit score, loan amount and term, the lender type, and your debt-to-income ratio. Shopping around and comparing offers from multiple lenders is vital to finding the most competitive rates. Improving your credit score and managing your debt effectively are proactive steps to enhance your chances of securing favorable personal loan interest rates today. Start researching personal loan interest rates today by comparing offers from various lenders. Your financial future depends on understanding the factors that affect your personal loan interest rate!

Featured Posts

-

Hailee Steinfelds Sharp Suit At Good Morning America

May 28, 2025

Hailee Steinfelds Sharp Suit At Good Morning America

May 28, 2025 -

Kanye Wests Escape Did Bianca Censoris Departure Trigger His Flight

May 28, 2025

Kanye Wests Escape Did Bianca Censoris Departure Trigger His Flight

May 28, 2025 -

Exploring The Capabilities And Limitations Of Googles Veo 3 Ai Video Generator

May 28, 2025

Exploring The Capabilities And Limitations Of Googles Veo 3 Ai Video Generator

May 28, 2025 -

Trendige Lavender Milk Nails So Stylen Sie Den Look

May 28, 2025

Trendige Lavender Milk Nails So Stylen Sie Den Look

May 28, 2025 -

Wawali Balikpapan Janji Bangun Taman Kota 1 Hektare Per Kecamatan

May 28, 2025

Wawali Balikpapan Janji Bangun Taman Kota 1 Hektare Per Kecamatan

May 28, 2025