Exclusive: Elon Musk's X Corp. Debt Fully Sold By Wall Street Banks

Table of Contents

The Scale of the Debt and the Banks Involved

The sheer magnitude of the debt sold is staggering. While precise figures are still emerging, reports suggest billions of dollars in X Corp debt were successfully unloaded by a syndicate of major Wall Street banks. Key players reportedly include Goldman Sachs, Morgan Stanley, JPMorgan Chase, and Bank of America, although the exact participation of each bank is yet to be fully disclosed.

- Role of the Banks: Each bank played a crucial role, from underwriting the initial debt to participating in the syndication process, effectively distributing the risk among multiple financial institutions. This complex process allowed for a swift and efficient sale, minimizing potential losses for any single entity.

- Risk Assessment: These banks assumed considerable risk by taking on Elon Musk’s X Corp debt. The platform's recent turbulent period, including significant staff reductions and ongoing platform changes, presented a considerable challenge for these financial institutions. The rapid and complete sale suggests a degree of confidence (or perhaps a swift need to offload the debt) in the overall long-term financial health of X Corp.

- Speed of the Sale: The speed at which the debt was sold is noteworthy. Such a large-scale transaction usually takes considerably longer. This rapid sale might indicate a pre-arranged strategy, high investor demand, or a pressing need to remove this liability from the banks’ balance sheets. This aspect warrants further investigation.

Implications for X Corp and its Future

The successful sale of X Corp's debt significantly impacts its long-term financial health. While the immediate pressure is relieved, the sale's terms will likely influence X Corp's operational strategies and future investment capabilities. The company might need to prioritize profitability over rapid expansion in the short term.

- Impact on Stock Price (if applicable): The debt sale's effect on X Corp's stock price, if publicly traded, would be a key indicator of investor confidence. A positive market reaction might signal investor belief in the company's long-term viability.

- Strategic Shifts: The sale could force X Corp to adopt a more fiscally conservative approach, potentially impacting its ambitious expansion plans and ongoing projects. This might lead to a shift in strategic focus, potentially involving resource reallocation and perhaps a scaling back of less profitable ventures.

- Future Mergers and Acquisitions: The improved financial position following the debt sale might enable X Corp to pursue strategic mergers or acquisitions to expand its market share or bolster its technological capabilities. However, the need to maintain a healthier balance sheet might make such large-scale moves less likely in the short term.

The Broader Market Reaction and Analysis

The news of the debt sale has generated significant buzz within the financial community and beyond. Investors are closely watching the developments, analyzing its implications for similar high-risk ventures and the overall tech sector.

- Market Fluctuations: The overall market response is likely to be complex and multifaceted. Immediate stock market fluctuations related to X Corp (and possibly other related companies) will be closely monitored. The effect on investor sentiment will be an important factor to analyze.

- Expert Opinions: Financial analysts and experts are likely to provide diverse perspectives on this event, influencing investor sentiment and potentially impacting the valuation of similar tech companies.

- Regulatory Implications: The scale and speed of the debt sale might attract regulatory scrutiny, particularly concerning transparency and the management of risk by the involved banks.

Elon Musk's Financial Strategy and Future Moves

This debt sale is a significant chapter in Elon Musk's often unconventional financial strategy. His history of navigating high-risk ventures and debt restructuring provides a framework for interpreting this latest move.

- Previous Financial Maneuvers: Musk's past financial maneuvers, including debt financing for Tesla and SpaceX, provide valuable context. His track record suggests a willingness to take on significant risk for potentially high rewards.

- Impact on Other Ventures: The success (or failure) of this X Corp debt offloading will likely have implications for Musk's other ventures, especially if it affects his overall borrowing power or investor confidence.

- Musk's Next Move: The future will reveal if this debt reduction represents a pivot toward more financial stability or merely a temporary reprieve, enabling further ambitious expansion for X Corp and his other companies.

Conclusion

The successful sale of Elon Musk's X Corp. debt marks a significant event with far-reaching implications. The involvement of major Wall Street banks, the scale of the debt, and the speed of the sale all highlight the complexity and potential risks involved. The impact on X Corp's future, the broader market, and Musk's overall financial strategy remains to be seen, but this development certainly warrants close monitoring.

Call to Action: Stay tuned for further updates on the evolving financial landscape surrounding Elon Musk's X Corp. Keep following our coverage for more exclusive insights into the impact of this significant debt sale and its implications for the future of X Corp and the tech industry. We'll continue to provide expert analysis on Elon Musk's X Corp. debt and related financial news.

Featured Posts

-

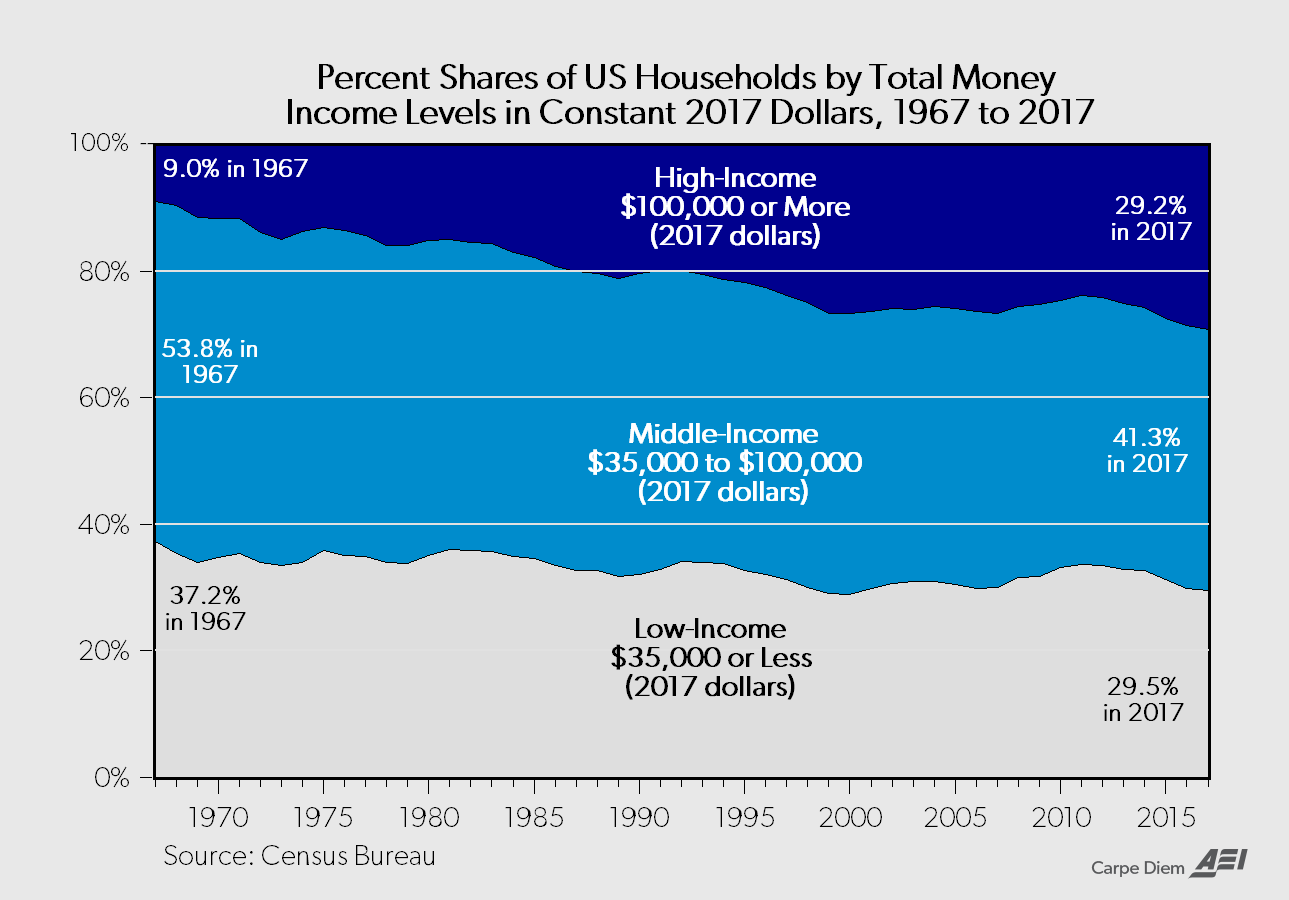

Us Middle Class Income State Specific Data And Analysis

Apr 30, 2025

Us Middle Class Income State Specific Data And Analysis

Apr 30, 2025 -

Channing Tatum 44 Confirms Relationship With Inka Williams 25

Apr 30, 2025

Channing Tatum 44 Confirms Relationship With Inka Williams 25

Apr 30, 2025 -

Fan Favourites Coronation Street Exit What To Expect

Apr 30, 2025

Fan Favourites Coronation Street Exit What To Expect

Apr 30, 2025 -

Martyny Thtfl Sjl Jdyd Lmhby Alraklyt

Apr 30, 2025

Martyny Thtfl Sjl Jdyd Lmhby Alraklyt

Apr 30, 2025 -

Louisvilles Early 2025 Weather A Story Of Snow Tornadoes And Catastrophic Flooding

Apr 30, 2025

Louisvilles Early 2025 Weather A Story Of Snow Tornadoes And Catastrophic Flooding

Apr 30, 2025