US Middle Class Income: State-Specific Data And Analysis

Table of Contents

H2: Methodology and Data Sources for US Middle Class Income Analysis

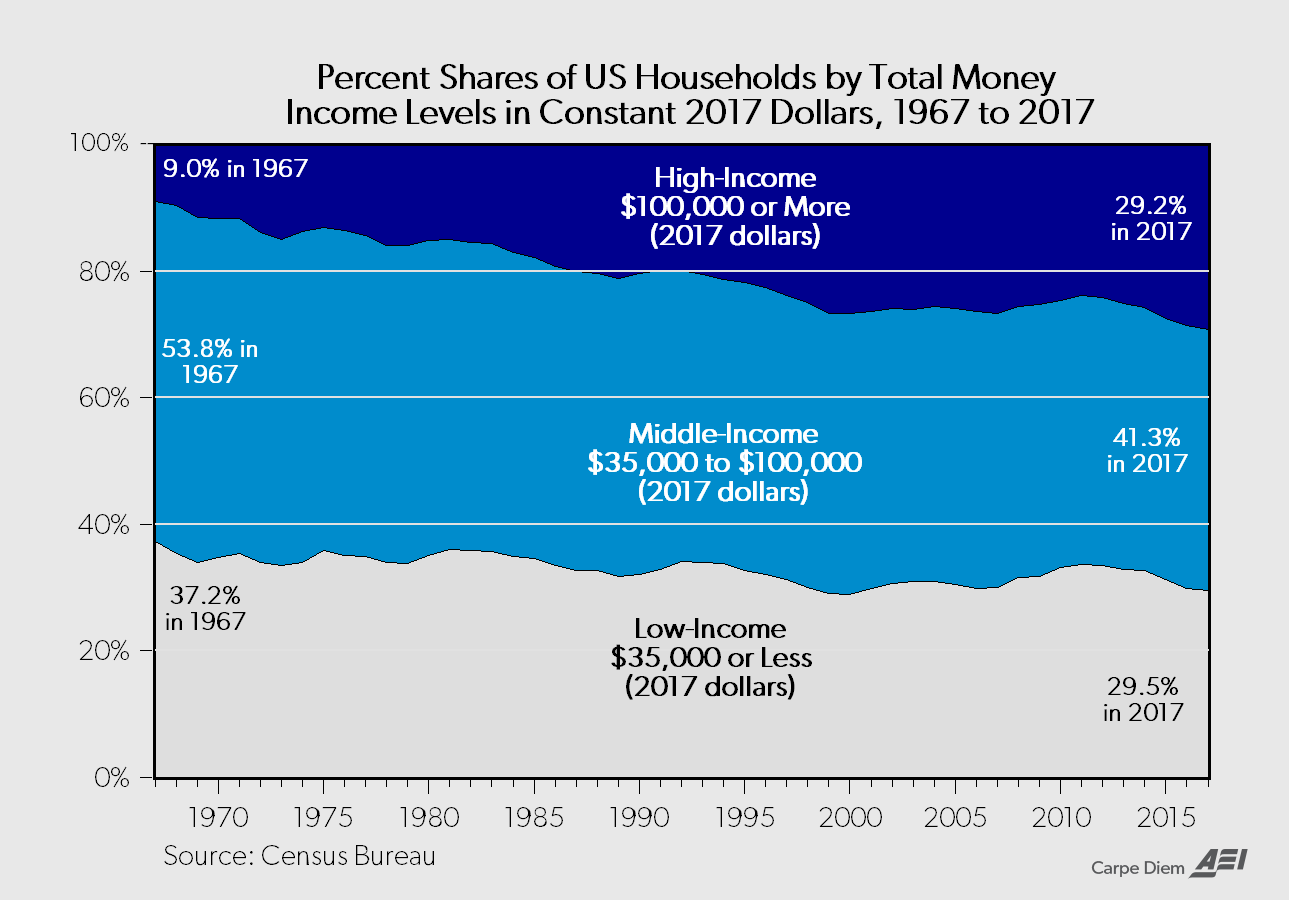

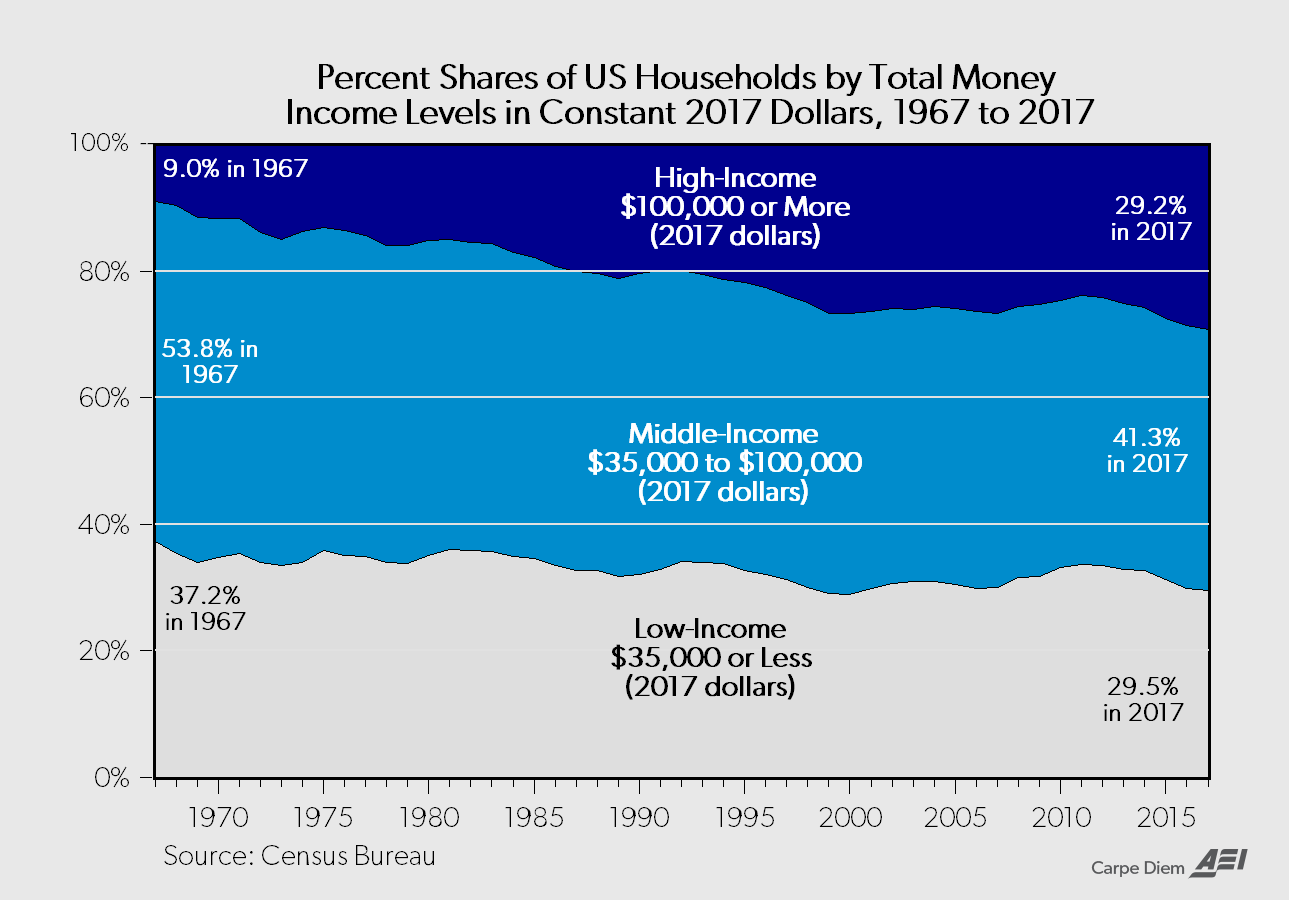

Our analysis of US middle class income relies on data from reputable sources to ensure accuracy and reliability. We primarily utilize data from the US Census Bureau, specifically their American Community Survey (ACS), which provides detailed information on household income, poverty, and other socioeconomic indicators at the state level. The Bureau of Economic Analysis (BEA) data, focusing on personal income and regional economic trends, complements the Census data.

To define "middle class," we use a common metric: households with incomes falling within the middle 60% of the national income distribution. This approach adjusts for cost of living variations across states, a crucial factor often overlooked in simpler income comparisons. We utilize the Consumer Price Index (CPI) data from the Bureau of Labor Statistics (BLS) to adjust household income figures for each state, offering a more accurate reflection of purchasing power.

- Specific data sources cited:

*

*

* - Adjustments for cost of living: We employ the BLS's CPI data to adjust nominal income figures for each state, providing a more accurate representation of real income and purchasing power. This ensures a fairer comparison between states with vastly different living costs.

- Limitations in data accuracy or coverage: While the data used is comprehensive, some limitations exist. The ACS relies on sampling, introducing a margin of error. Furthermore, the definition of "middle class" can be subjective, and this analysis uses a commonly accepted but not universally agreed-upon metric.

H2: State-by-State Breakdown of Middle Class Income

Analyzing state-specific income data reveals significant regional disparities in US middle class income. The following highlights some key findings, presented visually to enhance understanding:

[Insert interactive map or chart visualizing middle-class income by state. Color-coding would effectively highlight high and low income states.]

- Top 5 states with the highest middle-class income: (Insert data here, e.g., Maryland, Connecticut, New Jersey, Hawaii, California)

- Bottom 5 states with the lowest middle-class income: (Insert data here, e.g., Mississippi, West Virginia, Arkansas, New Mexico, Louisiana)

- Significant regional disparities and possible explanations: The Northeast and West Coast tend to exhibit higher middle-class incomes, likely due to a concentration of high-paying jobs in technology, finance, and other specialized sectors. Conversely, the South and parts of the Midwest frequently show lower incomes, potentially linked to lower education attainment, fewer high-paying industries, and a higher prevalence of lower-wage jobs.

H2: Factors Influencing Middle Class Income at the State Level

Several interconnected factors influence middle class income at the state level. These include:

-

Key economic factors:

- Employment rates: High employment rates, especially in high-paying sectors, directly contribute to higher middle-class incomes.

- Industry diversification: States with diverse economies, less reliant on a single industry, tend to be more resilient to economic downturns and offer more opportunities for higher incomes.

- Education levels: Higher levels of education attainment generally correlate with higher earning potential, impacting overall middle-class income.

- Taxation policies: State tax policies, particularly those related to income taxes and property taxes, can significantly influence disposable income and the overall financial well-being of the middle class.

-

Social factors:

- Social safety nets: Robust social safety nets, such as unemployment benefits and affordable healthcare, can help mitigate income shocks and provide a buffer for middle-class families.

- Access to healthcare: High healthcare costs can significantly strain middle-class budgets, impacting their overall financial security.

- Affordable housing: The availability of affordable housing is crucial for middle-class families, as housing costs are a major expense.

-

Impact of government policies: State-level policies on education, infrastructure, and job training can influence long-term economic growth and middle-class income.

H2: Implications and Future Trends of US Middle Class Income

The persistent disparities in US middle class income have profound implications:

-

Long-term consequences of income inequality: Widening income gaps can lead to social unrest, decreased social mobility, and slower economic growth.

-

Future trends: Without significant policy interventions, the trend of increasing income inequality may continue, potentially exacerbating the challenges faced by the middle class.

-

Policy implications: To address income inequality and support the middle class, policy interventions could include:

- Increased investment in education and job training programs.

- Strengthening social safety nets.

- Promoting economic diversification and creating high-paying job opportunities.

- Implementing progressive tax policies.

3. Conclusion: A Look Ahead at US Middle Class Income

This analysis of state-specific US middle class income data reveals significant regional disparities and underscores the complex interplay of economic, social, and policy factors shaping middle-class financial well-being. Understanding these variations is crucial for developing effective policies aimed at supporting the middle class and reducing income inequality. The data clearly shows a need for targeted interventions at the state level to address the specific challenges faced by middle-class families in different regions. Continue your research into US middle class income and engage in discussions about solutions to bridge the income gap – the future prosperity of our nation depends on it.

Featured Posts

-

Independent Office For Police Conduct Iopc Challenges Chris Kabas Panorama Coverage

Apr 30, 2025

Independent Office For Police Conduct Iopc Challenges Chris Kabas Panorama Coverage

Apr 30, 2025 -

Daisy Midgeleys Farewell Charlotte Jordan Exits Coronation Street

Apr 30, 2025

Daisy Midgeleys Farewell Charlotte Jordan Exits Coronation Street

Apr 30, 2025 -

Analisi Del Caso Becciu Le Preghiere Dei Fedeli E L Ipotesi Delle Dimissioni

Apr 30, 2025

Analisi Del Caso Becciu Le Preghiere Dei Fedeli E L Ipotesi Delle Dimissioni

Apr 30, 2025 -

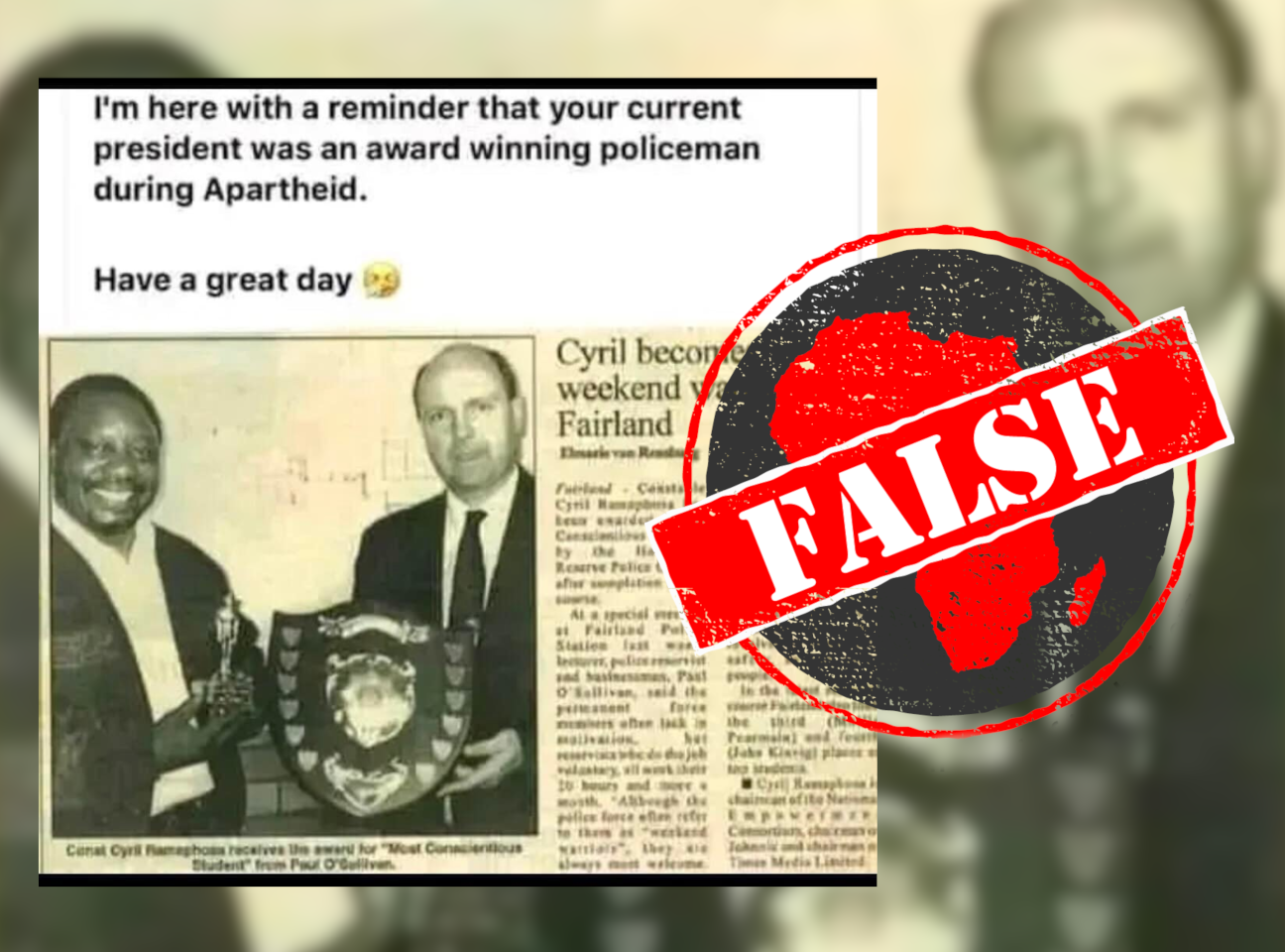

South Africa Ramaphosa Greenlights Apartheid Crimes Investigation

Apr 30, 2025

South Africa Ramaphosa Greenlights Apartheid Crimes Investigation

Apr 30, 2025 -

Gelecegin Doktorlari Eskisehir De Boksun Stres Azaltici Etkisi

Apr 30, 2025

Gelecegin Doktorlari Eskisehir De Boksun Stres Azaltici Etkisi

Apr 30, 2025